Finance is a core part of national competitiveness, and financial security is an important component of national security. Maintaining financial security is a strategic and fundamental undertaking that is relevant to the overall economic and social development of China. The world is currently in a period of turmoil and change as the external environment becomes more complex and challenging. The connotation of China’s national security has been broadened to an unprecedented degree, covering areas of external security and internal security, homeland security and public security, traditional security and non-traditional security, and our own security and common security, among many other areas. The number of areas that national security issues cover has also steadily increased to 20.1 Among these areas, financial security is classified as a non-traditional security issue. As risks continue to evolve and change, the meaning of financial security has also been developing and evolving itself. Traditional financial security is primarily concerned with domestic financial risks and the risk of contagion from international financial markets. However, with the significant increase in financial sanctions in recent years, the risk of being subjected to financial sanctions has heightened significantly as well. Since the outbreak of the crisis in Ukraine in 2022, the United States and the West have launched a series of financial sanctions against Russia, and have even unexpectedly frozen Russia’s central bank assets and removed many Russian banks from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system. The frequent use of financial sanctions and its increase in scope and intensity not only threaten the national financial security of the sanctioned countries, but also bring potential risks to other economies.

金融是国家重要的核心竞争力,金融安全是国家安全的重要组成部分,维护金融安全是关系我国经济社会发展全局的一件带有战略性、根本性的大事。当前,世界进入动荡变革期,外部环境更趋复杂严峻,我国国家安全内涵和外延比历史上任何时候都要丰富,涵盖了外部安全和内部安全、国土安全和国民安全、传统安全和非传统安全、自身安全和共同安全等诸多领域,国家安全议题领域也不断拓展至20个。其中,金融安全属于非传统安全,随着风险不断发展变化,金融安全也在发展演变中。传统金融安全更多关注国内金融风险以及国际金融市场传染风险,但近年来,伴随金融制裁数量明显增多,金融制裁风险亦显著加大。2022年乌克兰危机爆发以来,美西方针对俄罗斯开展了一系列金融制裁,甚至超预期地使用了冻结央行资产、将众多俄罗斯银行剔出环球银行金融电信协会(SWIFT)系统等手段。金融制裁频发,且范围不断扩展、力度持续增强,不仅威胁被制裁国的国家金融安全,也给其他经济体带来潜在风险。

I. The Increasingly Frequent Use of Financial Sanctions Shows New Characteristics of Threats Jeopardizing National Financial Security

一、日益频发的金融制裁呈现威胁国家金融安全的新特征

Up till now, the academic circle has not settled on a consistent definition of national financial security. It is generally believed that national financial security refers to a state of dynamic stability in which a country’s financial system can maintain normal operations without being damaged and threatened, and can withstand various financial crises. Compared with financial risks and financial crises, the connotation of national financial security is broader in scope.

关于国家金融安全,目前学术界尚无一致定义。一般认为,国家金融安全指一国金融体系保持正常运转不受破坏和威胁、且能抵御各种金融危机侵害的一种动态稳定状态。相较于金融风险和金融危机,国家金融安全内涵更加宽泛。

(1) Context behind the Increasing Risks of Financial Sanctions

(一)金融制裁风险上升的背景

Since the outbreak of the financial crisis in 2008, the landscape for global economic governance has been characterized by the “rise of the East and decline of the West”. Emerging market economies have voiced increasingly stronger demands to reform the international governance system, so as to meet their actual needs in reality, while the proposals put forward by developed countries tend to maintain their own interests. Against this backdrop, the United States and the West are more inclined to politicize their economic decisions, making finance a tool for engaging in power games and more and more frequently bound to national security and ideology. The competition among major powers is gradually eroding the basis and consensus for global financial governance. Furthermore, with the frequent occurrence of geopolitical risks and the increasing use of financial sanctions, there have been escalating risks of uncertainty challenging international financial security.

2008年金融危机爆发后,随着世界经济和全球治理格局的“东升西降”,新兴市场国家改革国际治理体系以切合现实需求的诉求日益强烈,而发达国家提出的方案往往更多维护自身利益。在此大背景下,美西方经济决策的政治化倾向不断加强,金融被当作权力竞争的工具,愈加频繁地与国家安全和意识形态捆绑在一起。大国间的竞争正逐渐侵蚀全球金融治理的共识基础,加之地缘政治风险频发,金融制裁频率上升,国际金融安全面临的不确定性风险增加。

The United States is the biggest beneficiary of economic and financial globalization, and it is also the one that dominates and leads the decisions on international financial sanctions. The capability to effectively implement financial sanctions is necessarily based on a country’s dominant position in the international financial system. Relying on the hegemony of the U.S. dollar, the United States has imposed more financial sanctions than other countries. It has carried out “precision strikes” against quite a few countries, institutions, and even persons. The main agency of the United States for imposing sanctions is the Office of Foreign Assets Control (OFAC) under the Department of the Treasury, which inflicts financial sanctions on specific targets by including the targets on the list of Specially Designated Nationals (SDN). Although the OFAC does not have a specific list of sanctioned countries, the list of country-related sanctions on its website shows that the United States has imposed financial sanctions on more than 20 countries and regions including North Korea, Iran, and Afghanistan.2

美国是经济金融全球化的最大受益者,也是国际金融制裁的主导者。金融制裁能够得以有效施行,必须基于该国在国际金融体系中的优势地位。凭借美元霸权,相比于其他国家,美国更多发起金融制裁,对不少国家、机构乃至个人进行“精准打击”。美国执行制裁的主要机构是财政部下的外国资产管理办公室(Office Of Foreign Assets Control,OFAC),主要通过将被制裁目标列入特别指定国民(SDN)清单等方式对特定目标实施金融制裁。尽管OFAC没有特定的制裁国家名单,但其网站上与国家相关的制裁项目名单显示,美国对朝鲜、伊朗、阿富汗等20多个国家和地区实施了金融制裁。

Objectively speaking, economic sanctions, including financial sanctions, do entail certain costs for the sanctioning country. First, sanctions increase the fiscal expenditures of the sanctioning country, including the administrative resources and law enforcement costs for imposing sanctions, as well as subsidies given to domestic companies damaged by sanctions. Second, sanctions undermine the economic and financial ties between the sanctioning and the sanctioned country, damage the economic interests of the sanctioning country, and reduce employment opportunities. Third, due to close international economic and financial ties, the losses of the sanctioned country have spillover effects, which in turn damage the sanctioning country’s economy. This can include damage to business operations and asset depreciation of enterprises and financial institutions in the sanctioning country, as well as the increase in risk exposures of financial institutions investing in the capital market of the sanctioned country. Fourth, the countermeasures taken by the sanctioned country result in losses to the sanctioning country.

客观来说,包括金融制裁在内的经济制裁对发起国而言,也并非毫无成本。第一,制裁增加发起国的财政支出,包括执行制裁的行政资源和执法费用,以及对国内因制裁受损企业的补贴等。第二,制裁减少发起国与受制裁国的经济金融联系,损害发起国经济利益,减少就业机会。第三,由于国际间经济金融联系密切,被制裁国的损失将回溢至发起国。包括发起国相关企业和金融机构经营受损、资产减值,投资于被制裁国资本市场的金融机构风险敞口上升等。第四,被制裁国的反制措施会给发起国造成损失。

Nevertheless, the United States still frequently resorts to sanctions for the following reasons: First, compared to military operations, sanctions generate less public opposition to the sanctioning country, and the political costs are relatively low. Second, the president, Congress, and state governments all have the right to initiate sanctions. In this case, sanctions not only cost less to initiate, but are also easier and quicker to deploy than military actions. Third, the sanctioned country cannot quickly adjust its economy in the short term, thus when the sanctioning country uses its superior position in the global economy, financial markets, science and technology, and supply chains to launch sanctions, it quickly strikes the economy of the sanctioned country and even threatens the basis for people’s livelihood in the country. At the same time, the sanctioning country can continuously improve the means and methods of sanctions and implement more joint sanctions to significantly improve the effectiveness of sanctions.

