The Russia-Ukraine conflict began on February 24th, 2022. Over the past two years, Russia has been hit with almost 20,000 different sanctions from 48 countries (mainly located in Europe and North America). The number of countries leveling sanctions, the number of sanctions, and the breadth of said sanctions are unprecedented.

两年前的2月24日,俄乌冲突爆发;随后的两年里,俄罗斯遭到欧美为首的48个国家近2万项制裁,制裁国家之多,项目之多,领域之广,前所未有。

However, after a brief period of turmoil, Russia’s economy and financial system stabilized. The Russian economy shrank by 2.1% in 2022, but in 2023, it grew by 3.6%, one of the fastest growth rates of any major country. Russia has become the largest economy in Europe, according to purchasing power parity.

然而,俄罗斯经济和金融系统在短暂的混乱过后回稳,2022年下跌了2.1%;但至2023年,俄罗斯经济实现了3.6%的增长,增速在全球主要大国中名列前茅,且按购买力平价计算,已成为欧洲最大的经济体。

How did Russia manage to achieve this? Guancha recently conducted an exclusive interview with Professor Xu Poling, Director of the Office of Russian Economic Studies at the Chinese Academy of Social Sciences’ Institute of East European, Russian, and Central Asian Studies. Professor Xu gave us a deep dive into Russia’s economic resilience, as well as the lessons that China can learn from it.

这一切靠什么?观察者网近日专访了中国社会科学院俄罗斯东欧中亚研究所俄罗斯经济室主任徐坡岭教授,为我们深度解读俄罗斯经济韧性背后的逻辑,以及中国可以借鉴的经验教训。

The Living Standards of the Russian People are Improving

俄罗斯百姓生活水平在提高

Guancha: A group of Chinese scholars traveled to Russia to conduct research in 2022-2023. They found that the political and social situation in Russia is quite stable, and that the war has not affected the lives of the vast majority of Russian urban residents. These results are quite surprising. Professor Xu, what did you learn from your research, and how do you interpret your findings?

观察者网:有国内学者2022-2023年去调研,发现俄罗斯政治社会很稳定,战争并没有影响绝大多数城市民众的生活,这令人惊讶,您了解和研究的情况是怎么样的?

Xu Poling: In June 2023, we visited Moscow, Saint Petersburg, and Armenia. In November 2023, we went to Khabarovsk and Yekaterinburg. We visited five different places during our two trips in an attempt to understand the effect of the sanctions on Russian public sentiment and the Russian economy.

徐坡岭:我们在2023年6月份考察了莫斯科、圣彼得堡,顺便去了亚美尼亚;2023年11月份,又去了哈巴罗夫斯克和叶卡捷琳堡。两次一共考察了五个地方,就是想了解一下制裁之下俄罗斯的民情和经济情况。

In June, we visited two Russian think tanks, as well as Russia’s two largest cities, Moscow and Saint Petersburg. We found that the Russian “social and living order” remained stable. The general mood of the people did not reflect the tension and anxiety typically seen in a nation at war. The everyday lives of ordinary citizens were largely unaffected.

6月参访了两家智库和两个最大的城市莫斯科、圣彼得堡,我们发现,俄罗斯人的生活秩序和社会秩序是稳定的,人们的精神面貌也并没有国家处于战争状态中应有的紧张和焦虑,老百姓的正常生活没有受到很大的影响。

In November, we visited the border region of Khabarovsk, as well as Yekaterinburg, one of Russia’s main economic centers. Each Russian federal district has its own economic hub: the Northwestern Federal District’s hub is Saint Petersburg, the Central Federal District’s hub is Moscow, the Volga Federal District’s hub is Kazan, and the Ural Federal District’s hub is Yekaterinburg. In the past, these four federal districts were the most important economic centers in Russia, with the Northwestern Federal District being the most active and developed.

11月份,我们又去了边疆地区哈巴罗夫斯克和经济中心之一的叶卡捷琳堡。俄罗斯每个联邦区都有其经济中心,西北联邦区在圣彼得堡,中央联邦区在莫斯科,伏尔加联邦区在喀山中心,乌拉尔联邦区在叶卡捷琳堡。过去这四个联邦区就是俄罗斯最重要的经济中心,当然最活跃最发达的还是西北联邦区。

After the sanctions, economic activity in the Northwestern Federal District decreased. Most of the main Russia-Europe joint ventures and trade-related enterprises are located in the Northwestern District, so its economy was heavily impacted by the sanctions.

被制裁之后,西北联邦区的经济活跃度就下降了,因为俄罗斯和欧洲之间的最主要的合资企业和贸易相关企业集中在这个区域,因而在制裁后经济受到了影响。

However, more than a year after the sanctions were first implemented, the manufacturing industry of the Ural Federal District, where Yekaterinburg is located, has actually experienced rapid growth. We observed that, particularly in Yekaterinburg, the standard of living has been improving. This also applies to the Far East region of Russia, where income levels have increased. Traditionally, Russian ride-hailing drivers have earned fairly high incomes. The driver who took us from the airport to our hotel mentioned that his monthly income was now over 200,000 rubles (about RMB 20,000). It was evident that the overall mood of the Russian people, as well as their attitudes towards consumption, were very positive. It did not feel like a society experiencing the hardships of war.

但是,被制裁一年多之后,叶卡捷琳堡所在的乌拉尔联邦区的制造业工业地位急速上升。特别是我们在叶卡捷琳堡观察到,老百姓的生活水平在提高,包括远东地区,居民的收入水平也提高了。本来俄罗斯网约车司机收入水平就相对高一点,当时从机场到宾馆的路上,我们的接车司机说,他的月收入达到了20多万卢布(折合人民币两万元左右)。明显能感觉到他们的消费心态和情绪是很向上、很积极的,并没有感觉到这是一个正在经历战争磨难的社会。

Our analysis has identified several reasons for this. After President Putin announced the “special military operation,” he laid out three principles: first: keep the hostilities outside of Russia’s borders and prevent them from spreading into Russian territory; second: the financial burden caused by the war should not affect the basic living standards of the Russian people; third: minimize casualties among both civilians and soldiers as much as possible.

我们分析有几个原因。普京总统在宣布“特别军事行动”之后,提出了三个原则:第一,将战火控制在俄罗斯境外,不往俄罗斯国土蔓延;第二,战争所造成的财政负担不能影响居民的基本生活;第三,战场上尽量避免平民和士兵的大规模伤亡。

These three principles played a vital role in mitigating the negative impact of the war on Russian society and the Russian economy.

这三个原则对控制战争对俄罗斯社会和经济的负面影响,发挥了很重要的作用。

The Russian economy has yet to suffer a significant downturn, even after two years of conflict. Russia’s GDP declined by 2.1% in 2022, with revised figures in October showing a smaller decrease of only 1.2%. Between July and August of 2022, the economy began to show positive growth compared to previous months. After experiencing 9 to 13 consecutive weeks of deflation, prices stabilized, and Russian residents’ lives began to return to normal.

在这种情况下,即使打了两年仗,俄罗斯经济下滑的幅度并不大。2022年俄罗斯GDP下降2.1%,去年10月份修正后的数据是只下降1.2%了。2022年7-8月份,经济增长环比开始转正。在之后连续9-13周的通货紧缩之后,物价也得到控制,居民生活开始恢复正常。

By 2023, the economy had grown by 3.6%, with real disposable income increasing by 5.4% year-on-year (adjusted for inflation), and real wages growing by 7.6%. Russian residents’ real disposable income reached 98.6% of its 2013 peak. Against the backdrop of war, the Russian people’s standard of living has not been significantly affected; in fact, real incomes are rising, and consumption is growing. We feel that Russian society has not actually experienced too much hardship from the war.

到2023年经济增长了3.6%,居民实际可支配收入同比增长5.4%(剔除物价因素),工资实际增长7.6%。居民实际可支配性收入达到了2013年高点的98.6%。在战争背景下,居民生活水平没有受到很大影响,实际收入反而在增加,消费在增长。我们确实感受到俄罗斯社会并没有经历太多的战争磨难。

How has Russia withstood the sanctions?

俄罗斯扛住了制裁,靠什么?

Guancha: You have long been dedicated to the study of Russia’s economic transition. The sanctions and isolation imposed on Russia by the West, especially the blockades of its financial sector and the freezing of its foreign exchange reserves, are unprecedented. Based on your research, what impact have these sanctions had on the Russian economy?

观察者网:您长期致力于俄罗斯转轨经济的研究,欧美对俄罗斯的制裁和孤立,尤其是金融领域的封锁和外汇储备的冻结,前所未有。据您的研究,这些制裁对俄罗斯经济产生了哪些影响?

Xu Poling: Russian scholars categorize the sanctions from the West into six categories. (1) bans on goods, (2) technology blockades, (3) sanctions against enterprises involved in the war, (4) sanctions against major entrepreneurs and political figures, (5) sanctions against the entire Russian financial system, (6) sanctions against the Russian energy sector. We’ve observed that all six types of sanctions have been implemented.

徐坡岭:俄罗斯学者把欧美的制裁分为六级。第一是商品禁运,第二是技术封锁,第三是制裁参与战争的相关企业,第四是对主要的企业家和政治人物进行制裁,第五级是金融系统制裁,第六级是能源。我们看到这六级的制裁全部都实施了。

Among these, the financial sanctions have had the most significant impact on the Russian economy. The West’s objective was to cause capital flight from Russia and deplete its financial resources, ultimately leading to a financial crisis. Clearly, that’s what started happening, at least initially.

