With the curtain now down on the U.S. election, Trump has returned. Given that Trump clearly stated during the campaign that “tariff” was the most beautiful word in his dictionary and threatened to escalate the trade war with China, concerns have been reignited about China’s foreign trade exports and economic prospects in particular.

随着美国大选落下帷幕,特朗普回归。鉴于特朗普竞选期间明确表示“关税”是其辞典中最美好的词汇,并威胁对中国升级贸易战,再度引发了各方对于中国外贸出口尤其是经济前景的担忧。

However, in my opinion, whether Trump can fully deliver on his tariff threats against China remains to be seen. Even if Trump reignites trade frictions with China, there will also be opportunities within crises. On the basis of managing its own affairs well and getting economic performance back on a reasonable track, China should seek to benefit from the situation and avoid harm, look for opportunities within crises, and strive for the best outcome while planning for the worst.

然而,笔者以为,特朗普能否完全兑现其对中国的关税威胁尚未可知,即便特朗普对中国再启贸易摩擦也是危中有机。中国宜在做好自己的事情、推动经济运行回归合理区间的基础上,趋利避害、危中寻机,从最坏处打算,争取最好结果。

Trump’s return is not necessarily the worst outcome

特朗普回归不一定是最坏结果

Following the announcement of the U.S. presidential election results, Trump’s return to the White House is assured. At present, the markets seem to believe that as far as the prospects for China-U.S. economic and trade relations are concerned, this outcome may have been the more detrimental one. Because the non-establishment Trump will act on his own inclinations, his trade policy towards China will be more extreme, more unpredictable and uncontrollable. However, this may be a kind of prejudice and misunderstanding.

随着美国大选揭晓,特朗普重返白宫已成定局。目前,市场似乎认为,就中美经贸关系的前景而言,这一结果可能更加不利。因为非建制派的特朗普随性而为,对华贸易政策会更加极端,更加不可预测、不可控制。然而,这可能是一种偏见和误解。

In the context of the United States’ supreme national interest being to maintain its super-hegemony, and containing China’s rise being the bipartisan consensus in the United States, the party in power will continue to target China, whether it is the Republican Party or the Democratic Party. Trump 1.0 opened the “Pandora’s box” of China-U.S. economic decoupling and science and technology (S&T) competition, but Biden’s four years in power further institutionalized and systematized it, establishing the three pillars of China strategy—investment, alliances, and competition. The resulting “small yard, high fence” and “decoupling and chain-breaking” have had an impact on China-U.S. economic and trade relations that is no less than that of the Trump 1.0 period.

在维护超级霸权地位是美国最高国家利益、遏制中国崛起是美国跨党派共识的情况下,不论共和党还是民主党执政,都将继续针对中国。特朗普1.0打开了中美经济脱钩、科技竞赛的“潘多拉盒子”,而拜登执政四年将其进一步机制化、体系化,确立了对华策略的三支柱——投资、联盟、竞争。由此形成的“小院高墙”“脱钩断链”,对中美经贸关系的冲击不比特朗普1.0时期小。

Taking China-U.S. S&T competition as an example, Trump 1.0, used a “three-pronged approach” of tariffs, blacklists, and national security, while during the Biden era it has been government subsidies and export controls, with export controls being upgraded to “scalpel-like precision.”

以中美科技竞争为例,特朗普1.0是运用关税、黑名单和国家安全“三板斧”,拜登时代则是政府补贴加出口管制,其中出口管制升级至像“手术刀般精准”。

During Trump’s first term, the actual average tariff rate on all Chinese goods imported to the United States rose from 2.7% to a high of 15.4%, then fell to around 12.5% after January 2020. Beginning in 2018, export controls and economic sanctions were used against Chinese-funded companies and institutions such as Huawei and ZTE, “weaponizing” the semiconductor supply chain. An executive order was issued in August 2020 banning the use in the United States of Tencent-owned WeChat and ByteDance-owned TikTok, but the ban was rejected by a U.S. court.

