I. Introduction

一、引言

Since Western countries led by the United States imposed financial sanctions on Russia on account of the Ukraine crisis in 2022, the issue of the weaponization of global public goods has frequently appeared in academic studies and media reports. In fact, long before the current crisis in Ukraine, the world had seen numerous U.S.-led financial sanctions, with Iraq, North Korea, Iran, and Russia among those subjected to such measures. Existing scholarship, however, has seldom discussed these sanctions in terms of the weaponization of global public goods: since those sanctions were relatively small in scale and the sanctioned countries had relatively limited influence, the sanctions did not pose a direct threat to global public goods and so researchers did not treat them as weaponization.

自从2022年以美国为主导的西方国家以乌克兰危机为由对俄罗斯实施金融制裁以来,“全球公共品武器化”的问题便开始经常出现在学术研究报告和媒体报道中。其实,早在此轮乌克兰危机发生之前,全球范围内已经频繁出现由美国主导的金融制裁。美国曾经先后对伊拉克、朝鲜、伊朗和俄罗斯采取此类行动。然而既有研究很少提及全球公共品武器化的问题。这是因为此前的金融制裁规模相对较小,而且被制裁的国家影响力也相对较低,那些制裁并未构成对全球公共品的直接威胁,因而研究者对相关问题的研究并未提升到全球公共品武器化的高度。

Since the current Ukraine crisis broke out, however, the situation has changed significantly. Western countries have not only taken advantage of global public goods to impose financial sanctions on an unprecedented scale on Russia, the world’s second-largest military power, but also threatened secondary financial sanctions against China, the world’s second-largest economy, pushing the weaponization of global public goods to new extremes—hence the widespread scholarly attention in China and abroad.1

但是此轮乌克兰危机发生后,情况出现了显著的变化。西方国家不仅利用全球公共品对全球第二军事大国俄罗斯采取了空前规模的金融制裁,而且威胁要对全球第二大经济体中国采取次级金融制裁,把全球公共品武器化的做法推向了极致。正是在这一背景下,该问题引起了国内外学术界的广泛关注。

In the current geopolitical context of the Russia-Ukraine conflict, the weaponization of global public goods means Western countries’ deployment of global financial public goods to impose financial sanctions on Russia. These sanctions include freezing or confiscating financial assets of Russian individuals and companies in Western countries, freezing the foreign exchange reserves and gold reserves of the Russian Central Bank, and restricting some Russian banks from using the Society for Worldwide Interbank Financial Telecommunication (SWIFT) messaging system.2 The financial sanctions rely on such structures and tools as the international financial market, international capital market, and international monetary and settlement system. They have two things in common: first, they are all global financial public goods, and second, they are designed and operated mainly by Western countries. We can thus conclude that Western financial sanctions against Russia are essentially the weaponization of global financial public goods.3 As it is a “new” strategy, however, academia and the media have yet to agree on a single term for it; common names for this strategy also include the “weaponization of the dollar” and the “weaponization of finance.”4

在当前俄乌冲突的地缘政治背景下,全球公共品武器化的含义是指西方国家动用全球金融公共品对俄罗斯实施金融制裁,这些制裁包括冻结或没收俄罗斯个人和企业投资于西方国家的金融资产,冻结俄罗斯中央银行的外汇储备和黄金储备、限制俄罗斯部分银行使用环球同业银行金融电讯协会(SWIFT)信息报送系统等。金融制裁所依托的设施和工具包括国际金融市场、国际资本市场、国际货币和国际结算体系。它们有两个共同点:其一,都属于全球金融公共品;其二,它们从制度设计到运作,主要由西方国家所掌控。由此我们可以认为,西方对俄金融制裁的本质是全球金融公共品的武器化。同时,作为一种“新”的战略行为,学术界和媒体对它的指称尚未统一,常见的还包括“美元武器化”或“金融武器化”等提法。

Western countries’ ability to weaponize global public goods to impose financial sanctions on other countries is closely related to globalization. During the Cold War, Western countries and the socialist camp—their geopolitical rival—belonged to two separate economic systems. As non-Western countries had not yet become highly dependent on public goods provided by Western countries, the conditions did not exist for Western countries to weaponize global public goods. Instead, they would impose financial sanctions on hostile countries by prohibiting such adversaries from using their financial resources.

西方国家把全球公共品作为武器对他国实施金融制裁的行为导致了全球公共品的武器化。这一趋势同全球化之间存在着密切的联系。冷战时期,西方国家与作为其地缘政治对手的社会主义阵营处在两个相互隔离的经济体系中。由于当时非西方国家还未形成对西方国家公共品的高度依赖,因此后者不具备实施全球公共品武器化的条件。它们对敌对国家实施金融制裁的手段是禁止对方利用其金融资源。

The advent of the era of globalization, however, has completely changed the situation described above. One consequential development in the world economy following globalization is that, while integrating into the Western-dominated financial system, countries around the world have become highly dependent on financial public goods provided by Western countries. This has created a favorable condition for Western countries to use global financial public goods to implement sanctions, and the U.S. government has indeed frequently done so since the start of the twenty-first century.

但是全球化时代的到来彻底改变了以上状况。全球化给世界经济带来的重要变化之一是世界各国在融入西方国家主导的金融体系的同时,对其提供的金融公共品形成了高度的依赖。这为西方国家利用全球金融公共品实施制裁提供了有利条件。进入21世纪后,美国政府开始频繁把全球金融公共品作为其实施制裁的武器。

II. Discussion of the Weaponization of Global Financial Public Goods

二、关于全球金融公共品武器化的讨论

The recent financial sanctions imposed by Western countries on Russia have triggered extensive discussion of the weaponization of global financial public goods in the international community. What follows is a review of three particular threads in the discussion.

自从西方国家对俄实施金融制裁以来,国际社会就全球金融公共品武器化问题展开了广泛的讨论。本文拟从以下三个方面对相关文献进行梳理:

First, a considerable number of studies argue that the weaponization of global financial public goods rests on deep globalization and that it is a new policy tool adopted by Western countries. As an analysis in the Financial Times points out, “this is a very new kind of war—the weaponization of the US dollar and other western currencies to punish their adversaries.” The article also emphasizes the relationship between globalization and the weaponization of the dollar: “Globalisation was once sold as a barrier to conflict, a web of dependencies that would bring former foes ever closer together. Instead, it has become a new battleground.”5

第一,相当数量的研究认为全球金融公共品武器化以全球化的深度发展为主要条件,是西方国家采取的一种新的政策工具。正如英国《金融时报》的一篇分析文章所指出的,美元的武器化“是一种非常新颖的战争———把美元及其他西方货币用作武器,惩罚对手”。文章还强调了美元武器化与全球化的关系。作者认为,“全球化一度被宣传为防止冲突的屏障,是一张能够将昔日对手紧密团结起来的相互依存的网络。然而,它已然成了新的战场”。