尽管如此,美国仍然动辄运用制裁这一手段,原因主要有:一是相较军事行动,制裁在发起国国内更少受到民众反对,政治成本相对较低。二是总统、国会、州政府均有权发起制裁,不仅启动成本低,相比于军事行动也更易迅速出台。三是被制裁国短期内来不及调整,发起国利用在全球经济金融、科技、供应链中的优势地位发起制裁,可迅速打击被制裁国的经济甚至民生基础。与此同时,发起国不断改进制裁手段和方式,更多实施联合制裁,大大提高制裁有效性。

(2) New Characteristics of Current Financial Sanctions

(二)当前金融制裁的新特征

Since the 21st century, the United States has used economic sanctions more frequently than military force, and the frequency of financial sanctions has increased significantly. In 2021 alone, the number of entities subject to OFAC economic and financial sanctions reached 9,421, an increase of 933% from that of 2000.3 As of October 2022, the OFAC’s SDN list included approximately 6,300 sanctions-related names. As the United States and the West are increasingly politicizing economic issues, financial sanctions have become a common tool. Sanctions are not only imposed on small and medium-sized countries, but also used as an important tool in the power games between major powers. The current financial sanctions present the following characteristics.

21世纪以来,相比于动用军事力量,美国更加频繁动用经济制裁手段,其中金融制裁频率显著提高,仅2021年OFAC经济和金融制裁的主体就达9421项,较2000年增长了933%。截至2022年10月,OFAC的SDN清单中有大约6300个与制裁相关的名字。随着美西方日益将经济问题政治化,金融制裁已成为常用工具,不仅对中小国家实施,也被作为大国博弈的重要工具。当前,金融制裁呈现以下特征。

First, financial sanctions are clearly targeted and can carry out precise strikes. Financial sanctions are often used as a supplementary or alternative measure to conventional wars, in order to ensure that the sanctioning country can constrain the sanctioned party from using and pooling funds and undermine its fighting power without suffering from military casualties and criticisms of the international community. The Treasury 2021 Sanctions Review of the U.S. Department of the Treasury clearly stated that a structured policy framework is used to link sanctions to clear policy goals. Judging from past cases, the United States has once frozen the overseas assets of the Libyan government and Muammar Gaddafi himself while simultaneously funding opposition forces, thus benefiting from the internal conflict in Libya (鹬蚌相争中渔翁得利, Chinese idiom “When the snipe and the clam fight, the fisherman profits”). Another example is the financial sanctions against Russia, which not only froze Russia’s assets, but also prevented Russia from receiving funds for exporting oil, natural gas, and other resources, weakening its economic strength to support the war.

一是目标明确,打击精准。金融制裁常被作为常规战争的配合措施或者替代选项,确保发起国在避免军事人员伤亡、国际舆论指责的同时,遏制被制裁方使用和获得资金,削弱其战斗力。美国财政部《2021年度制裁评估报告》明确指出,采用结构化政策框架将制裁与明确的政策目标相联系。从以往案例看,美国曾冻结利比亚政府和卡扎菲个人的海外资产,同时资助反政府武装,从利比亚国内鹬蚌相争中渔翁得利。又如对俄罗斯的金融制裁,既冻结资产,又遏制俄罗斯从石油、天然气等资源出口中获得收入,削弱其支撑战争的经济实力。

Second, financial sanctions can take various forms and are often used in combination with other sanctions. When imposing financial sanctions, the sanctioning country usually implements a package strategy, including freezing assets, prohibiting financial transactions, and curbing international financing. The scope and intensity of sanctions can be flexibly adjusted and steadily increased, resulting in multi-level impacts and damage to the sanctioned party. At the same time, financial sanctions are often used together with trade and technology sanctions, and it has become a trend that different means of sanctions are used in combination and with greater effectiveness. For example, since the Ukraine crisis in 2022, the United States and its allies imposed financial sanctions on Russia by methods of freezing the Russian central bank’s foreign exchange reserves, prohibiting financial transactions, and excluding some Russian banks from the SWIFT payment system. At the same time, the United States expanded its export restriction measures against Russia to cover the fields of microelectronics, telecommunications facilities, sensors, navigation equipment, and avionics equipment, and has included more Russian institutions in the Entity List. The combination of various types of sanctions have helped to achieve the overall goals of the U.S. government.

二是形式多样并常与其他制裁措施联合使用。发起国在金融制裁过程中通常实施组合策略,包括冻结资产、禁止金融交易、遏制国际融资等,其实施范围和力度可以灵活调整、不断加码,对被制裁方形成多层面冲击破坏。同时,金融制裁往往与贸易制裁和技术制裁手段共同使用,各种手段相互融合、不断升级的趋势日益明显。例如,2022年乌克兰危机以来,美国联合盟友对俄罗斯的金融制裁就采取了冻结央行外汇储备、禁止金融交易、将部分俄罗斯银行排除在SWIFT支付系统之外等多种方式;同时,美国将对俄罗斯的出口管制扩大到微电子、电信设施、传感器、导航、航空电子设备等,将更多俄罗斯机构列入实体清单,多种制裁相结合,助力实现美国政府的总体目标。

Third, more secondary sanctions are being imposed with an expanded scope of “long-arm jurisdiction”. Secondary sanctions mainly restrict non-U.S. financial institutions from conducting financial transactions with or providing financial services to sanctioned parties outside the United States, and the targets of these sanctions are third-country entities that do not have a jurisdictional nexus with the United States. Secondary sanctions have been widely criticized for being an inappropriate extraterritorial application of U.S. domestic law and have received much resistance. However, since the “9/11” attacks in 2001, the United States, relying on powerful synergy between its dollar hegemony and its intelligence apparatuses, forced third countries and their companies to choose between maintaining economic and financial ties with the sanctioned country or with the United States, which strengthened its ability to enforce secondary sanctions.

三是越来越多使用二级制裁,扩大“长臂管辖”。二级制裁主要限制非美国金融机构与被制裁方在美国境外进行金融交易或提供金融服务,制裁对象是不存在美国管辖连接点的第三国主体。二级制裁曾被广泛批评为对美国内法律的不当域外适用,遭到众多抵制。但自2001年“9·11”事件后,美国凭借其美元霸权和情报机器的深度融合,迫使第三国及其企业在被制裁国和美国的经济金融联系之间二选一,令二级制裁的强制执行力得以提升。

Fourth, countries may implement joint sanctions or resort to multilateral sanctions. When one country imposes sanctions individually, the sanctioned party can use third parties to circumvent the sanctions. In order to improve the effectiveness of sanctions, the United States in recent years has often initiated joint financial sanctions together with its allies and sought to form multilateral sanctions through sanction resolutions of the United Nations. For example, on the nuclear program of Iran, the United States had pushed the United Nations Security Council to pass multiple rounds of sanction resolutions against Iran, and pushed its allies and other non-Western countries to join in the financial sanctions against Iran. Eventually, under the pressure of multi-level sanctions, Iran was forced to reach the substantive Geneva Interim Agreement with six relevant countries at the end of 2013.4

四是实施联合制裁乃至寻求多边制裁。在单独制裁情况下,被制裁方可利用第三方迂回绕开制裁。为提高制裁效率,近年来美国在发起金融制裁时,多联合其盟友实行联合制裁,还会寻求通过联合国制裁决议形成多边制裁。例如,在伊朗核问题上,美国推动联合国安理会通过了多轮对伊朗的制裁决议,影响其盟友和其他非西方国家加入对伊朗的金融制裁中,最终迫使伊朗在叠加的制裁压力下,于2013年底与相关六国达成了具有实质性内容的《日内瓦协议》。

II. Means and Channels by Which Financial Sanctions Impact National Financial Security

二、金融制裁冲击国家金融安全的手段与渠道

Preventing and defusing risks of financial sanctions, and particularly guarding against systemic financial risks caused by such sanctions, is a fundamental task of financial work, and is integral to upholding China’s national financial security. To this end, it is urgent that we understand the means of financial sanctions and the transmission channels through which they impact financial security.