特朗普的第一个任期内,将对美国进口的全部中国商品的实际平均关税率由2.7%最高升至15.4%,并在2020年1月后降至12.5%左右。2018年起,对华为、中兴等中资企业和机构采取了出口管制和经济制裁措施,将半导体供应链“武器化”。2020年8月签发行政命令,禁止腾讯公司旗下的微信和字节跳动公司旗下的TikTok应用在美国使用,但相关禁令被美国法院驳回。

In 2018, the Export Control Reform Act was amended to further empower the U.S. Department of Commerce to control the provision of goods, technology, and software from the United States to foreign countries in the name of “security.” The Department of Commerce has accordingly added more Chinese S&T enterprises to the Entity List and strengthened the review of exports of S&T products and technologies of relevant entities. In 2019, regulations on “deemed exports” were amended to restrict the channels through which Chinese people in the United States can obtain technology. In August 2018, the Foreign Investment Risk Review Modernization Act (FIRRMA) was signed, expanding and strengthening the authority of the U.S. Committee on Foreign Investment (CIFUS) to review and decide on investments by foreign entities in critical technologies, infrastructure, sensitive fields, etc., in the United States, resulting in the rejection of many Chinese-funded investment projects in the United States.

2018年修订《出口管制改革法案》,进一步赋予美国商务部以“安全”名义对美国向外国提供商品、技术、软件的管制权限,商务部据此将更多中国科技企业纳入“实体清单”,强化针对相关主体科技产品和技术出口的审查力度。2019年修订“视同出口”条例,限制在美华人获取技术的渠道。2018年8月签署《外国投资风险审查现代化法案》(FIRRMA),扩大并强化美国外国投资委员会(CIFUS)针对外国主体投资美国关键技术、基础设施、敏感领域等的审查和决定权限,导致诸多中资企业对美投资项目被否。

In May 2019, Executive Order 13873 was issued, requiring the strengthening of “restrictions on foreign adversaries from damaging the U.S. information and communication technology supply chain,” further restricting Chinese information technology companies from investing in the United States, and restricting their equipment, products, and services from entering the U.S. market. In May 2020, [amended] “Foreign Direct Product” Rules were introduced, directly targeting semiconductor companies in countries and regions other than the United States. It prohibits those companies from using equipment and products derived from 16 categories of U.S.-origin technology and software and exporting them to companies on the Entity List.

2019年5月签发第13873号行政命令,要求强化“限制外国敌对势力破坏美国信息通信技术供应链”,进一步限制中国信息科技公司对美投资及其设备、产品、服务进入美国市场。2020年5月出台“外国直接产品”规则措施,直接指向除美国外的其他国家和地区的半导体公司,禁止这些公司利用源自美国的十六类技术及软件的设备和产品,出口给“实体清单”上的企业。

In November 2020, Executive Order 13959 was issued, prohibiting U.S. entities from investing in enterprises that the U.S. government has determined to be owned and controlled by the Chinese military, and prompting the New York Stock Exchange to take “mandatory delisting” measures against China’s three major telecommunications operators. In December 2020, the Holding Foreign Companies Accountability Act was signed, requiring the audit institutions of foreign companies listed in the United States to accept the inspection of their audit workpapers by U.S. regulatory authorities. This significantly increased the difficulty of Chinese companies going public in the United States to raise funds.

2020年11月签发第13959号行政命令,禁止美国主体对美国政府认定由中国军方持有并控制的企业进行投资,促使纽约证券交易所对中国三大电信运营商采取“强制退市”措施。2020年12月签署《外国公司问责法案》,要求在美上市外国公司的审计机构必须接受美国监管部门的审计工作底稿检查,中国公司赴美上市融资难度显著增加。

The Biden administration has basically accepted all of Trump 1.0’s S&T competition weapons without question, including imposing high tariffs on Chinese products, using bans or import restrictions against some Chinese companies and products, imposing export controls on key materials, restricting investment in China concept stocks, restricting investment in China by U.S. residents, and imposing comprehensive financial and economic embargoes against individual enterprises.