China’s foreign affairs experts and academics also pay close attention to the connection between globalization and the weaponization of global financial public goods. Le Yucheng, former vice minister at the Ministry of Foreign Affairs, points out that the West’s financial sanctions against Russia amount to a weaponization of globalization,6 a view that underscores the relationship between financial sanctions and globalization. Shi Donghui argues that “in a world where the global economy and finance are highly integrated, the dollar will inevitably become a weapon, and the U.S. government can exploit the global dominance of the dollar to expand the extraterritorial reach of U.S. law and policy.”7 Wu Xinbo sees the “weaponization of interdependence” and the “instrumentalization of international public goods” as new trends in the development of international relations.8

我国外交部门和学界研究者也极为关注全球化与全球金融公共品武器化之间的联系。外交部原副部长乐玉成指出,西方对俄实施金融制裁是把全球化武器化的行为,这一观点强调了金融制裁与全球化的关系。施东辉认为“在一个全球经济金融一体化程度很高的世界里,美元不可避免地会成为一种武器,美国政府可以利用美元的全球主导地位,扩大美国法律和政策的域外影响。”吴心伯则将“相互依存的武器化”和“国际公共物品的工具化”总结为国际关系发展的新趋势。

It is thus safe to say that deep globalization has enabled the weaponization of global financial public goods, that such weaponization is a new phenomenon, and that it is becoming a main political tool of the West in great power competition.

由此我们可以认为,全球金融公共品武器化的出现以全球化的深度发展为前提条件;全球金融公共品武器化是一种新现象;全球金融公共品武器化正在成为西方进行大国竞争的主要政治工具。

Second, some scholars believe that the weaponization of global financial public goods will have a negative impact on the future of the international monetary system. What Western countries have done will end up weakening the U.S. dollar system and enhancing the international status of the renminbi.

第二,一些学者认为全球金融公共品武器化将会对国际货币体系的前景产生负面影响,西方国家的这一做法会削弱美元体系和提升人民币的国际地位。

As Martin Wolf points out, currency is a public good for a country, and international currencies are a global public goods. By using the international monetary system to impose financial sanctions on Russia, Western countries have essentially weaponized international public goods, which will damage trust in dollar and euro assets and may cause some countries to break away from the Western-dominated international monetary system. The resulting fragmentation of the system may ultimately harm Western countries’ own interests.9 Gita Gopinath, first deputy managing director of the International Monetary Fund (IMF), also said that the United States’ weaponization of the dollar against geopolitical opponents threatens to fragment the international monetary system.10

马丁·沃尔夫指出,货币是一个国家的公共品,而国际货币是属于全球公共品。西方国家利用国际货币体系对俄罗斯实施金融制裁,其本质是将国际公共品武器化。这一做法会对美元和欧元资产的信用造成伤害,而且有可能引发一部分国家脱离由西方主导的国际货币体系,从而造成国际货币体系的分裂,最终有可能伤害西方国家自身的利益。国际货币基金组织第一副总裁吉塔·戈皮纳特也指出,美国把美元作为武器打击地缘政治对手的做法有可能导致国际货币体系出现碎片化的发展趋势。

Whether the Western financial sanctions against Russia will weaken the status of the U.S. dollar, however, is still open to debate among scholars. Martin Wolf and Gita Gopinath believe that this approach by the West will weaken the dollar. Barry Eichengreen, too, argues that the West’s financial sanctions against other countries would force those countries to adopt “de-dollarization” as a countermeasure, which would weaken the international status of the U.S. dollar.11 Michael P. Dooley and Megan Greene, meanwhile, have argued to the contrary.12 According to Dooley, as developing countries benefit economically from the dollar system, they are unlikely to exit the dollar bloc. Greene emphasizes that there is currently no international currency capable of replacing the U.S. dollar, whose supremacy will thus remain unchallenged.

但是在西方对俄金融制裁是否会削弱美元地位的问题上,学术界仍存在争议。如上所述,马丁·沃尔夫和吉塔·戈皮纳特认为西方国家的这一做法会削弱美元的地位。巴里·艾肯格林也持相同的观点。他认为西方对其他国家采取金融制裁会迫使这些国家采取“去美元化”的对策,从而会降低美元的国际地位。但是,麦克·杜利等和梅根·格林则认为西方对俄金融制裁不会削弱美元的地位。杜利指出,利用美元体系有助于发展中国家的经济发展,因此这些国家不会脱离美元体系。格林则强调目前不存在能够代替美元的国际货币,因此美元的地位不会受到挑战。

These scholars have also discussed the impact of Western financial sanctions against Russia on the internationalization of the renminbi. Gopinath and Eichengreen believe that although the sanctions will help boost the international status of the renminbi, it cannot replace the dollar in the short term. Wolf considers it possible that in the long run, with the rise of China, the world may split into two monetary systems—a dollar one and a renminbi one. Dooley and Greene, on the other hand, do not think that the sanctions will have a significant impact on the internationalization of the renminbi. For Dooley, the dollar still holds a competitive edge over the renminbi, and in Greene’s view, despite the U.S. financial sanctions against Russia, the dollar is still safer than the renminbi as an international currency.

这些学者的讨论还涉及西方对俄金融制裁对人民币国际化的影响。戈皮纳特和艾肯格林认为西方对俄罗斯的金融制裁有助于提升人民币的国际地位,但是短期内人民币还无法替代美元。沃尔夫则认为从长期来看,随着中国的崛起,全球有可能分裂成两个货币体系,一个是美元货币体系,另一个是人民币货币体系。然而,杜利和格林则认为西方对俄金融制裁不会对人民币国际化产生显著的影响。杜利认为美元相对于人民币仍具有竞争优势,而格林认为尽管美国对俄启动了金融制裁,但是作为国际货币,美元的安全性仍高于人民币。

Third, some scholars have pointed out that the weaponization of global financial public goods may lead to a contraction in their supply and demand, thus adversely affecting the world economy. They compare the situation to the “Kindleberger Trap” and highlight the harm caused by the weaponization of global financial public goods.13

第三,有学者指出,全球金融公共品武器化有可能引发全球金融公共品供给和需求的萎缩,从而对世界经济产生不利影响。他们将其类比早年的“金德尔伯格陷阱”,强调了全球金融公共品武器化的危害。

Drawing an analogy with similar historical situations, Lu Gang notes: “Whether it is a declining hegemonic superpower or not, the United States has become increasingly inclined to weaponize international public goods—for example, the U.S. dollar, which has become key to international finance and trade—against hostile states and sub-state actors in financial warfare. This is worse than interwar Britain’s inability—instead of unwillingness—to provide and maintain international public goods in Kindleberger’s account.”14 Here, Lu Gang implies that the weaponization of global financial public goods is more harmful than their absence. In fact, the two situations are effectively the same and have some common elements. The weaponization of global financial public goods will deter or restrict some countries from using them, which will eventually lead to a scarcity of those goods.