其中对俄罗斯经济最大的影响就是金融制裁。欧美国家的目的就是希望在俄罗斯造成资本外逃、金融资源枯竭,最终酿成金融危机。很显然,在初期确实出现了这样的情况。

The war started on February 24, 2022, and Western countries leveled sanctions for four consecutive days, causing significant fluctuations in the Russian stock market and the ruble exchange rate. The ruble depreciated sharply, with exchange rates plummeting across three markets. It fell to as low as 150 rubles to the dollar in the London market, 120+ rubles to the dollar in the Moscow market, and 120-130 rubles to the dollar in other offshore markets. Hence, the sanctions initially led to massive capital flight and a shortage of foreign currency supply in the Moscow market, making it very expensive to purchase foreign currency with rubles.

2022年2月24号战争开始,欧美国家连续四天出台制裁措施,俄罗斯股市和卢布汇率出现大幅波动。卢布贬值最厉害的时候,三个市场的汇率均出现大幅下跌:在伦敦市场到150卢布兑1美元,莫斯科市场上是120多卢布兑1美元,其他的离岸市场上也跌至120-130卢布兑1美元的水平。因此制裁一开始造成大规模资本外逃和莫斯科市场上的外汇供给短缺,用卢布购买外汇变得非常昂贵。

The Russian domestic financial system also faced severe problems. Initially, the Russian people were uncertain about the future and became leery of depositing their money in Russian banks. At the same time, Russian businesses lacked confidence in the use of foreign currency and international trade settlements. This all led to a short-term crisis of trust.

俄罗斯国内金融系统也出现了很严重的问题,一开始老百姓不知道将来的局势会如何,因而对银行的存款没有信心,企业也对外汇使用和国际贸易结算没有信心,当时就出现了一波短期的信任危机。

However, the Russian government responded quickly. We’ve identified three distinct counter-sanction measures that Russia employed to effectively control the situation.

但是俄罗斯政府反应很快,我们后来归纳总结,俄罗斯出台的三个反制裁措施,非常有效地控制住了局面:

First, Russia implemented capital outflow controls, restricting money transfers abroad, as well as foreign loans. It prohibited cash loans over $10,000 and temporarily suspended repayment of foreign debts.

一是资本流出管制,对向外汇款和向外借贷进行限制,超过1万美元的现金不允许贷出去,对外欠款暂停偿还。

Second, it enforced mandatory sales of foreign currency earnings. Russia decreed that 80% of the foreign currency earnings from foreign trade contracts signed after January 1, 2022 had to be sold to the central bank, thereby increasing the supply of foreign currency in the Moscow market. We estimate that Russia needed about $1 billion in foreign currency supply per day at the time, and this measure alleviated that shortage.

二是强制结售汇。俄方规定,2022年1月1日之后签订的外贸合同的外汇收入金额的80%要卖给央行,提高在莫斯科市场上的外汇供给能力。我们大概核算了一下,当时俄罗斯一天需要10亿美元左右的外汇供给,通过这个方式外汇紧缺的问题就缓解了。

To address public concerns, Russia adopted a method similar to the Bretton Woods system’s gold standard, specifying that 5000 rubles (equivalent to about RMB 400 at the time) could be exchanged for 1 gram of gold. This way, both businesses and individuals that lacked confidence in rubles could exchange them for gold at banks. This quickly restored confidence in the Russian financial market.

对于民众的担忧,俄罗斯借鉴了布雷顿森林体系美元与黄金挂钩的方式,规定5000卢布(当时折合人民币400多元)换1克黄金,将卢布与黄金挂钩。这样不管是企业还是个人,如果对持有卢布没有信心,可以拿卢布去银行兑换等额黄金,很快就稳住了俄罗斯金融市场的信心。

Confidence in the ruble recovered quickly, especially after the announcement of the “Natural Gas Ruble Settlement Order” on March 19, 2022. By April 9, the ruble had appreciated to 70+ rubles to the dollar, eventually reaching a peak value of 53 rubles to the dollar.

特别是在2022年3月19号宣布“天然气卢布结算令”之后,市场迅速恢复了对卢布的信心。4月9号,卢布已经升到70多兑1美元,最高的时候升到53兑1美元。

The “Natural Gas Ruble Settlement Order” was a masterstroke. Russia was prohibited from using euros, dollars, yen, and pounds for settlements, but Europe’s ability to purchase Russian natural gas had not yet been interrupted. Then Russia declared it would only accept rubles as payment. However, Europe didn’t have any rubles. Russia advised the European countries to open a ruble account and a euro account at the Russian Gazprombank, the bank that has always handled Russia-Europe natural gas trade settlements. European businesses would deposit euros into their euro accounts. Russia would then exchange the euros for rubles in the Moscow market and transfer them into the ruble accounts. This allowed European businesses to settle their natural gas transactions in rubles.

“天然气卢布结算令”是一个妙招。俄罗斯被禁止使用欧元、美元、日元和英镑结算,但当时欧洲采购俄罗斯天然气还没有中断,俄罗斯就宣布只收卢布,欧洲说没有卢布,怎么办?于是,俄罗斯给欧洲国家出主意:让他们在俄罗斯天然气工业银行开一个卢布账户,一个欧元账户,这个银行一直负责俄欧天然气贸易结算。欧洲商家存欧元进欧元账户,俄罗斯方面把欧元拿到莫斯科市场去换成卢布,然后再转入卢布账户,欧洲商家就可以用卢布来结算天然气的费用了。

This move effectively anchored the value of the ruble to natural gas, allowing Russia to control the pace of foreign exchange transactions in the market. Consequently, the ruble’s exchange rate quickly rebounded, stabilizing Russia’s financial system.

这样俄罗斯就将卢布的价值用天然气锚定了,市场上兑换外汇的节奏也由俄罗斯来掌控,所以卢布汇率迅速就回升了,这样俄罗斯的金融系统也就稳住了。

The export controls and technological restrictions imposed by Western sanctions had a significant impact on Russia, disrupting its international supply chain. Between March and May of 2022, Russia experienced significant disruptions in its manufacturing sector as its supply of intermediate products, such as equipment and raw materials imported from Europe, was abruptly cut off. Russian businesses had to rebuild their supply chains by finding new domestic and/or international suppliers.

欧美制裁对俄罗斯影响最大的还有出口管制和技术限制,使得俄罗斯的国际供应链被打断。俄罗斯在2022年的3-5月出现了严重的生产混乱,从欧洲进口的设备原材料等中间产品突然没有了,俄罗斯企业必须重建自己的供应链,在国内或国际市场重新寻找供应商。

After three months of turmoil, Russia began to stabilize. On May 31, 2022, Russia signed the “parallel import” decree, which covered over 1300 types of goods. This was essentially “official smuggling.” Foreign sellers had been prohibited, by sanctions, from selling certain products to Russia. Therefore, Russia decided to begin purchasing these goods through alternative channels, with the caveat that Russia would no longer protect these products’ trademark and intellectual property rights within the Russian market. Thus, Russia slowly restored its industrial supply chains by sourcing goods through parallel imports internationally while also developing domestic suppliers.

经过了三个月的混乱之后,俄罗斯初步稳定下来。2022年5月31日,俄罗斯签署了“平行进口”法令,涉及1300多种商品,实际上这就是“官方走私”,即国外的经销商不允许在俄罗斯销售产品,俄罗斯通过其他渠道买入产品后,宣布不再保护其在俄罗斯市场中的商标权和知识产权。就这样,俄罗斯在国际上通过平行进口来采购,在国内发展供应商,花了很长时间才恢复了产业链。

Another area that was significantly affected by sanctions was logistics and international transportation. Russia’s exports of crude oil and liquefied natural gas enter the international market through the Baltic Sea and the Atlantic Ocean. However, 95% of the international maritime transport insurance business is controlled by European companies. One of the financial sanctions imposed on Russia prohibited companies from insuring merchant ships that conduct business with Russia. The Baltic states were the first countries to join in the sanctions, and land rail transport and pipeline transport were also restricted. This severely disrupted Russia’s international logistics.

另一个受制裁影响比较大的领域是物流和国际运输。俄罗斯的原油出口、液化天然气是通过波罗的海、大西洋进入国际市场的,然而海上国际运输的保险业务95%都垄断在欧洲公司手里。金融制裁其中有一条就是,不允许为从事俄罗斯业务的商船提供保险,波罗的海三国首先加入了制裁,陆上铁路运输和管道运输也受到限制,因此俄罗斯的国际物流也被迫中断。

Guancha: When the West initiated sanctions, there were claims that they would turn the ruble into “worthless paper,” but that did not happen. Could you expand a bit on why the ruble and the Russian financial system have been so resilient?

观察者网:欧美在启动制裁的时候,曾扬言要把卢布变成废纸,但是并没有办到,能否再展开谈谈卢布和俄罗斯金融系统这么抗打的原因?

Xu Poling: Through our analysis, we’ve identified several reasons for the resilience of the Russian economy.

徐坡岭:我们在分析俄罗斯经济韧性的时候,总结了一些原因。

First, Russia worked hard to establish financial security, including the way it structured its own banking system. As of July 1, 2022, Russia had only 329 banks and 34 non-banking financial institutions, a product of its long-term initiative to establish financial security.

第一,金融安全建设,如银行自身的银行体系建设。俄罗斯在2022年7月1日时只有329家银行和34家非银行金融机构,这正是长期进行金融安全建设的结果。

After Russia’s transition, the banking system went through a period of chaos. At one point, Russia had over ten thousand banks. When Russia instituted its anti-crisis plan in 2015, it still had over 1500 banks. Subsequently, Russia began to have annual reorganizations of “banks in violation”. Banks that did not meet the capital adequacy ratio and/or were operating in violation of regulations had their licenses revoked. Russia revoked the licenses of about 90-100 banks per year. This prevented the health of Russian banks from becoming an issue. Therefore, when Russia was faced with this financial shock, there were no bank closures or shutdowns, and the financial sector quickly stabilized.

