The United States is the world’s largest economy and a major trading nation, and changes in its policies have a significant impact on global economic and trade development. On January 20, 2025, Donald Trump was officially inaugurated as the 47th President of the United States. Trump is a distinctive and controversial politician who, under new circumstances, has put forward some relatively radical policy reform proposals. Compared with the previous two administrations, his new administration has made considerable policy changes, adding more variables to China–U.S. economic and trade relations and to the changes unseen in a century that are transforming the world. This paper analyzes the policy proposals of the new Trump administration and their similarities and differences with the previous two administrations, assesses the impacts on China and global economy and trade, and puts forward targeted countermeasures. We hope this effort offers substantial research value and practical significance.

美国是世界第一大经济体和贸易大国,其政策变化对全球经贸发展具有不容忽视的影响。2025年1月20日,特朗普正式就任美国第47任总统。特朗普是一位个性鲜明、具有争议的政治家,在新形势下提出了一些较为激进的政策改革主张,且相较于前两届政府政策发生了不少变化,为中美经贸关系乃至世界百年未有之大变局增加了更多变量。分析新一届特朗普政府施政主张以及与前两届政府的异同点,研判其对全球及我国经贸的影响,提出具有针对性的对策建议,具有较强的研究价值和现实意义。

Review of the policy proposals of the new Trump administration

新一届特朗普政府施政主张的述评

The policy proposals of the new Trump administration share both similarities and differences with those of the previous two administrations and exert both positive and negative impacts on the U.S. economy. Due to the influence of multiple factors, the extent to which these proposals can be implemented remains uncertain.

新一届特朗普政府施政主张与前两届政府政策均存在相同点和差异点,其对本国经济存在正面和负面的影响。受多方面因素影响,施政主张能够兑现的程度存疑。

Main policy proposals

施政主张的主要内容

Overall, the new Trump administration advocates broad-based domestic tax cuts, comprehensive tariff increases on foreign trade, support for monetary easing and a weak dollar, the development of traditional energy to reduce inflation, and stricter immigration policies.

总体而言,新一届特朗普政府主张对内普惠性减税,对外全面加征关税,赞同货币宽松和弱美元,发展传统能源以降低通货膨胀,收紧移民政策。

Fiscal and tax policy: Increase fiscal spending while implementing broad-based tax cuts. The new Trump administration advocates an expansionary fiscal policy and increased investment spending in the infrastructure sector. Trump has stated that he will carry out tax reform centered on large-scale tax cuts, using tax reductions to subsidize the corporate sector, and lowering the corporate income tax rate from 21% to 15%. This may lead to increased pressure on the U.S. fiscal balance and a rise in the fiscal deficit ratio. At the same time, the 2024 Republican Party platform states that Trump’s first-term tax cuts should be made permanent, the “tip tax” on workers in the food service and hospitality industries should be eliminated, and unnecessary government expenditures should be cut to reduce the fiscal burden.

财税政策:加大财政支出,同时推行普惠性减税。新一届特朗普政府主张实施扩张性的财政政策,加大在基础设施领域的投资支出。特朗普宣称将开展以大规模减税为核心的税制改革,用减税补贴企业部门,将企业所得税率由21%减至15%,这可能会导致美国财政收支压力加大和财政赤字率的提升。同时,2024年美国共和党党纲指出,要使特朗普税改实现永久化,取消餐饮业和酒店业工人的“小费税”,还要削减不必要的政府开支来减少财政负担。

Financial policy: Support for monetary easing and a weak dollar. Trump advocates for interest rate cuts by the Federal Reserve and opposes inflation. He supports a weak-dollar policy to promote exports and reduce the trade deficit. In the financial sector, Trump favors deregulation of the financial industry, and he will block the Treasury Department from launching a central bank digital currency. He supports the development of cryptocurrency and seeks to ensure that U.S. citizens can retain individual custody of their digital assets.

金融政策:支持货币宽松和弱美元。特朗普主张美联储降息,反对通货膨胀。支持弱美元政策,促进出口,减少贸易逆差。在金融行业,特朗普倾向于放松对金融业的监管,同时将阻止财政部推出中央银行数字货币,支持加密货币的发展,确保美国公民自行保管其数字资产。

Trade policy: Further escalate trade protectionism without restraint and significantly raise tariffs. On February 1, Trump signed an executive order imposing a 10% tariff on goods imported from China. He has also stated that he intends to impose tariffs of 10% to 20% on imports from other countries, including raising tariffs on the European Union, with the goal of prioritizing the development of U.S. industry. For key products involving swing states, such as the automotive sector, Trump proposes terminating Biden’s electric vehicle mandate, imposing all necessary tariffs on Chinese electric vehicles, and levying a 100% tariff on electric vehicles imported from Mexico. He believes this will revitalize the U.S. auto industry. Trump emphasizes giving priority to U.S. producers over foreign outsourcers, promoting the reshoring of critical supply chains, creating more jobs for American workers and raising their wages, and enhancing the status of the United States as a manufacturing power.

贸易政策:进一步无底线加强贸易保护主义,大幅提高关税。2月1日,特朗普签署行政令,对进口自中国的商品加征10%的关税。同时,他曾宣称要对来自其他国家的进口产品征收10%至20%的关税,包括对欧盟加征关税,旨在优先发展美国工业。在涉及摇摆州选情的关键产品,如汽车领域,特朗普主张终止拜登的电动汽车强制令,对中国的电动汽车实施任何必要的关税,并对从墨西哥进口的电动汽车征收100%的关税,他认为这将振兴美国汽车产业。特朗普强调,要优先考虑美国生产者而非外国外包商,促成关键供应链回流,为美国工人创造更多就业机会并提高工资待遇,提升美国制造业大国的地位。

At the same time, the 2024 Republican Party platform states that it will gradually halt imports of essential goods from China and prohibit China from purchasing U.S. real estate and related industries. The Republican Party will continue to pursue the “Buy American and Hire American” policy and will prohibit outsourcing companies from conducting business with the U.S. federal government.

同时,2024年美国共和党党纲声称将逐步停止从中国进口必需品,并禁止中国购买美国房地产及相关产业。共和党将继续采取“买美国货,雇美国人”的政策,禁止外包公司与美国联邦政府开展交易。

Energy policy: Advocate for the development of traditional energy and increased energy supply to control inflation. Trump has repeatedly emphasized the need to expand oil and natural gas extraction, relax a range of environmental regulations, repeal the Inflation Reduction Act that supports the clean energy industry, and reclaim unused funds. He has pledged to declare a national energy emergency to increase U.S. oil and gas production and significantly boost domestic energy supply. Trump will focus on the development of traditional fuel vehicles, which will benefit the traditional energy industry. The 2024 Republican Party platform also states that the United States should become the largest energy producer that the world has ever seen. Trump’s support for traditional energy sources such as oil may be linked to interest groups backing him, such as his donor Timothy Mellon, whose Mellon Group is involved in sectors such as aluminum, oil, and coal mining.

能源政策:主张发展传统能源,增加能源供给以控制通货膨胀水平。特朗普多次强调要扩大石油和天然气开采,放宽一系列环境法规,废除清洁能源行业的《通货膨胀削减法案》,收回未动用的资金,并承诺将宣布进入国家能源紧急状态,提升美国的石油和天然气产量,实现国内能源供应的大幅增加。特朗普将侧重发展传统燃油汽车,利好传统能源行业。2024年美国共和党党纲中也指出,要让美国成为世界上迄今最主要的能源生产国。特朗普支持石油等传统能源的原因,或与背后的利益支持集团有关,以特朗普的“金主”蒂莫西·梅隆为例,他背后的梅隆集团业务范围涉及铝、石油、煤矿等行业。

At the same time, Trump has expressed support for solar energy development, though what comes of this remains to be seen. During a televised debate with Harris held in Philadelphia in September 2024, Trump accused Harris of intending to eliminate fossil fuels if elected but then went on to say that he is a “big fan” of solar energy.