通过类比历史教训,卢纲指出:“不管其霸权超级力量是否在走向衰落,美国已越来越倾向于利用国际公共产品并将其化为武器———比如美元成为国际金融和贸易体系的关键———来对付金融战中的敌对国家和次国家行为体。这比金德尔伯格阐述的两次世界大战之间英国无力而不是不愿提供并维持国际公共产品的情况更为糟糕。”这里卢纲认为全球金融公共品的武器化比它的缺失更具有危害性。其实,这两种情况殊途同归,有一定的共同之处。全球金融公共品武器化会导致一些国家不敢或无法使用全球金融公共品,最终会导致全球金融公共品陷入缺失的状况。

III. The Formation Mechanism of the Weaponization of Global Financial Public Goods

三、全球金融公共品武器化的形成机制

A prerequisite for the weaponization of global financial public goods is that sovereign states have assumed the responsibility of supplying them. Only then is it possible for a sovereign state to use its prerogative as the provider of global financial public goods to impose financial sanctions on other countries. That Western countries have such a prerogative is one of the objective conditions that allow them to weaponize global public goods.

全球金融公共品武器化的形成条件之一,是由主权国家承担全球公共品的供给。只有在这种情况下,主权国家才有可能利用其提供全球金融公共品的特权对其他国家实施金融制裁。西方国家具备了提供全球公共品的特权,这是其实施全球公共品武器化的客观条件之一。

In a sovereign state, the government is usually the provider and operator of public goods, but there is no global administrative body equivalent to a government in the international community, so the supply of global public goods is left in the hands of certain sovereign states. On the issue of who should provide global public goods, one influential view is Kindleberger’s hegemonic stability theory, according to which global public goods are usually provided by the hegemonic state, and the stability of the world economy hinges on whether or not the hegemon can provide sufficient global public goods.15 As the “Kindleberger Trap” points out, during the transition of hegemony, the established power is no longer able to meet the demand for global public goods, while the rising power does not yet have the ability and willingness to provide them. The resulting lack of global public goods gives rise to economic depression and war.

对主权国家而言,政府通常是公共品的提供者和运作方,但国际社会不存在相当于一国政府的全球管理部门,因此只能由一部分主权国家承担起全球公共品的供给。在到底应该由谁提供全球公共品的问题上,一个有影响力的理论是金德尔伯格的霸权稳定论。他认为,全球公共品通常由霸权国家提供,霸权国家是否能够提供足够的全球公共品关乎世界经济的稳定。正如“金德尔伯格陷阱”所强调的那样,在霸权转移过程中,守成国已无法满足全球公共品需求,而崛起国还不具备提供全球公共品的能力和意愿。由此导致的全球公共物品缺失引发了经济萧条与战争。”

Although the hegemonic stability theory emphasizes the necessity of the hegemonic state to provide global public goods, it does not pay enough attention to the problems that may arise from such a system. After the end of World War II, the United States assumed the responsibility of providing global public goods, and the U.S. dollar thus became the world’s dominant international currency. When the national interests of the United States conflict with global public interests, however, the U.S. government will naturally put its own country’s interests first, which inevitably harms global public interests.

尽管“霸权稳定论”强调了霸权国家提供全球公共品的必要性,却并未充分关注由霸权国家提供全球公共品的制度可能引发的问题。第二次世界大战结束后,美国承担了提供全球公共品的主要任务,美元也由此成为全球主导性国际货币。然而当美国的国家利益与全球公共利益出现冲突时,美国政府自然会采取本国优先的政策。这一做法必然会伤害全球公共利益。

After the outbreak of the subprime mortgage crisis in 2007, the Federal Reserve adopted the policy of quantitative easing to stimulate domestic demand and encourage the depreciation of the dollar. A weaker dollar meant that the foreign exchange reserves denominated in dollars held by countries around the world were at risk of shrinking in value. This case exposes the inherent contradiction in the provision of global public goods by a sovereign state: as Hua Min puts it, “As the dollar is an international public good, the United States must maintain the stability of its value; however, as it is also a sovereign currency, the United States can change its value according to U.S. interests.”16

2007年次贷危机爆发之后,为了刺激内需和引导美元贬值,美联储采取了量化宽松政策。这导致了美元贬值,使世界各国持有的美元外汇储备面临缩水的风险。这一现象反映了由主权国家提供全球公共品的内在矛盾。正如华民所指出的那样:“作为国际公共品,美国必须保持美元价值的稳定;但是,作为一个主权货币,美国可以根据自己的利益来改变美元的价值。”

In view of the serious consequences caused by the subprime mortgage crisis, the UN commission of experts on reforms of the international financial system and Zhou Xiaochuan, the then governor of the People’s Bank of China, both proposed a super-sovereign reserve currency to replace the U.S. dollar,17 a proposal that immediately drew widespread attention in the international community, with many heads of government and well-known scholars joining in the discussion. It was against this background that the then French president Nicolas Sarkozy called for the inclusion of the renminbi in the Special Drawing Rights (SDR) currency basket, so as to reform and diversify the international monetary system.18 Discussions on the reform of the international monetary system during this period facilitated the IMF’s inclusion of the renminbi in the SDR basket. On December 1, 2015, the IMF officially announced that the renminbi would be added to the SDR currency basket on October 1, 2016, which marked the renminbi’s status as one of the most important international currencies, after the U.S. dollar, the euro, the British pound sterling, and the Japanese yen. In the long run, the rise of the renminbi as an international currency will have a profound and far-reaching impact on the diversification of the international monetary system.19

鉴于次贷危机所造成的严重后果,联合国下属的国际金融体系改革专家小组和时任中国人民银行行长的周小川先后提出了以超主权储备货币取代美元的改革建议。该建议一经提出就在国际社会引起了广泛的关注,许多国家的政府首脑和知名学者纷纷参与了有关这一问题的讨论。正是在这一大环境的影响下,为了推动国际货币体系多元化的改革,时任法国总统的萨科齐提出了支持将人民币纳入特别提款权货币篮子的改革建议。这一时期,有关国际货币体系改革的讨论对于国际货币基金组织将人民币纳入特别提款权货币篮子起到了推动作用。2015年12月1日,国际货币基金组织正式宣布人民币将于2016年10月1日加入特别提款权货币篮子。至此人民币成为美元、欧元、英镑和日元以外的第五大国际货币。从长期来看,人民币作为国际货币的崛起将会对国际货币体系多元化进程产生深远的影响。

Although the U.S. subprime mortgage crisis has triggered discussions about the SDR as a supersovereign global financial public good, and although the international community has improved the structure of global financial public goods through institutional reforms, the main problems with those goods remain fundamentally unresolved. As a result, when the United States used its prerogative as the provider of global financial public goods to impose financial sanctions on Russia following the outbreak of the Ukrainian crisis in 2022, the international community once again questioned the rationality of the current global public goods system. Some academic and policy researchers argue that, in weaponizing global financial public goods, the United States has put its own interests above global public interests, which demonstrates the conflict between the interests of a sovereign state and global public interests. Compared with previous cases of such a conflict, furthermore, this instance shows some new characteristics.