俄罗斯转型之后,银行系统一度十分混乱,最多的时候有一万多家银行,2015年反危机计划中还有1500多家。后来每年对违规的银行进行整顿,若是资本充足率不达标,或者有违规经营的,就吊销营业许可。每年吊销营业许可的银行达到90-100家左右,所以俄罗斯银行自身的健康没有问题。因此在面对此次金融冲击时,银行系统并没有出现倒闭或关门的情况,金融领域很快就稳定下来了。

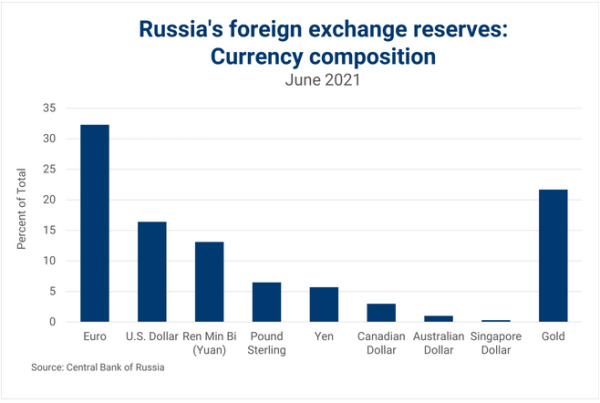

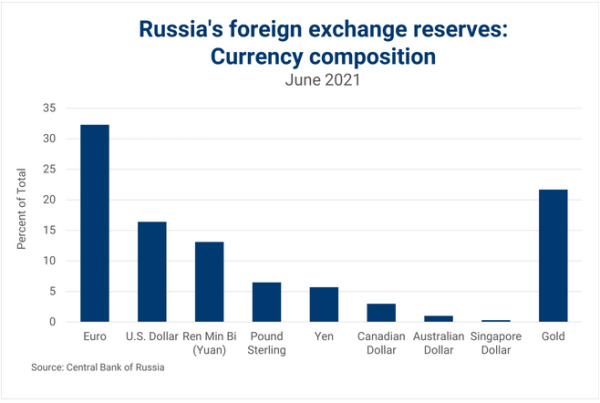

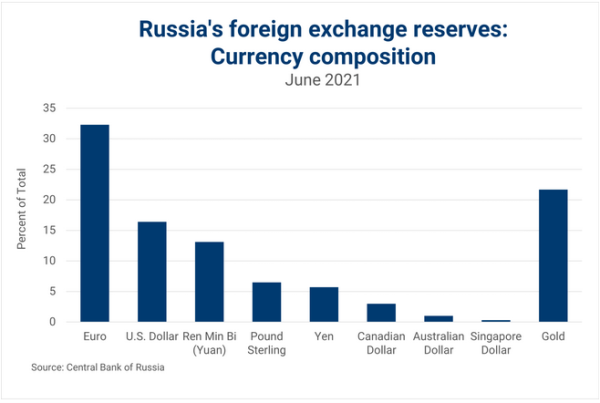

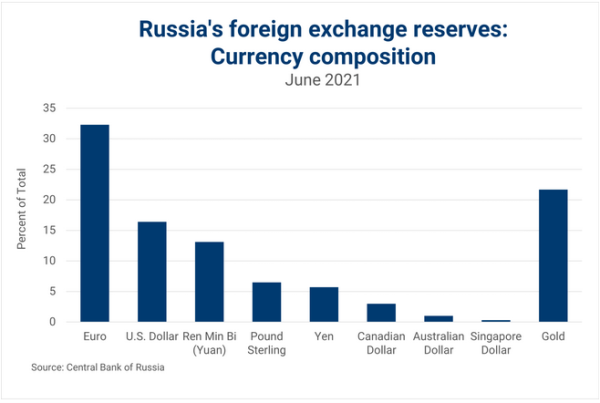

Second, after 2014, Russia started de-dollarizing, which played a significant role in countering financial sanctions. Russia saw that the U.S. was becoming more and more hostile. They recognized that it was no longer safe to rely on the U.S. dollar. However, there were significant barriers to de-dollarization. After multiple devaluations of the ruble, the Russian public lacked faith in the currency and preferred to exchange rubles for dollars. Thus, domestic Russian savings had become dollarized. International trade settlements were also conducted in dollars. Russia’s international reserves were invested heavily in dollar assets, and central bank assets were also dollarized.

第二,2014年之后俄罗斯一直在去美元化,这对应对金融制裁起了很大作用。俄罗斯发现美国对俄罗斯的敌意在扩展,它认识到依赖美元是不安全的。但当时去美元化面临很大挑战:俄罗斯老百姓因为卢布的多次贬值而不太信任卢布,因此都愿意把卢布换成美元,国内的居民储蓄是美元化的;国际贸易用美元结算,国际贸易也是美元化的;俄罗斯的国际储备投资了很多美元资产,央行资产也是美元化的。

The internationalization of the euro provided Russia with an opportunity to de-dollarize. Initially, the euro was mainly circulated within Europe. Few countries held euros, and the ones that did hold them held them in small amounts. Since Russia’s energy exports mainly flowed to Europe, Russia gradually adopted the euro for energy export settlements. Afterwards, the euro began to circulate widely outside Europe, becoming an international currency. After the West sanctioned Russia in 2022, and the euro could no longer be used in Russia, the proportion of international transactions settled in euros declined, turning the euro back into a regional currency.

欧元的国际化正好给俄罗斯的去美元化提供了契机。一开始欧元主要在欧洲内部运行,持有欧元的国家并不多,量也不太大。由于俄罗斯的能源出口主要是流向欧洲的,因此俄罗斯逐步在能源出口中采用欧元结算。此后,欧元开始大规模走出欧洲,成了国际货币。2022年西方制裁俄罗斯之后,欧元不能在俄罗斯使用之后,欧元的国际结算比重在下降,又成了一个局域货币。

Third, Russia benefited from good fiscal health and diversified international reserves. Research has showed that between 2019 and 2021, the Russian Central Bank added significant amounts of JPY and RMB to its reserves. Additionally, after 2019, Russia significantly increased its gold reserves. Over the next four years, it became the world’s main buyer of gold. When the Russian Central Bank’s assets were frozen in 2022, Russia had nearly $600 billion in reserves, and a large proportion of those reserves were in gold. Russia’s diversified international reserves provided stability for its financial system.

第三就是财政状况和国际储备多元化。2019年到2021年期间,有研究报告发现俄罗斯央行储备资产增加了很多的日元和人民币资产。此外,2019年以后俄罗斯还大幅增加了黄金的储备,此后的四年俄罗斯是全球最主要的黄金买入方。在2022年俄罗斯央行资产被冻结时,俄罗斯有将近 6000亿美元储备,其中黄金储备占了很大的比重,多元化的国际储备给俄罗斯金融稳定提供了保障。

The measures Russia took in response, implementing capital outflow controls, signing the natural gas ruble settlement order, pegging the ruble to gold to boost public confidence, etc., were very clever. Additionally, the coordination between Russia’s Central Bank and its Ministry of Finance played a vital role. When the Russian Central Bank’s financial resources were threatened by the sanctions, it re-allocated some of its assets to the Ministry of Finance through privatization. For example, it redistributed shares of Sberbank (Russia’s largest bank) and allocated a portion of the profits to the Ministry of Finance. The Central Bank’s cooperation with equity wealth funds also provided significant support for its construction of financial security.

在应对措施方面,俄罗斯对资本流出实行管制,签署天然气卢布结算令,通过卢布与黄金挂钩,提振居民信心等,都是非常巧妙的做法。还有央行与财政部的配合,在财政资源受到冲击的情况下,央行把一些资产通过私有化,重新配置给财政部,如对俄罗斯储蓄银行(俄罗斯最大的银行)的股权重新划分,将利润的一部分归属财政;还有和股权财富基金的配合,也为金融安全建设提供了很好的助力。

Does the resilience of the Russian economy have anything to do with its Soviet heritage?

俄罗斯经济韧性,苏联遗产在起作用?

Guancha: Some scholars think that the resilience of the Russian economy and its ability to withstand sanctions are due to the legacy of the Soviet era, such as its industrial system, its financial discipline, etc. What do you think?

观察者网:有学者分析,为什么俄罗斯经济这么有韧性,能抗住制裁,是因为苏联时期流传下来的遗产在起作用,如工业体系、财经纪律等,您怎么看?

Xu Poling: I don’t think that’s accurate. If there is any Soviet legacy, it definitely does not have much to do with finances. Debt expansion was one of the main reasons the Soviet Union disintegrated. Back then, Russia’s financial and fiscal systems were very weak. If we must identify a Soviet legacy, it would be that fiscal weakness significantly reduced the government’s capabilities, which taught Russia a valuable lesson.

徐坡岭:我觉得不能这么说,如果苏联有什么遗产的话,肯定在财政方面没有太多的遗产。苏联解体的一个很重要原因就是债务扩张,当时俄罗斯的金融系统和财政系统非常虚弱。如果一定要说有什么遗产的话,那就是财政虚弱使得政府能力下降,给俄罗斯带来了非常深刻的教训。

The financial chaos during the first decade of Russia’s transition led to a redistribution of wealth, severely impacting the lives of its citizens. Since 2000, Russia has been strengthening its financial and fiscal security. Its main task has been to continuously reduce its debt ratio.

转型初期十年的金融混乱,使俄罗斯的财富进行重新分配,给居民生活造成非常严重的影响。俄罗斯在2000年之后一直在加强财经安全建设,包括财政安全和金融安全,其主要任务就是不断降低债务的比例。

At the start of its transition, Russia inherited a staggering debt of $99.6 billion from the former Soviet Union, which was the main cause of the 1998 Russian ruble crisis and the collapse of its national credit. After President Putin took office in 2000, oil prices, coincidentally, began rising gradually. The influx of petrodollars greatly facilitated debt repayment, continuously reducing Russia’s debt-to-GDP ratio until Russia fully repaid the Soviet Union’s debt in 2017.

