“Debt-trap diplomacy” has become a popular term that some on the international stage have attributed to China in its investment and aid to Africa in recent years. They accuse China’s investment and aid of creating a debt trap, claiming that China ignores the debt status and solvency of the countries where projects are located. Instead, they accuse China of increasing the debt burden of the countries in question through large-scale investment and aid for certain projects, until they are unable to repay the debt, thus enabling China to gain control over the project or the entire sector, thereby further influencing the foreign policy of the country. This kind of accusation not only reflects anxiety with regard to China’s investment and aid in Africa, but also reveals lack of in-depth understanding of the current debt situation of African countries.

“债务陷阱式外交” (Debt-trap Diplomacy) 成为近年来国际上部分人指责中国对非洲投资与援助的高频词。他们指责中国的投资与援助是在制造债务陷阱,宣称中国不顾项目所在国的债务状况和偿债能力,通过对一些项目进行大规模的投资与援助,加重东道国的债务负担,直至该国无力偿还债务,从而取得对该项目或领域控制权,进而影响该国的外交政策。这种指责不仅反映了他们对中国在非洲进行投资与援助的焦虑,也折射出他们对目前非洲国家的债务状况缺乏深入的了解。

In order to demonstrate the actual situation of China’s aid and investment in Africa, dispel the outside world’s misunderstanding of China’s normal economic cooperation with African countries, and refute the baseless accusations arising from such misconceptions, this article intends to review and analyze the viewpoints of Western observers who accuse China of conducting “debt-trap diplomacy” and summarize their core arguments. Through a brief analysis of the characteristics and causes of the debt crisis currently facing African countries and based on the facts and figures for China’s aid and investment in Africa, the article will refute each of the above accusations in turn. At the same time, this article will put forward policy suggestions for improving China’s aid and investment in Africa.

为了呈现中国对非洲援助和投资的实际情况,澄清外界对中国与非洲国家正常经济合作的误解,驳斥相关无理指责,本文拟梳理和分析西方人士指责中国在非洲推行“债务陷阱式外交”的观点,提炼出他们的核心论调ꎻ通过对目前非洲国家债务危机的特点及其原因进行简要分析,并基于中国对非洲援助和投资的事实和数据,对上述指责分别进行反驳ꎻ同时对中国优化在非洲的援助和投资提出政策建议。

China’s So-Called “Debt-Trap Diplomacy”

所谓中国对非“债务陷阱式外交”

Since the start of the twenty-first century, Chinese investment in African countries has developed rapidly. In particular, after the Belt and Road Initiative was put forward in 2013, China further increased its investment and aid to African countries and established the Asian Infrastructure Investment Bank (hereinafter “AIIB”). Although the above-mentioned multilateral and regional economic development initiatives have been welcomed and positively evaluated by many relevant countries, they have also aroused anxiety and concern among some Western politicians and analysts. They believe that these measures of the Chinese government have strengthened China’s influence on the economies of African countries and led to the rapid growth in Chinese aid and investment in Africa as well as the foreign debts of African countries. For example, from 2006 to 2009, Africa’s existing external debt increased by an average of 7.8% per year, and from 2011 to 2013 by an annual average of 10.2%. Since 2013, the number of African countries at high risk of default has doubled, currently standing at 18. On this basis, they blame China’s investment and aid for causing the continuous rise in the foreign debts of African countries and believe that China is practicing “debt-trap diplomacy” in Africa and promoting a new imperialism—”creditor imperialism.” Such accusations mainly reflect the following lines of argument:

进入21世纪以来,中国对非洲国家的投资迅猛发展。尤其是在2013年“一带一路”倡议提出后,中国进一步加大了对非洲国家的投资和援助力度,并成立了亚洲基础设施投资银行 (Asian Infrastructure Investment Bank,以下简称“亚投行”)。尽管上述多边的、区域性的经济发展倡议受到了众多相关国家的欢迎和积极评价,但也引起了部分西方政客和分析人士的焦虑和担忧。他们认为中国政府的这些举措强化了中国对非洲国家经济的影响,导致了中国对非洲援助和投资以及非洲国家外债迅猛增长。如2006~2009年非洲外债存量年均增长78%,2011~2013年年均增长102%。而自2013年以来,非洲大陆债务高风险国家的数量翻了一番,目前已达到18个。据此,他们指责中国投资与援助致使非洲国家的外债不断攀升,认为中国正在非洲实行“债务陷阱式外交”,推行新的帝国主义———“债权帝国主义”。上述指责主要表现在以下两方面:

(i) The Chinese government’s aid and loans increase the sovereign debt risk of African countries

(一) 中国政府的援助和贷款增加了非洲国家的主权债务风险

Sovereign debt generally refers to the repayment obligations incurred by a sovereign nation when borrowing from abroad, where the country uses its sovereignty as collateral, to supplement public expenditures such as national defense, infrastructure construction, and education. The creditors can be other countries, or international organizations or agencies. Statistics show that, as the sovereign debt of African countries expands, the loans and aid from the Chinese government to Africa rise as well. Based on this correlation, some Western politicians and analysts believe that it is the Chinese government’s loans and aid to Africa that have caused the rapid growth in the sovereign debts of African countries. And the Belt and Road Initiative proposed by China in 2013 and the subsequent establishment of the AIIB have particularly triggered their panic. Citing Djibouti, Mombasa, Kenya, and other maritime ports that China has assisted in construction or acquisition in recent years, Brahma Chellaney of the New Delhi–based Center for Policy Research linked China’s Belt and Road Initiative with a “debt trap”, and holds that China is using the Belt and Road Initiative and large-scale loans and aid to lure many countries into debt traps. In order to avoid defaulting on their debts, these countries are forced to transfer part of their sovereignty and resources to China. Therefore, Chellaney believes that China’s Belt and Road Initiative is part of China’s imperialist plan. In short, Chellaney’s view is that China uses sovereign debt to force other countries to “submit.” Since the sharp rise in the debt of African countries in recent years has been basically concurrent with the Chinese government’s large-scale loans and aid to Africa, this seems to be “ironclad proof” that China is promoting “creditor imperialism” in Africa.

主权债务 (Sovereign Debt) 一般是指主权国家以自己的主权为担保,为补充国防、基础设施建设和教育等公共支出而对外借款所产生的偿还义务。债权人可以是其他国家,也可以是国际组织或机构。从统计数字上看,非洲国家主权债务在扩大的同期,中国政府对非洲贷款与援助的规模也在扩大。据此,部分西方政客和分析人士认为是中国政府对非洲的贷款与援助造成了非洲国家主权债务迅速增长,特别是2013年中国提出“一带一路”倡议及随后成立的亚设行更是引起了他们的恐慌。印度新德里政策研究中心 (New Delhi-based Center for Policy Research) 的切拉尼(Brahma Chellaney),以中国近年来援助建设或收购的吉布提和肯尼亚蒙巴萨等海上港口要冲为例,将中国的“一带一路”倡议与“债务陷阱”相挂钩,认为中国正在利用“一带一路”和大规模的贷款与援助诱使许多国家陷入债务陷阱。这些国家为了避免出现债务违约,迫于压力向中国让渡本国部分主权及资源,因此切拉尼认为中国的“一带一路”倡议是中国构建帝国主义计划的一部分。简言之,切拉尼的观点是中国凭借主权债务强迫他国“臣服”。由于近些年非洲国家债务的急剧上升与中国政府对非洲大规模的贷款和援助几乎同期,这似乎是成了中国在非洲推行“债权帝国主义”的“铁证”。

As soon as Chellaney proposed this so-called “creditor imperialism” argument, it was echoed by some Western media. Certain media reports expressed serious concerns about the impact of the “Belt and Road Initiative” as well as China’s loans and aid to Africa on Africa’s debt sustainability. Some analysts have even assessed the potential debt problems of the 68 countries identified as Belt and Road Initiative borrowers. Their main concern was that large-scale loan and aid programs will further reduce public investment and economic growth in these already heavily indebted countries. Some people are also concerned that debt problems will make debtor countries dependent, to varying degrees, on China, which acts as the creditor. In particular, China was accused of carrying out “debt-trap diplomacy” in sub-Saharan Africa in 2017. On his visit to Africa in 2018, former U.S. Secretary of State Rex Tillerson mentioned the rising debt of African countries at almost every stop. He accused China of using corruption and predatory loans to undermine African governments and forcing African countries into a quagmire of debt.

切拉尼所谓的“债权帝国主义”一经提出,就在一些西方媒体上引发了“共鸣”。一些媒体的报道对“一带一路”倡议以及中国在非洲的贷款与援助对非洲债务可持续的影响表示深度担忧。一些分析人士甚至还评估了被确定为“一带一”倡议借款方的68个国家可能潜在的债务问题。他们主要担心大规模的贷款与援助计划将使这些原本就已债务累累的国家的公共投资和经济增长进一步降低ꎻ也有人担心债务问题会使债务国对作为债权方的中国产生不同程度的依赖,尤其在2017年,中国更是被集中地指责在撒哈拉以南非洲推行“债务陷阱式外交”。美国前国务卿蒂勒森在2018年访问非洲时,几乎每到一站都会论及非洲国家债务上升的问题,他指责中国利用腐败和掠夺性贷款破坏非洲各国政府,使非洲国家陷入债务泥潭。

Generally speaking, the core argument of the above accusations is that the Chinese government, through initiatives or organizations such as the Belt and Road Initiative and the Asian Infrastructure Investment Bank, has been deliberately providing large-scale loans or aid to some major projects and key industries or fields in African countries, without regard to the actual debt situation of African countries. This increased the debt burden of African countries and escalated debt risks, thereby forcing these countries to cede to China some of their national sovereignty in important industries, such as ports, mineral resources, and telecommunications, in order to avoid sovereign debt default.