防范化解金融制裁风险,特别是防止由此引发系统性金融风险,是金融工作的根本性任务,也是维护国家金融安全的应有之义。这迫切要求我们洞悉金融制裁的实施手段和冲击金融安全的传导路径。

(1) Major Means of Financial Sanctions

(一)金融制裁的主要手段

1. Asset Freezing and Disposal

1. 冻结乃至处置资产

(1) Asset freezing. Such a method imposes controls on the assets deposited by the sanctioned party in U.S. financial institutions, and prohibits the sanctioned party from withdrawal, transfer, payment, trade, or any other form of disposal. Historically, the United States has frozen the assets of foreign governments or central banks many times, including the assets of North Korea, Cuba, Iran, Libya, Iraq, Afghanistan, Syria, and Venezuela. On February 28, 2022, the U.S. Treasury Department issued an announcement that, pursuant to Executive Order 14024, the Treasury’s OFAC prohibited American citizens from conducting transactions with the Central Bank of the Russian Federation, the National Wealth Fund, and the Ministry of Finance, effectively freezing all assets of the Central Bank of Russian Federation in the United States.5

(1) 冻结资产。对被制裁方存入美国金融机构的资产进行控制,禁止其对资产进行提取、转让、支付、交易或者任何形式的处置。历史上美国曾多次冻结外国政府或央行资产,包括朝鲜、古巴、伊朗、利比亚、伊拉克、阿富汗、叙利亚、委内瑞拉等。2022年2月28日,美国财政部发布公告,根据第14024号总统行政令,其所属OFAC禁止美国人与俄罗斯央行、国家财富基金和财政部进行交易,有效冻结了俄罗斯央行所有在美国的资产。

(2) Asset disposal. Technically, the ownership status of frozen assets will not be changed, and the assets in question should be unfrozen when the sanctions are lifted and left at the disposal of the previously sanctioned party. However, the United States has also set many precedents for disposing of frozen assets. For example, on March 20, 2003, the day the Iraq war broke out, the assets of the Iraqi government and Iraq’s central bank were confiscated by the United States and were used for post-war reconstruction in Iraq.

(2) 处置资产。被冻结的资产所有权没有发生转移,理论上应在制裁结束后解冻,交由被制裁方支配。但美国也创下不少对冻结资产进行处置的先例。例如,2003年3月20日伊拉克战争爆发当天,伊拉克政府、央行等资产被美国没收,用于伊拉克战后重建。

2. Financing Restrictions

2. 限制融资

(1) Restricting access to financial aid and loans from international financial institutions. The sanctioning country may take advantage of its dominance in international financial organizations to place restrictions on the sanctioned country, preventing it from receiving aid and loans from international institutions. For example, on March 11, 2022, after the outbreak of the Ukraine crisis, the Group of Seven (G7) issued a joint statement announcing that they would jointly block Russia from obtaining funds from major international financial institutions such as the International Monetary Fund, the World Bank, and the European Bank for Reconstruction and Development.6

(1) 限制获得经济援助和国际金融机构贷款。制裁发起国利用其在国际金融组织中的主导权压制被制裁国,令其无法获得国际机构援助和贷款。例如,2022年3月11日,乌克兰危机爆发后,七国集团(G7)发布联合声明,宣布共同阻止俄罗斯从国际货币基金组织、世界银行和欧洲复兴开发银行等主要的国际金融机构获得融资。

(2) Restricting access to international business loans or financing via international capital markets. Putting sanctioned entities on the SDN list is an important means for the United States to impose financial sanctions. As U.S. entities are prohibited from conducting transactions with institutions on the SDN list, the sanctioned entities will naturally not be able to obtain U.S. commercial loans. In addition, as the United States is the world’s largest capital market, it can use sanctions to stop the issuance and trade of bonds, stocks, and other securities of sanctioned countries in the United States, in order to limit their access to financing. For example, on February 24, 2022, pursuant to Executive Order 14024, the OFAC expanded its restrictions on Russian debt and equity to other key sectors of the Russian economy, prohibiting transactions and dealings by U.S. persons or within the United States in new debt of longer than 14 days maturity and new equity of Russian state-owned enterprises and the financial service sector. 7

(2) 限制获得国际商业贷款或利用国际资本市场融资。美国实施金融制裁的一个重要手段是将被制裁实体列入SDN,要求美国主体不得与SDN清单内机构进行交易,被制裁主体自然无法获得美国商业贷款。此外,全球最大的资本市场在美国,美国可以借口制裁阻止被制裁国的债券、股票等证券在美国发行和交易,以限制其获得融资。例如,2022年2月24日,OFAC根据美国第14024号总统行政令,将与俄罗斯有关的债务和股权限制扩大到俄罗斯经济的其他关键方面,禁止美国人或在美国境内对俄国有企业、金融服务部门等14天以上到期的新债务和新股权进行交易。

(3) In addition, the sanctioning country can also prevent the sanctioned country from obtaining international capital by restricting its investment. For example, on February 21, 2022, in response to Russia’s recognition of the independence of Donetsk and Luhansk, the United States issued Executive Order No. 14065, prohibiting U.S. persons from making new investments in the Donetsk and Luhansk regions of Ukraine.

(3) 此外,制裁发起国还通过限制投资方式来阻止被制裁国获得国际资本。例如,2022年2月21日,针对俄罗斯承认顿涅茨克和卢甘斯克独立,美国发布第14065号总统行政命令,禁止美国人在乌克兰顿涅茨克和卢甘斯克地区进行新投资。

3. Denying Access to International Payment and Settlement Channels

3. 切断国际支付清算通道

(1) Denying access to SWIFT. The sanctioning country may remove banks and other financial institutions of the sanctioned county from the SWIFT system and restrict the sanctioned institutions from engaging in global financial messaging, making it difficult for them to carry out international financial businesses and transactions. For example, on March 15, 2012, pursuant to the decision of the Council of the European Union, SWIFT announced that it would stop providing service to Iranian financial institutions sanctioned by Europe. On February 26, 2022, the European Commission, France, Germany, Italy, the United Kingdom, Canada, and the United States issued a joint statement removing certain Russian banks from the SWIFT messaging network in order to disconnect these banks from the international financial system and compromise their global operating capabilities.8

(1) 切断SWIFT。将银行等金融机构从SWIFT系统移除,限制被制裁机构参与全球金融报文传送,使其难以开展国际金融业务和交易。例如,2012年3月15日,根据欧盟理事会的决定,SWIFT宣布停止向被欧洲制裁的伊朗金融机构提供服务;2022年2月26日,欧盟委员会、法国、德国、意大利、英国、加拿大和美国发布联合声明,将部分俄罗斯银行从SWIFT报文传送系统中剔除,以使这些银行与国际金融体系脱节,打击其全球运营能力。

(2) Denying access to U.S. dollar payment and settlement channels. Because the U.S. dollar is the main currency for global payments and global foreign exchange transactions, cutting off sanctioned financial institutions from U.S. dollar payment and settlement channels will severely damage their international financial businesses. This is mainly implemented through OFAC’s Correspondent Account or Payable-Through Account (CAPTA) list. Financial institutions on the list are prohibited or strictly restricted from opening or holding U.S. correspondent accounts or payable-through accounts. For example, on February 24, 2022, the United States added Russia’s largest financial institution, Sberbank, and its affiliates to the CAPTA list. Given that the gross daily foreign exchange transactions of Russian financial institutions amounted to the equivalent of 46 billion U.S. dollars, with 80 percent of which in U.S. dollars, the U.S. Treasury Department believed that this measure, together with other measures, would block the vast majority of Russian transactions in U.S. dollar.9

(2) 切断美元支付清算通道。由于美元是全球主要的支付货币,也是全球外汇交易的主要货币,切断美元支付清算通道,会重击被制裁金融机构的国际金融业务。这主要是通过OFAC的往来账户或通汇账户(Correspondent Account or Payable-Through Account,CAPTA)清单实施的,即清单内的金融机构被禁止或被严格限制开立或持有美国往来账户或通汇账户。例如,2022年2月24日,美国将俄罗斯最大的金融机构俄罗斯联邦储蓄银行(Sberbank)及其附属实体列入CAPTA清单。鉴于俄金融机构每天在全球进行约460亿美元的外汇交易且其中80%是美元,美国财政部认为,这项措施与其他措施一起,将中断俄罗斯绝大多数的美元交易。

4. Indirect Attacks

4. 间接打击

Examples of indirect attacks include manipulating international rating agencies to lower the sovereign credit rating or corporate rating of the sanctioned country; provoking financial market turmoil in the sanctioned country by announcing financial sanctions; prohibiting sanctioned financial institutions from using IT hardware and software services provided by companies of the sanctioning country through information technology blocking, or even launching technology-targeted attacks.