同时,特朗普表达出支持太阳能发展的倾向,但后续有待进一步观察。特朗普在2024年9月同哈里斯参加在费城举办的电视辩论时,指责如果哈里斯当选“化石燃料将消亡”,而后又说他是太阳能的“超级粉丝”。

Immigration policy: Stricter immigration policy. Trump will strictly limit immigration, and the approval rate for immigration applications is expected to decline. He plans to deport illegal immigrants, restart construction of the U.S.-Mexico “border wall,” and use advanced technology to monitor the border. However, it is worth noting that Trump advocates easing restrictions on skilled immigration and allowing foreign graduates of U.S. universities to obtain green cards.

移民政策:收紧移民政策。特朗普严格限制移民,移民申请通过率将下降;计划驱逐非法移民,重启美墨“边境墙”,使用先进技术监控边境。不过需要注意,特朗普主张放宽技术性移民,允许在美国大学毕业的外国人获得绿卡。

Policies already introduced by the new Trump administration

目前新一届特朗普政府已出台的举措

Since taking office, the Trump administration has rapidly introduced a series of policies in areas such as trade, energy, and immigration. So far, these have been largely consistent with his campaign proposals, though there remains room for negotiation with other countries. This reflects Trump’s customary tactic of using negotiating leverage to pressure counterparts and secure greater benefits for the United States.

特朗普就任新一届美国总统以来,新政府迅速在贸易、能源、移民等领域密集出台了一批政策,目前看与竞选时的政策主张基本一致,但也存在与其他国家谈判的空间,这体现了特朗普借谈判筹码施压为美国获取更多利益的惯用手段。

On trade, Trump announced tariff increases on Canada, Mexico, and China, with plans to impose a total of 20% in tariffs on China in two phases. On February 1, Trump signed an executive order imposing a 25% tariff on products imported from Mexico and Canada, including a 10% tariff increase on Canadian energy products. On February 3, Trump announced a 30-day delay in implementing the tariff measures on the two countries and stated that negotiations would continue. Regarding China trade policy, Trump stated that starting March 4, a further 10% tariff would be imposed on imports from China, following a previous 10% tariff increase on February 4—bringing the total additional tariffs to 20%.

在贸易领域,特朗普宣布对加拿大、墨西哥和中国同时加征关税,其中拟对中国分两次加征合计20%的关税。特朗普2月1日签署行政令,对进口自墨西哥、加拿大两国的产品加征25%的关税,其中对加拿大能源产品的加税幅度为10%。2月3日,特朗普宣布对两国加征关税措施暂缓30天实施,并继续进行谈判。在对华贸易政策方面,特朗普表示从3月4日起对来自中国的进口商品再次加征10%的关税,此前已于2月4日对中国加征了10%的关税,加征关税合计将达到20%。

In the energy sector, Trump declared a national energy emergency after taking office, revoked electric vehicle incentives to save the U.S. traditional automotive industry, and floated plans to reallocate electric vehicle subsidies to defense and infrastructure sectors. At the same time, Trump announced that the United States would once again withdraw from the Paris Agreement aimed at addressing climate change.

在能源领域,特朗普上台后宣布进入国家能源紧急状态,撤销电动车优惠政策以拯救美国传统汽车工业,计划将电动车产业补贴资金转移至国防和基建领域。同时,特朗普宣布再次退出旨在应对气候变化的《巴黎协定》。

On immigration, Trump declared a national emergency at the southern border, launched a large-scale plan to deport illegal immigrants, and implemented measures such as increasing the deployment of personnel and resources, expanding physical barriers, and halting all illegal border crossings. At the same time, a new path will be opened for foreign nationals who invest at least 5 million dollars in U.S. projects to obtain residency and eventually citizenship.

在移民领域,特朗普宣布南部边境进入国家紧急状态,启动大规模驱逐非法移民计划,采取加强人员和资源部署、增加物理屏障等措施,停止所有非法移民入境;同时将面向对美国项目至少投资500万美元的外国人开辟获得居住权并最终入籍的新路径。

In addition, Trump has carried out sweeping reforms of domestic institutions, establishing a Department of Government Efficiency (DOGE) led by Elon Musk to review and downsize government departments. Approximately 75,000 people have been laid off, affecting around 3% of government employees.

此外,特朗普对国内机构进行大刀阔斧的改革,成立了由马斯克领导的政府效率部,对多个政府部门进行审查并裁员,约7.5万人接受资遣,影响涉及约3%的政府雇员。

Analysis of similarities and differences with policies of the previous two administrations