拜登政府基本照单全收了特朗普1.0的科技竞争武器,包括对中国产品征收高关税、对部分中企和产品采取禁止或限制进口、对关键物资施加出口管制、对投资中概股进行限制、对美国居民到中国投资进行限制,以及对个别企业进行金融和经济全面封锁等。

The Biden administration has also introduced new measures. In August 2022, it passed the CHIPS and Science Act, launching a subsidy package worth U.S. $52.7 billion, of which U.S. $39 billion is to be given to relevant manufacturing enterprises. However, companies receiving subsidies must sign an agreement with the U.S. government not to expand advanced chip production capacity in China and other regions of concern to the United States.

拜登政府还推陈出新。2022年8月通过《芯片与科学法案》,推出价值527亿美元的一揽子补贴计划,其中390亿美元将贴给相关制造企业。但接受补贴的公司必须与美国政府签署协议,不能在中国以及其他美国关切地区扩产先进芯片的产能。

On October 7, 2022, the U.S. Department of Commerce issued new regulations that, by setting specific hardware parameters, restrict China’s access to high-compute GPUs used to train artificial intelligence. At the same time, it imposes comprehensive restrictions on logic and storage chips with advanced manufacturing processes, and on supercomputing centers. Advanced Chinese chip manufacturing enterprises need a license to obtain U.S. equipment and technology, and U.S. residents are also prohibited from working in regulated enterprises. The new regulations have also expanded the focus of S&T competition from communications and chips to artificial intelligence. One year later, on October 17, 2023, the U.S. Department of Commerce updated its export control regulations, further refining and upgrading the restrictions. Furthermore, the U.S. government has also used the fact that the equipment and chips of European and Asian suppliers contain U.S. products, technology, and software to coerce them into implementing global containment actions against China in the semiconductor field.

2022年10月7日美国商务部颁布新规,通过设定具体的硬件参数,限制中国获得用于训练人工智能的高算力GPU,同时对先进制程的逻辑和存储芯片以及超算中心进行全面限制。中国本土芯片制造先进企业获得美国设备、技术需要许可证,美国居民在受管制企业就业也遭到禁止。新规更是把科技竞争的焦点从通信、芯片扩大到人工智能。时隔一年后的2023年10月17日,美国商务部更新出口管制条款,对限制细化升级。而且,美国政府还利用欧亚供应商的设备、芯片中包含美国产品、技术和软件,胁迫它们在半导体领域对中国实施全球遏制行动。

The Biden administration has continued the inherited investment restrictions, and continuously optimized and upgraded them as well. In October 2024, the U.S. government issued new regulations to control foreign investment by U.S. enterprises in mainland China in the fields of advanced semiconductors, quantum technology, and artificial intelligence in order to prevent U.S. investment in China from potentially “threatening U.S. national security.” The regulations specifically divide items into “prohibited” and “subject to notification” categories. The prohibited category mainly includes high-performance artificial intelligence, advanced semiconductor manufacturing, EDA and equipment, etc., with other items falling under the notification category. Biden also continued many of Trump’s “blacklists.” At the same time, some relevant bills explicitly require that departments such as Defense not procure the products of some Chinese companies.

拜登政府继承并不断优化升级投资限制。2024年10月,美国政府发布新规,管制美国企业对大陆先进半导体、量子技术和人工智能领域对外投资,具体分为“禁止类”和“申报类”,其中禁止类主要包括高性能人工智能、先进半导体制造、EDA和设备等,其他归于申报类,防止美国在华投资可能“威胁美国国家安全”。拜登还延续了特朗普的诸多“黑名单”。同时,一些相关法案明确要求国防等部门不得采购部分中企的产品。

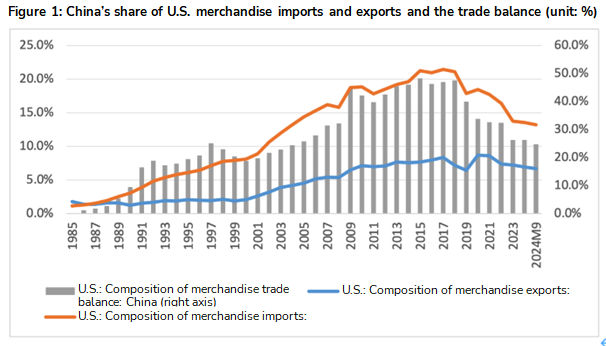

According to U.S. statistics, in 2020 (at the end of the Trump’s previous term), China accounted for 18.4% of U.S. imports, a decrease of 3 percentage points compared to 2017. In 2023 (a year before the end of the Biden administration’s term), the proportion was 13.7%, a decrease of 4.7 percentage points compared to 2020. In the first three quarters of 2024, it decreased further to 13.2%, a year-on-year decrease of 0.4 percentage points.