尽管美国次贷危机引发了对超主权全球金融公共品特别提款权货币篮子的讨论,国际社会也通过制度改革优化了全球金融公共品的结构,但未能从根本上解决全球金融公共品面临的主要问题。正因为如此,2022年乌克兰危机发生后,美国利用其提供全球金融公共品的特权对俄罗斯实施金融制裁的做法再次引起了国际社会对现行全球公共品体系合理性的质疑。一些学术与政策研究者认为,美国将全球金融公共品武器化的做法,是其将本国利益凌驾于全球公共利益之上的表现,反映了主权国家利益与全球公共利益之间的冲突。而且与以往的冲突相比,此次冲突还有一些新的特点:

First, it manifests in a different form. In the past, harm to global public goods was caused by the United States’ prioritization of its own interests when they were at odds with global public interests. This time, it is caused by the weaponization of global public goods to impose sanctions on other countries, which represents a new form of abuse of global public goods pioneered by the United States. In other words, the weaponization of global financial public goods is a new form in which the conflict between the interests of a sovereign state and global public interests manifests.

第一,形式有所不同。以往美国对全球公共品的伤害表现为在本国利益与全球公共利益发生冲突的情况下,采取以本国利益为优先的政策,这一次则表现为全球公共品的武器化,即把全球金融公共品作为制裁他国的武器。这是美国为滥用全球公共品开创的一种新的形式。换句话说,全球金融公共品武器化是主权国家利益与全球公共利益发生冲突的新的表现形态。

Second, the motivations behind the conflict are different. In the past, what the United States pursued were its own economic interests, and the conflict would usually arise in two ways. First, the United States would use its prerogative as the provider of an international currency to create dollars without restraint, which would result in the dollar’s depreciation and the fall in value of global foreign exchange reserves. Second, when the U.S. economic cycle was out of sync with the global economic cycle, the U.S. government would adopt economic policies that would benefit the United States but would harm the world economy. Unlike the purely economically driven motives before, however, this time the United States also uses global financial public goods as a tool to pursue geopolitical interests, imposing financial sanctions on other countries to advance its own political interests.

第二,动机有所不同。以往美国追求的是本国的经济利益。具体表现有二,一是利用提供国际货币的特权,无节制地发行美元,造成美元贬值和全球外汇储备的缩水;二是在美国经济周期与全球经济周期不同步的情况下,美国政府会采取对本国有利,对世界经济不利的经济政策。但与以往单纯追求本国经济利益的动机不同,这一次美国还把全球金融公共品作为其追求地缘政治利益的工具,对他国实施金融制裁,谋取本国的政治利益。

Third, the actors are different. The United States acted alone in previous instances of the conflict between national interests and global public interests, from which other Western countries suffered as well. In contrast, the weaponization of global financial public goods is a collective action, jointly implemented by the United States and other Western countries. The United States leads, and other Western countries follow. The conflict is now one between the interests of a group of sovereign states and the global public interests.

第三,主体有所不同。以往主权国家利益与全球公共利益之间的冲突是由美国单独引发的事件。在那些事件中,其他西方国家也是受害者。而将全球金融公共品武器化是美国与其他西方国家共同实施的集体性事件。在这一事件中,美国是主导者,而其他西方国家是追随者,反映的是一部分主权国家利益与全球公共利益之间的冲突。

Another prerequisite for the weaponization of global financial public goods is the high degree of global financial integration driven by financial globalization. Only when the sanctioned country is highly integrated into the global financial system can financial sanctions have a deterrent effect. In other words, only when the sanctioned country is highly dependent on global financial public goods can such goods become an effective weapon for sanctions.

全球金融公共品武器化的第二个形成条件是由金融全球化推动的全球金融高度融合。只有在被制裁国家高度融入全球金融体系的情况下,金融制裁行动才有可能发挥威慑作用。换句话说,只有在被制裁国家高度依赖全球金融公共品的情况下,它才有可能成为有效的制裁武器。

In discussing the weaponization of global financial public goods, it is worth asking why it was only after the beginning of the twenty-first century that Western countries started to frequently use global public goods for financial sanctions. The United States already had the prerogative to provide global public goods after World War II, and its ability to provide global financial public goods peaked in the early postwar decades, but the United States did not regularly weaponize global financial public goods against hostile countries during that period. In the twenty-first century, however, Western countries—led by the United States—began to frequently use their prerogative as the providers of global financial public goods to impose financial sanctions on other countries. From the Iraq War and the Iranian nuclear dispute to the Crimean crisis and the conflict between Russia and Ukraine, financial sanctions have become Western countries’ main weapon for undermining their rivals.

在全球金融公共品武器化的问题上,一个值得思考的现象是:为什么在进入21世纪后,西方国家开始频繁动用全球公共品实施金融制裁?第二次世界大战结束后,美国就拥有提供全球公共品的特权,而且在战后的最初几十年里,美国提供全球金融公共品的能力处于鼎盛时期。但当时美国并没有把全球金融公共品作为打击敌对国家的“常规武器”。然而,进入21世纪后,以美国为首的西方国家开始频繁利用提供全球金融公共品的特权对其他国家实施金融制裁。从伊拉克战争到伊朗核争端,从克里米亚危机到俄乌冲突,金融制裁已经变成了西方国家打压对手的主要武器。

Why did the weaponization of global financial public goods become popular in the twenty-first century and not earlier? To answer this question, it is useful to think about the relationship between the weaponization of global financial public goods and financial globalization. In the 1960s and 1970s, when financial globalization had not yet materialized, the financial markets of Western countries and non-Western countries were separate from each other, and non-Western countries’ reliance on global public goods was still very limited. In this context, using global financial public goods to impose financial sanctions on non-Western countries would have produced very little deterrent effect. The advent of the era of financial globalization, however, has transformed this situation. While financial globalization has brought new economic opportunities to developing countries, it has simultaneously increased their dependence on global financial public goods, which has set the scene for the effective weaponization of such goods.

全球金融公共品武器化的现象为什么会盛行于21世纪,而没有出现在更早的时期?回答这一问题需要我们思考全球金融公共品武器化与金融全球化的关系。我们可以做一个简单的假设,在20世纪60年代和70年代,当时金融全球化还没有形成,西方国家与非西方国家之间的金融市场还处于割裂状态,非西方国家对全球金融公共品的依赖还非常有限。在这一背景下,西方国家动用全球金融公共品对非西方国家实施金融制裁几乎不会产生威慑作用。但是金融全球化时代的到来,彻底改变了这一状况,金融全球化给发展中国家的经济发展带来了新的机遇,但同时也提高了其对全球金融公共品的依赖,这一变化为全球金融公共品武器化提供了有利条件。

An important contributing factor in financial globalization is capital account liberalization.20 Although the international community established a free trade system after World War II, it did not result in financial globalization, which was hindered by capital account controls then in place globally. As competitive devaluations were seen to have played a significant role in bringing about World War II, the postwar reconstruction of the international monetary system adopted a fixed exchange rate system in which the currencies of all countries were pegged to the U.S. dollar.21 In view of the “impossible trinity,” if each country was to maintain an independent monetary policy while keeping a fixed exchange rate, then global capital account controls would be unavoidable. Therefore, before the collapse of the Bretton Woods system, the IMF endorsed government controls on capital accounts, and national governments had no choice but to implement capital account controls so as to maintain the independence of monetary policy. Global capital account controls became the main obstacle to financial globalization at the time.