与前两届政府政策的相同点和差异点分析

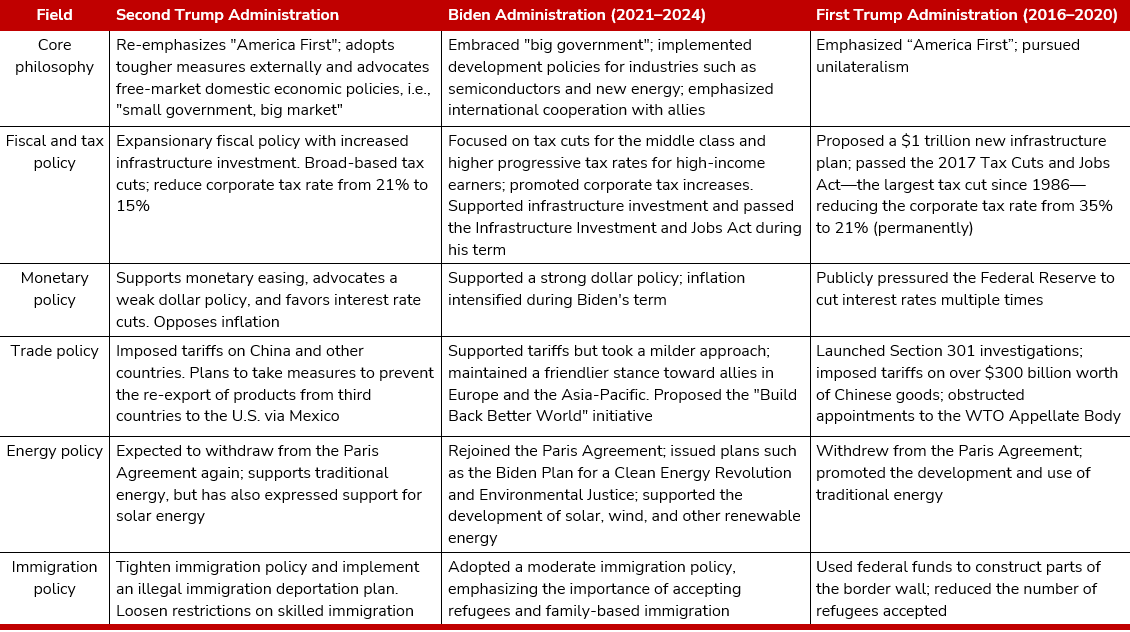

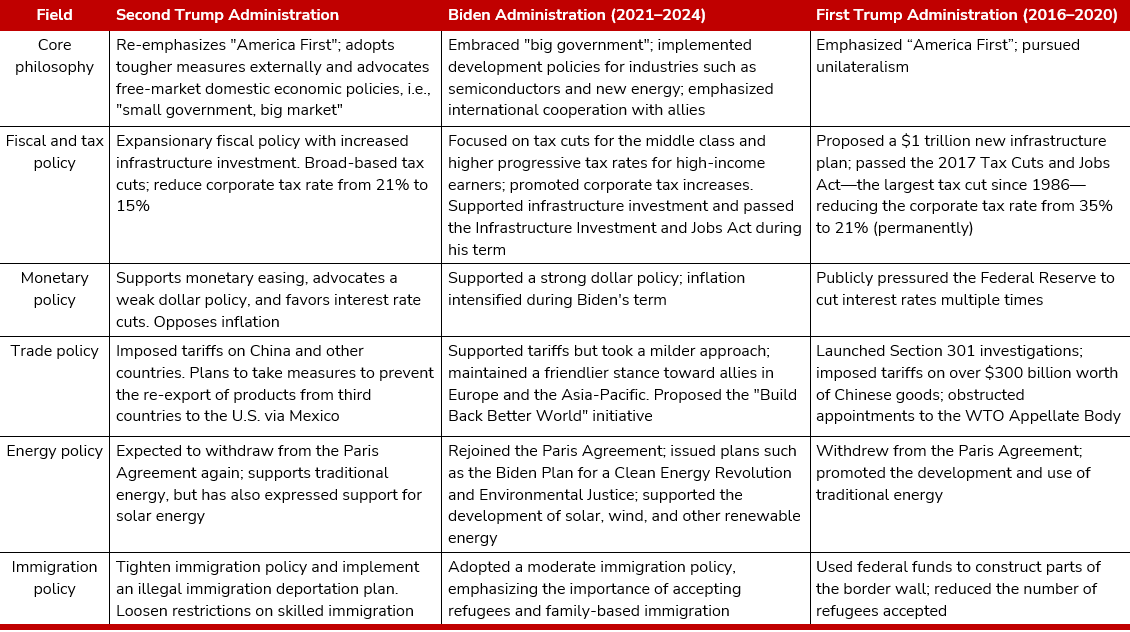

Similarities and differences with Biden administration policies. The new Trump administration shares similar policy positions with the Biden administration in areas such as raising tariffs, increasing infrastructure investment, and containing China’s development, but its tactics are more aggressive, as shown in Table 1. For example, Trump has declared that he will impose across-the-board tariff increases, including significant tariff hikes on China, which may harm the interests of U.S. allies. In contrast, the Biden administration took a friendlier stance toward allies, proposing the “Build Back Better World” initiative and emphasizing the importance of working with allies to contain China’s development.

与拜登政府政策的异同点。新一届特朗普政府与拜登政府在加征关税、加大基础设施投入、遏制中国发展等方面政策主张相近,但手段更为激进,如表1所示。例如,特朗普宣称将全面加征关税,其中针对中国大幅加征关税,可能会损害到其盟友的利益,而拜登政府对盟友的态度更加友好,提出“重建更美好世界”计划,注重联合盟友力量遏制中国发展。

Table 1: Differences Between Policies of the New Trump Administration and the Previous Two Administrations

表1 新一届特朗普政府施政主张与前两届政府政策的区别资料

来源:根据公开资料整理

来源:根据公开资料整理The new Trump administration differs significantly from the Biden administration in areas such as domestic taxation, climate and environmental policy, and immigration. During Trump’s second term, policies in these areas are expected to undergo major shifts. In terms of domestic taxation, unlike the Biden administration’s push to raise taxes on corporations and the wealthy, the new Trump administration advocates comprehensive and large-scale tax cuts. In the area of immigration, the new Trump administration’s policies are stricter, embracing skilled immigration while strictly screening for illegal immigration, whereas the Biden administration’s immigration policy was comparatively moderate. In terms of climate and environmental policy, in contrast to the Biden administration’s development of green energy to address climate challenges, the new Trump administration favors a return to traditional energy and may further expand domestic oil and gas exploration.

新一届特朗普政府与拜登政府在国内税收、环境气候、移民等方面存在较大分歧,在新一届特朗普政府执政期间,这些领域的政策将出现大幅转向。在国内税收方面,与拜登政府推进对企业和富人加税不同,新一届特朗普政府主张推行全面大规模的减税。在移民领域,新一届特朗普政府移民政策更为严苛,拥抱技术性移民但严格筛查非法移民,而拜登政府的移民政策更为温和。在环境气候方面,相较于拜登政府发展绿色能源以应对气候挑战,新一届特朗普政府主张回归传统能源,可能将加大开放本国石油和天然气的勘探力度。

Similarities and differences between the policies of the first and second Trump administrations. Compared with the first Trump administration, the second Trump administration maintains broadly consistent policy positions on domestic tax cuts, tariff increases, development of traditional energy, and immigration restrictions. However, its scope is broader, implementation more forceful, and stance more determined. For example, in terms of tariff increases, the new administration has expanded the scope of tariffs—not only targeting Chinese exports but also imposing 10% to 20% tariffs on other countries. This may impact Chinese enterprises that export through production facilities in third countries. In areas such as domestic tax cuts and immigration restrictions, the new Trump administration’s proposals are even stronger, with calls for further permanent reductions in tax rates and comprehensive use of technological and physical measures to block illegal immigration. It is also worth noting that 2025–2028 is likely to be Trump’s final term in office. Whether due to constitutional constraints or age, he is unlikely to seek re-election. As a result, the new Trump administration will have fewer concerns during its term and is expected to adopt a more aggressive approach to advance its policy agenda.

与上一届特朗普政府政策的异同点。与上一届特朗普政府相比,新一届特朗普政府在对内减税、对外加征关税、发展传统能源、限制移民等方面的政策主张基本一致,但覆盖范围更广、实施力度更大、态度更为坚决。例如,在加征关税方面,新一届特朗普政府的加征范围更广,在重点遏制中国出口的同时,对其他国家征收10%至20%的关税,这可能将对在第三国设厂出口的中国企业造成冲击。在对内减税、限制移民等领域,新一届特朗普政府政策主张力度更大,宣称推动税率进一步永久性地降低,综合运用科技、物理等手段限制非法移民入境。同时,需要注意到,2025—2028年大概率是特朗普的最后一个任期,后续无论是受宪法限制,还是年龄制约,几乎不可能再考虑寻求连任。因此新一届特朗普政府在执政过程中的顾虑会更少,推动政策实施的态度会更加强硬。

Objective evaluation of the new Trump administration’s policy proposals

客观评价新一届特朗普政府施政主张

The policy proposals of the new Trump administration will have both positive and negative impacts on the U.S. economy. On the positive side, the administration’s advocacy of tax cuts and the reshoring of manufacturing will strongly stimulate domestic demand and promote short-term economic growth. Encouraging the development of fossil fuels may help lower energy prices and ease inflation. On the negative side, the administration’s comprehensive tax cut policy may widen the gap between rich and poor and undermine the balance of government revenues and expenditures, leading to an increase in the budget deficit. At the same time, the imposition of tariffs on China and other countries is likely to exacerbate inflation, disrupt supply chains, and raise the cost burden on middle-class households. It may also trigger retaliatory measures from other countries, ultimately affecting the development of the U.S. economy. The deportation of immigrants may result in labor shortages. In addition, the new Trump administration’s passive stance toward sectors such as new energy vehicles could cause the United States to gradually lose its international voice in these fields.

新一届特朗普政府施政主张对其本国经济既存在正面影响,也有负面影响。从正面影响来看,新一届特朗普政府主张减税和促进制造业回流,将会有力刺激美国国内需求,在短期内促进经济增长。鼓励化石能源的发展,有助于能源价格的下降和缓解通货膨胀。从负面影响来看,新一届特朗普政府的全面减税政策不仅会拉大贫富差距,而且影响政府财政收支平衡,会导致预算赤字的增加。同时,新一届特朗普政府对中国及其他国家加征关税,不仅会导致通货膨胀的加剧及供应链混乱,抬高中产阶级家庭的支出负担,而且也会引发他国的反制措施,最终影响美国经济的发展。驱逐移民可能会导致劳动力的短缺。另外,新一届特朗普政府在新能源汽车等领域态度消极,美国可能会逐渐失去在这些领域的国际话语权。

The extent to which the new Trump administration’s policy proposals can be realized remains questionable. These proposals stem not only from Trump and his team’s understanding of economic policy but are also influenced by swing voters, vested interest groups, partisan struggles, and the international situation. Whether these policies will be smoothly implemented in the future depends on the level of support from the U.S. Congress and Supreme Court, as well as responses of other countries and the degree of public support. An analysis by Guo Xinyi (2024) found that of Trump’s campaign promises in 2016, approximately 41% were not fulfilled, and about 32% were only partially fulfilled1. Based on the current policy proposals of the new Trump administration, there seems to be a tendency to “overpromise” on the campaign to secure votes from swing states and centrist voters. For example, the construction of the border wall is expensive, and whether the fiscal budget can accommodate it on schedule is uncertain. Policy proposals such as tax reform require congressional approval. Although the Republican Party holds a slight majority, there are still internal differences within the party. Trump’s tariff proposals not only risk violating U.S. trade remedy laws and exceeding the scope of congressional authorization but will also inevitably encounter resistance and opposition from other countries2, and they may even prompt other nations to follow suit—ultimately harming the U.S. economy and increasing the burden on the American people.