例如,操控国际评级机构下调被制裁国主权信用评级或企业评级;通过宣告金融制裁诱发被制裁国金融市场动荡;通过信息技术封,禁止被制裁金融机构使用制裁发起国公司的IT硬件及软件服务,甚至采取技术攻击等。

(2) Transmission Channels for Financial Sanctions’ Impact on National Financial Security

(二)金融制裁冲击国家金融安全的传导路径

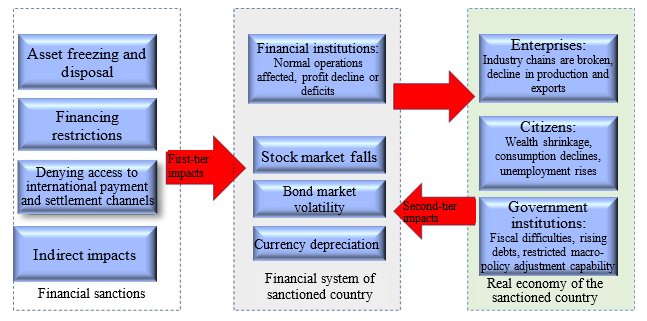

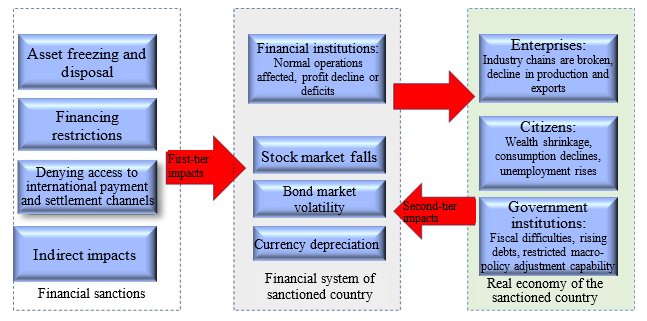

The impact of financial sanctions on the national financial security of the sanctioned country can be divided into two rounds. In the first round, there is a direct impact on the financial market and financial institutions, resulting in violent fluctuations in the financial market, as well as operational constraints and losses inflicted on financial institutions. In the second round, there are indirect impacts from the spillover and contagion damage originating from the real economy. Finance is the lifeblood of the economy. Once the financial system is damaged, its ability to serve the real economy will decline, and the damage suffered by the real economy will in turn aggravate the volatility of the financial system.

金融制裁对被制裁国国家金融安全的冲击可以分为两轮。第一轮是直接冲击金融市场和金融机构,导致金融市场剧烈波动,金融机构经营受阻并遭受损失;第二轮是间接冲击,来自实体经济的溢回传染。金融是经济的血脉,金融体系受损后,服务实体经济的能力下降;实体经济遭受损害,反过来加剧金融体系波动。

1. First-tier Impacts

1. 第一轮冲击

When the assets of financial institutions of the sanctioned country are frozen, the available cash flows will decrease, and normal operations will be affected. If financing channels are restricted, the business of financial institutions will decrease, and if the financial institutions have been denied access to the international payment and settlement systems, they cannot conduct receipts and payments businesses in foreign currencies. Due to the threat of sanctions and their own interests, other financial institutions and cross-national enterprise groups are very likely to terminate business cooperation with the sanctioned institutions, therefore gravely damaging banks’ ability to serve customers and conduct operations. All of these effects will lead to a decline in projected income and profits, or even result in major losses or inability to continue business operations.

对被制裁国金融机构而言,如果被冻结资产,其账面可动用的现金流减少,正常经营受到影响;如果限制融资,金融机构的业务减少;而如果金融机构与国际支付清算体系的连接被切断,意味着无法进行外币收付业务。其他金融机构和经营跨国业务的企业集团出于制裁威胁及自身利益的考虑,极有可能中止与被制裁机构的业务合作,银行对客户的服务能力及经营将受到重创。这些都会导致金融机构预期收入降低、利润减少,甚至出现重大亏损,乃至无力持续经营。

In terms of the financial markets of the sanctioned country, its stock market, bond market, and foreign exchange market will all be impacted. Once financial sanctions are announced, the currency of the sanctioned country will often see a sharp depreciation. On the one hand, financial sanctions serve as a signal that the economic and financial prospects of the sanctioned countries are bleak. This is likely to lead to rising sovereign credit risks and downgraded ratings, harming investor confidence and thus resulting in disinvestment and capital flight. On the other hand, freezing the central bank’s foreign exchange reserves would weaken the central bank’s ability to intervene in the foreign exchange market and stabilize currency values. The sharp drop in foreign exchange reserves will cause a decline in the international liquidity of the sanctioned country, while blocking financing access will constrict the channels used by the sanctioned country to obtain international reserve currencies, further aggravating the depreciating pressure on local currency.

对被制裁国金融市场而言,股市、债市、汇市都会受到冲击。金融制裁的消息一宣布,被制裁国的货币往往大幅贬值。一方面,金融制裁具有信号作用,被制裁国经济金融运行前景堪忧,极大可能引起主权信用风险上升和评级下调,投资者信心不稳,导致撤资和资本外逃。另一方面,冻结央行外汇储备,导致央行干预外汇市场、维护货币价值稳定的能力下降,外汇储备骤减导致被制裁国国际清偿能力下降,阻断融资使被制裁国获取国际储备货币的渠道受阻,进一步增加其本币贬值压力。

Financial sanctions will affect the stock market and bonds of the sanctioned country through channels of sovereign risk and credit, driving up short- and medium-term financing costs. First, if the sanctions directly prohibit investors from the sanctioning country from buying stocks and bonds of companies in the sanctioned country, the decrease in demand for securities will lead to a slump in the sanctioned country’s stock and bond markets. Second, financial sanctions lead to higher risks for companies in the sanctioned country and lower estimated values of its stocks. Restrictions on accessing financing also cause a reduction in the supply of funds in the sanctioned country, an increase in interest rates, and a slump in the bond market. Finally, being more and more sensitive to the risks of the sanctioned country, investors will reduce their holdings of financial assets such as stocks in order to avoid risks. This will cause the funding pool of the capital market to contract drastically, triggering further declines in the stock and bond markets.

金融制裁通过主权风险渠道和信贷等渠道影响被制裁国股票市场和债券,造成中短期融资成本上升。首先,如果制裁直接禁止发起国投资者购买被制裁国企业的股票和债券,证券需求减少导致股市、债市下跌。其次,金融制裁导致被制裁国企业风险增大、股票估值下跌;限制融资也导致被制裁国资金供给减少,利率上升,债市下跌。最后,投资者对被制裁国的风险情绪上升,在避险动机下主动减持被制裁国股票等金融资产,资本市场资金池大幅缩水,进一步引发股市债市下跌。

2. Second-tier Impacts

2. 第二轮冲击

The impact of financial sanctions on the financial institutions and financial markets of the sanctioned country will be transmitted to the real economy, leading to a decline in investment, consumption, and output, as well as an increase in inflation. Then, these effects will in turn impact the stability of the financial system.

金融制裁对被制裁国金融机构、金融市场的影响,传导至实体经济,导致投资、消费、产出下降,通胀上升,进而反过来影响金融体系的稳健。

First, financial sanctions usually result in slower economic growth or even lower output and increased unemployment in the sanctioned country. In terms of consumption, sanctions cause a sharp depreciation of the local currency of the sanctioned country. Coupled with the freezing of certain assets, there will be a contraction of people’s wealth, higher inflation rates, and reduced purchasing power. In terms of investment, sanctions will lead to a large-scale flight of international capital and a decline in foreign direct investment, which, in combination with obstructed international financing channels, are not conductive to investment growth. In terms of export, international trade payments, settlement, and pricing are still mainly conducted in U.S. dollars. When financial institutions are excluded from the SWIFT system and enterprises’ access to international financing is restricted, it will have a major negative impact on the export of the sanctioned country. Financial sanctions are often accompanied by other economic sanctions. For example, when key production links are put in a “stranglehold,” it will disrupt some industry chains in the sanctioned country, causing a decline in output, economic depression, and rising unemployment.