对于金融全球化的成因,一个重要的解释是资本项目开放的影响。第二次世界大战结束后,国际社会建立了自由贸易体系,但是该体系并没有促成金融全球化。妨碍金融全球化发展的是当时存在的全球性资本项目管制。鉴于竞争性货币贬值是助长第二次世界大战爆发的重要原因之一,战后国际货币体系的重建吸取了这一教训,选择了世界各国货币与美元挂钩的固定汇率制度。而从“三元悖论”的视角来看,在采用固定汇率制的前提下,要保持各国货币政策的独立性,就必须实施全球性资本项目管制。因此在布雷顿森林体系崩溃之前,国际货币基金组织认可各国政府对资本项目实施管制。而各国政府为了保持货币政策的独立性,也不得不对资本项目实施管制。全球性资本项目管制一度是妨碍金融全球化发展的主要障碍。

The end of the Bretton Woods system ushered in an era of floating exchange rates, and with no need to maintain a fixed exchange rate system, capital account controls were no longer necessary. Countries around the world began to liberalize capital accounts one after another, laying the institutional foundations for financial globalization. During this period, global capital account liberalization was characterized by twofold competition—both between developing countries and between developed countries. On the one hand, to obtain more foreign investment, governments of developing countries engaged in competitive liberalization of capital accounts. On the other hand, developed countries competed to accelerate capital account liberalization, so that their enterprises could draw on the low labor costs in developing countries to gain a competitive edge.22 This twofold capital account liberalization brought about two important changes. First, since Western countries could provide a mature international financial market, developing countries began to use it for investment and capital raising, which led to a high degree of global financial integration. Second, the twofold capital account liberalization enabled multinational companies to transfer their production bases to developing countries with low labor costs, contributing to the close integration of industrial chains between Western countries and developing countries.

而在布雷顿森林体系崩溃以后,全球进入了浮动汇率制时代,资本项目管制不再是维护固定汇率制的必要手段。世界各国纷纷开始开放资本项目,为金融全球化的发展奠定了制度基础。这一时期,在发展中国家和发达国家出现的双重资本项目开放的竞争成为全球性资本项目开放的重要特征。一方面,发展中国家政府为了获得更多的外国投资,纷纷展开了开放资本项目的竞争。另一方面,发达国家为了让本国企业获得发展中国家的低劳动力成本竞争优势,也纷纷展开了加速了资本项目开放的竞争。双重资本项目开放带来了以下两个重要变化:其一,鉴于西方国家能够提供成熟的国际金融市场,发展中国家开始利用这一市场进行投融资业务,推动了全球金融的高度融合;其二,双重资本项目开放为跨国公司将生产基地转移到低劳动力成本的发展中国家敞开了大门,促进了西方国家与发展中国家产业链的高度融合。

However, global financial integration as a result of financial globalization has also made it easy for Western countries to use global financial public goods as a tool to contain rival countries. Developing countries deposit their foreign exchange earnings from exports as currency investment in financial institutions and markets in Western countries, which makes it possible for Western countries to freeze or even confiscate these assets. In addition, developing countries often use the currencies and payment systems of Western countries for international settlement, which allows Western countries to disrupt their industry chains by cutting them off from the international settlement network.

然而由金融全球化促成的全球金融一体化也为西方国家将全球金融公共品作为遏制对手国的工具提供了便利。后发国家把出口获得的外汇收入以货币投资的形式存放于西方国家的金融机构和金融市场,为西方国家冻结甚至没收这些资产提供了可能性。另外,后发国家多利用西方国家的货币和支付体系进行国际结算,也为西方国家通过切断国际结算网络,破坏其产业链提供了便利。

Clearly, financial globalization is a double-edged sword. It has brought economic opportunities to developing countries, but it has also exposed them to financial sanctions by Western countries. China is no exception. Although financial globalization has boosted its economic development, its high reliance on global financial public goods means that the country is likely to face an extremely unfavorable situation if sanctioned by the West.23

可见金融全球化是一把双刃剑,它给后发国家带来了经济发展的机遇,但同时也增加了它们遭受西方国家金融制裁的风险。对中国而言同样如此,金融全球化为中国提供了发展机遇,但是对全球金融公共品的高度依赖,也增加了中国一旦被西方制裁将面临极为被动局面的风险。

A third prerequisite for the weaponization of global financial public goods is the actors’ monopoly over their supply. If a sovereign state could only partially provide a type of global public good, it would be difficult to weaponize it to sanction political rivals, as the sanctioned state can turn to alternative providers, and the sanctioning state may lose its original share in supplying the public good. On the other hand, as Pei Changhong notes, if a global public good is provided only by the United States, then this public good becomes a monopoly.24

全球金融公共品武器化的第三个形成条件是行为实施主体对此类全球公共品供给高度垄断。试想,如果一个主权国家只能部分地提供某一类全球公共品,那么很难将之作为制裁政治对手的武器。因为被制裁的对象可以寻找其他国家提供上述公共品,这反而可能使实施金融制裁的国家失去提供原本份额的资格。反之,则正如裴长洪所指出的:如果某个全球公共品只有美国提供,那么这个全球公共品就具有了垄断的性质。

A monopoly of global financial public goods will lead to global market failure. The weaponization of those public goods is not a market-driven decision, but a manifestation of global market failure. Unlike in Pei Changhong’s scenario, however, the U.S. dollar is not the only international currency, and the United States does not have a monopoly on international currencies. This limits the United States’ ability to unilaterally impose financial sanctions: imposing unilateral sanctions on Russia, for example, would prompt it to use the euro instead for international trade settlements, which would render the sanctions ineffectual. Therefore, to avoid this outcome, the United States has to try to team up with other Western countries to monopolize global financial public goods, so that the weaponization of them could produce a full deterrent effect.25

全球金融公共品的垄断属性会造成“全球市场失灵”。它的武器化并不是市场化行为,而是“全球市场失灵”的一种表现形式。但与裴长洪的假设不同,美元并不是唯一的国际货币,美国对国际货币并不具有完全的垄断性,这限制了美国单独实施金融制裁的能力。也就是说,如果美国单独对俄罗斯实施金融制裁,那么这会迫使俄罗斯使用欧元进行国际贸易结算,从而导致制裁无法达到预期目的。因此为了避免出现这种情况,美国必须设法联合其他西方国家实现对全球金融公共品的垄断,才能充分发挥全球公共品武器化的威慑作用。

