In September and October 2013, General Secretary Xi Jinping put forward the proposal of jointly constructing a “Silk Road Economic Belt” and a 21st Century “Maritime Silk Road.” This was a major strategic decision made in close connection with the new situation of economic globalization and the deepening development of regional economic integration, in order to better integrate the domestic and international situations, better coordinate the two focuses of domestic development and opening up to the outside, and foster shared development and prosperity in the world, thereby promoting the building of a community of common destiny for humankind. BRI construction centers on regional economic cooperation along six international economic corridors, namely, the New Eurasian Land Bridge, China–Mongolia–Russia, China–Central Asia–West Asia, China–Central Asia–South Asia, China–Pakistan, and China–India–Myanmar. Adhering to development based on openness, cooperation, and win-win outcomes, and the principles of bilateral, multilateral, and regional openness and cooperation, it integrates diversified cooperation mechanisms1 at multiple spatial levels, such as “point-to-point,” “point-to-line,” “point-to-area,” “belt-to-road,” and “circle-to-line” (between economic regions and corridors). With policy communication, infrastructure connectivity, unimpeded trade, financial integration, and closer people-to-people ties as its main content and powerful tools, it seeks to jointly promote the orderly and free flow of economic factors, efficient allocation of resources, and deep integration of markets, and to join hands with the countries along its corridors (“routes”) in building a new framework for regional economic cooperation that is open, inclusive, balanced, and beneficial to all.

2013年9月和10月,习近平总书记先后提出共同建设“丝绸之路经济带”和 21 世纪“海上丝绸之路”的倡议。这是紧密结合经济全球化和区域经济一体化深入发展的新形势,为更好 统筹国内国际两个大局,更好统筹国内发展和对外开放两个着力点,促进世界共同发展繁荣, 推动构建人类命运共同体所作出的重大战略决策。“一带一路”建设围绕新亚欧大陆桥、中蒙 俄、中国—中亚—西亚、中国—中南半岛、中巴、孟中印缅六大国际经济走廊的区域经济合 作,坚持开放、合作、共赢的发展,坚持双边、多边、区域开放合作原则,融 “点”对“点”、 “点”对“线”、 “点”对“面”、 “带”对“路”、 “圈”对“线” 等多空间层次的多元化合作机制, 以政策沟通、设施联通、贸易畅通、资金融通和民心相通为主要内容和有力抓手,共同促进经济要素有序自由流动、资源高效配置和市场深度融合,与沿线国家和地区携手打造一个开放、包容、均衡、普惠的区域经济合作新构架。

Between 2013 and the present, construction of the Belt and Road Initiative (BRI) has gradually moved from the layout initiation stage to the high-quality development stage. As BRI construction continues to advance, the spillover effects of related economic security risks are becoming more and more prominent, gradually rising to become a focus of strategic competition and games among powers. In order to achieve high-quality development of the Belt and Road, China should strengthen the early prediction, accurate identification, and strong prevention of economic security risks. The vast geographical coverage and complexity of the countries and regions involved in constructing the BRI has resulted in many risks and challenges for BRI economic construction: Most of the countries along the BRI are developing countries with low levels of economic development, so there are uncertain sovereign debt risks and financial security risks; geopolitical problems in the regions along the BRI are pronounced and terrorism is frequent, which leads to threats to infrastructure construction and subsequent operation, as well as high investment risk; conflicts between multiple cultures and religions lead to certain obstacles to civil exchanges; there is a mentality in some countries of “waiting for, relying on, and requesting from others,” and China has undertaken too many construction tasks, with the risk of imbalance in the structure of investment and construction, and even negative effects on the upgrading of China’s industrial structure; and so on. Under these circumstances, China urgently needs to be guided by the concept of overall national security, deeply study the principles and methods of national economic security governance, and push BRI construction in the direction of high-quality development. By sorting out the manifestations of economic security problems in BRI construction, and systematically studying the causes of the relevant economic security problems and the political, economic, and cultural logic behind them, this paper will clarify the development objectives and international discourse expressions of BRI construction, which helps promote benefit-sharing and risk-sharing, and put forward ideas and approaches to actively address the economic security risks and challenges, thereby promoting the high-quality development of BRI construction and the modernization of national economic security governance.

2013 年至今,“一带一路”建设从启动布局阶段逐步走向高质量发展阶段。随着“一带一路”建设的持续推进,相关的经济安全风险溢出效应日益凸显,逐渐上升为大国战略竞争和博弈的焦点。为实现“一带一路”的高质量发展,中国应当加强对经济安全风险问题的提前预估、精准识别与有力防范。“一带一路”建设覆盖地域之广阔,涉及国家和地区之复杂,为“一带 一路”经济建设带来诸多风险挑战。沿线国家多为发展中国家,经济发展水平较低,存在不确定的主权债务风险以及金融安全风险;沿线区域的地缘政治问题突出,恐怖主义多发,导致基础设施建设及其后期运营面临威胁,投资风险偏高;多种文化和宗教的冲突导致民间交流受到一定阻碍;一些国家存在“等靠要”思想,我国承担过多建设任务,存在投资建设结构失衡的风险,甚至对我国产业结构升级产生负面效应,等等。在此情形下,我国亟须以总体国家安全观为指导,深入研究国家经济安全治理的原则和路径,推动“一带一路”建设走向高质量发展。本文通过梳理“一带一路”建设中经济安全问题的表现,系统研究相关经济安全问题的产生原因及其背后的政治、经济、文化逻辑,明确“一带一路”建设的发展目标和国际话语表达,促进利益共享和风险共担,提出积极应对经济安全风险与挑战、推动“一带一路”建设高质量发展和国家经济安全治理现代化的思路和对策。