其一,金融制裁通常导致被制裁国经济增长放缓甚至产出下降、失业上升。从消费渠道看,制裁引起被制裁国本币大幅贬值,加之部分资产被冻结,导致居民财富缩水和通胀率攀升,购买力下降。从投资渠道看,制裁导致国际资本大量撤离和外商直接投资下降,加之国际融资渠道受阻,不利于投资增长。从出口渠道看,目前国际贸易支付、结算和计价主要仍以美元为主,金融机构被剔除出SWIFT系统以及企业被限制国际融资,对被制裁国出口形成巨大负面冲击。金融制裁往往还会伴随其他经济制裁,如关键生产环节被“卡脖子”,导致被制裁国一些产业链断裂,产出下降,经济萧条,失业上升。

Second, financial sanctions usually lead to relatively serious inflation in the sanctioned country. On the one hand, sanctions obstruct international payment and settlement channels of the sanctioned country, reduce its ability to engage in foreign trade, and reduce its supply of imported goods. The depreciation of the sanctioned country’s currency and the rise in import prices will all impose imported inflationary pressure on the country. On the other hand, sanctions will lead to a decline in output and insufficient supply of commodities, while the scarcity of some commodities can even trigger panic buying in the public, which further exacerbates inflation.

其二,金融制裁通常导致被制裁国出现比较严重的通货膨胀。一方面,制裁导致被制裁国国际支付清算受阻、对外贸易能力下降,进口商品供给下降;被制裁国本币贬值、进口价格上涨,均会造成输入性通胀压力。另一方面,制裁导致产出下降,商品供给不足,部分商品稀缺乃至引发民众抢购,加剧通胀。

Third, the sanctions’ damage to the real economy will spill over and flow back to the financial system. In this case, businesses will struggle to operate themselves, defaults will increase, and financial institutions will have higher bad debt ratios and suffer greater losses. At the same time, the financial market serves as a barometer that reflects the performance of the real economy. If the real economy is sluggish, the stock and bond markets will consequently decline, also increasing the downward pressure on the national currency of the sanctioned country.

其三,实体经济运行受损,其效应会回溢至金融体系。企业经营困难,违约增多,金融机构坏账率上升、亏损加大。同时,金融市场是实体经济表现的晴雨表,实体经济萎靡不振,股市、债市下跌,本币贬值压力加大。

Figure 1 Diagram of the Transmission Channels of How Financial Sanctions Impact National Financial Security

图1金融制裁冲击国家金融安全的传导路径示意图

(3) Financial Sanctions will also Impact the Financial Security of Other Countries

(三)金融制裁也会对其他国家金融安全形成冲击

Currently, the scope of financial sanctions continues to expand. Unlike in the past, sanctions are no longer limited to small and medium-sized economies, where sanctions only produce local impacts. Due to the universal connectedness of the global economy and finance, sanctions will add to global economic and financial risks, which in turn will have an impact on the financial security of other countries. Specific impacts include: First, due to concerns about secondary sanctions, other financial institutions are very cautious about businesses involving the sanctioned country. Sanctions not only obstruct foreign payment and settlement in some regions and sectors, but drive up the compliance costs for financial institutions. Second, financial institutions that hold financial assets of sanctioned countries may be subject to risks and losses. Third, sanctions cause investors to become prone to risk avoidance, leading to capital outflow from emerging market economies, depreciation of local currencies in some emerging economies, rising international refinancing costs, and subsequently complicating foreign debt repayment. Fourth, financial sanctions impact the normal operation of the international economy and even increase the risk of recession. Some relatively fragile economies may face pressures due to factors such as insufficient supply of raw materials, declining output, and soaring inflation, further escalating their financial risks. Fifth, sanctions will further aggravate the difficulty of international financial governance and policy coordination.

当前金融制裁范围不断扩展,已非昔日局限于中小经济体、在局部产生影响。由于全球经济金融普遍联系,会造成全球经济金融风险累积,进而对其他国家金融安全形成冲击。具体冲击包括:一是由于担心二级制裁,其他金融机构对于涉被制裁国的业务非常谨慎,不仅部分区域和领域的对外支付结算可能受阻,还会加大金融机构的合规成本。二是持有被制裁国金融资产的金融机构遭受风险和损失。三是投资者避险情绪上升,资本从新兴市场经济体流出,部分新兴经济体本币贬值和国际再融资成本上升,外债偿付压力随之上升。四是金融制裁冲击国际经济正常运行甚至加大衰退风险,一些相对脆弱的经济体可能面临原材料供给不足、产出下降、通胀飙升等压力,进一步加剧金融风险。五是国际金融治理和政策协调难度进一步加大。

III. The Degree of Impact Imposed by Financial Sanctions on National Financial Security Depends on Many Factors

三、金融制裁影响国家金融安全的程度取决于多种因素

Financial sanctions are only effective when the sanctioning country occupies an important position in the international financial system. However, if the sanctioned country has robust and stable economic and financial operations, takes appropriate response measures, and has a strong ability to manage risks, these factors will help mitigate the impact of financial sanctions on national financial security. Because most of the current sanctions are not supported by UN resolutions, the sanctioned country usually chooses to use third parties to bypass the sanctions. The sanctioning country either relies on the deterrence power of secondary sanctions to prohibit other countries from providing assistance to the sanctioned country, or further tightens the noose of sanctions through joint sanctions with its allies. In this context, the economic and financial security of other countries may be affected. They may have to make a choice under pressure or voluntarily: either reduce their economic and financial ties with the sanctioned country, or reduce economic and financial ties with the sanctioning country. The pros and cons of this decision weighed by a third party not only concern political factors, but are also related to how closely the economic and financial interests of the third party are bound to the sanctioning country and the sanctioned country. Generally speaking, when faced with sanctions, there is leeway for the sanctioned country to manage and respond to national financial risks, while sanctions are also a double-edged sword for the sanctioning country.

金融制裁之所以能起作用,在于制裁发起国在国际金融体系中占据重要地位,但如果被制裁国自身经济金融运行稳健、应对措施得当,且有较强管理风险的能力,将有助于减轻金融制裁对国家金融安全的冲击。由于现行的多数制裁并未得到联合国决议的支持,被制裁国通常会选择第三方迂回绕过制裁。而发起国或者凭借二级制裁威慑禁止其他国家为被制裁国提供帮助,或者通过与盟友等联合制裁进一步勒紧制裁的索套。在此国际局势下,其他国家经济金融安全可能受到波及,被迫或主动作出选择:或者减少与被制裁国的经济金融联系,或者减少与制裁发起国的经济金融联系。第三方的利弊权衡,既受到政治因素的影响,也取决于第三方与制裁发起国和被制裁国经济金融利益关联程度。总体看,面对制裁,被制裁国有管理和应对国家金融风险的空间,而制裁对发起国而言也是双刃剑。

(1) The Sanctioned Country’s Own Financial Stability is the Basis for Defense against the Risks of Sanctions

(一)被制裁国自身金融运行稳健是抵御制裁风险的基础

The risks of financial sanctions can be intertwined with and superimposed upon traditional financial risks, therefore generating higher threats. The robust and stable operation of the domestic financial system is itself the foundation for national financial security. In terms of national financial security, systemic financial risks are more threatening. Such risks generally concern temporal and spatial dimensions. In the temporal dimension, the [level of risks] is manifested by procyclical self-strengthening and escalation of risks. In the spatial dimension, it is manifested by the connection and inter-contagion between the institutions and the market. If financial sanctions are targeted at a financial institution of systemic importance, while the institution is not robust or lacks the means and measures to manage sanctions risks, unable to withstand the impact of sanctions, the sanctions may directly cause systemic financial risks. Even if financial sanctions’ target is not systemically important financial institutions, if sanctions achieve broad coverage, or if the breakage of an already fragile but critical link causes the financial system to be partially dysfunctional, or if the financial market itself is already in turmoil, then traditional financial risks and sanction risks may reinforce each other. As a result, sanctions are likely to trigger systemic risks or even financial crises. In terms of the temporal dimension, if the risk of financial sanctions coincides with the time when the economy is at the top or bottom of the financial cycle, it will aggravate the shock that sanctions have on the financial system. Therefore, as it takes a good blacksmith to forge good steel (打铁还需自身硬, Chinese idiom), only when the domestic financial system is stable and healthy, can the sanctioned country better withstand the impact of financial sanctions on its national financial security.