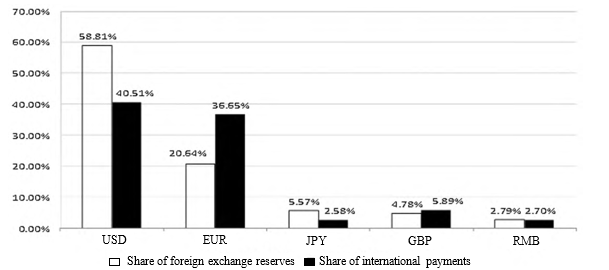

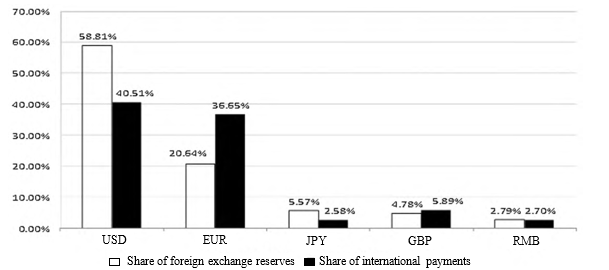

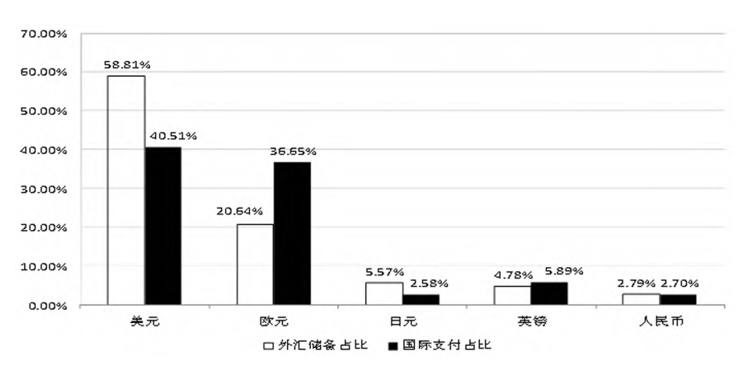

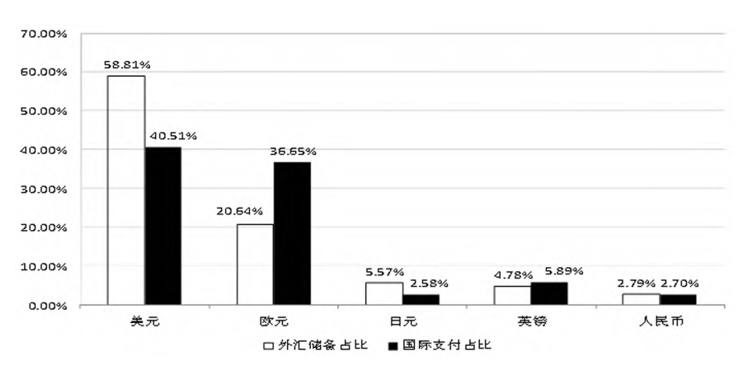

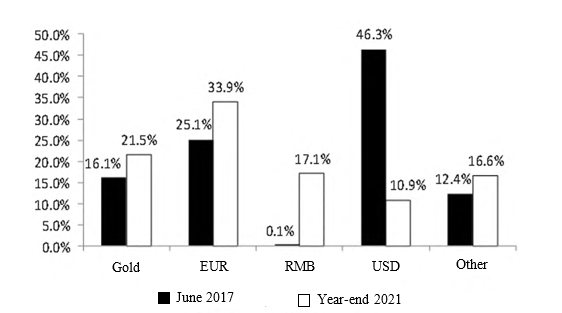

Fig. 1 Currency shares of global foreign exchange reserves and international payments (data from the end of 2021)

图1全球外汇储备和国际支付货币的占比比较(2021年年末数据)

A currency’s shares of global foreign reserves and international payments are two important measures of how internationalized a currency is, and the U.S. dollar accounted for 58.8 percent and 40.5 percent of them respectively at the end of 2021, as shown in Figure 1. As the United States does not enjoy a monopoly on international currencies, it lacks the ability to unilaterally impose effective financial sanctions.

国际储备货币和国际支付货币是反映货币国际化程度的两个重要数据。图1数据显示,2021年年末,美元占二者的比重分别为58.8%和40.5%。美国并没有达到完全垄断国际货币的程度,这削弱了美国实施金融制裁的能力,使得美国很难单独实施高效的金融制裁。

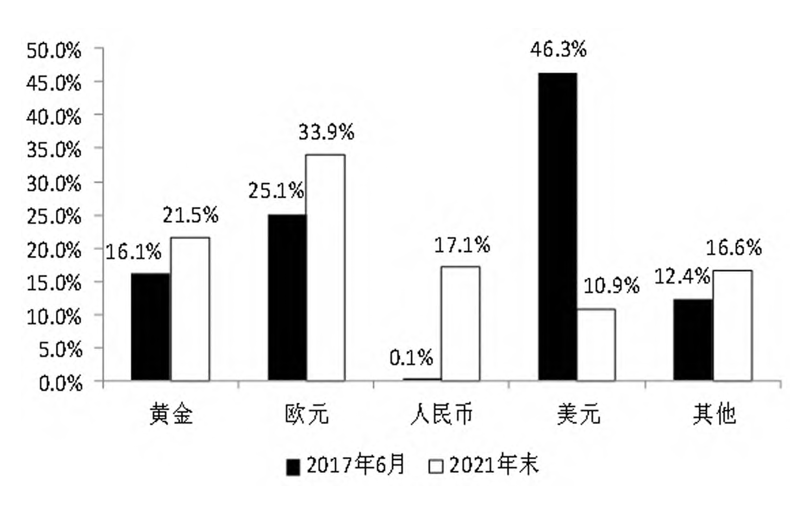

In fact, after the Crimean crisis, the United States already restricted some Russian banks from using the dollar for settlement, a move that forced Russia to adopt a strategy of “de-dollarization” and substantially increase its holdings of euro and renminbi assets. As Figure 2 illustrates, the U.S. dollar accounted for 46.3 percent of Russia’s international reserves in mid-2017, but by the end of 2021, its proportion had dropped to 10.9 percent—not only lower than the euro’s share, but also lower than that of the renminbi, which surged from 0.1 to 17.1 percent over the same period. In addition, the share of gold rose from 16.1 to 21.5 percent, the share of the euro rose from 25.1 to 33.9 percent, and the share of other currencies rose from 12.4 to 16.6 percent. Since the dollar does not enjoy a monopoly, U.S. attempts to impose unilateral financial sanctions on Russia would not only fail to have their desired effect, but may allow other international currencies to eat away at the dollar’s share in Russia’s international currency reserve basket.

其实,在克里米亚危机发生后,美国方面已经限制一部分俄罗斯银行使用美元进行结算。这迫使俄罗斯采取了“去美元化”策略,大幅度增持欧元和人民币资产。图2的数据显示,2017年年中,美元占俄罗斯国际储备的比重高达46.3%;但是到2021年年末已下降至10.9%,不仅低于欧元,而且也低于人民币。同一时期,人民币在俄罗斯国际储备中的占比从0.1%上升到17.1%,出现了井喷式增长;另外黄金从16.1%上升到21.5%,欧元从25.1%上升至33.9%,其他货币从12.4%上升到16.6%。因此,在美元缺乏市场垄断性的情况下,美国若单独对俄罗斯实施金融制裁,不仅无法达到制裁预期,反而有可能促进其他国际货币挤压美元在俄罗斯国际货币储备篮子中的空间。

Fig. 2 Changes in the composition of Russia’s foreign reserves

图2俄罗斯国际储备结构的变化

Having learned the above lesson, the U.S. government used the language of “political correctness” to induce other Western countries to take sides and jointly participate in financial sanctions against Russia after the Ukrainian crisis had erupted, so as to maximize the impact of the weaponization of global financial public goods. With an eye to ensuring their energy supply, EU countries at first opposed kicking Russia out of the SWIFT financial information exchange system and restricting its ability to make international transactions. Eventually, however, at the insistence of the United States, the United Kingdom, and some Baltic states, EU countries had no choice but to agree to the decision to impose SWIFT sanctions on some Russian banks.26