总体而言,上述指责的核心观点是:中国政府通过“一带一路”和亚投行等倡议或组织,不顾非洲国家的实际债务状况,有计划地对非洲国家的一些重大项目和关键行业或领域进行大规模的贷款或援助,加重非洲国家的债务负担,恶化债务风险,进而迫使这些国家为了避免主权债务违约,不得不将港口、矿产资源或通信等重要行业的部分国家主权让渡给中国。

(ii) The Chinese government controls the business operations of state-owned enterprises

(二) 中国政府控制国有企业的经营行为

The second accusation made by Western politicians and analysts against China regarding the “debt trap” in Africa is that, although the main investing entities in Africa are enterprises, most of them are controlled or guided by the Chinese government, especially large state-owned enterprises. These state-owned enterprises, funded or controlled by the Chinese government, can defeat competitors in market competition more easily and gain a dominant position, and may even monopolize a country’s market. This means that, although it seems that it is enterprises engaging in economic activities in the African market, in actuality, it is the Chinese government that dominates or controls the markets of African countries.

部分西方政客和分析人士对中国在非洲制造“债务陷阱”的第二条指责是,尽管中国在非洲进行投资的主体是企业,但大部分企业受中国政府的控制或主导,尤其是大型国有企业。这些受中国政府的资助或控制的国有企业更容易在市场竞争中击败竞争对手而取得主导地位,甚至还有可能垄断一国市场,这意味着表面上在非洲市场从事经济活动的是企业,而实质上却是中国政府主导或控制着非洲国家的市场。

As early as 2013, the U.S. RAND Corporation published a report assessing the scale, trends, and composition of Chinese aid and government-funded investment activities in Africa, the Middle East, and Central Asia. This report concluded that, prior to 2004, many of China’s aid and investment programs in Africa focused on forms classified as “Other”(such as debt cancellation and humanitarian assistance). Since then, and especially after the Forum on China–Africa Cooperation in 2003 and 2006, the fields receiving Chinese aid and investment have shifted to natural resource development projects(such as petroleum, gold, and uranium) and infrastructure construction, including hydropower, road, and railway projects. In the field of natural resource development, such as petroleum resources, the main investors are state-owned enterprises controlled by the government, such as PetroChina, CNOOC, and Sinopec. Much of the Chinese government’s aid to Africa comes in the form of financial and technical support from these state-owned enterprises. Loans, especially concessional loans, are a key means of securing needed resources and providing credit to major Chinese construction enterprises. Based on this, some politicians and analysts believe that the Chinese government is using these state-owned enterprises to make large-scale investments in economic sectors or projects that are important to African countries, in order to plunder African resources.

早在2013年,美国兰德公司 (RAND) 就发表报告,对中国在非洲、中东和中亚等地区的援助和政府资助的投资活动的规模、趋势与构成进行了评估,认为在2004年之前,中国对非洲援助和投资的许多方案都侧重于“其他”形式(例如,取消债务和提供人道主义援助)。从那时起,特别是在2003年和2006年的中非合作论坛之后,中国的援助和投资领域转向了自然资源(如石油、黄金和铀)开发项目,以及基础设施建设领域,包括非洲的水电、公路和铁路项目。在石油资源等自然资源开发领域,主要的投资商是中石油、中海油和中石化等受政府控制的国有企业,而中国政府对非洲的很多援助来自这些国有企业的财政支持和技术支持。贷款尤其是优惠贷款是确保获得所需资源和为主要的中国建筑公司提供信贷的一个关键手段。

In an article in June 2018, The New York Times directly accused Chinese enterprises of having political intentions in their investment activities in Africa and warned Chinese enterprises not to operate road, rail, and sea transportation in Africa in a way that might hamper competition from American enterprises. It argued that, while these infrastructures are neutral, their operation has political implications. When Chinese enterprises build ports in African countries, this may not seem to be a problem in itself, but when the host countries are forced to hand over operation rights to Chinese parties, national security concerns arise. They also believe that the construction of telecommunications infrastructure in Africa by Chinese enterprises is the same as the construction of other infrastructure such as ports, roads, and railways, with Chinese enterprises occupying a dominant position in all these sectors, posing a great danger to host countries. Telecom enterprises such as ZTE and Huawei are very active in Africa, which raises concerns that the Chinese government may have access to mobile phone networks and data, because most of these large telecom enterprises are considered to be more or less funded or controlled by the Chinese government.

据此,一些政客和分析人士认为,中国政府正在利用这些国有企业对非洲国家重要的经济部门或项目,进行大规模投资,掠夺非洲的资源。«纽约时报»在2018年6月的一份报道中,直接指责中国企业在非洲的投资活动具有政治性,警告中国企业不能以不利于美国企业参与竞争的方式在非洲经营公路、铁路和海上运输,并提出这些基础设施虽是中立的,但其运作则颇具政治性ꎻ当中国公司建设非洲国家的港口时,这本身似乎并无问题,但当东道国被迫将业务移交给中方时,国家安全问题就产生了。他们还认为,中国企业在非洲的电信基础设施建设与港口、公路和铁路等其他基础设施的建设一样,都占据了主导地位,对东道国构成了很大的威胁。中兴通讯、华为公司等电信企业在非洲地区非常活跃,引发了人们对中国政府获取手机网络和数据的担忧,因为这些大型的电信企业被认为大部分都或多或少地接受中国政府的资助或控制。

These accusations do not recognize the market autonomy of Chinese enterprises in their economic activities in Africa. The people who level these accusations believe that the economic activities of these enterprises in Africa are actually managed and controlled by the Chinese government. They worry that Western enterprises will lose out in competition with Chinese enterprises, leaving Chinese-funded enterprises in a dominant position in certain fields and projects. In other words, the investment of these Chinese enterprises in African host countries is essentially an investment made by the Chinese state, and the funds borrowed by host countries from these enterprises are actually loans from the Chinese government. When a host country is forced to hand over a project or business to a Chinese enterprise due to climbing debt and inability to meet its obligations, it is actually handing the project or business over to the Chinese government. On this basis, they believe that Chinese enterprises, by making large-scale investments in Africa and especially in key industries and sectors, are actually creating “debt traps” for African countries. It is worth mentioning that the above two accusations are aimed at different entities. The former points more to the government, while the latter points to the enterprises. However, there is also some degree of overlap between them. Specifically, the government, as a political entity, cannot directly participate in the economic activities of foreign markets. Its participation in foreign market activities, whether in the form of loans or aid, generally relies on enterprises. Therefore, the economic activities of these enterprises in African countries are essentially under government control.

上述指责并不认可中国企业在非洲经济活动中的市场自主性。他们认为这些企业在非洲的经济活动实际上受到中国政府的管理与控制,担心西方的企业与中国企业在市场竞争中败下阵来,使中资企业在某些领域或项目中处于主导地位。换言之,这些中国企业在非洲东道国的投资行为在本质上就是国家的投资行为,东道国对企业的借贷实际上就是向中国政府的借贷。当东道国由于债务不断累积上升,无力清偿债务而被迫将该项目或业务移交给中国企业时,实际上是移交给中国政府。据此,他们指责中国企业在非洲进行大规模的投资,尤其是对关键行业领域的投资,其实是在给非洲国家制造“债务陷阱”。值得一提的是,以上两条指责针对的是不同的主体,前者更倾向于政府,后者则是企业,但它们之间也存在交集。具体而言,政府作为一个政治行为主体,无法直接参与外国的市场经济活动。它对外国市场活动的参与,无论是贷款还是援助,一般都是以企业作为依托,因此这些企业在非洲国家的经济活动实质上是受政府控制的。

To sum up, the core point of these accusations is that the Chinese government, disregarding the existing debt burdens of African countries, has significantly increased the sovereign debt risk of African countries through large-scale loans, aid, and investment by Chinese enterprises in certain key projects or industries. When the sovereign debt of African countries accumulates to a certain level so that they are unable to repay and are therefore forced to hand over these key projects or businesses to Chinese enterprises, the Chinese government may gain control over these key projects or businesses and use them to influence the domestic and foreign affairs of the country.

综上所述,这些指责的核心观点是中国政府不顾非洲国家已有债务负担,通过企业对非洲国家的一些关键项目或行业进行大规模的贷款、援助和投资,显著增加了非洲国家的主权债务风险。当非洲国家的主权债务累积到一定程度,无力偿还而被迫将这些关键项目或业务移交给中国的企业时,中国政府就取得了对这些关键项目或业务的控制权,并藉此影响该国的内政和外交。

Judging from the current debt situation of African countries, a considerable portion of countries are in a moderate- or high-level debt crisis, which is very worrying. China’s role in this emerging debt crisis has drawn much attention, with accusations claiming that it is conducting “debt-trap diplomacy” in Africa. However, this accusation has never been convincingly demonstrated. Some analysts have criticized this line of argument, holding that such accusations ignore the actual situation of China’s aid and investment in Africa, and are nothing more than suppositions and assumptions about future issues. The rationale behind these accusations seems to be that China is maximizing its own economic or geostrategic interests while the partners, the receiver of Chinese aid and investment, are caught in a quagmire. Is this really the case? To answer this question, we must investigate and analyze the characteristics and causes of the external debt of African countries.