金融制裁风险具有与传统金融风险相互交织叠加强化的可能,国内金融体系自身的稳健运行是国家金融安全的根基。对于国家金融安全而言,系统性金融风险更具威胁,通常有时间和空间两个维度。时间维度上,体现为顺周期的自我强化和放大;空间维度上,体现为机构与市场间的联系和相互传染。如果金融制裁针对的是系统重要性金融机构,而该机构稳健性欠佳或者缺乏管理制裁风险的手段和措施,无力抵御制裁冲击,可能直接引起系统性金融风险。即便金融制裁未针对系统重要性金融机构,但如制裁涉及面广泛,或者某个关键环节原本就很脆弱而导致金融体系丧失部分功能,或者某个金融市场本身已经在动荡之中,那么传统金融风险与制裁风险相互加强,很可能引发系统性风险乃至金融危机。如果在时间维度上,金融制裁风险正好与金融周期顶部或底部叠加,也会放大金融体系的震荡。因此,打铁还需自身硬,只有国内金融体系自身运行稳健,才能更好地抵御金融制裁对国家金融安全的冲击。

(2) Prompt and Effective Countermeasures are a Safety Valve to Mitigate the Impact of Sanctions

(二)及时有效的应对是减轻制裁冲击的安全阀

When the sanctioned country is politically stable and has a firm determination to resist the sanctions, the more stable the sanctioned country’s economy and finances are, the more effective its countermeasures will be. Prompt and effective measures can reduce the impact of sanctions on national security to a considerable extent. For example, during the Crimea conflict in 2014, in the face of U.S. and Western sanctions, Russia methodically adopted many countermeasures: starting the process of de-dollarization, such as restricting the use of U.S. dollars in cross-border payment and settlement, reducing U.S. dollar assets in foreign exchange reserves, and increasing the shares of Euros, gold, and RMB to reduce dependence on the U.S. dollar; and improving its financial infrastructure in an orderly manner by establishing the (System for Transfer of Financial Messages) SPFS cross-border financial information transmission system and National Payment Card System (NSPK) to replace the SWIFT, MasterCard, and Visa systems while expanding access to international financing through multiple channels. After the outbreak of the Ukraine crisis in 2022, in the face of escalating sanctions from the United States and the West, Russia responded with a combination of actions: rapidly raising its interest rates and implementing strict capital controls; using its advantages in the energy sector to impose a “Ruble Settlement Decree” for natural gas and stabilize of the ruble exchange rate; expanding bilateral trade in local currencies; and withdrawing “Russian concept stocks” (俄概股) from U.S. and UK stock markets. Due to these prompt, timely, and highly targeted response measures, some macroeconomic indicators in Russia quickly stopped falling and rebounded, and the ruble exchange rate bottomed out after a rapid depreciation period.

在被制裁国政治稳定、反制裁决心坚定的情况下,被制裁国经济、金融越稳定,越有能力采取应对和反制措施,及时、有效的措施可在相当大程度上减轻制裁对国家安全的冲击。例如,2014年克里米亚冲突后,面对美西方制裁,俄罗斯逐步采取诸多应对和反制措施:开启去美元化进程,如在跨境支付结算中限制美元使用,外汇储备减少美元资产转而增加欧元、黄金与人民币比例,减轻对美元的依赖;完善金融基础设施,先后建立跨境金融信息传输系统(SPFS)与国内支付卡系统(NSPK),取代SWIFT系统与万事达卡、维萨卡,并多渠道拓展国际融资。2022年乌克兰危机爆发后,面对美西方不断升级的制裁,俄罗斯打出组合拳应对:快速升息并实施严格资本管制;利用能源优势实施天然气“卢布结算令”,促进稳定卢布汇率;扩大双边本币贸易;采取“俄概股”退出美英股票市场等反制手段。由于应对措施迅速及时、针对性强,俄罗斯部分宏观经济指标快速止跌回升,卢布汇率快速贬值后触底反弹。

(3) The Financial Competitiveness of the Sanctioning Country Affects the Severity of Sanctions Risks

(三)制裁发起国的金融实力是影响制裁风险强弱的要素

To date, the United States has imposed the most financial sanctions, and U.S. sanctions have a serious impact on the financial security of the sanctioned countries. Some other Western countries will follow the sanctions imposed by the United States, but few have initiated financial sanctions alone, and there are also very few financial sanctions resulting from UN sanction resolutions. The reason the United States can impose effective “long-arm jurisdiction” in the financial field lies in its dollar hegemony. As the most important international reserve currency and an important infrastructure that allows the United States to dominate the international financial system, the U.S. dollar is the basis for U.S. financial sanctions. After World War II, the U.S. dollar became the most important international reserve currency, accounting for nearly 60% of the foreign exchange reserves among central banks. 10 Globally important commodities such as oil and grains are mainly settled in U.S. dollars.

迄今,美国采用金融制裁最多,对被制裁国金融安全影响很大。其他一些西方国家会跟随美国制裁,但单独发起金融制裁的较少,而且由联合国制裁决议产生的金融制裁也很少。美国之所以能在金融领域实施强有力的“长臂管辖”,依托的就是美元霸权。美元作为最重要的国际储备货币以及美国主导国际金融体系的重要基础设施,是美国进行金融制裁的基础。二战以后,美元成为最重要的国际储备货币,各国央行外汇储备中美元占比近60%,全球重要的大宗商品如石油和粮食都主要以美元进行结算。

The United States also plays a leading role in the international financial infrastructure, especially the SWIFT system. SWIFT helps users communicate and exchange financial messages such as payment instructions through a safe and reliable channel. The payment and settlement systems of various countries and economies, such as the Clearing House Interbank Payment System (CHIPS) for the U.S. dollar, and the Trans-European Automated Real-time Gross Settlement Express Transfer (TARGET) for the euro, will complete fund payment and settlement after receiving SWIFT payment instructions. The United States and its allies hold the majority of seats on the SWIFT board of directors, with a U.S. representative serving as chairman of the board. U.S. financial security and intelligence organizations have also gradually strengthened their control over SWIFT in the name of anti-terrorism. Since 2011, the U.S. State Department has been monitoring real-time SWIFT data.11 At present, SWIFT is connected to more than 11,000 banks, securities institutions, financial market infrastructures, and corporate users around the world, and its business covers more than 200 countries and regions.12 The United States has benefited significantly from controlling SWIFT: On the one hand, the United States obtains relevant financial information through the SWIFT system, which improves its effectiveness of secondary sanctions; On the other hand, if a sanctioned institution is excluded from the SWIFT system, it will be extremely difficult for the institution to conduct business involving international payment and settlement.