俄罗斯在转型开始时继承了前苏联996亿美元的天价债务,这也是导致1998年俄罗斯卢布危机、国家信用崩溃最主要的原因。普京总统2000年上台执政后,正好赶上2000年油价的逐渐攀升,大量的石油美元流入对于还债十分有利,债务占GDP比重不断缩小,直到2017年俄罗斯才还完清苏联的欠债。

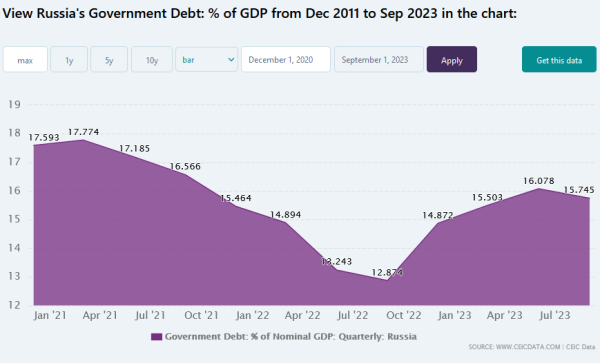

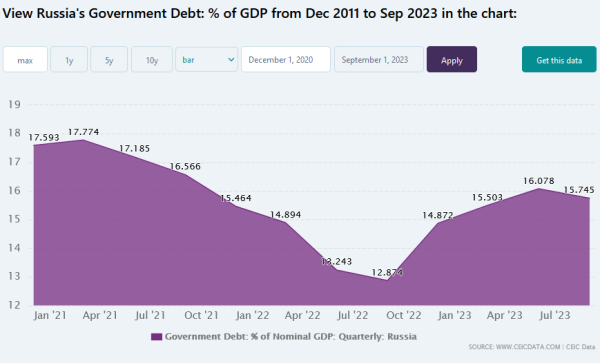

Before the sanctions, Russia’s core sovereign external debt, the debt for which the Central Bank is responsible, was only about $35 billion, just over 3% of GDP. When you include the debts of federal subjects and state-owned enterprises, Russia’s total debt-to-GDP ratio was 13.4%. Among the 89 economies monitored by the World Bank and the International Monetary Fund, Russia has one of the lowest levels of debt.

制裁之前,俄罗斯核心主权外债,就是由联邦中央负责偿还的外债,只有350多亿,占GDP的比重只有3%多一点。加上联邦主体和国有企业欠的债,总共比重是13.4%。在全球89个被世界银行、国际货币基金组织监测的经济体中,俄罗斯的债务水平是最低的。

We know that there are countries with high levels of debt, such as Japan, with a debt-to-GDP ratio of over 200%, and the United States, with a debt-to-GDP-ratio of 130%. Countries without full currency sovereignty can encounter debt crises if their debt-to-GDP ratio rises above 70%, as seen in the debt crises in Greece and several Latin American countries, which occurred even though their debt levels had not yet exceeded 100% of GDP. The most recent example is Sri Lanka, which has a high foreign debt ratio. The U.S. Federal Reserve’s interest rate hikes, combined with the appreciation of the U.S. Dollar and the depreciation of its own local currency, resulted in significantly increased debt repayment costs. This eventually caused a debt crisis.

我们知道国际上债务率比较高的国家,比如日本的国家债务占GDP的比例超过200%,美国也有130%多。没有完全货币主权的国家债务占GDP水平如果上升到70%以上,就可能出现债务风险,比如当年的希腊债务危机,还有拉美国家的债务危机,都是在债务水平没有超过GDP的100%时候就发生了。这两年最典型的反例就是斯里兰卡,由于斯里兰卡外债比例过高,美联储多次加息之后,美元指数升值,本币贬值,还款成本大幅提高,最后出现了债务危机。

Russia has consistently kept its debt-to-GDP ratio at around 15%. Some observers have even criticized Russia for being too fiscally conservative, i.e., not taking on foreign debt, despite having limited domestic financing capabilities, and maintaining a low level of domestic debt. However, this approach has kept Russia’s finances very secure, with no deficit financing and mostly balanced budgets or budget surpluses. After 2021, Russia adopted a more proactive fiscal policy in order to respond to the pandemic and support national infrastructure projects.

而俄罗斯的债务水平一直控制在15%左右。我们有时候甚至说,俄罗斯很长一段时间财政太保守,不借外债,国内融资能力有限,内债也不高。但这样使得俄罗斯的整个财政非常安全,没有赤字财政,大部分时候是平衡财政和盈余财政。在2021年之后,为了应对疫情和国家项目建设,财政才开始变得积极。

By 2023, Russia’s GDP had reached 171 trillion rubles. Its domestic debt levels had reached 24 trillion rubles, compared to the previous years’ range of 18 to 23 trillion rubles. Even when you factor in foreign debt, Russia’s overall debt level was still very low. This can be seen as a lesson learned from the Soviet Union.

2023 年俄罗斯GDP达到了171万亿卢布,内债水平在24万亿卢布左右,之前几年的内债水平在18万亿卢布到23万亿卢布之间。即使内债外债加起来,俄罗斯整体债务水平都是很低的。这可以说是它吸取了前苏联的教训。

One key aspect of the Soviet Union’s legacy is that it left Russia with a solid base in fundamental sciences, setting the stage for significant technological advancement. After the dissolution of the Soviet Union, Russia experienced a temporary “brain drain”, but it continuously reformed its scientific research institutions, improved the efficiency of its research, and increased or at least maintained financial allocations to research institutions. This is also why Russia was able to successfully respond to sanctions and maintain normal economic operations during the Russia-Ukraine conflict.

如果说前苏联遗留下了什么,那就是俄罗斯的基础科学实力比较雄厚,俄罗斯的科技发展潜力很大。苏联解体之后,经历了一段时间的人才流失,俄罗斯不断改革科研机构,提高研究效率,增加或至少维持了对科研机构的财政拨款,这也是俄罗斯能够成功应对制裁,并在俄乌冲突中保持经济正常运行的原因。

Was Russia’s economic performance in 2023 driven by a war economy?

2023年经济表现好,是战争经济拉动?

Guancha: Russia’s economy unexpectedly grew by 3.6% in 2023. Western media generally attribute this growth to a war economy. What do you think about this?

观察者网:2023年俄罗斯经济增长出人意外地达到了3.6%,西方媒体在报道这一新闻的时候普遍认为,这是战争经济带来的增长,您怎么分析?

Xu Poling: I think Western media are setting the narrative. They believe Russia’s economic performance is due to its strong military-industrial sector. I don’t agree. In fact, Russia only began to strengthen import substitution in the military sector in 2014. At that time, Russia’s military-industrial foundation was relatively weak.

徐坡岭:我觉得西方媒体在带节奏,他们认为俄罗斯经济好,是因为军工强带来的。我不这么认为,实际上俄罗斯是在2014年才开始在军工领域加强进口替代建设的。当时军工方面的基础,还是比较虚弱的。

During the Soviet era, each region of the USSR specialized in different military industries, ex. gas turbines and rocket engines in Ukraine and large aircraft manufacturing in Uzbekistan. Russia did indeed inherit some of the Soviet military assets, but in no way did these assets form a complete system.

苏联时期各区域军工产业分工不同,燃气轮机在乌克兰,火箭发动机在乌克兰,大飞机制造在乌兹别克斯坦。俄罗斯的确继承了苏联的一些军工资产,但并没有形成一个完整的体系。

Russia’s military-industrial or strategic resource sectors were most severely impacted in the first decade after the dissolution of the Soviet Union. It was only after the year 2000 that Russia began to reorganize and restore its military-industrial sector. The Yukos-Khodorkovsky incident in 2003 was a turning point. That was when the oligopoly in Russia’s strategy resource sector started to break down.

俄罗斯的军工或者战略资源部门,在苏联解体之后最初十年受到冲击是最严重的。2000年之后,俄罗斯才着手整顿和恢复俄罗斯的军工领域。2003年的尤科斯-霍多尔科夫斯基事件是一个转折点,俄罗斯战略资源部门的寡头垄断从那时候才开始扭转。

Traditionally, Russia’s military sector has been strong, but also very fragile. Back then, Russia, having been influenced by the United States’ Gulf War and anti-terrorism military campaigns, deemed large-scale foreign conflicts to be unlikely. Thus, it felt that massive investments in homeland security and military production were unnecessary. Russia’s anti-terrorism operations in Syria were not large-scale foreign wars either.

军工领域是一个传统优势领域,但也很虚弱。当时,在军事建设方面俄罗斯受到美国海湾战争和反对恐怖主义军事行动的影响,俄罗斯认为大规模国家间冲突的可能性不大,因此大规模国土防御和军工生产是不必要的。包括俄罗斯后来在叙利亚的反恐作战,都不是国家间的大规模对抗战。

Russia’s militarization reforms were carried out according to this same concept. In this context, Russia’s military-industrial sector had few large purchase orders and was still relatively small in scale. During Medvedev’s presidency (2008 to 2012), he once noted that it would be difficult for Russia to achieve complete autonomy in its military sector.

俄罗斯的军事化改革正是在此理念之下展开的。在此情况下,俄罗斯的军工领域订单不多,整体规模也不大。2008年至2012年,梅德韦杰夫任总统时就曾指出,俄罗斯军工完全自主是有问题的。

Thus, I do not believe the military-industrial complex dominated Russia’s economy before the war. In fact, it was the resource sector which played a significant role in the Russian economy. This is why Russia experienced issues with weapon and ammunition supplies during the Russia-Ukraine conflict.