新一届特朗普政府的施政主张能够兑现的程度值得怀疑。新一届特朗普政府的施政主张,不仅源自特朗普本人及其团队对经济政策的理解,也受到中间选民、背后利益集团、党派斗争、国际局势等因素影响。未来政策实施是否顺利,需要观察美国国会、最高法院的支持力度大小,以及其他国家的应对策略和民众的支持程度。郭馨怡(2024)分析发现,在2016年特朗普的竞选承诺中,约41%的承诺未能兑现,约32%的承诺仅得到部分兑现。从新一届特朗普政府施政的主张来看,为获得“摇摆州”和中间选民的选票,特朗普在竞选时存在“夸大承诺”的嫌疑,例如建设边境墙耗费过大,财政能否如期负担是存疑的。减税改革等政策主张需要国会通过,尽管共和党稍占上风,但意见仍然存在分歧。特朗普的加征关税主张,不仅涉嫌违背美国贸易救济法和超出国会授权范围,也必将遭到其他国家的抵制和反对,或引起他国效仿,反过来危害美国经济,加重美国人民的负担。

Impact on the global economy and trade

对全球经贸的影响

Due to the impact of the new Trump administration’s policy proposals, the global economic and trade landscape will undergo more intense adjustments. There will be broader and more frequent global economic and trade frictions, the multilateral international economic cooperation order will endure shocks, the reshoring of global supply chains will accelerate, a divergence will emerge between the development of new and traditional energy sources, and the evolution of a diversified international monetary system will speed up.

受新一届特朗普政府施政主张的影响,全球经贸格局将会发生更加剧烈地调整。全球或将发生更大范围、更高频次的经贸摩擦,多边国际经济合作秩序将受到冲击,全球供应链回流现象将会加剧,新能源和传统能源出现分化发展,多元化国际货币体系加快演进。

Broader and more frequent global economic and trade frictions. The new Trump administration has declared that it will impose higher tariffs not only on China but also on other countries, including U.S. allies, which will expand the scope of global economic and trade frictions. These actions will inevitably be met with resistance and opposition from other countries. If retaliatory measures are taken against the United States, it may respond by further raising tariffs, resulting in increased frequency and impact of global trade conflicts. For example, when Trump imposed tariffs on steel and aluminum in 2018, the European Union, Canada, and Mexico quickly responded with countermeasures. Trump subsequently announced plans to impose tariffs on imported cars from the EU. Although this was not ultimately implemented, it still reflected his “America First” and “tit-for-tat” approach to resolving disputes. Compared to Trump’s first term, countries are now more familiar with the policy orientation and methods of Trump’s team and have prepared more comprehensive countermeasures and contingency plans. It is foreseeable that under the new Trump administration, major power competition in the economic and trade sphere will shift toward a negative-sum game that harms all parties 3, increasing trade costs, reducing trade efficiency, and ultimately dragging down global trade growth and economic recovery.

全球或将发生更大范围、更高频次的经贸摩擦。新一届特朗普政府宣称不仅对中国加征更高关税,而且对包含盟友国家在内的其他国家加征关税,将导致全球经贸摩擦范围不断扩大。同时,这些举措必将遭到其他国家的抵制和反对,在其他国家对美国采取报复措施后,美国有可能会再度提高关税,导致全球经贸摩擦的频次和影响不断增加。例如,在2018年特朗普对钢铁和铝征收关税时,欧盟、加拿大和墨西哥就迅速采取了报复措施,随后特朗普宣称要对欧盟进口汽车加征关税,尽管最终并未生效,但仍反映出其“美国优先”“以牙还牙”的问题处理方式。相较于上一届特朗普政府执政时期,当前各国已经更加熟悉特朗普团队的施政方针和手段,做好了更完善的反制预案和应对准备。可以预见,在新一届特朗普政府执政期间,大国经贸博弈正在转向令各方受损的负和博弈,增加贸易成本,降低贸易效率,最终拖累全球贸易增长和经济复苏。

The multilateral international economic cooperation order will be impacted. During the last Trump administration, the United States repeatedly withdrew from international agreements, broke contracts, and opposed multilateral trade rules, such as those of the WTO. The new Trump administration is expected to continue this approach. For example, during his campaign, Trump stated that he would abolish the Indo-Pacific Economic Framework launched by the Biden administration. However, the new Trump administration may push for bilateral economic cooperation negotiations between the United States and its allies or other countries to replace existing multilateral agreements and contain China’s development, leading to the challenge of “fragmentation” in international economic cooperation. For example, during the previous Trump administration, the United States led the signing of the United States–Mexico–Canada Agreement (USMCA), which replaced the original North American Free Trade Agreement (NAFTA). The new Trump administration may introduce new discriminatory and America First–oriented economic cooperation agreements that exclude non-trade partner countries. Possible provisions may include, but are not limited to, tariff exemption agreements targeting specific sectors in certain countries, strict rules of origin requirements, and local content requirements in subsidy programs, thereby restricting exports from non-trade partner countries.

多边国际经济合作秩序将受到冲击。在上一届特朗普政府执政期间,美国多次“退群毁约”,反对以WTO为代表的多边国际贸易规则。新一届特朗普政府将延续这一做法,例如,特朗普在选举期间曾声称要废除拜登政府推出的印太经济框架。但新一届特朗普政府有可能推动美国与盟友和其他国家开展双边经济合作谈判,用来取代原有的多边协议,遏制中国的发展,导致国际经济合作面临“碎片化”的挑战。例如,在上一届特朗普政府执政时期,美国主导签署《美国—墨西哥—加拿大协定》,取代原有的《北美自由贸易协定》。新一届特朗普政府可能会推出新的具有歧视性、美国优先的经济合作协定,将非贸易合作伙伴国家排除在外,可能的条款包括但不限于针对某些国家特定领域签订不征收关税协议、严格建立产品原产地制度、在补贴项目中提出本地成分要求等,对非贸易合作伙伴国家的出口进行限制。

The reshoring of global supply chains will intensify. Trump advocates for returning manufacturing to the United States and implementing large-scale tax cuts for enterprises, which will increase the willingness of companies to invest in the U.S. and promote “de-Sinicization” of supply chains. With the new Trump administration in office, measures to drive supply chain reshoring may prompt allies to adopt similar approaches, accelerating the reshoring of supply chains in various countries and leading to a greater frequency in the relocation of foreign-invested enterprises out of China. At the same time, influenced by Trump’s “America First” stance and sharp and drastic shifts in his administration’s policies, some multinational corporations may adjust their business strategies and become more inclined to keep key production processes in their own countries to ensure supply chain security and stability. As a result, the restructuring and reshoring of global supply chains will further intensify.

全球供应链回流现象将会加剧。特朗普主张鼓励制造业回归本土,并对企业实施大规模减税,会提升企业在美投资意愿,推动供应链的“去中国化”。在新一届特朗普政府上台后,推动供应链回流的措施可能会引起其他盟友的效仿,导致各国供应链加速回流,使得在华外资企业迁移更加频繁。同时,受特朗普的“美国优先”主张和“大开大合”政策剧烈转变的影响,一些跨国公司可能会转变经营方向,更倾向于将重要生产环节留在本土,保证供应链安全稳定,全球供应链的重构和回流本土趋势将进一步加剧。

A divergence will emerge between the development of new and traditional energy sources. The energy sector is one of the greatest points of divergence between the new Trump administration and the Biden administration. The new Trump administration has declared that it will repeal the Inflation Reduction Act supporting the clean energy industry, terminate the electric vehicle mandate, and strengthen the domestic supply of fossil fuels. These moves will result in a drastic shift in U.S. energy policy and profoundly affect the global energy landscape. In terms of traditional energy, U.S. production of crude oil, natural gas, and other resources is expected to rise significantly, impacting the market share of OPEC countries and potentially leading to a global oversupply of traditional energy and a decline in international prices. In terms of new energy, the United States may work with allies such as the EU to further strengthen restrictions on the export of Chinese electric vehicles and related products. As a result, the global new energy product market may face more trade barriers, and competition among countries for international influence in this field will become increasingly intense.