从目前非洲国家的债务发展状况来看,有相当一部分国家处于中度或高度债务危机中,非常令人担忧。中国在这次新兴债务危机中的作用引起了人们的极大关注,被指责为在非洲推行“债务陷阱式外交”。然而,这种指责从未令人信服地被论证过。一些分析人士对此提出了批评,认为这种指责罔顾了中国对非洲援助与投资的实际情况,仅仅是对未来的猜想与假设。这些指责的假设似乎是当它投资或援助的伙伴国陷入困境的时候,中国正将自身的经济或地缘战略利益最大化。事实果真如此吗?我们有必要对此次非洲国家外债的特点及成因进行考察与分析。

General Characteristics and Causes of the Present External Debt of African Countries

当前非洲国家外债的总体特点及成因

After World War II, one after another, many African countries carried out large-scale economic construction after gaining independence, and their debts gradually accumulated as the international environment and domestic economic conditions changed. There was a sharp increase in debt between 1970 and 1999. The external debt crisis of African countries began in the late 1970s and early 1980s. At that time, the debts of one African country after another came due, just as they encountered difficulties in their economic development. This made it difficult for them to repay their debts on schedule, which caused them to be further entangled in chains of debt. According to World Bank statistics, in 1970, the total external debt of Africa was only 7 billion U.S. dollars, and in 1980 it was only $48 billion. However, by 1989, the size of Africa’s external debt had soared to $253 billion U.S. dollars. In terms of the debt-to-equity ratio, the proportion of public debt of African countries relative to their Gross Domestic Product(GDP) rose sharply from 30% in 1980 to 83% in 1987, and then continued to rise until it reached 103% in 2000. Looking at their debt service coverage ratios, the debt burden of these countries has completely exceeded the amount that they could bear. Since then, the economic development of African countries has been weighed down by their heavy load of debt, and the accumulated weight is hard to escape. Since the beginning of the twenty-first century, the scale of Africa’s external debt first declined and then increased, causing the debt crisis to reemerge. The reasons for its phenomenon are relatively complicated, involving both causes internal to debtor countries and external causes related to the international environment.

二战后,许多独立后的非洲国家纷纷开展大规模经济建设,其债务也随着国际环境和国内经济状况的变化而逐渐累积,在1970年至1999年期间增加非常显著。非洲国家的外债支付危机始于20世纪70年代末80年代初,当时非洲国家债务纷纷到期,恰逢其经济发展遭遇困境,使它们难以按期偿还债务,随之深陷债务链。按世界银行统计,1970年全非外债总额只有70亿美元,1980年也只达到480亿美元,但至1989年非洲的外债规模已突飞猛进为2530亿美元。从负债率来看,非洲国家公共债务占国内生产总值(GDP)的比重则从1980年的30%急剧上升到1987年的83%,此后一路上扬,直到2000年达到103%。从债务清偿率来看,债务负担已完全超过这些国家的承受能力。自此,非洲国家的经济发展背上了沉重的债务包袱,积重难返。进入21世纪以来,非洲外债规模先抑后扬,再现债务危机,其形成原因比较复杂,既有债务国的内因,也有国际环境的外因。

(i) The size of Africa’s external debt

(一) 非洲的外债规模

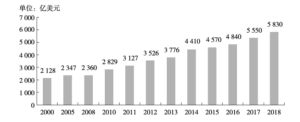

During the period from 2000 to 2008, African countries experienced strong national economic growth, exchange rate appreciation, and fiscal balance improvement. These trends, along with the “Heavily Indebted Poor Countries Initiative” (HIPC)and the Multilateral Debt Relief Initiative (MDRI)proposed by international institutions, have significantly reduced the debt burden of many African countries. Among these countries, the debt levels of seven countries including Ghana, Mozambique, and Zambia dropped rapidly after debt relief, and the proportion of their national external debt compared to their GDP fell from an average of 75% before debt relief to 26%. From 2006 to 2007, the average debt of African countries fell by about 18% of GDP, and their current account deficits accounted for 4.8% of GDP on average. However, the external debt stock of some countries remained very high, and in just a few years, they returned to the debt level they had before the implementation of the “HIPC”. Although the implementation of these debt relief programs continued, in general, African countries remained in debt, with the external debt of sub-Saharan African countries alone reaching $234.7 billion U.S. dollars in 2005(See Figure 1).

在2000年至2008年期间,非洲国家国民经济强劲增长、汇率升值、财政收支状况改善,以及国际机构“重债穷国减债计划” (Heavily Indebted Poor Countries Initiative, HIPC) 和多边减债倡议计划 (Multilateral Debt Relief Initiative, MDRI) 的实施,使很多非洲国家的债务负担明显下降。其中,加纳、莫桑比克和赞比亚等七国在债务减免后债务水平迅速下降,国家外债占比重从债务减免前的平均75%降至26%ꎻ2006~2007年,非洲国家的平均债务降幅约为国内生产总值的18%,经常账户赤字占国内生产总值的比重平均为48%。但部分国家的外债存量仍然很高,在短短几年内就恢复到实施“重债穷国减债计划”以前的债务水平。尽管这些减债计划一直在继续实行,但总体而言,非洲国家的债务依旧存在,仅撒哈拉以南非洲国家2005年的外债就已达到2347亿美元(参见图1)。

Starting in 2008, with the outbreak and spread of the global financial crisis, the existing external debt of African countries increased rapidly (See Figure 1). According to World Bank statistics, the total external debt of sub-Saharan African countries alone reached $555 billion U.S. dollars in 2017, an increase of 15% over 2016. Concerns about continued debt growth have not slowed debt accumulation in African countries, and the combined external debt stock of the 30 sub-Saharan African countries benefiting from the HIPC and MDRI increased by 11% in 2017, compared with an increase of only 7% in 2016. Their external debt stocks have doubled since 2010. The increase in the external debt stocks of African countries has outpaced economic growth, which has serious implications for debt repayment. As of the end of 2017, the average external debt-to-GNI ratio of Sub-Saharan African countries was 34.2%, up slightly from 32% in the previous year, but 50% higher than that in 2010. Between 2010 and 2017, GNI in sub-Saharan African countries grew by an average of 23%, while their external debt stocks increased by 90% over the same period. In 2017, the ratio of external debt to export earnings was 138%, nearly double the 2010 ratio of 70%, among which the ratio of external debt to export earnings exceeds 150% in half of sub-Saharan African countries. In 2018, the total external debt of sub-Saharan Africa continued to climb, reaching $585 billion U.S. dollars. There is no doubt that the burden of external debt on African countries has become increasingly heavy.

自2008年以来,随着全球金融危机的爆发和蔓延,非洲国家的外债存量增长迅猛(参见图1)。据世界银行统计,仅2017年撒哈拉以南非洲国家的外债总额就已达到5550亿美元,较2016年增长了15%。对债务持续增长的担忧并没有减缓非洲国家的债务积累,从“重债穷国减债计划”和“多边减债倡议”中受益的30个撒哈拉以南非洲国家的综合外债存量在2017年上升了11%,而在2016年只上升了7%,它们的外债存量自2010年以来翻了一番。非洲国家外债存量的增长超过了经济的增长,对债务清偿产生了严重的影响。截至2017年底,撒哈拉以南非洲国家外债占国民总收入的比例平均为342%,较上年32%略有上升,然而这仍比2010年高出了50%ꎻ2010~2017年期间,撒哈拉以南非洲国家的国民总收入平均增长23%,而同期的外债存量增长了90%ꎻ2017年外债占出口收益的比率为138%,是2010年70%的将近两倍,其中撒哈拉以南有一半非洲国家的外债占出口收益比率超过150%。2018年,撒哈拉以南非洲外债总额继续攀升至5850亿美元。毋庸置疑,非洲国家外债负担日益沉重。

Figure 1 External Debt Size of Sub-Saharan Africa from 2000 to 2018

图1 2000-2018 年撒哈拉以南非洲外债规模的变化

(ii) Composition of Africa’s external debt

(二) 非洲的外债结构

Compared with previous crises, this round of debt crisis has shown different characteristics, with the composition of debt undergoing major changes. First, although the proportion of financing from traditional bilateral or multilateral creditors has declined, they are still an important source of financing for most African countries. The share of traditional bilateral or multilateral debt in total long-term external debt fell from 44% in 2010 to 34% at the end of 2017. The share of long-term external debt obtained from bilateral creditor countries that are members of the Paris Club dropped significantly. By the end of 2017, Paris Club creditor countries accounted for only 5% of the stock of long-term public and publicly guaranteed external debt of sub-Saharan African countries, only one-fourth compared to the number at the end of 2010. Second, the proportion of concessional debt (loans with an original grant of 25% or more) relative to total external debt fell. Among the 33 most heavily indebted poor countries in Africa, only seven countries achieved a less than 50% ratio between concessional debt and total external debt from 2011 to 2013, but this number had increased to 16 countries by the end of December 2015. Overall, the weighted ratio of Africa’s concessional debt to total external debt fell from 42.4% in 2006–2009 to 36.8% in 2011–2013. Third, financing from private creditors increased significantly, and non-concessional debt experienced a massive rise. After the outbreak of the global financial crisis in 2008, African countries diversified their sources of financing and were increasingly inclined to use international investors as an additional source other than sovereign debts. Before 2009, few African countries issued sovereign bonds. From 2010 to 2012, bond issuance increased moderately, with annual bond issuance totaling $1.5 billion to $2.5 billion. By 2014, bonds issued by African countries had increased to $6.25 billion. The total stock of international sovereign bonds increased from $1 billion in 2008 to more than $18 billion in 2014. At least 14 countries have issued international sovereign bonds with an average quota of $1 billion, an average maturity of 10 years, and an average interest rate of 5% to 10%. Finally, the diversification of international financing channels was accompanied by the diversification of the currency composition of African countries’ external debt. African countries hold debts denominated in dollars, euros, Swiss francs, pounds sterling, yen, and special drawing rights, as well as debt involving a range of multi-currency and other currency compositions. From 2011 to 2013, many African countries including Botswana, South Africa, and Mali held multi-currency foreign debts that accounted for more than 40% of their total foreign debts.