所以我不认为俄罗斯的军工复合体在战争之前就在经济中占主导地位,实际上是资源部门在俄罗斯经济中占据重要位置。这也是为什么俄乌冲突中,俄罗斯一度出现武器弹药供应问题的原因。

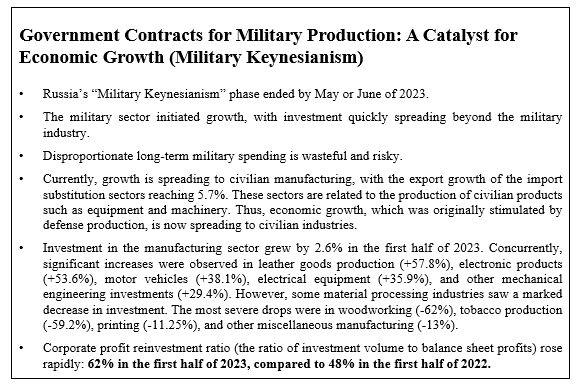

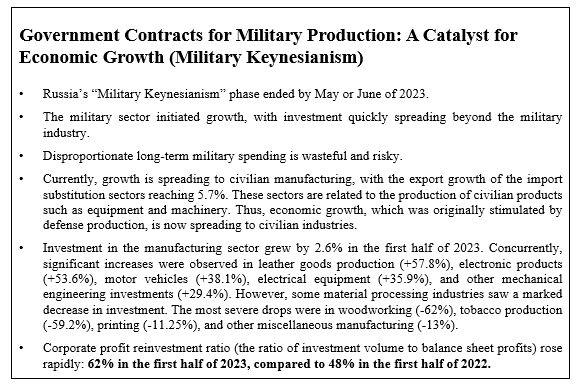

In 2014, Russia began implementing import substitution policies in the military sector, and it quickly achieved 98% autonomy in military equipment production. However, Russia’s supply of munitions and military equipment only began to accelerate after July 2022. The military-industrial complex shifted to three shifts production after the partial mobilization order in October 2022. Following inspections of military-industrial enterprises by Putin, Medvedev, and Shoigu from November to December 2022, Russia began to fully invest its economic resources into the military-industrial complex, and the volume of government contracts for military production significantly increased.

虽然说2014年之后俄罗斯在军工领域实施进口替代政策,很快实现了98%的军工产品自主生产,但是军火供应和武器装备供应是在2022年7月之后才开始加速的,军工综合体三班倒生产是在2022年10月份局部动员令之后开始的。2022年11-12月,普京、梅德韦杰夫和绍伊古相继视察军工企业之后,国防订单才开始大幅度提升,俄罗斯才全方位把经济资源投入到军工复合体中。

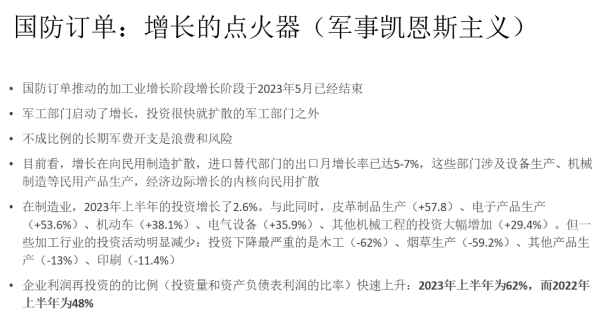

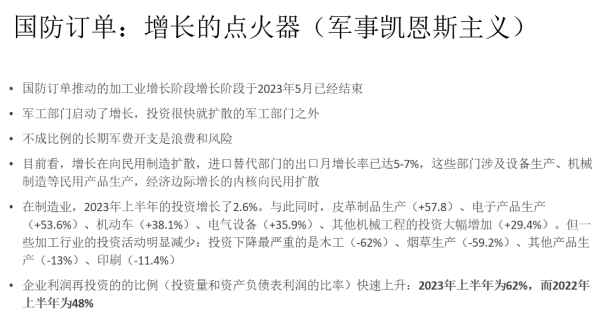

Thus, we can see that Russia’s military-industrial sector has not always been strong. In fact, the sector’s revival has been relatively recent. Before that, it was in a state of decline. Russian economists understand that it was the resource sector, not the military-industrial complex that drove Russia’s past economic growth. Moreover, the volume of government contracts for military production experienced explosive growth in the second half of 2022, but decreased after April 2023.

因此,俄罗斯的军工行业是属于衰败之后的重振,而不是一直强势的部门。俄罗斯的经济学家在分析过去经济增长的时候,都很明确,俄罗斯不是军工在拉动经济增长,而是资源部门。而且军工订单在2022年下半年曾呈现出爆发式增长,但到2023年4月份之后就缩减了。

The expansion of the production scale of military enterprises led to a significant increase in demand for downstream enterprises’ equipment, materials, and components. Demand for investment in machinery and equipment grew, and industrial production expanded from purely military goods to other manufacturing industries related to military production.

军工企业的生产规模扩大之后,对下游企业的设备和材料、零部件需求大幅增加,机械设备投资需求增大,工业生产也从纯军事军品扩展到与军品生产相关的其他加工制造业。

Transitioning from an energy-dependent economy to an economy where investment and consumption are balanced

从能源依赖型经济,向投资-消费平衡型经济转型

Guancha: So, do you believe that during these past two years of war, the Russian economy, instead of collapsing, actually underwent a successful structural transformation?

观察者网:所以您认为在两年战争期间,俄罗斯经济不但没有崩溃,反而成功实现了经济结构的转型?

Xu Poling: It’s still too early to conclude whether this transformation was successful. However, one thing we have observed is that Russia’s economic growth is breaking its previous dependency on the energy sector. In 2023, the share of revenue from energy/fuel fell by 22.8%, whereas the share of revenue from non-oil and gas sectors increased by 26.5%. With the decline in oil and gas revenue, its relative contribution to fiscal revenue remained flat, compared to the previous year, at about one-third. The decreased contribution from the energy and raw materials sector to Russian GDP, as well as the increased contribution from the manufacturing sector, reflect the Russian economy’s transformation from an energy-dependent economy to an economy where investment and consumption are balanced.

徐坡岭:这个转型是不是成功,目前还很难下结论。但是,我们看到一种结果是俄罗斯经济增长正在打破原来对能源行业的依赖。2023年俄罗斯能源燃料综合体对预算收入的贡献下降22.8%,非油气部门对财政的贡献增长了26.5%。在油气收入下降的情况下,对财政收入的贡献与上年持平,在三分之一左右。能源原材料部门对GDP贡献下降,制造业部门占比上升,反映出俄罗斯经济结构的转型,从能源依赖型经济,向投资-消费平衡型经济转型。

Russia has long had a low rate of capital accumulation, with net capital accumulation consistently below 20%. Even when you include inventory accumulation, it’s still between 20% and 22%. Russia had aimed to raise the capital accumulation rate (the ratio of accumulated funds to total national revenue used) above 25%, but this goal was never achieved.

俄罗斯长期以来资本积累率偏低,净资本积累长期低于20%,加上库存的积累也就在20%- 22%之间。俄罗斯曾提出将资本积累率(积累基金与国民收入使用总额的比例)提高到25%以上,但是一直没有实现。

On February 7, 2024, Russia’s Federal State Statistics Service announced that Russia’s capital accumulation rate in 2023 was 27%, with final consumption accounting for 68.7% and imports and exports accounting for 4.3%. Russia had finally resolved its long-standing issue of a low capital accumulation rate.

今年2月7日,俄罗斯国家统计局发布的数据显示,2023年俄罗斯的资本积累率已经达到27%,最终消费占比是68.7%,进出口占比是4.3%,解决了长期的资本积累率偏低的问题。

The importance of increasing the capital accumulation rate cannot be overstated. A higher rate provides the possibility for future economic expansion. According to Marx’s “Das Kapital,” a 20% capital accumulation rate is the minimum standard for simple reproduction. For economic expansion, the rate must exceed 20%. For accelerated growth, it must exceed 25%. For an economy to “take flight”, the rate must reach 35%.

资本积累率上升的重要性再怎么强调都不为过。资本积累率上升为未来经济扩张提供了可能。按照马克思《资本论》的说法,20%的资本积累是简单再生产的最低标准;经济要扩张,资本积累率就必须要高于20%;经济要加速,必须高于25%;经济要起飞,资本积累率要达到35%。

Traditionally, the energy sector has been very critical to the Russian economy, with energy and raw material exports accounting for 70%-80% of GDP. Wealth was concentrated in the energy sector, where salaries, profits, and other income were high. This created a social structure where the vast majority of Russia’s wealth was concentrated the hands of a small oligarchy. Energy exports were the main source of Russia’s trade surpluses, and the state obtained tax revenue from the energy sector. After receiving petrodollars, the government injected funds into the public sector through fiscal transfers and social policy expenditures. This provided the main source of income for government employees and service industry workers. This income was akin to welfare benefits. It did not stimulate increased labor.

能源部门过去对俄罗斯经济非常重要,能源和原材料出口占GDP的比重达到70%-80%。其社会意义在于,社会财富主要集中在能源部门,能源部门的薪酬、利润等收入很高,这形成了一种社会结构,即俄罗斯的社会财富集中在了一部分人手里。能源出口成为俄罗斯贸易盈余的主要来源,国家从能源部门获得税收,获得石油美元流入之后,通过财政转移和社会政策支出,注入到社会公共部门,形成政府人员和服务业的收入。这种收入是福利性质的,没有劳动激励的作用。

The national economy’s high dependency on the energy sector suppressed the development of its manufacturing sector. In 2012, the core manufacturing sector’s value added accounted for only 12.8% of GDP. When you add in mineral processing, it still accounts for only 16%, merely at the level of Germany (Germany’s core manufacturing sector accounted for 17.8% of GDP at the time) and the United States, which was already in a post-industrial phase.