正是基于以上“教训”,这次在乌克兰危机发生后,美国政府为了提高将全球金融公共品作为武器的打击力度,以“政治正确”的话语引导其他西方国家“选边站”,共同参与金融制裁,以此提升对俄金融制裁的力度。计划实施制裁之初,欧盟国家为了保证能源供给,反对把俄罗斯踢出SWIFT金融信息交换系统,限制其国际支付业务。但是最终在美国、英国和一部分波罗的海国家的强烈要求下,欧盟国家不得不接受对部分俄罗斯银行实施SWIFT制裁的决定。

By persuading the European Union to participate in financial sanctions, the United States has increased the control it and its allies have over international currencies and decimated Russia’s ability to use global financial public goods for foreign economic activities.27 The currencies of Western countries almost completely dominate foreign exchange reserves and international payments, making up 97.2 and 97.3 percent of them respectively.28

通过促使欧盟参与金融制裁,美国提升了自身及盟友对国际货币的垄断程度,较为彻底地封杀了俄罗斯利用全球金融公共品进行对外经济活动的空间。西方国家货币占各国外汇储备货币和国际支付货币的比重分别高达97.2%和97.3%,几乎达到了完全的垄断。

In retrospect, Russia misjudged the position of EU countries to some extent. Given that the European Union was highly dependent on its energy supply, Russia had always believed that it would not agree to the SWIFT sanctions or freeze its foreign assets, taking the precaution of reducing its dollar holdings and increasing its euro holdings. However, the principle of putting “political correctness” first compelled EU countries to join in the U.S.-led financial sanctions in the end.29

而从事态发展的结果来看,俄罗斯在一定程度上误判了欧盟国家的立场。考虑到欧盟高度依赖其能源供给,俄罗斯一直认为欧盟不会接受对其实施SWIFT制裁,也不会冻结其对外资产,因此采取了减持美元资产、增持欧元资产的预防措施。但是最终结果表明,“政治正确”优先的原则使欧盟国家最终也参与了由美国主导的金融制裁。

IV. Characteristics and Implications of the Weaponization of Global Financial Public Goods

四、全球金融公共品武器化的特点与影响

The weaponization of global financial public goods would not have been put into action had there not been a motivation to do so. Clearly, it was political rather than economic interests that drove such decisions and actions, which were economically damaging to Western countries. Trust is the foundation of commerce, and the loss of public trust inevitably hurts the economy.

将全球金融公共品武器化付诸行动还需要西方国家拥有实施相关行动的主观动机。显然,推动相关决策与行动的是政治利益而非经济利益。因为从经济的视角来看,这一做法对西方国家有百害而无一利。商业的基础是信用,公信力的损失必然会伤害经济。

Remarks of U.S. policymakers may help us understand the United States’ motivation for weaponizing global financial public goods. On June 2, 2014, the Center for Strategic and International Studies and the U.S. Department of the Treasury cohosted a symposium titled “The Evolution of Treasury’s National Security Role.” In his keynote speech, the then U.S. treasury secretary Jacob Lew noted that the weaponization of finance [wording in the Chinese text; in the actual speech this part reads “TFI,” referring to the Office of Terrorism and Financial Intelligence] “has opened up a new battlefield for the United States, one that enables us to go after those who wish us harm without putting our troops in harm’s way or using lethal force.”30 Similarly, in a speech in Warsaw at the end of March 2022, U.S. President Joe Biden stressed that “these economic sanctions are a new kind of economic statecraft with the power to inflict damage that rivals military might,” and that the measures were “sapping Russian strength, its ability to replenish its military, and its ability to project power.”31

美国决策者的言论有助于我们了解美国主导全球金融公共品武器化的主观动机。2014年6月2日,美国战略与国际研究中心与美国财政部共同举办了一场题为“财政部在国家安全中角色的演变”的研讨会。时任美国财长雅各布·卢发表主旨演讲指出:“金融武器化为美国提供了全新的战场,使美国能够让美军在不陷入危险境地或不使用致命武力的情况下,打击那些希望伤害美国的人。”2022年3月底,美国总统拜登在华沙发表演讲时也强调:“经济制裁是一种全新的经济国策,具备同军事实力旗鼓相当的破坏力。”这些措施将“削弱俄罗斯的实力、补充军事力量并将其投射到前线的能力。”

These remarks suggest two characteristics of the weaponization of global financial public goods. First, in terms of its trajectory of development, it is a new phenomenon, a brand-new policy tool, and a new form of warfare launched by the United States. It gradually took shape over the past 20 years, and the Ukrainian crisis has brought it to the forefront of the world stage. Second, in terms of its place in politics, it will become a regular means by which the U.S. government undermines competitors and hostile countries, serving as an extension of and alternative to military warfare. The change from military warfare to financial warfare is not an accident or a one-time expedient, but a systematic strategic reorientation and trend.

从上述两位美国高官的言论看,全球金融公共品武器化有两个特点:其一,从发展历程来看,它是一种新的现象,是全新的政策工具,是美国推出的一种全新的战争形态。它在过去20多年中逐步成形,在乌克兰危机发生后,正式走向世界的前台。其二,从政治定位来看,全球金融公共品武器化将成为美国政府打压竞争对手和敌对国家的常规手段,成为军事战争的延伸和替代。从军事战争向金融战争的转变并不是偶发性事件或一时的权宜之计,而是系统性的战略调整和战略趋势。

Three factors contributed to Western countries’ preference for weaponizing global financial public goods against geopolitical rivals in the twenty-first century.

进入21世纪后,西方国家把全球金融公共品作为打击地缘政治对手的一类重要武器与以下三个因素有关:

First, compared with a hot war, a financial war comes with a relatively low political cost and is more palatable to the people of the United States, hence the U.S. government’s increasing preference for routinely weaponizing global financial public goods against geopolitical rivals. In order to win over voters, the United States’ two major political parties have to choose a form of war that the people can tolerate. This is the main reason why the U.S. government has proceeded with the weaponization of global financial public goods. As a Financial Times analysis notes: “It is an approach to conflict two decades in the making. As voters in the US have tired of military interventions and the so-called ‘endless wars,’ financial warfare has partly filled the gap. In the absence of an obvious military or diplomatic option, sanctions—and increasingly financial sanctions—have become the national security policy of choice.”32

第一,与发动军事战争相比,金融战争的政治成本相对较低,更容易被美国国民所接受。所以美国政府越来越倾向于把全球金融公共品作为打击地缘政治对手的常规武器。美国两大政党为了在选举中获得选民的支持,就必须选择能够被民众接受的战争形态,这是美国政府推动全球金融公共品武器化的主要原因。正如英国《金融时报》的一篇评论文章所指出的那样:“这是一种20年来形成的冲突策略。随着美国选民厌倦了军事干预和所谓的无休无止的战争,金融战一定程度上填补了这个空白。在缺乏明显的军事或外交选项时,制裁与日益金融化的制裁已成为国家安全政策的选择。”

Second, the growing dependence of countries around the world on global public goods has increased the motivation of the West to weaponize global financial public goods. As mentioned above, globalization has greatly amplified the damaging impact of the weaponization of global financial public goods, providing favorable conditions for Western sanctions—a fact that enhances the West’s willingness to use global public goods to undermine geopolitical rivals.