与之前相比,此次债务危机呈现出不同的特征,债务的组成发生了重大变化。第一,来自传统的双边或多边债权方的融资比例虽下降,但依旧是非洲大多数国家融资的重要来源。传统的双边或多边债务在长期外债总额中所占的份额从2010年的44%降至2017年底的34%ꎻ作为巴黎俱乐部成员的双边债权国的长期外债份额明显下降,2017年底,巴黎俱乐部债权国仅占撒哈拉以南非洲国家长期公共和公共担保外债存量的5%,仅为2010年底的1/4。第二,优惠债务(原始赠款达到或超过25%的贷款)占外债总额的比例下降。在33个非洲重债穷国中,2011~2013年优惠债务占外债总份额不到50%的只有7个国家,而至2015年12月底,则有16个国家。总的来说,非洲优惠债务占外债总额的加权比例从2006~2009年的424%下降到2011~2013年的368%。第三,向私人债权人的融资显著增加,非优惠债务明显上升。2008年全球金融危机爆发后,非洲国家的融资来源更加多样化,越来越倾向于利用国际投资者作为主权融资的额外来源。2009年以前,很少有非洲国家发行主权债券,2010~2012年,债券发行温和增长,每年发行15亿至25亿美元,到2014年,非洲国家发行的债券已增至625亿美元ꎻ国际主权债券的总存量从2008年的10亿美元增加到2014年的180多亿美元。至少有14个国家发行了国际主权债券,平均份额为10亿美元,平均期限为10年,平均利率为5%~10%。最后,与国际融资渠道多样化相伴而来的是非洲国家外债货币组成的多元化。非洲国家持有美元、欧元、瑞士法郎、英镑、日元和特别提款权,以及一系列多种货币和其他货币组成的债务。2011~2013年,博茨瓦纳、南非和马里等众多非洲国家所持有的多种货币外债占其总外债的40%以上。

(iii) Reasons for the accumulation of Africa’s external debt

(三) 非洲外债形成的原因

As in other developing countries, Africa’s external debt problem is the result of both internal and external factors. Looking at internal factors, the increase in external debt is deeply shaped by the countries’ domestic economic development and debt management. In terms of economic development, on the one hand, Africa’s economic growth has been strong since 2000. During this period, many countries chose highly expansionary fiscal policies and economic development programs. Government fiscal expenditures continued to expand, with the increase in expenditures exceeding the increase in tax revenue. As a result, the amount of foreign debt accumulated continuously. On the other hand, the commodities exported by the African continent are still bulk commodities such as ores and other primary products. The product structure lacks flexibility and is extremely vulnerable to the influence of the international trade environment. After the 2008 global financial crisis, bulk commodity prices experienced a major slump. In 2009, the trade deficit in goods of the African continent was $17.73 billion. Between 2013 to 2016, Africa’s merchandise exports continued to experience negative growth, and its foreign trade deficit in goods expanded. In 2016, the deficit reached $145.36 billion. As a consequence, the debt of African countries soared.

与其他发展中国家一样,非洲外债问题是内外因素共同作用的结果。就内部因素而言,外债增加深受其国内经济发展和债务管理的影响。在经济发展方面,一方面,自2000年以来非洲经济增长强劲,不少国家在此时期选择了高度扩张的财政政策和经济发展方案,政府的财政支出不断扩大,支出的增长超过了税收的增长,外债数额由此不断累加。另一方面,非洲大陆出口的商品仍然是以矿石等初级产品为主的大宗商品,产品结构缺乏弹性,极易受国际贸易环境的影响。在2008年全球金融危机之后,大宗商品价格下跌,

In terms of debt management, African countries are moving towards market-driven debt. Although increased financing from the international financial market offers huge potential benefits for African countries, such as supplementing insufficient domestic savings, further diversifying the composition of investors, and extending the maturity of debts about to come due, the large-scale issuance of national bonds for external investors still significantly increases the foreign exchange risk of African countries, plaguing these countries with the risk of future currency depreciation and hence soaring debt servicing costs. Albert Zeufack, the World Bank’s Africa Region Chief Economist, said that changes in their debt structure have exposed African countries to new types of risks. This is a very complex market-driven risk for which countries “lack sufficient management capacity.” In 2014, the sharp depreciation of the currencies of Ghana and Nigeria provided proof for his view. Although the issuance of long-term national sovereign bonds by African countries to the international community can help them reduce their short-term repayment burden, it also poses a challenge to the ability of these countries to manage long-term debts. In fact, these African countries do not yet have sufficient debt management capabilities.

2009年非洲大陆商品贸易余额赤字为1773亿美元,2013~2016年,非洲商品出口额持续负增长,对外商品贸易逆差扩大,2016年逆差达到14536亿美元。非洲国家的债务也随之飙升。在债务管理方面,非洲国家正走向由市场主导的债务。尽管增加在国际金融市场融资能够为非洲国家提供巨大的潜在收益,可以补充国内储蓄不足、进一步使投资者的构成多样化和延长临到期的债务期限等,但是,大规模地对外发行国债也使非洲国家外汇风险显著增加,使这些国家面临未来货币贬值、偿债成本飙升的风险。世界银行非洲首席经济学家佐法克 (Albert Zeufack) 表示,债务结构的变化使非洲国家面临新型风险。这是一种非常复杂的市场导向风险,而各国并“没有足够的管理能力”。2014年,加纳和尼日利亚货币大幅度的贬值就验证了上述观点。虽然非洲国家向国际社会发行长期的国家主权债券可以助其减少短期偿还负担,但这也对这些国家对长期债务管理的能力提出了挑战,事实上这些非洲国家尚未具有足够的管理能力。

As far as external factors are concerned, the size of external debt and solvency of African countries have also been deeply affected by the deterioration of the global economic situation, the decrease of inbound capital inflows, and the changes in the exchange rates of major currencies. After the 2008 financial crisis, the outlook for the global economy was bleak. Countries in the Eurozone pursued fiscal austerity policies and had a weak recovery; China changed its mode of economic growth, focusing on stimulating domestic demand, and its economic growth slowed; and weak global manufacturing and trade growth dampened global demand and investment, leading to a plunge in commodity prices. These factors have negatively impacted Africa’s economic development prospects and national debt status. The slowdown in global economic growth was accompanied by a decline in foreign direct investment in Africa. In 2011, Africa’s foreign direct investment amounted to $38.84 billion. Except for an increase from 2014 to 2015, it showed a downward trend year by year. By 2017, foreign direct investment was only U.S. $15.722 billion, only 40.5% of the amount in 2011. The reduction in capital inflows forced African countries to obtain financing from other financing channels and raising funds through foreign debt became their predominant option. Changes in the currency composition of their foreign debts and shifts in exchange rates of major currencies have had a major impact on Africa’s debt crisis. The more debt a country holds in a specific foreign currency, the more vulnerable the country is to potential exchange rate, macroeconomic, and political shocks in the currency-issuing country. Sudden increases in debt interest payments resulting from the depreciation of domestic currencies relative to foreign currencies have raised the cost of debt servicing for African countries and weakened their ability to repay their debts. As of the end of 2017, the maturing international debt of African countries and rising global interest rates appeared to drive the rise in Africa’s foreign debt-to-export ratio, exacerbating concerns about debt sustainability. In addition, within the structure of foreign debt, the decline in the proportion of long-term debt and the increase in the proportion of short-term debt have shortened the debt repayment period and placed higher requirements on the solvency of African countries. Moreover, market-driven debt accumulation may have coincided with the short-term domestic economic situation, amplifying the risk of refinancing, leading to a sudden reduction in public spending with devastating consequences for development.

就外部因素而言,非洲国家的外债规模和偿债能力也深受全球经济形势恶化、外部资金流入减少和主要货币汇率变化的影响。2008年金融危机后,全球经济前景黯淡。欧元区国家实行财政紧缩政策,复苏乏力ꎻ中国转变经济增长方式,着重刺激国内需求,经济增长放缓ꎻ全球制造业和贸易增长疲软,抑制了全球的需求和投资,导致大宗商品价格骤降,对非洲的经济发展前景和国家债务产生了负面影响。伴随全球经济增长放缓而来的是对非外来直接投资的下降。2011年非洲的外来直接投资额为38840亿美元,除了2014~2015年有所上升外,而出现逐年下降之势,至2017年时只有15722亿美元,仅为2011年的405%。外部资金流入减少迫使非洲国家利用其他融资渠道进行融资,举借外债成为重要选项。外债的货币组成与主要货币汇率的变化对非洲债务危机产生了重要影响。一个国家以某一种外币持有的债务越多,该国就越容易受到该货币国家的潜在汇率、宏观经济和政治冲击的影响。本币相对于外币的贬值而导致债务利息支付突然增加,提高了非洲国家偿债的成本,削弱了其偿债能力。截至2017年底,非洲国家到期的国际债务与全球利率的上升,似乎使非洲外债占出口比例保持上升态势,更加剧了人们对债务可持续性的担忧。此外,在外债总额中,长期债务比例的下降和短期债务比例的上升缩短了偿债的期限,对非洲国家的偿债能力提出了更高要求。而且,市场化导向的债务累积还可能与国内的短期发展相结合,放大再融资的风险,导致公共开支突然减少,对发展产生破坏性的后果。

In summary, compared with previous crises, this round of debt crisis presents different characteristics. Under the shock of the 2008 financial crisis, the combined impact of internal factors in African countries and external factors resulted in a substantial increase in the debt levels of African countries. As China’s large-scale investment in Africa in recent years has basically coincided with the rapid increase in African countries’ debts, some politicians and analysts believe that China’s investment in African countries is creating a debt trap and accuse China of conducting “debt trap diplomacy” in Africa. The two events seem to be synchronous, but their internal logic and facts show otherwise.