国家经济对能源部门的高度依赖,使得制造业部门受到挤压发展不起来。2012年,俄罗斯核心制造业增加值占GDP的比重只有12.8%,加上采矿加工也只有16%左右,仅仅是德国(核心制造业占比当时是17.8%)和美国的水平,而美国已经处于后工业化时期了。

The expansion of Russia’s manufacturing sector after the Russia-Ukraine conflict is a fascinating phenomenon. Russia experienced rapid wage growth in the light industry, machinery manufacturing, and electronic information sectors. The primary distribution of income through wages and salaries created strong labor incentives. This is why, during our visits to Russia in June and November of last year, we noticed a different spirit among the people.

俄乌冲突之后出现的制造业的扩张,呈现出一种非常有意思的现象,轻工、机械制造和电子信息领域的工资增长特别快,通过工资薪酬实现的一次分配产生了非常强的劳动激励。这也是我们在前面说的,去年6月份和11月份在俄罗斯考察的时候,发现人们的精神状态很不一样的原因。

In the past, people outside the energy sector had few opportunities to earn money through work and relied on social welfare. Now, people can work in factories and earn money. Companies have started “bidding wars,” where they attempt to lure qualified employees by offering more attractive salaries. This approach has created labor incentives through primary distribution, which has, in turn, boosted the spirit of the Russian people.

过去非能源部门的老百姓,可能没有太多机会去通过参与工作挣钱,只坐吃社会福利。现在老百姓可以到工厂去上班,可以挣钱。企业还开启“雇工竞赛”,为了雇到合适的员工,提供非常诱人的薪水。这样仅通过一次分配,就实现了劳动激励,这是俄罗斯社会精神面貌发生变化的很重要原因。

The Russia-Ukraine conflict has injected a steroid shot into the lethargic Russian economy, making it stronger and more vigorous. We even speculate that President Putin is not exactly in a hurry to end the conflict. The military purchase orders triggered by the conflict have expanded investment into non-military sectors, providing better job opportunities and earning potential for Russian citizens. This has stimulated Russian society.

所以俄乌冲突相当于给一个虚胖的人注入了激素,让它强健,变得更加有活力。我们甚至有个推论,可能普京总统不着急结束俄乌冲突。因为这场冲突中的军事订单引发的投资增长已经扩展到非军事领域,为社会提供了更好的劳动机会和挣钱机会,使得俄罗斯社会变得更加活跃。

Data from the second and third quarters of 2023 reveal a rapid expansion of investment in industries related to military production, including leather, machinery manufacturing, and electronics. This led to an increase in Russia’s fixed asset investment growth rate to 12.9% in the second quarter and 13.3% in the third quarter. The total capital accumulation for the year (including inventory) was 19.8%, with net fixed asset investment growing by 10.5%.

从2023年第二、三季度的数据我们发现,跟军品生产相关的行业,包括皮革、机械制造、电子这几个领域的投资快速扩张,导致俄罗斯固定资产投资在第二季度投资增速达到12.9%,第三季度达到13.3%。全年总积累(包括库存)19.8%,净固定资产投资增长10.5%。

The growth in investment led to an increase in output, with data released by Russia’s Federal State Statistics Service on February 7 showing that manufacturing experienced the fastest growth. Specifically, the production of computers, electronic equipment, and optical equipment increased by 32.8%, the production of metal processing products increased by 27.8%, other vehicles and equipment production increased by 25.5%, and food production grew by 5.9%. Services supporting production, such as warehousing and transportation, also grew by 12.8%. These rapidly growing sectors may be closely related to the military industry, but they don’t just produce products for the military. They are civilian industries, even though their products may also support military enterprise production. This is actually the diffusion of investment from the military sector to downstream industries.

投资增长带来产出增长,俄罗斯国家统计局2月7日公布的数据显示制造业增长最快,其中,计算机、电子和光学产品生产增长了32.8%,金属加工产品增长了27.8%,其他车辆和设备增长了25.5%,食品行业也增长了5.9%。为生产服务的仓储运输也增长了12.8%。这些快速增长的部门可能与军工密切相关,但并不都是军工厂,而是民用工业,但生产的产品可能会为军工企业生产提供支持。实际上这是从军工领域往下游的投资扩散。

Why hasn’t Russia’s traditionally strong energy sector led to investment diffusion? Because the equipment for oil and natural gas extraction in Russia is imported, it is a one-off investment. However, producing even one machine requires lathes, materials, electronic devices, energy, and power plants, creating a very long industrial chain. Producing a single mortar shell involves dozens of steps. These dozens of steps, in turn, require dozens of factories. These factories did originally produce civilian goods and then later expanded to focus more on military production. However, due to industrial division and cooperation, investment then diffused to civilian production.

那为什么俄罗斯的一直以来强大的能源领域没有实现投资扩散?因为俄罗斯石油天然气开采的设备是进口的,所以投资是一次性。但是制造业有一个特点,每制造一架机器,都需要机床、材料、电子设备,需要能源和电厂,这就形成了一个非常长的产业链。一发炮弹的生产需要几十个环节,这几十个环节就代表了几十个工厂。这些工厂一开始可能是做民品生产的,但由于产业分工协作,实现了向非军事领域生产的投资扩散。

If the investment rate remains this high over the next six months, then Russia’s structural transformation will have been effective.

再观察半年,如果投资率还继续这么高,那么俄罗斯结构性转型就出现成效了。

The state economy played a significant role.

国有经济起了重要作用

Guancha: You mentioned that Russia’s capital accumulation rate reached 27% in 2023, which was a major contributing factor to the 3.6% growth of its economy. Where did Russia get the money for such a significant increase in investment?

观察者网:您提到俄罗斯的资本积累率2023年达到了27%,这是俄罗斯经济能够增长3.6%的一个主要原因。俄罗斯的投资大幅提高,它的钱哪儿来的?

Xu Poling: Russia’s investment growth in 2023 was related to its active fiscal and monetary policies. The main sources of funds were fiscal spending and preferential mortgages. Before 2015, Russia’s macroeconomic policy was non-interventionist and aimed at balancing the budget. After Russia adjusted the ruble exchange rate on January 1, 2015, the Central Bank of Russia shifted the focus of its monetary policy from stabilizing the exchange rate to targeting inflation. It adopted more focused policy objectives, which yielded more noticeable effects. However, its basic principle of not interfering with economic growth remained unchanged.

徐坡岭:2023年的投资增长,与积极的财政政策和货币政策有关。财政支出和优惠抵押贷款是最主要的来源。前面提到,俄罗斯在2015年之前宏观经济政策方面,一直执行的是不干预和平衡财政政策。2015年1月1日卢布汇率改革后,俄罗斯央行货币政策从过去的汇率稳定转型为通货膨胀目标制,政策目标更集中,效果更显著,但不干预经济增长的原则没变。

After Mikhail Mishustin became Prime Minister, he fully committed to implementing the national projects proposed by President Putin in the “May Decrees” of 2018. It’s worth noting that before becoming Prime Minister, Mishustin was a director at the Federal Treasury, where he significantly improved tax revenue collection efficiency. Additionally, before Prime Minister Mishustin took office, the 13 national projects proposed in the “May Decrees” were not being implemented well due to a lack of funds.

米舒斯京出任总理之后,全力以赴执行和落实普京总统2018年“五月总统令”提出的国家项目。应当指出,米舒斯京出任总理之前,是俄联邦财政部的一个局长,为提高预算收入效率做出了突出贡献,就是说搞钱有一套。另外,他出任总理之前,“五月总统令”提出的13项国家项目也执行的不好,关键是没钱。

Upon taking office, Mishustin undertook substantial reforms, transforming Russia’s Foreign Economic Affairs Bank into the State Development Corporation and merging other development institutions, which had long been ineffective, into the National Development Group. A financing vehicle was established to implement large national infrastructure projects, similar to China’s National Development and Reform Commission and the China Development Bank.

米舒斯京执掌政府大权之后,大刀阔斧进行改革,把对外经济银行改组成俄联邦发展集团,把其他长期效果不佳的发展机构合并到国家发展集团;为落实国家大项目建设,建立融资工厂,形成了由经济发展部和国家发展集团组成的、相当于我们的发改委和国开行的大项目建设支持机制。

During the COVID-19 pandemic, Mishustin organically combined anti-crisis measures with major project construction, achieving a 4.7% economic growth rate in 2021. After the outbreak of the Russia-Ukraine conflict in 2022, Mishustin’s main focus became securing a budget for military operations and continuing to support major national construction projects. His policies provided a firm foundation for the rapid recovery and stabilization of the economy in 2022. The Central Bank also introduced a series of policies to support economic recovery, including cutting interest rates during the U.S. Federal Reserve’s 2022 rate hikes, supporting businesses that lost external financing, etc.

新冠疫情期间,米舒斯京就把反危机和大项目建设有机结合,2021年实现了4.7%的经济增长率。2022年俄乌冲突爆发后,为军事行动筹集预算,继续支持大项目建设,把握经济增长的节奏,快速恢复经济,是米舒斯京的主要政治任务,也为2022年经济快速恢复稳定提供了政策保障。同时,央行在配合经济恢复方面也出台了一系列政策加以配合,包括2022年美联储加息的时候,俄央行在降息,给失去外部融资的企业提供支持,等等。

In 2022, Russia received lots of revenue from rising energy prices, resulting in a very favorable fiscal situation. To complete the 2022 budget plan, Russia spent 6.5 trillion rubles in December 2022, which accounted for 22.5% of that year’s expenditures. This spending provided important start-up capital for investment growth in 2023. Russian federal fiscal spending continued to expand in 2023, with total budget revenue reaching 29.1 trillion rubles, a 4.7% increase from 2022, and budget expenditures exceeding 32.3 trillion rubles, a 4% increase from 2022. Spending on government procurement and national construction projects grew the fastest.