新能源和传统能源发展将出现分化。能源领域是新一届特朗普政府与拜登政府最大的分歧点之一。新一届特朗普政府宣称废除清洁能源行业的《通货膨胀削减法案》,终止电动车强制令,加强国内化石能源的供应,将导致美国能源政策的剧烈转向,深度影响全球能源格局。在传统能源方面,美国原油、天然气等产量将明显增加,影响OPEC国家的市场份额,可能会导致全球传统能源的供应过剩,国际传统能源价格将出现下降。在新能源方面,美国可能会联合欧盟国家等盟友,进一步加强对中国电动汽车等产品出口的限制,全球新能源产品市场可能会出现更多的贸易壁垒,各国围绕这一领域对国际话语权的争夺将更加激烈。

The evolution of a diversified international monetary system will speed up. The new Trump administration advocates a weak dollar policy and supports further interest rate cuts by the Federal Reserve. If these policies are implemented as planned, they will reduce returns and increase risks for global investors holding dollar-denominated assets. As a result, central banks in other countries and investors may consider reducing their holdings of U.S. dollars and turning to alternative reserve assets such as the renminbi, the euro, or their own national currencies. The global trend of “de-dollarization” will continue, and the status of currencies such as the renminbi and the euro will rise further as they play a greater role in cross-border trade, investment, and payment and settlement. This will contribute to quicker formation of a more diversified international monetary system. In addition, interest rate cuts by the Federal Reserve may prompt other countries to follow suit. To avoid the appreciation of their own currencies and the resulting impact on exports, other countries may begin a new wave of interest rate reductions, leading to global price increases.

多元化国际货币体系将加快演进。新一届特朗普政府主张实施弱美元政策,支持美联储进一步降息,如果如期实现,这将导致全球各国投资美元资产的收益减少、风险增加,其他国家央行和投资者会考虑减少持有美元,寻求人民币、欧元或本币等其他储备资产。全球“去美元化”趋势将得到延续,人民币、欧元等货币地位将继续提升,在跨境贸易、投资、支付清算等领域发挥更大作用,这有助于加快形成更加多元化的国际货币体系。另外,美联储降息行为可能会导致其他国家的效仿,为避免本币升值影响出口,其他国家或开启新一轮的降息潮,导致全球物价上涨。

Impact on China’s economy and trade

对我国经贸的影响

If all of the policy proposals of the new Trump administration are implemented as planned, China’s foreign trade may face some short-term shocks, but the overall impact is expected to be limited. At the same time, the export destinations of Chinese enterprises will shift, and outbound investment by Chinese companies will face greater challenges. However, China’s international influence in the field of new energy products will gradually increase, and the process of renminbi internationalization will present both challenges and opportunities.

如果新一届特朗普政府施政主张均能如期实现,我国外贸在短期内会受到一定冲击,但总体看影响有限。同时,我国本土企业出口外销流向将发生转变,企业出海投资将面临更多挑战,但在新能源产品领域的国际话语权将逐渐提升,人民币国际化发展中挑战与机遇并存。