美国在国际金融基础设施方面也有主导权,特别是SWIFT系统。SWIFT协助用户通过安全可靠的途径开展通讯并交换支付指令等金融报文,各国或经济体的支付清算系统,如美元的清算所银行同业支付系统(Clearing House Interbank Payment System,CHIPS)、欧元的泛欧实时全额自动清算系统(The Trans-European Automated Real-time Gross Settlement Express Transfer,TARGET)等,在收到SWIFT支付指令后完成资金支付结算。美国及其盟友拥有SWIFT中大多数的董事席位,且由美国代表担任董事会主席。美国的金融安全和情报组织还借反恐之名逐步加强对SWIFT的控制,从2011年起,美国国务院开始对SWIFT数据进行实时监控。目前,SWIFT对接全球超过11000家银行、证券机构、金融市场基础设施和企业用户,业务覆盖200多个国家和地区。美国掌控SWIFT获益颇丰:一方面,美国通过SWIFT系统获取相关金融信息,提高了二级制裁的执行力;另一方面,被制裁机构被剔除出SWIFT系统,其国际收付清算业务就会极度困难。

The power to formulate international financial rules serves as a critical part of U.S. financial sanctions. The United States holds the biggest voting rights in major international financial institutions. As of October 2022, the United States holds 16.5% of the voting rights in the International Monetary Fund (IMF).13 According to the regulations of the IMF, a majority of at least 85% is required to pass major resolutions, which means that the United States has the power to veto any major resolutions. At the same time, the voting rights of the United States in the International Bank for Reconstruction and Development, the International Finance Corporation, the International Development Association, and the Multilateral Investment Guarantee Agency of the World Bank Group are 15.6%, 18.78%, 9.86%, and 14.81%, respectively.14 In addition, the presidency of the World Bank has long been held by a U.S. representative.

国际金融规则制定权是美国实施金融制裁的重要抓手。美国在主要国际金融机构中拥有最大投票权。截至2022年10月,美国在国际货币基金组织拥有16.5%的投票权,而依据国际货币基金组织的规定,重大事项须获85%以上的投票权通过,这意味着美国有一票否决重大事项的权力。同时,美国在世界银行集团中的国际复兴开发银行、国际金融公司、国际开发协会、多边投资担保机构中所占投票比例分别为15.6%、18.78%、9.86%、14.81%,且世界银行行长长期由美国人担任。

(4) The Choices Made by Other Parties will also Affect Sanctions Risks

(四)其他方选择也会对制裁风险产生影响

There is an essential difference between “the strong bullying the weak” and “the rivalry between great powers.” On the one hand, the United States and the West have increased the power of sanctions through continuous “improvement” of financial sanctions, gradually expanding the scope of financial sanctions from being mainly used against small and mid-sized economies to being a part of the strategic rivalry between major powers. In this scenario, if the sanctioned party is also a major power, it will be endowed with high economic resilience and the power to initiate countermeasures in the financial rivalry. Today, with the deep economic integration due to globalization, it is unrealistic for a sanctioning country to be completely decoupled from its target country economically and financially. Furthermore, if other countries bear close economic and financial ties with the target country, sanctions will prompt these countries to weigh the pros and cons of the sanctions more cautiously, rather than blindly following the sanctioning country in lockstep on all issues. On the other hand, although the United States can use the hegemony of the U.S. dollar to impose financial sanctions, this deterring effect may also push some countries to double down on their “de-dollarization” efforts. For example, in 2019, Germany, France, and the United Kingdom created the Instrument for Supporting Trade Exchanges (INSTEX) mechanism to support legal trade between Europe and Iran. And up until now, 10 countries have joined this system. After financial sanctions were imposed on Russia in 2022, Russia and India were also exploring the establishment of an exchange for ruble-rupee trade payments.15 In the long run, the continuous weakening of international economic and financial ties will also diminish the competitiveness and overall national strength of the sanctioning country. Not only will more countries use other currencies for trade, investment, and financing to reduce their dependence on major reserve currencies, global cooperation will also decrease, hindering scientific and technological innovation.

“以强凌弱”的打击与“大国博弈”的角逐存在本质上的区别。一方面,美西方通过不断“改进”金融制裁来提高制裁威力,将金融制裁从主要用于中小型经济体,逐步扩展至大国博弈。在此情景下,对手方的大国属性赋予其在金融博弈中具有较高的经济韧性与反制能力。在全球化深度融合的今天,制裁发起国欲与对手方在经济金融上完全脱钩并不现实。不仅如此,如果其他国家与对手方的经济金融联系非常紧密,也会促使这些国家更加审慎地权衡利弊,而非盲目地在所有问题上与制裁发起国保持完全一致。另一方面,虽然美国可以利用美元霸权实施金融制裁,但这种威慑效应也会促使一些国家加快“去美元化”的步伐。例如,2019年德国、法国和英国创建贸易往来支持工具(Instrument for Supporting Trade Exchanges,INSTEX)的贸易结算支持机制,以支持欧洲与伊朗之间的合法贸易,目前已有10个国家加入。2022年对俄金融制裁后,俄罗斯和印度探索建立卢布—卢比贸易支付。长期来看,国际经济金融联系持续减弱也会削弱发起国的竞争力和综合国力,不仅更多国家采用其他货币进行贸易及投融资以降低对主要储备货币的依赖,全球合作还会减少,阻碍科技创新等。

Overall, financial sanctions are also a double-edged sword for the sanctioning country. On the global chessboard, if one’s opponent can win more partners, this will not only help the country reduce the risk of sanctions, but also allow it to transform the international political and economic landscape towards its own interests, ensuring its national financial security in the long run.

总体看,金融制裁对发起国也是双刃剑,在全球博弈的大棋盘上,如果对手方能够争取更多的伙伴,不仅有助于减轻制裁风险,更能推动国际政治经济局势向于己有利的方向转化,从长远上保证国家金融安全。

IV. Approaches to Address the Risks of Financial Sanctions

四、应对金融制裁风险的思路

The world is currently facing major changes unseen in a century, and national financial security is confronting new challenges, especially the challenge of financial sanctions. On the one hand, the frequent use of financial sanctions has a negative impact on normal international economic and financial operations. In particular, the United States continues to expand its “long-arm jurisdiction,” which has a spillover and contagion effect on China, and may affect the operations of Chinese enterprises and financial institutions. On the other hand, the international landscape is complex and challenging, and the possibility that some countries will stir up trouble and find excuses to impose financial sanctions on China cannot be ruled out. These trends will all increase national financial security risks. National security is the foundation of China’s national rejuvenation, and social stability is the prerequisite for national prosperity. We must plan for the troubles ahead, coordinate economic growth and national security, strengthen our ability to maintain national financial security, and firmly safeguard national financial security.

当前世界面临百年未有之大变局,国家金融安全面对新的冲击因素,特别是金融制裁的挑战。一方面,频繁的金融制裁对国际经济金融正常运行产生负面影响,特别是美国不断扩大“长臂管辖”,对我有溢出传染效应,可能影响我国企业和金融机构运营;另一方面,国际局势复杂严峻,不排除某些国家制造事端和找借口对我进行金融制裁的可能性。这些都会增大国家金融安全风险。国家安全是民族复兴的根基,社会稳定是国家强盛的前提,必须未雨绸缪,统筹发展和安全,增强维护国家金融安全能力,坚定维护国家金融安全。

(1) Strengthen Countermeasures against Sanctions, Interference, and “Long-arm Jurisdiction” in Finance and Respond to Financial sanctions in a Duly Justified and Well-grounded Manner

(一)健全金融领域反制裁、反干涉、反“长臂管辖”机制,有理有据有节应对金融制裁

First, we must strengthen the legal system for countering sanctions. In recent years, China has gradually established anti-sanction laws and regulations, such as the Provisions on the Unreliable Entity List and Rules on Counteracting Unjustified Extra-territorial Application of Foreign Legislation and Other Measures. In particular, the Anti-Foreign Sanctions Law was issued in June 2021, providing solid legal basis and protection for China to take corresponding countermeasures. On that basis, countermeasures can be a multi-level combination of various departmental regulations and other forms of approaches, and especially combinations of economic and financial measures that can be flexibly adjusted. Anti-sanction measures serve as a means of both self-protection and deterrence. They prompt major powers to make decisions based on rational judgments during power games, and promote peace by achieving the optimal equilibrium of power. Second, financial institutions must acquire the necessary methods for sanctions relief, give full play to the role of industrial associations and other organizations, and improve the effectiveness of responses to sanctions. In theory, a sanctioned financial institution can apply to be removed from the sanction list by appealing to the administrative institution of the sanctioning country or filing lawsuits in court in the sanctioning country. After weighing the costs and benefits, the sanctioned institution can adopt relevant laws and regulations of the sanctioning country in a proper manner, to delay or even avoid sanctions through litigation and other means. Due to the increasing frequency of sanctions and the high cost of litigation and other methods, industrial associations and other organizations can play a greater role in disseminating relevant knowledge on how to effectively respond to sanctions risks, so as to leverage the large size of the industrial sector to reduce the relative costs of countermeasures. Third, overseas institutions must strictly abide by their local laws and regulations. In addition to strengthening everyday business management to accommodate local practices, they also need to pay close attention to and monitor geopolitical risks, pay close attention to various sanctions lists in the United States and Europe, monitor the real-time situation of clients and risk exposure relevant to cross-border businesses, and formulate proper contingency plans. Fourth, we must diversify our trading channels, strive to diversify and decentralize our investment, reduce our dependence on any single financial trading platform, and make adjustments to establish a multi-currency financial portfolio, especially diversifying the constitutive currencies of foreign exchange reserve assets.