据美方统计,2020年(特朗普政府上个任期结束时),美国进口商品中,中国占比18.4%,较2017年下降3个百分点。2023年(拜登政府任期结束的前一年),该比例为13.7%,较2020年回落4.7个百分点;2024年前三个季度进一步降至13.2%,同比回落0.4个百分点。

Obviously, if Harris had won the election, the basic framework of China policy during the Biden era would likely have continued. It is just that the Democratic Party’s economic policy towards China is perhaps not so aggressive, with an impact that is more like a light rain than a sudden storm. However, while it is true that you cannot hide from an open attack, who says that a concealed attack is necessarily easier to defend against than an open one?

显然,如果哈里斯赢得大选,大概率会延续拜登时期对华政策的基本框架。只是民主党的对华经济政策可能不会那么张扬,影响也会是轻风细雨而非疾风骤雨。然而,“明枪”固然不好躲,谁说“暗箭”就一定比“明枪”更好防呢?

资料来源:美国经济分析局;美国人口普查局;万得;中银证券

资料来源:美国经济分析局;美国人口普查局;万得;中银证券Trump’s tariff policy is subject to significant variables

特朗普关税政策存在较大变数

During the election campaign, Trump threatened to escalate trade sanctions against China in four ways: 1. canceling Permanent Normal Trade Relations (PNTR, i.e., Most Favored Nation treatment) for China; 2. imposing tariffs of 60% or more on all Chinese exports to the United States; 3. ceasing to import essential goods produced in China within four years; and 4. cracking down on Chinese goods exported to the United States through third countries.

这次大选过程中,特朗普曾威胁将从四方面升级对华贸易制裁:一是取消中国永久正常贸易关系(PNTR,即最惠国待遇);二是对中国对美所有出口商品征收60%或以上关税;三是四年内停止对中国生产的必需品的进口;四是严厉打击中国商品通过第三国出口到美国。

In contrast to Trump’s passion for tariff measures, the Biden era has had a greater preference for non-tariff measures, such as intervening in global production chains and supply chains in the name of “risk mitigation.”

相比特朗普对于关税措施的热衷,拜登时期则更偏好非关税措施,如以“去风险化”之名,行干预全球产业链供应链之实。

Trump 1.0 delivered on his campaign promises on trade policy to a large degree, and one cannot rule out Trump 2.0 wielding the tariff stick with ease, striking deftly in all directions. First, taking advantage of China’s current economic pressures and its greater dependence on external demand, tariffs would be used to hit China while it is down. Second, additional tariffs would be imposed to compensate for the decline in tax revenue caused by the implementation of tax reduction policies, thereby alleviating pressure from U.S. fiscal deficit expansion. Third, even without considering further suppression of China’s economy, tariffs may also be used as a bargaining chip to exchange for China’s compromises and concessions in other areas. Fourth, in early 2020, China and the United States signed the Phase One economic and trade agreement, which hit the pause button on China-U.S. economic and trade frictions. However, the agreement could not be implemented due to the pandemic. Trump may use tariffs to coerce China into completing the agreement and giving compensation.

特朗普1.0在贸易政策上兑现竞选承诺的程度较高,不排除特朗普2.0会得心应手地继续挥舞关税大棒,大杀四方。一是趁着中国当前经济运行压力较大,对外需依赖程度更高,运用关税手段对中国落井下石。二是运用加征关税来弥补因推行减税政策引发的税收收入减少,进而缓解美国财政赤字扩张的压力。三是即便不考虑进一步打压中国经济,也可能运用关税手段作为谈判筹码,换取中国在其他方面的妥协和让步。四是2020年初中美签订了第一阶段经贸协议,按下了中美经贸摩擦的暂停键,但因疫情原因协议执行不了了之,特朗普可能以关税手段要挟中国完成协议并进行补偿。

In 2023, Robert Lighthizer, who served as U.S. Trade Representative in the Trump administration from 2017 to 2020, denounced the consensus on the benefits of trade liberalization in his new book No Trade Is Free. If he again serves as U.S. Trade Representative, it will undoubtedly increase the probability of China and the United States resuming tariff conflicts. That probability would be raised further by China hawks such as Marco Rubio joining the Trump 2.0 inner circle.