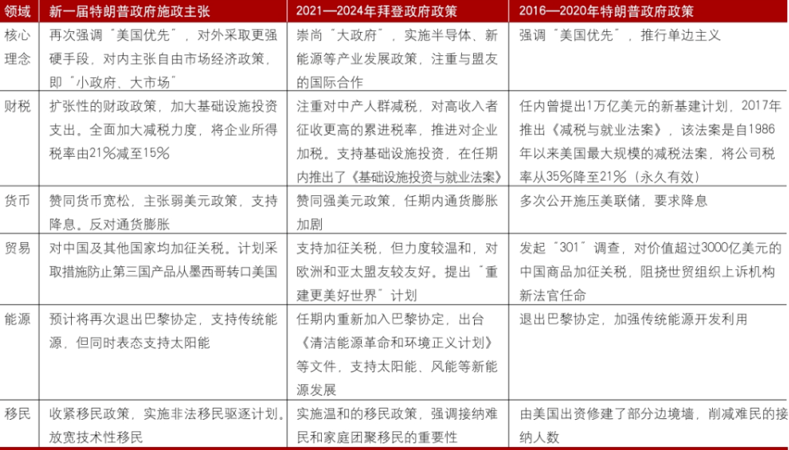

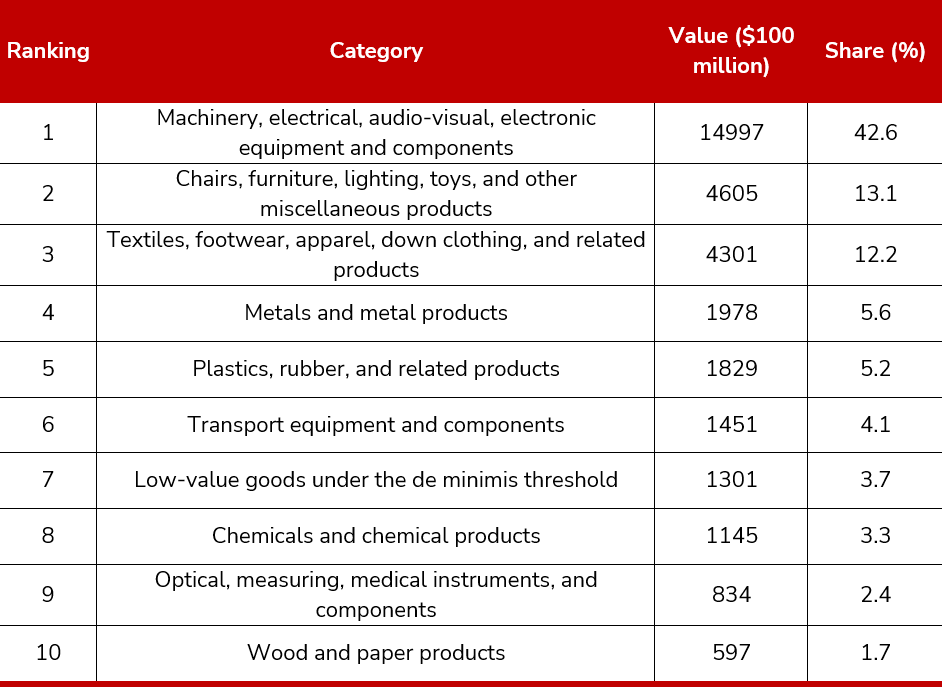

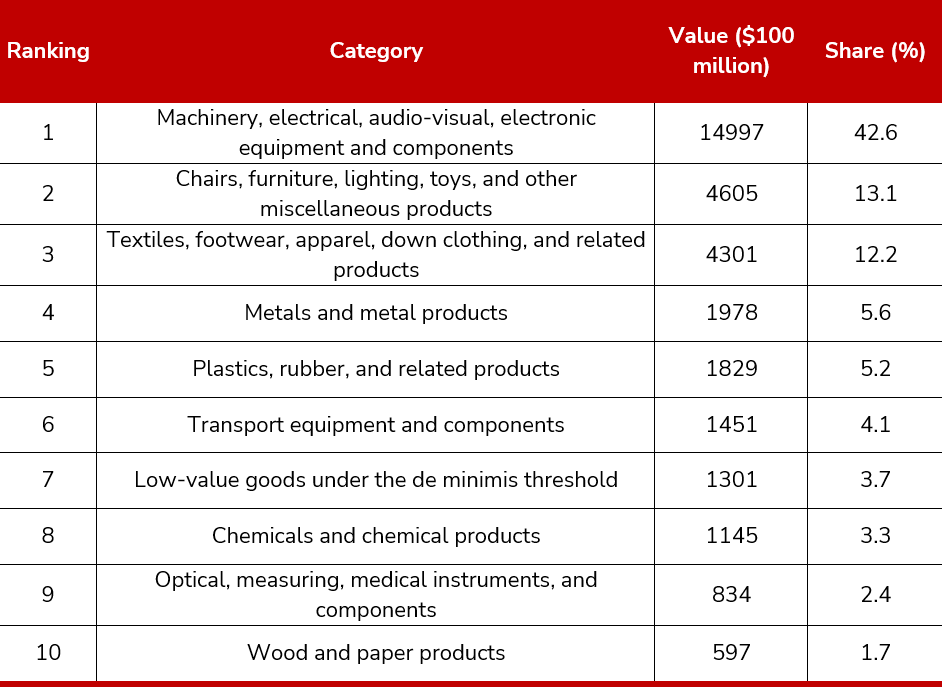

Foreign trade may face some short-term shocks, but the overall impact will likely be limited. The new Trump administration’s tariff increases may cause short-term shocks to China’s foreign trade, but the overall impact is expected to be less severe than in 2018, and the effect on economic development will be relatively limited. First, in recent years, China’s share of exports to the United States has declined, reducing the impact of U.S. tariff policies on China’s foreign trade. As shown in Table 2, in 2023, China–U.S. trade accounted for approximately 11.2% of the total value of China’s trade in goods, down 3 percentage points from 14.2% in 2017. Meanwhile, China’s exports to emerging economies such as Russia and Brazil have increased significantly. Second, the new Trump administration has repeatedly emphasized putting U.S. interests first, exerting pressure not only on China but also imposing tariffs on its own allies. This will inevitably harm the interests of those allies and has already led to concerns among them. This may create opportunities for China to improve trade relations with the EU, Japan, South Korea, and other countries, and to pursue new development opportunities in areas such as the export of the “new three” products [solar cells, lithium-ion batteries, and electric vehicles] and automobiles. Third, compared to the first Trump administration, China and other countries now have more mature countermeasures against U.S. trade bullying and will better utilize diverse tools across areas such as trade, law, and international cooperation to respond. In terms of impacted sectors, as shown in Table 3, China’s exports to the United States are currently concentrated in three major industries: machinery, electrical, audio-visual, and electronic equipment and components; miscellaneous products such as chairs, furniture, lighting, and toys; and products such as textiles, footwear, apparel, and down clothing. These three categories account for approximately 70% of China’s exports to the United States. Even after the large-scale tariff hikes under the first Trump administration in 2018, China’s foreign trade maintained solid growth in 2019, and the fundamentals of its economy’s strong development were not affected. After the outbreak of COVID-19, China was the first major economy to achieve positive economic growth, providing an important source of momentum for global economic and trade recovery. China is now actively building a new pattern of development that takes domestic great circulation as the mainstay, in which domestic and international dual circulation are mutually reinforcing. Domestic demand is playing an increasingly important role in economic development, and the level of opening-up continues to rise. China still maintains strong resilience in responding to external shocks.

外贸在短期内会受到一定冲击,但长期看影响有限。新一届特朗普政府加征关税,我国外贸在短期内会受到一定冲击,但受冲击的影响将小于2018年,对经济发展的影响较为有限。第一,近年来我国对美国出口占比已经有所减少,美国关税政策对我国外贸的影响将更小。如表2所示,2023年中美贸易额占我国货物贸易进出口总值比重约为11.2%,相较于2017年的14.2%下降了3个百分点,同时我国对俄罗斯、巴西等新兴经济体的出口占比明显增加。第二,新一届特朗普政府多次强调美国利益优先,不仅对中国施压,也对其盟友加征关税,必然会伤害其盟友国家的利益,已经引起其盟友国家的担忧,这将有助于我国改善与欧盟、日韩等国家的贸易关系,在“新三样”出口、汽车出口等方面谋求新发展机遇。第三,相较于上一届特朗普政府执政时期,当前我国和其他国家对美国贸易霸凌的应对措施更加成熟,将更加充分地利用贸易、法律、国际合作等领域的多样化手段进行反制。从受影响的行业来看,如表3所示,当前我国向美国出口的主要商品集中在机械/电气/音像/电子设备及零部件、坐具/家具/灯具/玩具等杂项制品、纺织品/鞋服/羽发等制品等行业,这三个行业出口占比约为七成。在2018年上一届特朗普政府大规模加征关税后,2019年我国外贸仍然保持了较好的增长,经济向好发展的基本面未受影响。在新冠疫情暴发后我国在主要经济体中率先实现经济正增长,为世界经贸复苏提供重要动力源。当前,我国正在积极建设以国内大循环为主体、国内国际两个循环相互促进的新发展格局,内需在经济发展中发挥着愈发重要的作用,同时对外开放水平进一步提升,在应对外部冲击时仍然具有较强的韧性。

Table 2: China’s Top 10 Trade Partners in Goods in 2023

表2 2023年中国货物贸易伙伴前十名

Table 3: Top 10 Categories of Chinese Exports to the United States in 2023

表3 2023年中国向美国出口的主要商品前十名

The export destinations of Chinese domestic enterprises will shift. On one hand, China’s export flows will increasingly shift toward countries and regions other than the United States. Chinese enterprises will actively explore markets in Europe, Southeast Asia, Japan, South Korea, Africa, and other countries, and they will accelerate the establishment of export sales channels in densely populated areas such as airports, ports, and commercial districts outside the United States. In addition, imposing tariffs will effectively increase the cost of living for ordinary Americans, which will prompt more U.S. consumers to purchase Chinese goods and services abroad. On the other hand, Chinese enterprises are accelerating the shift from export to domestic sales. As China’s unified management system for domestic and foreign trade gradually improves, enterprises continue to accelerate the pace of their integration of domestic and foreign trade operations4, enabling them to adapt more effectively to changes in the domestic and international landscape and their own operational needs, and to better leverage production factors such as capital, technology, labor, and data to switch between markets freely. In response to the new Trump administration’s tariff increases on Chinese exports, China’s foreign trade enterprises will place greater emphasis on domestic market expansion.

本土企业出口外销流向将发生转变。一方面,我国出口外销流向更加倾向于除美国之外的国家和地区。我国企业将积极开拓欧洲、东南亚、日韩、非洲等国家市场,加快在美国之外的主要城市机场、港口、商圈等人员密集场所布局外销渠道。此外,加征关税实际上增加了美国普通民众的生活负担,更多的美国人会选择到国外购买中国商品和服务。另一方面,我国企业加快出口转内销。随着我国内外贸一体化管理体制逐渐健全,企业开展内外贸一体化经营的步伐不断加快,企业能够根据国内外形势变化和自身实际需要,更加充分地利用资本、技术、人力、数据等生产要素,自由地转换市场经营。受新一届特朗普政府将对中国出口加征关税影响,我国外贸企业将更加注重开拓国内市场。

Outbound investment by Chinese companies will face greater challenges. Amid the wave of supply chain reshoring led by the United States and other Western countries, and due to concerns over the politicization of economic and trade issues, Chinese multinational companies may scale back investments in the U.S. market and those of its allies, relocate production lines in key supply chain sectors, or establish “backup” production lines domestically while investing overseas to ensure the stability and security of their supply chains. In the process of outbound investment, multinational companies will face issues such as more severe geopolitical pressures, unreasonable unilateral sanctions, and extraterritorial jurisdiction. This will place higher demand on enterprises’ capabilities in policy research and assessment, overseas market analysis, cross-border supply chain management, and compliance system development.