第二,世界各国对全球公共品依赖程度的上升提高了西方将全球金融公共品武器化的主观能动性。如前所述,全球化大幅度地提高了全球金融公共品武器化的杀伤力,为西方国家实施制裁提供了有利条件。这在客观上提升了它们动用全球公共品打压地缘政治对手的主观意愿。

Third, among various measures of economic sanctions, Western countries favor financial sanctions in particular, because they usually achieve more with less. As countries mostly use global public goods provided by the West for financial transactions, the weaponization of such goods can affect all international economic exchanges, including those between non-Western countries and sanctioned countries. This situation has increased the deterrent and destructive power of the weaponization of global financial public goods.33 Of the current Western financial sanctions on Russia, the SWIFT sanctions—rightly dubbed “a financial nuclear bomb”—dealt the greatest blow. An important feature of the SWIFT sanctions is that, if fully implemented, they would disrupt economic ties not only between Western countries and Russia, but also between all other countries and Russia, because almost all international payment settlements in the world currently go through the SWIFT messaging system. Although the renminbi cross-border payment system established by China is equipped with an alternative messaging system, China’s cross-border renminbi transactions still mainly go through SWIFT as it is the primary communications channel used by other financial institutions around the world.

第三,在诸多经济制裁措施中,西方国家尤其重视金融制裁。因为与其他措施相比,金融制裁通常能够起到事半功倍的作用。由于各国多使用西方国家提供的全球公共品进行金融交易,因此其武器化可以影响到所有包括非西方国家与被制裁国在内的国家间经济往来。这一模式加大了全球金融公共品武器化的威慑力和破坏力。此番西方国家对俄实施的金融制裁中,SWIFT制裁的打击力度最大,堪称“金融核弹”。SWIFT制裁的一个重要特点是,如果全面实施,那么不仅会中断西方国家与俄罗斯之间的经济联系,而且会中断其他所有国家与俄罗斯之间的经济联系,这是因为目前全球几乎所有的国际支付结算都使用SWIFT信息报送系统。尽管中国建立的人民币跨境支付系统自身也配备了备用信息报送系统,但是由于全球其他金融机构主要使用SWIFT信息报送系统,使得我国的人民币跨境支付系统仍主要借道SWIFT进行交易。

Furthermore, Western countries’ freezing or confiscation of the sanctioned countries’ foreign exchange reserves and foreign assets obstructs economic activities not only between Western countries and the sanctioned countries, but also between other countries and the sanctioned countries. Since the currencies of Western countries account for as much as 97 percent of global foreign exchange reserves and international payments, the sanctioned countries can no longer use dollars or euros to pay non-Western countries for goods and debts once their foreign assets are frozen.

另外,西方国家冻结或没收被制裁国的外汇储备和对外资产的做法不仅会阻断西方国家与被制裁国之间的对外经济活动,而且还会阻断其他国家与被制裁国的对外经济活动。西方国家货币占全球外汇储备货币和国际支付货币的比重高达97%,在这种情况下,一旦被制裁国的对外资产被冻结,那么这些国家也无法使用美元和欧元支付西方以外国家的货款和债务。

The above has analyzed the motivation behind Western countries’ weaponization of global financial public goods from three angles. However, current Western sanctions against Russia have exposed another problem: in a globalized world, the more powerful such weaponization is, the more severely it will backfire on the actors.34 This risk will act as a constraint on Western countries. Having imposed sanctions on Russia, the European Union is facing an energy crisis, and Western countries in general are facing problems such as rising energy prices and rapid inflation. In the long run, the negative impact on European countries participating in the financial sanctions may eventually dampen their enthusiasm for continued involvement. The international status of the U.S. dollar may also weaken as a result of the financial sanctions, which may temper the United States’ willingness to impose more.

以上从三个方面分析了西方国家推进全球金融公共品武器化的主观动机,但是,西方国家此番对俄制裁也暴露出了另一个问题,即在全球化已经形成的背景下,全球金融公共品武器化的杀伤力越大,其对实施各方的反噬也越强。这一反噬作用将会对西方国家起到牵制作用。在对俄实施制裁的同时,欧盟面临能源危机,西方国家总体也都面临能源价格上涨和通货膨胀率快速上升等问题。而从长远来看,欧洲国家参与金融制裁遭受的反噬最终可能削弱其参与制裁的积极性。金融制裁的另一个负面影响是削弱美元的国际地位,这也可能制约美国发动金融制裁的主观意愿。

V. Concluding Remarks

五、结语

The weaponization of global financial public goods has become Western countries’ main tool to attack geopolitical rivals. However, they cannot wield it forever, as the weaponization will undermine the conditions that make sanctions effective and thereby weaken a sanctioning state’s ability to damage its rivals. Once a weapon is no longer effective, it will inevitably lose its value.

全球金融公共品武器化已经成为西方国家打击地缘政治对手的主要工具。然而,西方国家无法永久地把全球金融公共品作为本国或联盟的武器,因为全球金融公共品武器化会破坏发起国实施制裁的条件,进而削弱其打击对手的能力。而一旦制裁发起国无法有效地打击对手,那么这一武器必然会丧失其存在价值。

To be specific, a necessary condition for Western countries to use global financial public goods to impose sanctions is a sanctioned state’s high dependence on these public goods. Therefore, if more and more countries turn away from global financial public goods provided by the West out of fear of such sanctions, Western countries will lose its ability to impose such sanctions on other countries, and there will no longer be any reason for them to weaponize global financial public goods.

具体而言,西方国家利用全球金融公共品实施制裁的必要条件是被制裁国家高度依赖该公共品。因此如果越来越多的国家因为担心此类制裁而放弃使用西方国家提供的全球金融公共品的话,后者就无法对前者实施制裁,全球金融公共品武器化将会失去其存在的基础。

In fact, since Western countries imposed financial sanctions on Russia, some countries have adopted “de-dollarization” and “de-euroization” as their strategies on foreign exchange reserves and international payments. Both strategies essentially aim to reduce dependence on global financial public goods provided by the West. The faster this process advances, the sooner the weaponization of global public goods will exit from the stage of history. Moreover, the trends of de-dollarization and de-euroization will themselves have a deterrent effect on Western countries, which may just be enough to stop them from weaponizing global financial public goods.

实际上,在西方国家对俄罗斯实施金融制裁之后,已经有一些国家启动了“去美元化”和“去欧元化”的外汇储备与国际支付发展战略。两者的本质就是降低对西方提供的全球金融公共品的依赖。这一进程发展得越快,全球公共品武器化退出历史舞台的时间就越早。而且“去美元化”和“去欧元化”这一趋势本身会对西方国家产生威慑作用,从而可能迫使其终止将全球金融公共品武器化的行为。