2023年,曾于2017~2020年在特朗普政府中担任贸易代表的莱特希泽在其新书《没有贸易是自由的》中,对贸易自由化益处达成的共识提出严厉的控诉。若他重新担任美国贸易代表,无疑将提升中美两国再启关税冲突的概率。加之卢比奥之流的对华鹰派加盟特朗普2.0的核心圈,前述概率将进一步提升。

The Japanese example may provide a certain reference for the future of China-U.S. economic and trade ties. According to U.S. statistics, in 1986 (the year after the September 1985 Plaza Accord), Japan accounted for 22.2% of U.S. imports (0.8 percentage points higher than the historical high China’s share reached in 2017). That proportion has fallen to below 10% since 2003. In 2023 it was only 4.7%, and it dropped further to 4.5% in the first three quarters of 2024. Japan accounted for a record high of 56.4% of the U.S. merchandise trade deficit in 1991. That proportion has fallen to below 10% since 2014, reaching 6.7% in 2023 and 5.7% in the first three quarters of 2024.

日本样本或可以给未来中美经贸联系的前景提供一定的参考。据美方统计,1986年(1985年9月广场协议次年),美国进口商品中,日本占比22.2%(较2017年中国占比的历史高点还高出0.8个百分点);2003年起,该比例跌破10%;2023年,该比例仅为4.7%,2024年前三个季度进一步降至4.5%。1991年,美国商品贸易逆差中,日本占比56.4%,创历史新高;2014年起,该比例降至10%以下,2023年为6.7%,2024年前三个季度进一步降至5.7%。

Judging from similar indicators, the current China-U.S. economic and trade frictions have already surpassed the severity of the Japan-U.S. frictions at that time. For example, over the six years from 2018 to 2023, China’s shares of U.S. merchandise imports and merchandise trade deficits fell by 7.7 and 20.7 percentage points, respectively. From 1987 to 1992, Japan’s two respective shares fell by 4.1 percentage points and rose by 13.3 percentage points.

从类似指标看,当前中美经贸摩擦的惨烈程度已超过了当年的日美。如2018至2023年六年间,美国商品进口和商品贸易逆差中,中国占比分别累计回落7.7和20.7个百分点。而1987至1992年,日本两项占比分别回落4.1和上升13.3个百分点。

Of course, it is not written in stone that Trump will deliver on his China trade policy, or even if he does, the timing may be later, and there will be uncertainties as to pace and intensity.

当然,特朗普兑现其对华贸易政策并非板上钉钉,或者即便要动手,时间会比较靠后,节奏和力度也会有不确定性。

First, the Republican Party swept both houses of Congress in this election, making it possible for Trump to focus more on solving domestic issues. The lackluster results of Trump 1.0 on the domestic side could be said to be one of Trump’s regrets.

一是美国共和党在这次大选中横扫参众两院,让特朗普有可能将更多精力放在解决国内问题上。特朗普1.0在内政方面乏善可陈可谓是特朗普的一件憾事。

Second, given that China’s shares of U.S. merchandise imports and trade deficits have dropped significantly, there is no great political benefit from continuing to pressure China on trade issues. If Trump really cares about the U.S. trade imbalance issue, Trump 2.0 may be more interested in imposing tariffs on economies whose shares of U.S. merchandise imports and the trade deficit have risen significantly in recent years.