企业出海投资将面临更多挑战。在以美国为首的西方国家供应链回流浪潮下,出于对经贸问题政治化的担忧,我国跨国公司可能会适当减少在美国及其盟友国家市场投资,在关键供应链领域将生产线迁出,或者在出海投资的同时,将关键生产线在国内进行“备份”,保障企业供应链的稳定性和安全性。在出海投资过程中,跨国公司将面临更为严峻的地缘政治压力、不合理的单边制裁与长臂管辖等问题,对企业的政策研判能力、海外市场分析能力、跨国供应链管理能力和合规体系建设等提出了更高的要求。

China’s international influence in the new energy product sector will increase. Overall, the new Trump administration offers little support for the development of new energy products, and U.S. international influence in this field is expected to decline. In contrast, China has already become the world’s largest producer and consumer of new energy, and domestic enterprises will play an increasingly important role in leading global development in the new energy product sector. According to data from the National Energy Administration, China accounted for over half of the world’s newly installed renewable energy capacity in 2023, with its cumulative installed capacity approaching 40% of the global total. In addition, data from the China Association of Automobile Manufacturers shows that, China’s production and sales of new energy vehicles ranked first in the world for the ninth consecutive year in 2023. As the production and usage costs of new energy products continue to decline, China’s new energy products will be welcomed by more countries and regions. Taking new energy vehicles as an example, domestic enterprises can not only seize international influence in the trade of vehicle hardware, but also gradually establish a Chinese standards system in service areas such as intelligent cockpit technology, driver assistance systems, and in-car entertainment systems.

在新能源产品领域的国际话语权将得到提升。总体来看,新一届特朗普政府缺乏对发展新能源产品的支持,在这一领域的国际话语权将有所下降,而我国已成为全球最大的新能源生产者和消费者,本土企业将在引领全球新能源产品发展中发挥越来越重要的作用。根据国家能源局数据,2023年我国可再生能源发电新增装机超过全球的一半,累计装机规模占全球比重接近40%。另据中国汽车工业协会数据,2023年我国新能源汽车产销量连续9年居全球首位。随着新能源产品生产使用成本的降低,我国新能源产品将会受到越来越多的国家和地区欢迎,以新能源汽车为例,本土企业不仅可以在汽车硬件等货物贸易领域抢占国际话语权,还可以在智能座舱技术、辅助驾驶和车载娱乐系统等服务领域逐渐构建起中国标准体系。

The process of renminbi internationalization will present both challenges and opportunities. The new Trump administration’s strict restrictions on Chinese enterprises engaging in trade and investment activities have impacted market expectations and confidence, prompting some foreign-invested enterprises to relocate from China. This may produce shocks on the renminbi exchange rate and further lead to a continued deficit in the foreign exchange settlements and sales under direct investment conducted by banks on behalf of clients. However, the Trump administration’s assertion of dollar hegemony may push the United States to levy international seigniorage taxes on other countries, while shifting costs and risks onto them. This may encourage more countries to join the “circle of friends” of the renminbi and choose to use it as an official reserve currency. The extensive imposition of tariffs by the United States may also provoke resistance from other countries, accelerating the formation of de-dollarized regional blocs centered around smaller currencies. Furthermore, the new Trump administration’s explicit opposition to launching a central bank digital currency creates a historic window of opportunity for China to accelerate international cooperation on the digital renminbi. This will aid its efforts to bypass SWIFT and build a secure and controllable international payment and settlement system5.

人民币国际化发展中挑战与机遇并存。新一届特朗普政府严格限制中国企业开展贸易和投资活动,影响市场预期和信心,导致部分外资企业迁出中国,可能会对人民币汇率造成冲击,进一步导致银行代客直接投资项下结售汇持续为逆差。不过,新一届特朗普政府的美元霸权行为会推动美国对其他国家征收国际铸币税,同时把成本和风险转嫁给其他国家,这可能会导致越来越多的国家愿意加入人民币的“朋友圈”,选择使用人民币作为官方储备货币。美国对外普遍加征关税的政策也会导致其他国家的抵制,一些区域和国家会加快形成去美元化的小型货币集团。此外,新一届特朗普政府明确反对推出中央银行数字货币,为我国加快推进数字人民币国际合作提供了历史窗口期,有助于绕开SWIFT打造安全可控的国际支付清算体系。

Countermeasure recommendations

对策建议

To respond effectively to the impacts of the new Trump administration’s policy proposals, China should focus on six areas: actively promote multilateral and bilateral international economic and trade cooperation; accelerate reforms for the integration of domestic and foreign trade; further increase efforts to attract foreign investment; encourage new energy products to expand into overseas markets; accelerate the internationalization of the renminbi; and strengthen public opinion guidance to amplify confidence in China’s economic outlook. These measures will help China focus on managing its own affairs well and elevate economic and trade development to a new level.

为精准应对新一届特朗普政府施政主张的后续影响,我国需要在积极推动多双边国际经贸合作、加快推进内外贸一体化改革、进一步加大吸引外资力度、鼓励新能源产品走向海外市场、加快提升人民币国际化水平、加强唱响中国经济光明论的舆论引导等六个方面下功夫,集中精力办好自己的事,推动经贸发展迈上新台阶。

Actively promote multilateral and bilateral international economic and trade cooperation. First, jointly develop international trade dispute settlement mechanisms. Work together with other WTO member states to restore the functioning of the WTO Appellate Body, make full use of existing WTO dispute settlement mechanisms to address trade and economic issues, promote further improvement and development of these mechanisms, and call on all countries to jointly respond to the new Trump administration’s “weaponization” of trade. Make appropriate use of the Multi-Party Interim Appeal Arbitration Arrangement to properly manage economic and trade relations with the EU, Japan, and other countries. Second, accelerate the process of joining multilateral trade agreements. Speed up efforts to join CPTPP and DEPA, actively align with high-standard economic and trade rules and carry out pilot reforms in free trade pilot zones (such as Hainan Free Trade Port), and expand both the breadth and depth of international economic and trade exchanges. Third, steadily advance high-quality Belt and Road cooperation. In line with the historical trend of economic globalization, promote coordination in hard connectivity of infrastructure, soft connectivity of rules and standards, and people-to-people connectivity with partner countries, and work toward building a new order for international economic and trade cooperation. Fourth, strengthen economic and trade cooperation with emerging economies. In sectors heavily impacted by tariff increases—such as machinery, electrical, audio-visual, electronic equipment and components, and textiles—bolster bilateral cooperation with emerging economies such as Russia and Brazil, promote export market diversification, and inject new momentum into economic and trade development.

积极推动多双边国际经贸合作。一是合力发展国际贸易争端解决机制。与其他WTO成员国一道,共同推动WTO上诉机构重新发挥作用,利用好现有WTO争端解决机制处理经贸问题,推动其进一步完善发展,呼吁各国共同应对新一届特朗普政府的贸易“武器化”举措。合理利用《多方临时上诉仲裁安排》,处理好与欧盟、日本等国家的经贸合作关系。二是加快推进加入多边贸易协定。加快推进加入CPTPP和DEPA的进程,在自由贸易试验区(海南自由贸易港)主动对标高标准经贸规则进行先行先试,提升国际经贸往来的广度和深度。三是扎实推进高质量共建“一带一路”。顺应经济全球化历史大势,积极统筹推进基础设施“硬联通”、规则标准“软联通”以及与共建国家人民“心联通”,推动构建国际经贸合作新秩序。四是加强与新兴经济体的经贸合作。针对机械/电气/音像/电子设备及零部件、纺织品等受加征关税冲击较大的领域,加强与俄罗斯、巴西等新兴经济体的双边经贸合作,推动出口市场多元化,为经贸发展注入新动能。

Accelerate reforms for the integration of domestic and foreign trade. First, improve the integrated regulatory system for domestic and foreign trade. Further clarify the functions of regulatory authorities, accelerate the establishment of a unified, law-based, transparent, balanced, and coordinated regulatory framework for domestic and foreign trade, and promote information and data sharing among departments. Second, continue to promote the alignment of standards and certifications. Advance the coordination of technical standards, quality standards, inspection and quarantine, and certification and accreditation between domestic and international systems and gradually achieve mutual recognition of standards. Further support enterprises in producing products that meet the requirements of “same production line, same standards, and same quality,” and encourage broader recognition of the “three-same” certification results. Third, accelerate the development of new business models and formats for integrated domestic and foreign trade. Encourage the growth of new models such as cross-border ecommerce and market procurement trade, and support initiatives such as campaigns to promote the sale of export-grade products in the domestic market. Fourth, focus on cultivating enterprises that are engaged in integrated domestic and foreign trade. Support qualified enterprises in leveraging their strengths in niche sectors to actively expand into both domestic and international markets, enhance their capabilities in market research, channel development, supply chain management, and business compliance, and improve their international competitiveness. Improve public information services provided by the government and encourage the development of third-party professional service providers to offer support such as policy interpretation, country-specific analysis, legal assistance, and compliance consulting to enterprises engaging in integrated domestic and foreign trade.