I. Situation and Development Characteristics along the BRI

一、“一带一路”沿线情况与发展特征

The BRI Initiative (BRI) has driven countries and regions along its routes to expand their development space through innovative cooperation. The “Silk Road Economic Belt” mainly consists of three direct land corridors to Europe through northwest China and Central Asian countries. The “21st Century Maritime Silk Road” starts from China’s southeastern coast and covers Southeast Asia, South Asia, West Asia and Southern Europe, reaching as far as East Africa and other countries. Under General Secretary Xi Jinping’s initiative, in order to strengthen the close ties between the economies of Eurasian countries and promote mutual cooperation, in 2015 China issued the Vision and Actions on Jointly Building the Silk Road Economic Belt and 21st-Century Maritime Silk Road, which proposes to strengthen the construction of bilateral and multilateral cooperation mechanisms, highlight the role of the relevant international forums and other platforms, and gradually realize policy communication, infrastructure connectivity, unimpeded trade, financial integration, and closer people-to-people ties.

“一带一路”倡议以创新合作带动沿线国家和地区拓展发展空间。“丝绸之路经济带”主 要包括三条陆路通道,途径中国西北和中亚国家,直抵欧洲。21世纪“海上丝绸之路”始于中国东南沿海,沿线包括东南亚、南亚、西亚和南欧,远达东非等国家。在习近平总书记倡 议下,为加强欧亚各国经济的紧密联系,促进相互合作,2015年我国发布了《推动共建丝绸之路经济带和 21 世纪海上丝绸之路的愿景与行动》,提出加强双边合作、多边合作机制建设, 突出相关国际论坛等平台作用,逐步实现政策沟通、设施联通、贸易畅通、资金融通、民心 相通。