2022年俄罗斯得到大量能源涨价的溢价收入,财政形势非常好。为了完成2022年的预算计划,当年12月,财政支出6.5万亿卢布,占全年支出的22.5%,这成为2023年投资增长的重要启动资金。2023年俄联邦财政支出继续扩大,全年预算收入为29.1 万亿卢布,较2022年增长4.7%;预算支出逾32.3万亿卢布,较2022年增长4%。其中用于政府采购和国家大项目建设的支出增长最快。

At the same time, the Central Bank provided numerous preferential mortgages for the development of the Far East and Arctic regions, as well as for investments in major projects. The proportion of consumer spending that was financed by credit grew by more than 10 percentage points in 2023, from 37% to 48%. The mortgage rates on self-built housing in the Far East are only 3%, despite the key interest rate in Russia being raised to 16% in December 2023 to curb inflation. These preferential mortgages have become a subsidy for both businesses and residents.

与此同时,央行对远东和北极地区开发、对大项目投资提供了大量优惠抵押贷款,居民消费中信用消费比重在2023年增长了10多个百分点,从37%增长到48%。在远东自建房的贷款利率只有3%,要知道为了抑制通胀,俄罗斯的关键利率在2023年12月已经提高到了16%。优惠抵押贷款对企业和居民而言都成了补贴。

Investments in major projects, supported by project finance vehicles and direct/indirect financial support from the government, are not affected much by the increase in the key interest rate. Therefore, raising the key interest rate affects social investments that do not receive policy support.

大项目投资得到项目融资工厂的支持和财政支持,对关键利率提升并不敏感。因此提高关键利率影响的是没有得到政策支持的社会投资。

Additionally, Russia’s ability to withstand pressure after being sanctioned and blockaded in 2023, while still achieving rapid economic growth, is a direct result of the Russian government’s control of and investment in the economy.

另外,俄罗斯在被制裁和封锁后能抗住压力,并在2023年实现快速增长,也与俄罗斯的国有经济对经济和投资的掌控分不开。

Since the year 2000, despite multiple rounds of privatization in which many state-owned enterprises and shares were sold off, the state-owned economy’s contribution to GDP output has increased rather than decreased, rising from 31.2% in 2000 to 56.23% in 2021 (before the war). There were two reasons for this increase. First, the Russian government reduced the proportion of companies with more than 50% state ownership but increased the proportion of companies in which it had a 25% stake to over 75%. This allowed the government to gain control over a wider swath of the economy while also growing the total amount of state assets.

2000年以来,尽管俄罗斯搞了多轮私有化,卖出国有企业或国有股份,但国有经济在GDP产出中的贡献不降反升,从2000年的31.2%上升到2021年开战之前的56.23%。这种上升有两个原因,一个是俄政府减少了50%以上控股的企业比重,但把25%控股的国有企业比重提升到了75%以上,在国有资产总量继续增长的情况下,实际上控制了更多经济活动。

Moreover, within Russia, state-owned and state-controlled companies hold dominant positions across a variety of industries. As of 2021, Russia had 2045 state-owned companies and 2587 state-controlled public companies, with tens of thousands of subsidiaries, dominating the operations of various industries. Military mobilization orders and wartime policies further increased the importance of the state-owned enterprises in terms of investment and output. This government control of the economy is what allowed its fiscal spending and preferential mortgages to take effect so quickly.

另外,俄罗斯国有经济在各产业都具有垄断地位,2045家(2021年数据)和2587家国有控股上市公司,下属子公司往往上万家,对各个产业的经营活动都具有主导地位。军事动员令和战时政策进一步提高了国有经济在投资和产出中的重要性。这是财政支出、优惠抵押贷款快速发挥作用的基础。

Who Benefits from the Russia-Ukraine Conflict?

俄乌冲突,谁获益?

Guancha: In a previous speech, you mentioned that China played a significant role in the structural transformation of Russia’s economy. How so? Some Western media claim that China is profiting from the war in Russia, that they are hiding in the background reaping benefits from the conflict. What’s your take?

观察者网:您在之前的一次演讲中提到,中国在此次俄罗斯在经济结构转型中发挥了很多作用,具体体现在哪些方面?一些西方媒体就认为中国借俄罗斯打仗,在背后坐收渔翁之利,您怎么看?

Xu Poling: At the Munich Security Conference, Wang Yi stated that China and Russia have what could be considered a normal relationship for two major neighboring countries. He clarified that both nations adhere to the principles of non-alignment, non-confrontation, and not targeting any third party. These principles form the foundation for the Russia-China relationship, as well as an important template for relations between two major countries.

徐坡岭:王毅这次在慕尼黑安全会议上讲,中国与俄罗斯是正常的相邻大国的关系,我们坚持不结盟、不对抗、不针对第三方,这是一个中俄关系非常重要的原则,也是非常重要的大国关系的典范。

Of course, you’ll discover that after Russia was sanctioned by the West, foreign luxury brands, machinery, and automotive companies withdrew from the country, leaving Russians unable to purchase these products. China stepped in to fill the void, producing and exporting the goods Russia needed. Western countries stopped importing Russian energy, but it’s cheap and of high quality. Naturally, China started to import more energy from Russia. The Russia-China relationship has been a win for both sides.

当然,你会发现,俄罗斯被西方制裁之后,外资的一些名品、机械和汽车等行业企业都撤走了,这些产品俄罗斯人买不到了,但社会有需要,而中国正好能生产,那么中国就出口给俄罗斯。俄罗斯的能源西方不进口了,但它又便宜又好,中国当然就会大力进口,中俄实现了互利共赢。

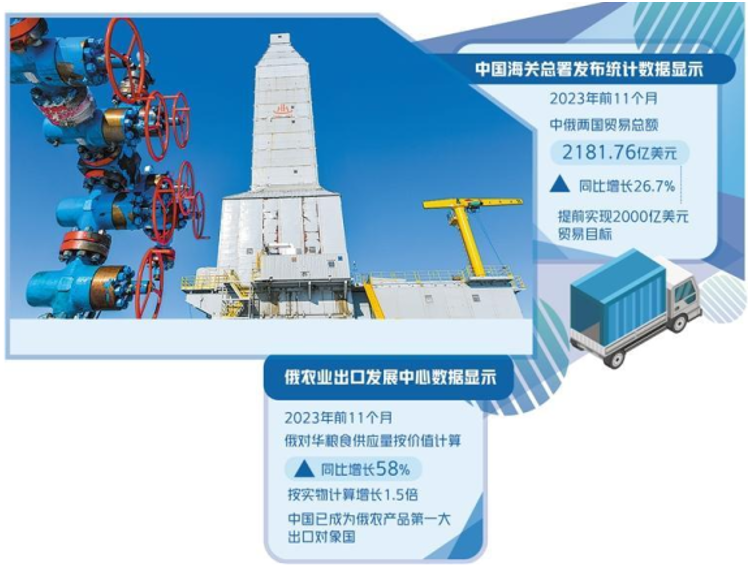

In 2022, the total volume of trade between China and Russia was $190.27 billion. In 2023, it reached $240.11 billion, accounting for about 39% of Russia’s total trade volume, a significant increase. Russia’s foreign trade underwent significant structural changes, with the proportion of its total foreign trade conducted with European nations falling from 40% to 20%. Conversely, trade with Asian countries rose to comprise 72% of Russia’s total foreign trade, while trade with African and Latin American countries increased to account for 8%.

2022年中俄贸易总额达到1902.7亿美元,2023年达到2401.1亿美元,占到俄罗斯贸易总额的39%左右,增幅非常大。俄罗斯对外贸易也出现了明显的结构性转型,欧洲的贸易占整个对外贸易比重从原先的40%下降到20%,与亚洲地区的贸易增加到了72%,与非洲、拉美的贸易的占比增长到8%。

The growth in Russia’s foreign trade with Asia was largely driven by China. In 2023, Russia’s imports from China reached $110.97 billion, and exports to China reached $129.14 billion. The trade imbalance between China and Russia began to narrow, with Russia’s trade surplus with China decreasing. Many of China’s exports to Russia are products not available in the Western market. These products are filling the gaps in the industrial chains that were created when the West sanctioned Russia.

俄罗斯与亚洲的对外贸易增幅,主要来自中国。2023年俄罗斯从中国的进口额达到1109.7亿美元,对中国的出口达到1291.4亿美元,中俄之间的贸易不平衡开始缩小,俄罗斯对中国的顺差缩小。中国对俄罗斯的出口产品很多是西方市场上采购不到的,弥补了俄罗斯被制裁之后与西方断链造成的产业链空缺。

From March to June 2022, due to sanctions-related settlement and transportation issues, China-Russia trade initially experienced a monthly decline of 18%-26%. However, after companies from both countries found alternative solutions, Russia-China trade experienced 20 straight months of continually accelerating growth. This was primarily due to a rapid increase in Russia’s purchases from China, especially in 2023. After September 2023, flights departing Russia for China were filled with Russian business delegations eager to purchase anything that Russia needed and China could produce.