综上,与以往相比,此次非洲国家债务危机呈现出不同的特征。在2008年金融危机的冲击下,非洲国家的内部因素与国际外部因素共同作用,导致了非洲国家债务水平大幅度上升。由于中国近年来在非洲进行大规模投资与非洲国家债务的迅猛增加几乎同步,因此部分政客和分析人士据此认为中国对非洲国家的投资就是在制造债务陷阱,指责中国正在非洲推行“债务陷阱式外交”。二者貌似同步,但内在逻辑和事实并非如此。

China’s Financial Cooperation with Africa Did Not Create the So-Called “Debt Trap”

中国对非资金合作未造成所谓非洲“债务陷阱”

As mentioned above, the huge amounts of external debts facing African countries are mainly the result of internal and external impacts, and the composition of debts has also changed compared to the past. According to statistics, of the nearly $600 billion external debt of the entire African region, 38% of the debt is loans from commercial banks, 36% is loans from international financial institutions such as the International Monetary Fund (IMF) and the World Bank, and the remaining 26% are loans from bilateral channels or other governments. China’s loans to Africa account for only a portion of this 26%. The total amount of Chinese loans is $4.5 billion, of which grants account for 30%. Obviously, China does not account for a large share of the total external debt of African countries. The reports and opinions of some Western media that blame China for Africa’s debt problem are full of prejudice and inconsistent with the facts.

如前所述,当前非洲国家面临的巨额外债主要是由内部因素和外部因素共同造成的,债务的组成相比以往也发生了改变。据统计,在整个非洲地区近6000亿美元外债中,38%是商业银行贷款,36%是国际货币基金组织和世界银行等国际金融机构的借贷,其余26%是双边途径或其他国家政府的借贷,中国对非洲的借贷只占这26%中的一部分ꎻ中国的整体贷款额为45亿美元,其中赠款金额占30%。显而易见,中国在非洲国家外债总量中所占的份额并不大。一些西方媒体对于非洲债务问题归咎于中国的报道和言论,既充满偏见,又与事实不符。

(i) China did not exacerbate sovereign debt risks in African countries

(一) 中国没有加剧非洲国家主权债务风险

Among the aforementioned accusations, some Western politicians and analysts believe that, through its Belt and Road Initiative and aid, the Chinese government has caused the debt of African countries to surge, exacerbating their sovereign debt risks. In fact, whether in terms of the amount, quantity, sector of investment, or in terms of the consequence of debtor countries defaulting on their debts, this accusation is not consistent with the facts.

在前述指责中,部分西方政客和分析人士认为,中国政府通过“一带一路”倡议与援助致使非洲国家债务激增,加剧非洲国家主权债务风险。实际上,无论是从中国对非洲援助或贷款的金额数量、行业领域,还是债务国未能偿债的结果来看,这个指责都罔顾了事实。

First, the amount of China’s aid and investment in Africa has been exaggerated. In terms of the amount of aid, at the Forum on China–Africa Cooperation held in Beijing in 2000, China made roughly the same commitment as the HIPC, which was reducing or canceling the debt of Africa’s least developed countries and most heavily indebted poor countries. Subsequently, China took the opportunity to cancel the government debt of heavily indebted poor countries that had come due but could not be repaid. Unlike other countries, the Chinese government usually provides aid to African countries in the form of loans. When publicly announcing the amount of loans, a period of three years or longer is often applied. In contrast, aid from OECD countries, the World Bank, or the International Monetary Fund is usually calculated on an annual basis. This inevitably produces misunderstandings when foreign media are interpreting China’s foreign aid. They may view the total amount of Chinese loans over several years as the amount for one year, thereby exaggerating China’s aid and loans to African countries. In addition, China’s currency is the renminbi (RMB), while the international community’s common currency is the U.S. dollar. As a result, the media often takes the amount expressed in renminbi (RMB) as the U.S. dollar amount, which obviously exaggerates China’s amount of aid to African countries.

第一,中国对非援助和投资金额被夸大。在援助金额方面,2000年,在北京举行的中非合作论坛上,中国做出了同“重债穷国减债计划”大体相同的承诺,减少或免除非洲最不发达国家以及重债穷国的债务。随后,中国更是择机免除重债穷国到期而无法偿还的政府债务。与其他国家不同,中国政府通常是以贷款的形式向非洲国家进行援助。在对外宣布提供贷款的时候,经常使用三年或者更长的时间年限,而经合组织(OECD)国家、世界银行或国际货币基金组织的援助通常是按年度计算的。因此,国外媒体在解读中国对外援助时难免会产生误解,把中国数年的贷款数额当作是一年的贷款数额,进而夸大中国对非洲国家的援助贷款。此外,中国的货币单位是人民币,而国际社会通用货币单位是美元,这经常使媒体误把人民币元当成美元,中国对非洲国家的援助金额被明显夸大了。

In terms of investment volume, the European Union (EU) and the United States are still the main sources of direct investment to sub-Saharan African countries. In 2012, the EU and the United States accounted for 26% and 9% respectively of the total foreign direct investment inflows to the region, while China’s foreign direct investment accounted for only 1.5% of the GDP of sub-Saharan African countries in 2012. In 2013, the volume of Chinese direct investment to sub-Saharan African countries reached $3.1 billion, accounting for 7% of global investment in the region. Overall, Western Europe is still the largest source of capital investment in Africa, with an investment of $30.1 billion in 2015, accounting for 45% of the African market share. The United States is the largest source of foreign direct investment projects in Africa, and its stock of direct investment in Africa far exceeds that of China. In fact, in 2016, China’s direct investment stock in Africa was $40 billion, ranking behind the United States ($57 billion), the U.K. ($55 billion), and France ($49 billion), only the fourth largest investor in the world. Moreover, the total stock of direct investment in Africa of the top three countries, the United States, the U.K., and France ($161 billion), exceeds the total stock of direct investment in Africa from the fourth-place to tenth-place countries and regions ($144 billion). By 2017, the Chinese stock of direct investment in Africa was $43 billion, dropping to fifth place. France, the Netherlands, the United States, and the U.K. occupy the top four places, and their combined total stock of direct investment in Africa reached $223 billion, while the total of the fifth- to tenth-ranked countries and regions was only $146 billion. This shows that, compared with the EU and the United States, China’s share of foreign direct investment in Africa is very small.

就投资额而言,在流入撒哈拉以南非洲国家的直接投资中,欧盟和美国仍然是主要的投资来源。2012年欧盟和美国分别占该地区外国直接投资流入总额的26%和9%,而2012年中国对外直接投资占撒哈拉以南非洲国家国内生产总值的比例仅为15%。2013年,中国对撒哈拉以南非洲国家的直接投资流量达到31亿美元,占全球在该地区投资的7%。总体来看,西欧仍是非洲最大的资本投资来源地,2015年投资达301亿美元,占非洲市场份额的45%ꎻ美国是非洲外国直接投资项目的最大来源国,对非洲直接投资的存量远超中国。实际上,2016年中国对非洲直接投资存量为400亿美元,排名位居于美国(对非投资额570亿美元)、英国(550亿美元)和法国(490亿美元)之后,仅为世界第四。而且,排名前三的美、英、法三国对非洲直接投资存量的总额(1610亿美元),已经超过排名第四至第十的国家和地区对非洲直接投资存量的总额(1440亿美元)。而到2017年时,中国对非洲直接投资的存量为430亿美元,排名降至第五ꎻ法国、荷兰、美国和英国占据前四位,上述四国对非直接投资存量的总额达到2230亿美元,而排名第五至第十的总额仅为1460亿美元。由此可见,相比于欧盟和美国,中国在非洲吸引的外国直接投资中所占的份额很小。

Second, when the opportunity presents itself, China has chosen to restructure Africa’s debt or cancel the loans, rather than seizing the assets of African countries. It is true that China has increased its aid loans to Africa in the past decade. In some African countries, such as Angola, Ethiopia, Kenya, and Sudan, China also accounts for a relatively high proportion of foreign debts. As a result, some analysts worry that the Chinese government will take advantage of these debts to implement “debt-trap diplomacy.” An example they often cite is that, because the Sri Lankan government was unable to repay its sovereign debt to China, it had no choice but to sign a 99-year lease with the Chinese government, leasing Hambantota Port to China and thereby losing control of the port. They worry that China will restructure its debts in Africa in a similar manner and gain control of a certain project or sector.