加快推进内外贸一体化改革。一是完善内外贸一体化调控体制。进一步理顺管理部门职能,加快形成内外贸统一、法治、透明、均衡、协调的监管体制,推动部门间信息数据的共享。二是持续推动标准认证衔接。推动技术标准、质量标准、检验检疫、认证认可等方面的国内外衔接,逐步实现国内外标准互认。进一步支持企业生产“同线同标同质”产品,鼓励各方采信“三同”认证结果。三是加快发展内外贸一体化新业态新模式。鼓励跨境电商、市场采购贸易等新模式发展,鼓励举办外贸优品拓内销系列活动。四是重点培育内外贸一体化企业。支持有条件的企业利用细分领域优势,积极开拓海内外市场,增强市场调研、渠道布局、供应链管理、业务合规等能力,提高国际竞争力。完善政府公共信息服务,鼓励第三方专业服务机构发展,为内外贸一体化企业提供政策解读、国情分析、法律援助、合规咨询等服务。

Further increase efforts to attract foreign investment. First, ease market access restrictions. While ensuring national security, align with high-standard economic and trade rules, further reduce the negative list for foreign investment, and relax entry and operating restrictions in key industries. Second, continuously improve the business environment for foreign investors. Make full use of the foreign enterprise roundtable mechanism to facilitate communication between the government and foreign businesses, respond promptly to their concerns, and strengthen investor confidence in the Chinese market. Fully implement national treatment for foreign-invested enterprises, promote the cancellation of unreasonable restrictions, and ensure fair competition between domestic and foreign enterprises. Continue to improve visa policies to facilitate travel for personnel of foreign-invested enterprises. Third, step up efforts to attract investment in key sectors. Encourage capable local governments to increase investment promotion in areas such as high technology and critical supply chains to align with their industrial development plans, offer incentives such as subsidies and tax breaks, address gaps in industrial development, and promote diversification of production and supply chains.

进一步提高吸引外资力度。一是放宽市场准入限制。在保证国家安全的前提下,对标高标准经贸规则,进一步缩减外资准入负面清单,放宽重点行业的准入准营限制。二是不断完善外资营商环境。积极发挥外资企业圆桌会议制度作用,畅通政府和外资企业沟通渠道,及时回应外资关切问题,强化外商投资中国的信心。深入落实外资企业国民待遇,推动取消不合理的限制规定,实现内资和外资企业的公平竞争。持续优化签证政策,为外资企业人员出行提供便利。三是加大对关键领域的引资力度。鼓励有条件的地方结合自身产业发展规划,围绕高科技、关键供应链等领域加大招商引资力度,给予补贴、税收优惠等政策,补齐产业发展短板,推动产业链供应链的多元化发展。

Encourage new energy products to expand into overseas markets. First, promote the diversification of overseas expansion by new energy enterprises. Encourage leading new energy enterprises to leverage their technological and cost advantages to help upstream and downstream enterprises in the production chain expand market shares in Europe, Southeast Asia, Japan and South Korea, Africa, and other regions. Support the establishment of overseas R&D centers, delivery centers, and service centers, and the deployment of a global after-sales service system. Second, encourage Chinese standards to “go global” in the new energy product sector. Encourage enterprises to lead or participate in the formulation of international standards related to new energy products—for example, by offering Chinese solutions in areas such as intelligent cockpit technology and driver assistance systems in new energy vehicles—to accelerate the enhancement of China’s international influence. Third, improve the supporting service system. Encourage development banks, policy banks, and other financial institutions to increase credit support for new energy enterprises. Support insurance providers such as SINOSURE in developing trade credit insurance for the new energy sector to reduce transaction risks. Promote the formation of strategic alliances among shipping enterprises and new energy enterprises to integrate warehousing and logistics resources and ensure smooth international logistics channels.

鼓励新能源产品走向海外市场。一是推动新能源企业出海多元化。鼓励龙头新能源企业利用技术和成本优势,带动产业链上下游企业开拓欧洲、东南亚、日韩、非洲等国家市场份额,在海外建设研发中心、交付和服务中心等,在全球布局售后服务体系。二是推动新能源产品领域中国标准“走出去”。鼓励企业引导或参与制定新能源产品领域的相关国际标准,例如,在新能源汽车的智能座舱技术、辅助驾驶等方面提供中国方案,加快提升国际话语权。三是完善支撑服务体系。鼓励开发性银行、政策性银行等加强对新能源企业的信贷支持力度,支持中信保等保险公司发展新能源领域的贸易信用保险,降低企业交易风险。鼓励航运企业、新能源企业等组建战略联盟,整合仓储物流资源,畅通国际物流通道。

Accelerate the internationalization of the renminbi. First, increase the use of the renminbi in foreign trade and investment. Promote the use of the renminbi for pricing and settlement in economic and trade exchanges with Belt and Road countries and regions, as well as RCEP member states. Support enterprises in using the renminbi for cross-border transactions in outbound investment, overseas contracts, and other activities. Second, accelerate the development of an independent and controllable cross-border payment system. Continue advancing the multilateral central bank digital currency bridge (m-CBDC Bridge) project and promote the cross-border use of the digital renminbi. Encourage foreign financial institutions to participate in the Cross-Border Interbank Payment System (CIPS) for renminbi transactions. Promote the co-construction of payment systems among BRICS countries and the joint maintenance of cross-border payment security. Third, strengthen bilateral local currency swaps and settlement cooperation. Explore local currency settlement arrangements with other countries, promote direct trade between the renminbi and other national currencies, and support the development of renminbi foreign exchange markets in foreign countries and regions to help elevate the international status of the renminbi.

加快提升人民币国际化水平。一是加强人民币在对外贸易投资中的使用。在推进与“一带一路”沿线国家和地区、RCEP国家等经贸往来中,加强人民币的计价结算使用。支持企业在对外投资、对外承包工程等活动中跨境使用人民币。二是加快建设自主可控的跨境支付体系。持续推进多边央行数字货币桥项目,加快推动数字人民币的跨境使用。鼓励外资金融机构参与人民币跨境支付系统。推动共建金砖国家间支付系统,共同维护跨境支付安全。三是加强双边本币互换和本币结算合作。探索开展与其他国家的本币结算合作,推动人民币与其他国家货币的直接贸易,支持境外国家和地区在当地发展人民币外汇市场,助力提升人民币的国际地位。

Amplify confidence in China’s economic outlook. First, enhance influence in international economic discourse. In response to the new Trump administration’s repeated dissemination of narratives such as the “China economic threat theory,” it is necessary to accelerate the development of international communication platforms that can rival mainstream U.S. financial media. Leverage the agenda-setting and discourse-guiding functions of elite national think tanks to strengthen the ability in shaping international economic narratives. Use internationally recognized expressions to refute U.S. economic hegemony, tell the story of China’s economic development well, and boost foreign investors’ expectations for China’s economic prospects. Second, foster a favorable domestic public opinion environment through multiple channels. Make full use of official government platforms, elite national think tanks, research institutions, media outlets, and other channels to strengthen publicity around China’s bright economic outlook, create a favorable public opinion climate, and strengthen the confidence of entrepreneurs and consumers.

唱响中国经济光明论。一是提高国际经济舆论影响力。为应对新一届特朗普政府多次散播“中国经济威胁论”等负面国际舆论,要加快打造与美国主流财经媒体相抗衡的经济外宣国际传播平台,发挥国家高端智库的议题设置、舆论引导等作用,提升国际经济舆论的引导能力,利用国际通行话语表达范式驳斥美国经济霸权,讲好中国经济发展故事,提振外商投资者对我国经济发展的预期。二是多渠道打造良好的国内舆论环境。充分利用政府官方发布平台、国家高端智库、研究机构、媒体等渠道,加强宣传中国经济光明论,营造良好的舆论氛围,增强企业家和消费者的信心。