一是健全反制裁相关法律法规体系。近年来,我国逐步建立反制裁法律法规制度,如《不可靠实体清单规定》《阻断外国法律与措施不当域外适用办法》等,特别是2021年6月出台了《反外国制裁法》,为我国采取相应反制措施提供了坚实的法律支撑和法治保障。在此基础上,可以部门规章等多种形式丰富多层次反制手段,特别是力度可灵活调节的经济金融手段组合。反制裁措施既是自我保护又是威慑,有助于在大国博弈中推动双方理性思维抉择,实现最优博弈均衡的和平效应。二是金融机构要掌握必要的制裁救济方法,发挥好行业协会等行业组织作用,提高应对制裁的效率。理论上,被制裁金融机构可以向制裁发起国行政部门申请将其从制裁名单移除,或向其法院起诉。被制裁机构在权衡成本收益情况下,可适当运用制裁发起国相关法律条款,通过诉讼等方式拖延甚至阻止制裁。考虑到制裁日益频繁以及诉讼等方式成本高昂,可以更多发挥行业协会等行业组织的作用,普及有效应对制裁风险的相关知识,发挥规模效应,降低应对成本。三是境外机构要严格遵守当地法律法规,除加强日常业务合规性管理外,还需密切关注和监测地缘政治风险,高度关注美欧各类制裁名单,动态监测跨境业务的客户及风险头寸情况,妥善制定应急预案。四是拓展多元化交易渠道,坚持多元化、分散化投资,降低对单一金融交易平台依赖,对金融资产进行多币种结构调整,特别是要多元化外汇储备资产币种结构。

(2) Strengthen Security Capability Building in the Financial Sector and Guard Vigilantly against Systemic Financial Risks from the Combined Effects of Financial Sanctions and Traditional Financial Risks

(二)加强金融领域安全能力建设,严防金融制裁冲击与传统金融风险交织引发系统性金融风险

First, we must pay attention to the potential risks of financial sanctions and possible contagion effects, continuously improve the risk monitoring and assessment framework of the financial industry, include financial sanction risks and their interaction with traditional financial risks as factors for consideration, enhance emergency response plans, improve financial risk prevention, early warning, treatment, and accountability systems, and shore up the weak points in financial risk prevention and response systems. Second, we must strengthen and refine modern financial regulation, reinforce the systems that safeguard financial stability, bring various financial activities under regulation according to law, and ensure no systemic risks arise. Third, we must further promote and deepen the reform of financial institutions, improve corporate governance structures, and effectively guide financial institutions to operate in a robust and stable manner. The financial sector should take serving the real economy as its immutable goal, comprehensively improve its efficiency and standard of work, promote financing facilitation, reduce costs of the real economy, improve resource allocation efficiency, and ensure risk control. It should also facilitate the national economy to achieve better development in quality, efficiency, fairness, sustainability, and security, which in turn will contribute to the security and stability of financial operations. Fourth, we must build a national financial security inspection mechanism to strengthen the defensive borders of national financial security, make critical infrastructure, key financial technologies, and the security of financial data the focuses of national financial security inspection, and comprehensively and objectively assess and review their impact on national financial security. Fifth, we must properly respond to risks of information technology, improve our independence and capabilities in operating and maintaining software and hardware purchased abroad, thoroughly investigate and rectify potential security hazards in network equipment and software packages, ensure the availability of data backup and business emergency response plans, and gradually replace foreign hardware and software with domestic hardware and software through research and development of information technology infrastructure with its own core capabilities.

一是关注金融制裁潜在风险及可能的传染效应,不断完善金融业风险监测与评估框架,引入金融制裁风险及其与传统金融风险交互影响的因素考量,完善应急处置预案,健全金融风险预防、预警、处置、问责制度体系,补齐金融风险防范化解制度短板。二是加强和完善现代金融监管,强化金融稳定保障体系,依法将各类金融活动全部纳入监管,守住不发生系统性风险底线。三是进一步推动深化金融机构改革,完善公司治理结构,切实引导金融机构稳健经营。金融要把为实体经济服务作为出发点和落脚点,全面提升服务效率和水平,促进融资便利化、降低实体经济成本、提高资源配置效率、保障风险可控,促进国民经济更高质量、更有效率、更加公平、更可持续、更为安全发展,这反过来也有助于金融安全稳定运行。四是以国家金融安全审查机制建设强化国家金融安全防御边界,将关键基础设施、金融关键技术和金融数据安全作为国家金融安全的审查重点,全面客观评估审查其对国家金融安全的影响。五是妥善应对信息技术风险,提高外购软件和硬件的自主运营维护能力,彻查和整改网络设备及软件包安全隐患,做好数据备份及业务应急预案,并通过研发具有自身核心能力的信息技术基础设施,逐渐使用国产硬件和软件替代。

(3) Making Headway in High-quality Opening Up of the Financial Industry and Actively Participating in Global Economic and Financial Governance

(三)深入推进金融业高质量开放,积极参与全球经济金融治理

Opening up the financial sector can be risky, but an exclusionary financial system is much less secure. Deepening high-level opening up of the financial industry, expanding global partnerships based on equality, openness, and cooperation, as well as broadening the convergence of our interests with other countries are not only necessary for promoting high-quality development, but also help to ensure national financial security. First, we must promote targeted financial reform through financial opening and introduce international financial resources in the “dual circulations” (双循环, domestic and international circulation) through high-level opening up. We must adhere to the principle of developing a market-oriented, law-based, and international economy, roll out nationwide the management system of pre-establishment national treatment plus a negative list, and achieve institutional and systematic opening up. Second, we must play a constructive role in global economic and financial governance and international financial cooperation, engage in global economic governance and policy coordination in an all-round, multi-level, pragmatic, and flexible manner, jointly promote global economic growth, and maintain international financial stability. Third, we must promote the internationalization of RMB in an orderly manner. Based on the principles of adapting to demand and “things will naturally fall into place when conditions are ripe” (水到渠成), we must respect the market demand and independent choices of enterprises, further improve the policy support system and infrastructure arrangements for the cross-border usage of RMB, promote the two-way opening-up of the financial market, develop offshore RMB market, and create a more convenient environment for market entities to use RMB. At the same time, we must further improve the prudential management framework for cross-border capital flows and ensure no systemic risks arise.

金融开放可能会带来风险,但封闭的金融体系更不安全。深化金融高水平对外开放,拓展平等、开放、合作的全球伙伴关系,致力于扩大同各国利益的汇合点,不仅是推动高质量发展的需要,也有助于保障国家金融安全。一是以金融开放推动金融改革向精细化发展,通过高水平开放引进国际金融资源参与“双循环”。坚持市场化、法治化、国际化原则,推动全面落实准入前国民待遇加负面清单制度,实现制度性、系统性开放。二是建设性参与全球经济金融治理和国际金融合作,全方位、多层次、务实灵活地参与全球经济治理和政策协调,共同促进全球经济增长,维护国际金融稳定。三是有序推进人民币国际化。以顺应需求和“水到渠成”为原则,坚持市场驱动和企业自主选择,进一步完善人民币跨境使用的政策支持体系和基础设施安排,推动金融市场双向开放,发展离岸人民币市场,为市场主体使用人民币营造更加便利的环境,同时进一步健全跨境资金流动的审慎管理框架,守住不发生系统性风险的底线。