第二,中国择机重组债务或放弃贷款,而不是占有非洲国家资产。的确,近十年来,中国确实增加了对非洲的援助贷款。在一些非洲国家,如安哥拉、埃塞俄比亚、肯尼亚和苏丹的外债中,中国所占的比例也较高,于是就有一些分析人士担心中国政府会借助这些债务来推行“债务陷阱式外交”。他们经常引用的一个例证就是,由于斯里兰卡政府无力偿还对华主权债务,不得不和中国政府签订了为期99年的租约,把汉班托塔港 (Hanbantota Port) 租给中国,从而丧失了对该港口的控制。他们担心中国也会对它在非洲的债务进行类似的重组,进而取得对该项目或领域的控制权。

However, the above-mentioned accusations ignored the 84 cases over the past decade in which China restructured debts or forgave loans without taking possession of assets, including its third restructuring of Ethiopian debts. At the same time, they also ignore the case of Venezuela. When Venezuela’s economy collapsed and it defaulted on its debts, China did not take over its state-owned assets.

然而,上述指责忽略了过去十几年间中国重组债务或放弃贷款而没有占有资产的84起案例,这其中包括了对埃塞俄比亚债务的第三次重组。同时,他们也无视了委内瑞拉这个案例,在委内瑞拉经济崩溃、债务破产时,中国并没有接管其国有资产。

Third, China’s aid is concentrated in sectors such as infrastructure construction, agriculture, and food production. With regard to the African countries and sectors aided by China, many analysts have accused China of being motivated by its own energy needs when providing investment and aid, rather than by its consideration of the host country’s social and economic development needs. But the facts show otherwise. First, the funds from China’s aid to Africa are used for a wide range of purposes and are not focused on a specific project or field. China’s aid mainly focuses on infrastructure construction (such as bridges, roads, and railways), agriculture and food production, healthcare and sanitation, education, and human resource development. Among Chinese aid to Africa from 2000 to 2013, social infrastructure, economic infrastructure, productive sectors, and government fiscal support accounted for 10.0%, 48.9%, 12.2%, and 28.9% respectively. By the end of 2016, construction, manufacturing, finance, and scientific research and technology services accounted for 66.0% of total Chinese investment in Africa. Second, the Chinese government’s loans and aid to resource-intensive countries are not significantly larger than those to countries with scarce resources. In 2006, the proportion of Chinese investment in African countries without oil or mineral resources was 38.6%, which rose to 58.4% in 2016, and the proportion of investment in resource-poor countries increased from 19.6% to 31.4%. The Chinese government’s lending and aid to African countries are mainly based on the actual needs of the specific country, and its reasoning for providing aid is strictly based on social, economic, and political benefits the investment may bring, rather than a country’s abundant reserve of resources. In terms of the destination of loan funds, China’s policy banks generally only provide the funds for the loan. As for which projects these loans are used for, it is up to the debtor countries themselves to decide. For example, China provided assistance to a public housing project in Botswana and a drainage project in Mauritius according to the needs of the African side. Much of China’s lending has focused on Africa’s infrastructure and power sectors, which are essential to Africa’s long-term industrialization and economic growth. For most developing countries that receive aid, aid for the infrastructure sector can attract more foreign direct investment, acting as a lever for unlocking more investment, which promotes a virtuous circle of national savings and investment. In fact, China’s loans and aid to African countries have promoted the economic growth of these countries.

第三,中国的援助集中于基础设施建设、农业和粮食生产等领域。就中国对非援助的国家和领域而言,不少分析人士指责中国的对外投资与援助更多的是受自身能源需求的驱动,而不是出于东道国社会和经济发展需要的考量。但事实并非如此。其一,中国对非洲援助的资金用途广泛,并没有集中于某一特定的项目或领域。中国提供的援助主要集中在基础设施建设(如桥梁、公路、铁路等)、农业和粮食生产、医疗卫生、教育以及人力资源开发等领域。在2000年至2013年中国对非援助中,社会类基础设施、经济类基础设施、生产性部门和政府财政支持援助占比分别为100%、489%、122%和289%。截至2016年末,建筑业、制造业、金融业和科学研究技术服务业在中国所有对非洲投资中总计占比达660%。其二,中国政府对资源丰富的国家的贷款与援助并没有显著地多于那些资源贫乏的国家。2006年,中国对非洲非石油矿产国家的投资比重为386%,2016年升至584%,其中对资源贫乏国家的投资比重从196%增长到314%。中国政府对非洲国家的放贷与援助主要是基于该国的实际需求,且有严格的社会效益、经济效益、政治效益论证,而不是其资源的丰富程度ꎻ在借贷资金的流入领域方面,中国的政策性银行一般只提供借贷的额度。至于这些借款用于哪些项目,则由债务国自己决定,例如,中方根据非方的需求,对博茨瓦纳的公共住房项目和毛里求斯的排水工程施以援助。中国的贷款大多集中在非洲的基础设施和电力部门,这些部门对非洲长期的工业化和经济增长是必不可少的。对于大多数发展中的受援国来说,来自基础设施领域的援助可以吸引更多的外国直接投资,起到吸引投资的杠杆作用,并且促进国民储蓄与投资的良性循环。实际上,中国对非洲国家的贷款与援助促进了非洲国家的经济增长。

This shows that, whether in terms of the amount of the Chinese government’s aid or loans to African countries, the sector in which China invests, or the consequence of debtor countries’ failure to repay their debts, the reality belies the accusation from certain Western observers: that the Chinese government has been providing large-scale aid and loans to some key projects or sectors in African countries, and when the host country is unable to repay its debts, it will force the debtor country to hand over control of these key projects or sectors to China. On the contrary, China’s loans to Africa only account for a small part of Africa’s total debt, and China’s aid, loans, and investment are not concentrated in certain specific countries and specific sectors, but are widely scattered. From this, it can be seen that these accusations are baseless.

由此可见,无论是从中国政府对非洲国家援助或贷款的额度、行业领域,还是债务国未能偿债的结果而言,实际上并不像部分西方人士所指责的那样:中国政府对非洲国家的一些关键项目或行业领域进行大规模援助与贷款,直至东道国无力偿还债务,然后迫使其将那些关键项目或行业领域的控制权移交给中国ꎻ相反,中国对非洲的借贷只占非洲债务总额的一小部分,而且中国的援助、贷款与投资并没有集中于某些特定的国家及特定的行业领域,它是分散的。由此可见,相关指责在事实上并不成立。

(ii) China’s investment in Africa is mainly driven by business activities

(二) 中国的对非投资主要是企业行为

In their second accusation, some Western politicians and analysts argue that most of the Chinese-funded enterprises investing in Africa, especially large enterprises, are state-owned enterprises controlled or managed by the Chinese government. These subsidized state-owned enterprises enjoy an advantageous position when engaging in market competition in Africa, and thus may easily obtain dominant positions in certain projects or sectors. Since most of these enterprises are managed or controlled by the Chinese government, when the host country obtains financing from these enterprises, it is actually receiving financing from the Chinese government, and the acquisitions by Chinese enterprises actually become acquisitions by the Chinese government. In fact, such an accusation ignores the changes in the investments of Chinese enterprises in Africa over the past ten years. Whether in terms of the nature of Chinese-funded enterprises or the improvement of their competitiveness, the above accusations are unfounded.

在第二条指责中,部分西方政客和分析人士认为,在非洲进行投资的中资企业,尤其是大型企业大多数是中国政府控制或管理的国有企业,这些受补贴的国有企业在非洲的市场竞争中处于优势地位,进而易于取得某些项目或行业领域的主导权ꎻ由于这些企业大多是由中国政府管理或控制的,所以当东道国向这些企业进行融资时,实际上是在向中国政府进行融资,企业的收购行为实际上也成了中国政府的收购行为。事实上,他们丝毫没有看到近十几年来中国企业在非洲投资的变化。无论是从中资企业的性质,还是竞争力的发展而言,上述指责都不能成立。

First, private enterprises are the main source of Chinese investment in Africa. In terms of the nature of the enterprises, the Chinese enterprises investing in Africa are mainly private enterprises. Since 2004, the Chinese government has adopted a series of measures aimed at promoting private Chinese enterprises to invest overseas, and in the face of climbing labor costs at home, many private enterprises have gradually relocated to countries with lower wages, including many countries in sub-Saharan Africa. In the process of “Going Global” (走出去) of private Chinese enterprises, fueled by factors such as production costs and market potential, private Chinese enterprises’ investment in Africa has been growing rapidly. In 2002, among the 21 direct investment projects of Chinese enterprises in Africa, only four belonged to private enterprises. By 2013, 1217 of the 2282 projects were private projects, accounting for 53% of the total. Even at the height of the global financial crisis in 2009, 66 of the roughly 70 manufacturing projects of Chinese enterprises in Africa were privately owned. Private investment accounts for about 45% of China’s total foreign direct investment. In 2017, McKinsey conducted a survey in eight African countries and found more than 10000 Chinese-funded enterprises in these countries, 90% of which were private enterprises. In Nigeria, the proportion of private enterprises was 95%. Even in Angola, an important source of oil for China, the proportion of private enterprises was 75%. According to statistics from the Ministry of Commerce of China, by the end of 2017, there were 3413 Chinese enterprises investing in Africa, including more than 2000 private enterprises. Although the above statistics come from different sources, and there might be slight differences in the number of non-private Chinese enterprises, it is an indisputable fact that private enterprises, rather than state-owned enterprises, represent the main source of China’s investment in Africa.