2022年3至6月份,因为制裁导致的结算和运输问题,中俄贸易数据先呈现单月18%-26%的下降,之后,两国企业找到了替代性方案,又呈现出超过20个月的同比增长,就是因为俄罗斯从中国采购快速增加,特别是2023年增长得非常快。2023年9月之后的俄罗斯出境航班中,前往中国的航班都被俄罗斯的商务代表团给挤满了,只要是俄罗斯缺的、中国生产的,他们就到处去采买。

Russian energy exports to China also increased. Last year, Russia’s crude oil exports to China rose by 24%, reaching 107 million tons. However, due to falling prices, the actual amount that China paid only increased by 4% YoY. This proves that Russian crude oil is both cheap and of good quality and that Russian pipelines are secure. Last year, China imported over 34 billion cubic meters of natural gas from Russia, of which 22.7 billion cubic meters were via pipeline, accounting for over one-third of Russia’s total natural gas exports.

俄罗斯对中国的能源出口也在增加。俄罗斯去年对中国的原油出口增加了24%,达到 1.07亿吨,但是价格下降了,因此支付金额与之前相比只增加了4%。这就证明俄罗斯的原油又便宜又好,通过管道输送又很安全。去年中国从俄罗斯进口天然气达到340多亿立方米,其中管道天然气是 227亿立方米,占俄罗斯去年总共出口天然气的三分之一以上。

Russian energy exports to China are extremely significant. They have helped stabilize Russia’s financial and fiscal situation. China’s exports to Russia have provided crucial support for the restoration of Russia’s industrial and supply chains, with both sides benefiting.

俄罗斯对中国出口能源,为俄罗斯金融稳定和财政稳定提供了保障,具有延伸性意义。中国对于俄罗斯的商品出口是其产业链、供应链恢复生产的重要支持,而且双方都在获益。

The decline in Russia’s trade with Europe and the increase in its trade with China stem from the widespread security concerns of the Western world. The Western media’s notion of “China profiting from the Russia-Ukraine conflict” is unfounded.

俄欧贸易下降,中俄贸易上升,这是西方世界泛安全化的结果。西方媒体所谓的“中国从俄乌冲突中坐收渔翁之利”是没有道理的。

Wang Yi articulated this point very clearly at the Munich Conference. China has normal relations with Europe. China has normal relations with Russia. The blame for the Ukraine crisis cannot be shifted to China. The West understands what really provoked this crisis. Russia and Ukraine both have security concerns which can be resolved through negotiation and other peaceful means. There have been many “windows” to secure peace, along with numerous peace proposals.

王毅在慕尼黑会议上讲的很好,中欧关系是大国关系,中俄关系也是大国关系,不能把乌克兰危机的锅甩到中国人身上,这个事怎么激起来的,西方实际上心里很清楚。俄罗斯有安全担忧,乌克兰也有安全担忧,这种安全担忧其实可以通过协商、和平的方式解决。和平的窗口期很多,方案也很多。

Politically speaking, if you look at who stands to benefit the most from this conflict, it’s the United States. The Americans themselves have said that the money spent on supporting Ukraine was well worth it. American aid effectively reduced Russia’s military capacity by 50% without sacrificing a single American soldier. In this light, it can be seen as one of the most successful investments in American history. This was openly stated by U.S. Senator Lindsey Graham.

如果往政治上扯,这一仗谁受益多,美国受益更多。美国人自己都说了,援乌花的钱太值了,让美国在没有损失一兵一卒的情况下,就把俄罗斯的战斗力削减了50%,这是美国历史上最成功的投资回报。这是美国资深参议员格雷厄姆公开说的。

Furthermore, it’s the United States, not China, which has profited immensely in the European natural gas market. After Russian energy was banned, U.S. exported liquefied natural gas to Europe at a price of $2,200 per thousand cubic meters (8-9 times the usual price), earning a substantial profit.

此外,在欧洲天然气能源市场上挣得盆满钵满的,不是中国,而是美国。俄罗斯能源被禁买之后,美国的液化天然气以2200美元/千立方米的高价(是平时的8-9倍)对外出口,赚得盆满钵满。

The American elite and the deep state have reconsolidated their alliance and hegemony systems. They are the ones making money in the background, or perhaps, they originally provoked the Russia-Ukraine conflict with this goal in mind. Ultimately, they achieved their goal. What’s more, they managed to cripple Europe’s industry, technology, capital, and currency (the euro), which posed a threat to the U.S., in addition, of course, to entangling Russia in the conflict.

美国的精英、美国的深层政府把它的联盟体系、霸权体系重新巩固起来,他们在背后挣钱,或者说他们一开始就想达到这个目的,才挑起了俄乌冲突。最终,确实也如愿达到目的了,而且不但达到目的,还把对于美国有威胁的欧洲的产业、技术、资本和欧元都给打垮了,当然也把俄罗斯给拖住了。

However, this conflict represents both a crisis and an opportunity for every nation-state and actor involved. For Europe, the conflict has led to a security crisis. However, it also presents an opportunity for Europe to reassess its identity. The same applies to the United States.

但是,冲突作为一个事件,对每个国家与行为体而言既可能是危机,也可能是机会。对于欧洲来讲,冲突造成了欧洲的安全危机,当然也是欧洲重新看清自己身份的一个机会。对美国也是这样。

I think that President Putin may be able to utilize the Russia-Ukraine conflict to restructure Russian society and the Russian economy. It may actually become a shot-in-the-arm for Russia. Yes, it is true that the increase in China-Russia trade is definitely related to Western sanctions against Russia. However, throughout the crisis, China has adhered to the principles of non-alignment, non-confrontation, and not targeting any third party in its relationship with Russia. China has consistently worked towards a peaceful resolution, offering support, proposals, and constructive input.

我认为,对于俄罗斯来说,普京总统可能是把俄乌冲突变成了一针激素,对俄罗斯社会和经济进行了重整。对于中国而言,客观上中俄贸易的增加,肯定与西方对俄罗斯的制裁有关。但是,在危机的发展过程中,中国还是秉持了中俄关系的不结盟、不对抗、不针对第三方的原则,中国一直在为和平解决提供助力,提供方案,提供建设性的力量。

Guancha: The sanctions placed on Russia sparked lots of conversations in the Chinese academic community. The main topic of concern is what China should do if it were to be sanctioned. What lessons can China learn from Russia’s response to the sanctions?

观察者网:俄罗斯被制裁之后,中国学界有各种讨论,其中大家最关心的就是,一旦中国被制裁,我们应该怎么办?从俄罗斯遭受制裁的应对来看,中国有哪些可以汲取的经验教训?

Xu Poling: I believe the Russia-Ukraine conflict is one factor that has stimulated a sudden change in the international order. China’s insistence on neutrality has somehow become a sin, leading the U.S. to escalate the confrontation. But that is not the strategic choice that China wanted.

徐坡岭:我觉得俄乌冲突是一个导致国际秩序突变的激发性因素。中美关系的变化,从过去的合作竞争变成竞争合作,最后变成带有一定对抗性质的关系,与俄乌冲突之后美欧强迫选边站队有关。中国坚持中立,也成了罪过,美国因此提高了对抗水平。但这不是中国想选择的战略。

China has always wanted to focus on domestic development and avoid causing trouble abroad. China’s foreign development strategy has always been about peace, development, cooperation, and win-win outcomes. Even now, our view of the global environment remains unchanged: China is facing a “major change, the likes of which haven’t been seen in a hundred years,” with insecurity and uncertainty on the rise.

中国一直想专注于国内发展,不想在外面搞事。所以说中国对外发展战略一直是和平、发展、合作和共赢,甚至现在我们对国际大环境的描述还是,中国在遭遇“百年未有之大变局”,不安全因素、不确定因素在上升。

The United States feels that its hegemony is being threatened and seeks to rebuild a hegemonic alliance system aimed at containing and encircling China. Indeed, a few hot-button issues could lead to a rapid escalation of security risks, resulting in sanctions against China.

美国认为它的霸权受到威胁,要重建围堵中国、遏制中国的霸权联盟体系,这确实可能会因为某些热点事件使得安全风险急速上升,导致其对中国实施制裁。

I believe an important lesson from Russia in effectively dealing with sanctions is to maintain financial security, as well as “safe backup plans” for international reserves, international settlement systems, key technologies, and production chains and supply chains related to national security.

我认为,在有效应对制裁方面,俄罗斯的重要的经验,就是在金融安全、国际储备、国际结算体系方面,在关键技术、涉及到国家安全的生产链、供应链方面都持有安全备份。

Beyond passive defense, we must also prepare some proactive and aggressive measures to use if necessary. For example, Russia later used energy, grain, rare metals (titanium for manufacturing aircraft engines), potash fertilizer (over 80% of Europe’s imports), and uranium (which the U.S. still imports in large quantities from Russia) as strategic tools to manage imports and exports. This is why the West cannot fully sanction Russia and may even have to compromise with it in some cases. Simply put, security is not about building a Great Wall and avoiding expansion.

除了被动的防御之外,还得储备一些积极的进取性手段,比如俄罗斯后来把能源、粮食、稀有金属(生产飞机发动机的钛)、钾肥(欧洲进口的80%以上)、铀(美国仍在从俄罗斯大量进口)等作为战略工具实施进出口管理。这都是美欧无法对俄罗斯实施全面制裁,甚至不得不妥协的原因。说白了,安全不是说建一座长城,不对外扩张就安全了。

Russia has taught us that weaknesses in technological supply chains and financial systems can lead to big losses. Thus, Russia was somewhat disorganized initially when it was sanctioned by the West. However, since 2014, Russia has been building its own economic security.

俄罗斯给我们的教训就是,技术生产链和金融体系比较虚弱会吃大亏。因而,一开始被西方制裁的时候,俄罗斯有些手忙脚乱。当然从2014年开始,过去8年,俄罗斯一直在为经济安全建设做准备。

China must also prepare for similar potential risks. We do not seek trouble or provoke conflicts, but we should not be afraid of them either.

对于中国来讲,我们也需要未雨绸缪,把风险想足了,把手段储备足了,我们不挑事、不惹事,也不能怕事。