二是鉴于中国在美国商品进口和贸易逆差中占比已大幅下降,继续对中国在贸易问题上施压政治收益不大。如果真在意美国贸易失衡问题,特朗普2.0或许对于近年来在美国商品进口和贸易逆差份额上升较多的经济体加征关税会更感兴趣。

Third, high inflation triggered public discontent, which was the main reason for the Democratic Party’s defeat in this election. Economic work was Trump 1.0’s strong suit, and fighting inflation will remain a top priority for Trump 2.0. But regardless of whether it is imposing a high tariff of 60% on China or a 10% tariff on the world in general, it would increase inflation, which may make Trump 2.0 apprehensive.

三是高通胀引发民众不满是这次民主党大选失利的主要原因,而擅长经济工作是特朗普1.0的亮点,抗通胀仍将是特朗普2.0的当务之急。而不论是对中国加征60%的高关税还是对全球普遍加征10%的关税,都会增加通胀黏性,这有可能令特朗普2.0心存顾忌。

Fourth, China’s share of the U.S. import market has declined, but its share of the global export market has risen, indicating that achieving a shift in the trade balance through foreign investment is an effective way to circumvent trade barriers. This is also the main reason why Trump 2.0 has threatened to impose tariffs on Chinese exports to the United States through third countries. However, blockading China’s indirect exports to the United States globally is easier said than done: On one hand, the screening process is difficult and costly, and on the other hand, it may arouse opposition or even retaliation from the places where Chinese-funded overseas investment enterprises are located.

四是中国在美进口市场份额下降但在全球出口市场份额上升,表明通过对外投资实现贸易差额转移,是规避贸易壁垒的有效做法。这也是特朗普2.0扬言要对中国通过第三国对美出口加征关税的主要原因。然而,全球围堵中国对美间接出口说易行难:一方面甄别工作难度大、成本高,另一方面还可能引起中资境外投资企业所在地的反对甚至报复。

Fifth, since the Biden administration has carried forward and built upon many Trump 1.0 practices, Trump 2.0 can also learn from some of the Biden administration’s practices. In particular, whereas Trump 1.0 emerged as a sudden new force, and the government team was made up mainly of non-mainstream extremists, with this strong comeback, Trump 2.0 will receive support from more think tanks and mainstream figures, so its policies may well be more systematic and rational.

五是既然拜登政府继承和发扬了特朗普1.0的很多做法,特朗普2.0也可以学习借鉴拜登政府的一些做法。尤其是特朗普1.0属于异军突起,政府班底主要是一些非主流的偏激人士。这次强势回归,特朗普2.0将获得更多智库和主流人士的支持,政策有可能会更加成系统、偏理性。

In summary, China must be prepared for the China-U.S. economic and trade relationship to get worse before it gets better, but it must also avoid losing its head in a panic. Instead, it must remain calm and counter each move. Even if, in the long term, China-U.S. trade relations might develop into the situation like that between Japan and the United States today, in order to reduce the impact of short-term drastic adjustments on the Chinese economy, China must still actively create conditions for extending this period as long as possible.

综上,中国既要做好中美经贸关系变好之前变得更坏的准备,也要避免自乱阵脚、未战先怯,而要沉着冷静、见招拆招。即便从长远看,中美贸易关系有可能会发展成为今天日美的状况,中国也要积极创造条件,尽可能将这个时间拉长一些,以减轻短期剧烈调整对中国经济造成的冲击。

The key to actively responding to external shocks is to accelerate the implementation of existing and additional policies, further deepen and broaden reform and opening-up, get economic performance back on a reasonable track, turn market expectations around, and boost market confidence. This will strengthen China’s bargaining power and confidence in foreign economic and trade negotiations. At the same time, on the basis of simulation exercises and scenario analysis, China must closely follow and dynamically assess the progress of Trump’s China trade policy, and should take the initiative, lay the groundwork in advance, seek to benefit from the situation and avoid harm, look for opportunities within crises, and strive for the best outcome while planning for the worst.

积极应对外部冲击,关键是要加快落实存量和增量政策,进一步全面深化改革开放,推动经济运行回归合理区间,扭转市场预期、提振市场信心。这将增强中国在对外经贸磋商中的底牌和底气。同时,中国要在沙盘推演、情景分析的基础上,适时跟进、动态评估特朗普对华贸易政策进展,主动作为、提前布局,趋利避害、危中寻机,从最坏处打算争取最好的结果。