第一,私营企业是中资投资非洲的主力军。在企业性质方面,对非洲投资的中国企业主要以私营企业为主。2004年以来,中国政府采取了一系列旨在促进中国私人企业对海外投资的措施,而且面对国内不断上升的劳动力成本,许多私营企业已经陆续迁往工资水平较低的国家,其中包括不少撒哈拉以南的非洲国家。在中国私营企业“走出去”过程中,基于生产成本、市场潜力等因素,中国私营企业对非洲的投资迅猛增长。2002年,在21家中国企业对非直接投资项目中,只有4家属私营企业ꎻ到2013年时,2282个项目中有1217个项目是私人项目,占总项目的53%ꎻ即使在2009年全球金融危机最严重的时候,中国企业在非洲约70个制造业项目中,就有66个为私人所有。私人投资约占中国对外直接投资总额的45%。麦肯锡集团 (McKinsey) 在2017年调查了非洲8个国家,在这些国家中资企业超过1万家,其中90%为私营企业ꎻ在尼日利亚,私营企业比重达到95%ꎻ即使在中国重要的石油来源国安哥拉,私营企业的比重也达到了75%。另据中国商务部统计,截至2017年末,中国在非洲投资的企业有3413家,其中民营企业超过2000家。虽然上述数据统计来源不同,在非私营中企数量有不同程度的差异,但一个不争的事实是,私营企业是中国对非投资的主体,而非国企。

Second, for Chinese enterprises with overseas investment, their competitiveness is endogenous to them, rather than mainly derived from the support of the Chinese government. The increased competitiveness of Chinese enterprises is not due to preferential loans or export credit subsidies alone, but to the combined influence of a variety of factors. As far as external factors are concerned, on the one hand, the new changes in the world economic environment since 2008 have not only posed challenges to the overseas investments by Chinese enterprises, but also presented opportunities. Under the impact of the economic crisis, foreign direct investment from developed countries has decreased, and, one after another, they have changed their development strategies to focus on their domestic markets. This has expanded the window of opportunity for Chinese enterprises to invest directly in Africa and enhanced the competitiveness of Chinese enterprises. On the other hand, the Chinese government has adopted a number of reform measures in recent years, including streamlining the approval procedures for foreign investment and relaxing foreign exchange restrictions on foreign investment. These measures have made the domestic environment more favorable to Chinese enterprises’ foreign direct investment and reduced the cost of Chinese enterprises to “Go Global.” Moreover, the high domestic savings rate in China affords these enterprises with relatively low domestic financing costs, equipping them with strong financing capabilities and opportunities. Looking at internal factors, on the one hand, as China continues to integrate deeply into economic globalization, Chinese enterprises themselves are constantly improving and reforming their modern enterprise system, and their personnel training, brand strategy, and management levels have greatly improved. Chinese enterprises are placing more emphasis on the development of global core competitiveness than ever before. On the other hand, Chinese enterprises entered the African market and began to conduct business cooperation a long time ago. Many of them have been dealing with the African market for 20 to 30 years. They are very familiar with local African markets and customs. Therefore, they have a clear understanding of the needs of African people in the project bidding process, so it is easier for them to win the bidding.

第二,中国对外投资企业的竞争力是内生的,而非主要源于中国政府的支持。中国企业竞争力的提升,并不仅仅是凭借优惠贷款或出口信贷补贴,而是受多种因素的综合影响。就外部因素而言,一方面,2008年以来世界经济环境的新变化既给中国企业海外投资带来了挑战,同时也带来了机遇。发达国家受经济危机的影响,对外直接投资减少,纷纷转变发展战略,开发国内市场,这为中国企业在非洲直接投资扩大了机会窗口,提升了中国企业的竞争力水平。另一方面,近年来中国政府采取了多项改革措施,包括减少对外投资的审批程序和放宽境外投资的汇兑限制等,这些措施改善了中国企业对外直接投资的国内环境,降低了中国企业“走出去”的成本ꎻ而且,中国国内的高储蓄率使得这些企业在国内进行融资的成本比较低,具有较强的融资能力和融资机会。就内部因素而言,一方面,随着中国不断深度融入经济全球化,中国企业自身也在不断地完善现代企业制度改革,其人才培养、品牌战略和管理水平也有了很大的提高,中国企业比以往任何时候都更加重视发展全球核心竞争力。另一方面,中国的企业在很早前就进入非洲市场,进行业务合作,许多经营者甚至在非洲国家工作了二三十年,他们对非洲的当地市场和风土人情等都非常了解,所以在项目的竞标中更能清楚地知道非洲人民的需求,因而也更容易中标。

In summary, over the past ten years, the nature and competitiveness of Chinese enterprises investing in Africa have undergone great changes. Among the Chinese enterprises investing in Africa, state-owned enterprises do not occupy a dominant position. These enterprises are mainly private, and the proportion of private enterprises is still growing. The increase in the investment competitiveness of Chinese enterprises in Africa is not mainly due to the support of the Chinese government. The government has only provided a good environment to help enterprises expand their investment in Africa, but enterprises are the main entities and implementers who are developing the African market, and their own capacity-building has played a fundamental role. Therefore, Chinese enterprises have obtained business opportunities in the African market not only due to the government’s advocacy and facilitation, but also thanks to a combination of internal and external factors such as changes in the African investment market and Chinese enterprises’ internal reforms.

综上所述,近十几年来,在非洲投资的中国企业无论是其性质,还是其竞争力都发生了很大的变化。在非洲投资的中国企业中,国有企业并不占据主导地位,主要是以私营企业为主,并且仍处于继续增长中。中国企业在非洲投资竞争力的提升,并不是主要源于中国政府的支持。政府仅是为企业扩大对非投资提供了良好的外部环境,而企业者是开拓非洲市场的主体和实施者,后者的自身能力建设起到了根本性作用。因此,中企在获得非洲市场商机,不仅仅在于政府的倡导与推动,更在于非洲投资市场的变化及中国企业自身改革等内外综合因素。

As mentioned above, some Western media have given exaggerated descriptions of China’s “debt trap” for Africa and concocted a story of China’s holding countries hostage by debt. In fact, this reflects their uncertainty, anxiety, and fear with regard to China’s significantly increased influence in Africa. But such accusations are just conjectures, not facts. In the words of the African Development Bank President Akinwumi Adesina: “China is not trying to ensnare African countries into a ‘debt trap’, but is rather providing vital investment along with other countries.”

如上所述,部分西方媒体大力渲染中国对非造成“债务陷阱”,炮制中国债务绑架等言论,实际上体现了他们对中国在非洲影响力显著增强而产生的纠结、焦虑和恐惧心态,相关指责仅是臆断,而非事实。正如非洲开发银行行长阿金文米阿德西纳 (Akinwumi Adesina) 所言: “中国并没有试图把非洲国家带入‘债务陷阱’,而是在与其他国家一道提供至关重要的投资。”

Suggestions for China to Respond Rationally to the So-Called “Debt-Trap Diplomacy”

理性回应中国对非所谓“债务陷阱式外交”的相关建议

In order to address the argument that China is conducting “debt-trap diplomacy” toward Africa, it is necessary to locate the reasons for the accumulation of Africa’s foreign debt. The current heavy external debt burden on African countries is not only due to long-term accumulation and historical causes, but also shaped by other factors such as economic growth rates, debt management capabilities, and changes in the international economic environment. There is no doubt that China’s investment in and development cooperation with Africa will not exacerbate the debt burden of African countries and will not drag Africa into a “debt trap.” Some Western media’s accusation that China is carrying out “debt-trap diplomacy” in Africa, has ignored the real story of China’s aid and investment in Africa. Therefore, this is an invalid accusation against China. To address such an accusation, China must respond rationally, focusing on two aspects.

欲辨明中国对非“债务陷阱式外交”言论的真伪,需找准非洲外债形成的原因。非洲国家当下沉重的外债负担既有长期累积和遗留下来的历史原因,也受到自身经济增速、债务管理能力、外部国际经济环境变化等现实因素的影响。毫无疑问,中国对非投资和发展合作,并不会加剧非洲国家的债务负担,没有把非洲拖入“债务陷阱”。一些西方媒体对中国在非洲推行“债务陷阱式外交”的指责,罔顾了中国在非洲援助和投资的事实,是对中国的不实指控。对此,中方需从两方面理性应对。

First, we must take a more in-depth reexamination of China’s aid and investment activities in Africa and explore ways to optimize aid and investment in Africa, especially by broadening and deepening cooperation with African countries across multiple fields. Since the beginning of the twenty-first century, at both the official and non-governmental levels, exchanges and interactions between China and Africa have become increasingly frequent, further enhancing the willingness of Chinese enterprises to invest in Africa and deepen cooperation. Although the fields of Chinese investment in Africa are widely distributed across various industries, covering construction, transportation, manufacturing, mining, finance, business services, agriculture, and other fields, the construction, mining, and manufacturing industries are still the sectors where China has the highest investment stock. This may lead Western media into tunnel vision, focusing only on the energy field and interpreting the implications of Chinese investment one-sidedly. Although this is a false accusation, it does point to the fact that China still needs to further diversify its investment fields and projects in Africa and deepen multi-level cooperation with African countries and enterprises.

第一,对中国在非洲的援助和投资活动进行更深入的思考,探讨对非洲援助和投资的优化路径,尤其是拓宽和深化与非洲国家多领域、深层次的合作。进入21世纪以来,无论是在官方还是在民间层面,中非之间的交流互动日益频繁,进一步增强了中国企业投资非洲、深化合作的愿望。尽管中国在非洲的投资领域中各行业分布广泛,涵盖建筑业、交通运输、制造业、采矿业、金融业、商务服务业、农业等各个领域,但建筑业、采矿业和制造业仍然是中国对非投资存量最高的行业,由此易被一些西方媒体选择性失明,聚焦能源领域,加以片面解读。虽然这是一种不实的指责,但这也从侧面说明了中国在非洲的投资领域和项目仍需进一步多样化,深化与非洲国家和企业的多层次合作。

At the enterprise level, Chinese enterprises should strengthen their ability to assess investment risks in host countries, such as debt risks and political risks, to dilute or avoid investment risks. For an individual enterprise, expanding its field of investment is an effective means to avoid risk. Taking a long-term perspective, Chinese enterprises need to develop diversified trade and investment channels and increase investment in fields not related to energy resources, such as fisheries, agriculture, food processing, manufacturing, and the electricity sector. Deepening multi-level cooperation and diversifying investment and aid across sectors and projects will not only help Chinese enterprises dilute the risks of investment or aid, but also help upgrade goods exported by African countries, transitioning them from primary processed products to products with added value. To a certain extent, this can also dispel the Western countries’ misunderstanding over China’s investment and aid in Africa.

在企业层面,中国企业应该加强对东道国的债务风险和政治风险等有关投资风险的评估能力,分散或规避投资风险。对于单个企业而言,扩展投资的领域是规避风险的有效手段。从长远角度看,中国企业需发展多元化贸易投资,在非能源资源领域,如渔业、农业、食品加工、制造业和电力部门等领域增加投资。深化多层次合作,增加投资与援助领域或项目的多样化,这不仅有助于中国企业分散投资或援助的风险,而且还有助于提高非洲国家的出口商品类型由初级加工产品向附加值增值产品转变,也能在一定程度上减轻西方国家对中国在非洲投资与援助的误读。

At the government level, we should improve the effectiveness of aid to Africa, and rationalize aid distribution to matching sectors. As a large developing country, China also has a great demand for funds to fuel its own economic and social development, so we should also better manage and utilize the precious aid funds directed to Africa. The industrial sectors receiving aid should be selected based on the actual development needs of African countries and enhance the “blood generating” (造血, metaphorically the process of creating something new, alive, and dynamic) function in the development of African countries. Economic infrastructure sectors and productive industries relevant to the people’s livelihood should become the focus points and priority areas of China’s aid to Africa. First, China should increase its aid and cooperation in the agricultural field in Africa. China’s experience in agricultural development can be a useful reference for African countries. Vigorously developing agriculture is the key to lifting oneself from poverty, increasing income, and achieving economic growth for most low-income countries in Africa. Increasing aid to African countries for agriculture and food security will not only improve the people’s livelihood and enhance the ability of these countries to develop independently, but also allow them to lay the foundations for their industrial development. Second, China should continue to deepen its aid in economic infrastructure such as roads, ports, and industrial parks to help African countries improve conditions for economic development, enhance their ability to attract investment, increase their economic vitality, and improve their self-development capabilities. In fact, foreign direct investment and aid play an important role in the economic development and debt reduction of African countries. China should promote the sustainable development of African countries through aid and investment, so as to use the outstanding development performance of African countries to disperse the false accusations made by Western media concerning China’s so-called “neo-colonialism.”

在政府层面,应进一步提升对非洲的援助有效性,合理配置援助的行业领域。中国作为发展中的大国,自身经济与社会发展对资金也有大量的需求,对于宝贵的对非援助资金应更好地管理与使用。援助的行业领域要基于非洲国家发展的实际需要,增强非洲国家发展的“造血”功能。有关民生的经济基础设施部门、生产性行业应该成为中国援助非洲的重点和优先领域。首先,中国首先应该加大对非农业领域的援助与合作。中国的农业发展经验对非洲国家具有较高可借鉴性。大力发展农业是非洲多数低收入国家脱离贫困、增加收入和实现经济增长的关键。加大对非洲国家农业和粮食安全的援助,不仅能够推动民生改善,增强其自主发展的能力,还能为其工业的发展积蓄力量。其次,中国应继续深化在公路、港口和工业园区等经济基础设施领域的援助,帮助非洲国家改善经济发展的条件,增强其招商引资的能力,增进经济活力,提高非洲国家的自身发展能力。事实上,外国直接投资与援助对非洲国家的经济发展和减债具有重要作用,中国应该通过援助和投资来促进非洲国家的可持续发展,以非洲国家的良好发展业绩来证伪一些西方媒体对中国所谓“新殖民主义”的不实指责。

Second, we should strengthen communication and external publicity efforts with African countries and Western media, thereby enhancing China’s soft power. We live in an era of information diversity, so false reporting is not uncommon. However, the deliberate spread of false or misleading information has sharply increased over the past few decades. The emergence of this situation is both the result of the progressive development of media technology (such as TV, Internet, radio, and news media) and, at the same time, the fact that those trying to deliberately mislead public opinion are using channels such as social media (自媒体) and relying on increasingly sophisticated technical means to spread erroneous information. Although the investment of Chinese enterprises in Africa has improved the level of infrastructure construction in African countries, played a positive role in the transformation of the industrial structure of African countries, and significantly promoted the economic development of African countries, some people in the media still ignore such facts and accuse China of creating a “debt trap” in Africa with its investment and aid, creating hype over China’s “debt trap diplomacy.” Whether such misleading accusations are spread unintentionally or with ulterior motives, they have not only distorted the image of the Chinese government, but also, to a certain extent, arouse the vigilance and hostility of other countries towards the overseas investments of Chinese enterprises. This has had a serious negative impact on Chinese enterprises’ endeavors to go abroad and explore overseas markets.

第二,加强与非洲国家和西方媒体的沟通和外宣工作的力度,增强软实力建设。我们生活在一个信息多元化时代,不实报道并不少见。但是,在过去几十年里,蓄意传播虚假或误导信息的行为激增。这种状况的出现既是传媒技术(如电视、互联网、广播和新媒体)不断发展的结果,同时也由于那些故意误导舆论者利用自媒体等渠道,凭借愈发老练的技术手段,传播一些错误信息,以期影响舆情。尽管中国企业在非洲的投资提高了非洲国家的基础设施建设水平,对非洲国家产业结构的转型发挥积极作用,显著地促进了非洲国家经济的发展,但仍有部分媒体人士罔顾事实,指责中国的投资与援助正在非洲制造“债务陷阱”,中国“债务陷阱式外交”甚嚣尘上。这种误导性指责不管是无意的,还是别有用心的传播,不仅歪曲了中国政府的形象,而且还在一定程度上引起了其他国家对中国企业进行海外投资的警惕与敌视,对中国企业走出国门、开拓海外市场造成了严重的负面影响。

Misunderstandings and criticism are often the products of information asymmetries. To address this, it is necessary for China to further strengthen the building of soft power and spread information about its aid and investment in Africa through multiple channels. At the government level, on the one hand, China should focus on using the China International Development Cooperation Agency as the mainstay to further improve mechanism design for African aid work, and form a more complete chain of feasibility investigation and research before foreign aid decision-making, feedback on the aid implementation process, evaluation of aid recipient countries, and assessment of aid’s effects and impacts. We should also ensure the prompt release of foreign aid information reports, so as to alleviate or eliminate doubts from African countries and Western media. On the other hand, China can further strengthen cooperation with international organizations or other countries regarding aid to Africa, pursue more exchanges with them, enhance mutual understanding, increase trust and dispel doubts, and reduce their misunderstandings of China’s aid to Africa.

误解和非议往往是信息不对称的产物。为此,中国有必要进一步加强软实力建设,多渠道宣介对非援助和投资情况。在政府层面,一方面,中方应以中国国家国际发展合作署为主,进一步完善对非援助工作的机制建设,对外援助决策前的可行性调查研究、援助实施过程情况的反馈、受援国评价以及援助效果和影响的评估等环节,形成一条更加完整的链条,并不定期的发布对外援助的信息报告,减轻或消除非洲国家和西方媒体的疑虑。另一方面,中方可进一步加强与国际组织或其他国家在援非领域的合作,扩大同它们的交流,增进彼此之间的了解,增信释疑,减少它们对中国援助非洲的误解。

At the enterprise level, on the one hand, Chinese enterprises in Africa should further strengthen their research and understanding of the laws and social norms of host countries, abide by local laws, regulations, and customs, actively integrate themselves into the local environment, find areas where the interests of the enterprises and those of the host country meet, adjust business strategies according to local social conditions and public opinion, and provide products and services that local people truly need. On the other hand, Chinese enterprises should strengthen ties with NGOs and the media, increase the transparency of their business activities in host countries with data and facts, and effectively improve the credibility and effectiveness of information release, thereby alleviating or eliminating external suspicions, and preventing the spread of rumors or misinformation. Moreover, Chinese-funded enterprises should pay attention to fulfilling their corporate social responsibilities in host countries, be mindful of giving back to society in the process of production and operation, attach importance to the recruitment of local workers, provide them with good skills training, improve their competitiveness, and promote the improvement of their living standards, so as to build a corporate image featuring openness and mutually beneficial cooperation.

在企业层面,一方面,中国在非洲的企业应进一步加强对东道国的法律和社会规则的研究与理解,遵守当地的法律法规和风土人情,积极融入当地的环境,找到企业与东道国利益的结合点,根据当地的社情民意调整经营策略,提供当地民众真正需要的产品和服务。另一方面,中企应该加强与非政府组织和媒体之间的联系,提高企业在东道国经营活动的能见度,以数据和事实说话,切实提高信息的传播的公信力及有效性,减轻或消除外界的猜忌,防止谣言或错误信息的扩散。而且,中资企业应该注重在东道国履行企业社会责任,在生产经营过程中注意回馈社会,注重员工的本土化,为他们提供良好的技能培训,提高他们的竞争力,从而促进他们生活水平的提高,借此塑造开放、合作共赢的企业形象。