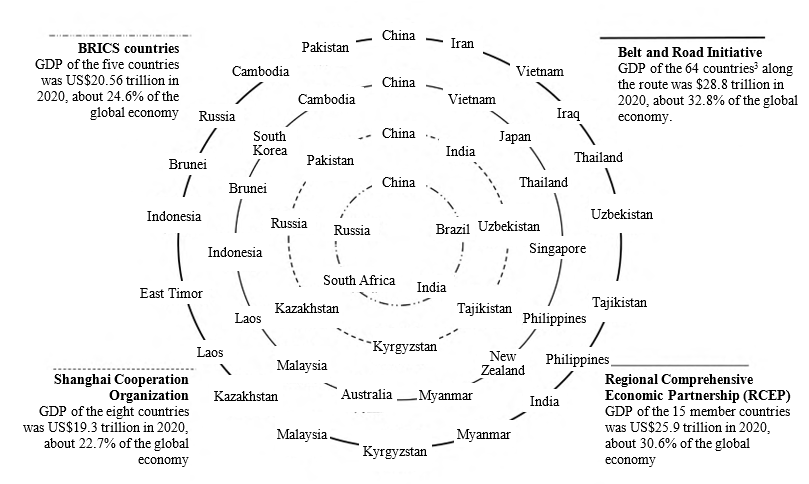

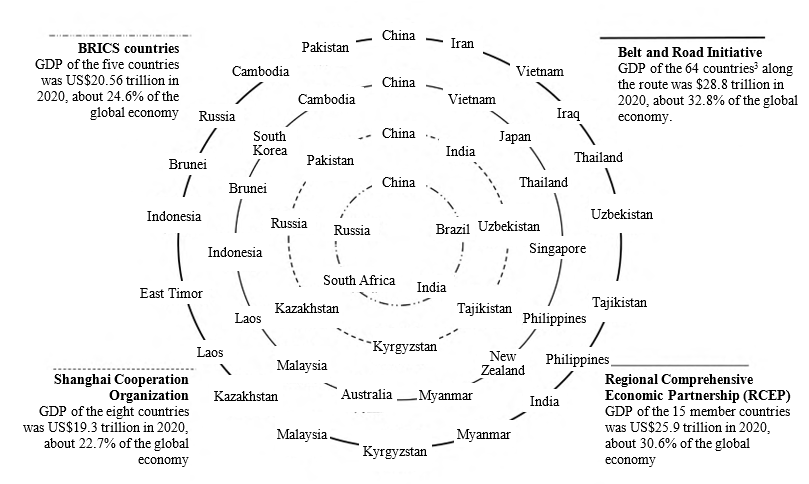

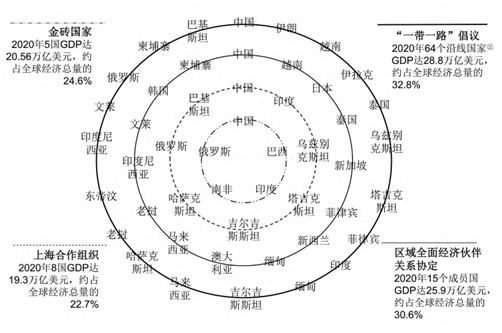

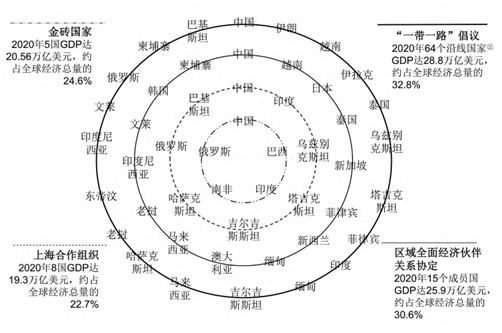

As of the end of March 2022, China had signed more than 200 cooperation documents on joint BRI construction with 149 countries and 32 international organizations, covering areas such as connectivity, investment, trade, finance, science and technology, society, culture, people’s livelihood, and the oceans. Between 2013 and May 2022, China’s trade in goods with countries along the BRI totaled about US$11.8 trillion, and direct non-financial investment by Chinese enterprises in those countries totaled over US$140 billion. The BRI’s fruitful results have created a favorable external environment for China to build a new pattern of development that takes domestic circulation as the mainstay and in which domestic and international circulation are mutually reinforcing. According to a 2019 World Bank research report, the implementation of the BRI will enable 7.6 million people in the countries concerned to escape from extreme poverty (living on less than US$1.9 per day), and 32 million people to escape from moderate poverty (living on less than US$3.2 dollars per day), and will increase total trade volume globally and of countries along the BRI by 6.2% and 9.7%, respectively, causing global income to increase by 2.9%. 2 In 2020, the combined GDP of the countries along the BRI reached US$28.8 trillion, accounting for 32.8% of the global economy, which is a higher share of the global economy than that of BRICS, Shanghai Cooperation Organization, or Regional Comprehensive Economic Partnership (RCEP) member countries (see figure 1). 3

截至 2022 年 3 月底,我国已与 149 个国家、32 个国际组织签署 200 多份共建“一带一路” 合作文件,涵盖互联互通、投资、贸易、金融、科技、社会、人文、民生、海洋等领域。2013 年至 2022 年 5 月,我国与“一带一路”沿线国家货物贸易额累计约 11.8 万亿美元,我国企业对“一带一路”沿线国家非金融类直接投资超过 1400 亿美元。共建“一带一路”取得丰硕成果,为我国构建以国内大循环为主体、国内国际双循环相互促进的新发展格局营造了良好外部环 境。世界银行 2019 年研究报告显示,共建“一带一路”倡议的实施将使相关国家 760 万人摆脱极端贫困(日均生活费低于 1.9 美元),3200 万人摆脱中度贫困(日均生活费低于 3.2 美元),使全球和“一带一路”沿线国家的贸易总额增幅分别达6.2% 和9.7%,使全球收入增幅达2.9%。 2020 年,“一带一路”沿线国家 GDP 总和达到 28.8 万亿美元,占全球经济总量的 32.8%,高于金砖国家、上海合作组织和《区域全面经济伙伴关系协定》成员国在全球经济总量中的份额(见图 1)。

Figure 1. Composition and economic size of countries along the BRI and participating countries in relevant international and regional economic cooperation organizations or agreements

图 1 “一带一路”沿线国家与相关国际区域经济合作组织或协定参与国构成及经济体量

Countries along the BRI have different degrees of national advantage in industries and fields such as energy, infrastructure, agriculture, machinery, and chemicals. Singapore’s electronics, finance, and shipping industries are well developed; Indonesia is rich in oil, natural gas, and tin resources; Iran and Iraq have oil industries as their main economic pillars; India mainly exports textiles, jewelry, machinery products, agricultural products, and minerals; Kazakhstan mainly exports minerals, and is rich in coal, iron, copper, lead, and zinc, as well as oil and gas resources; Russia mainly exports oil and natural gas; Ukraine mainly exports ferrous metals and inorganic chemical materials; Belarus is more developed in machinery manufacturing, metallurgical processing, agriculture, and animal husbandry.

“一带一路”沿线国家在能源、基础设施、农业、机械和化工等产业和领域具有不同程度的国家优势。新加坡的电子、金融和航运产业发达;印度尼西亚的石油、天然气和锡等资源丰富;伊朗和伊拉克均以石油工业为主要经济支柱;印度主要出口纺织品、珠宝、机械产品、农产品和矿产品等;哈萨克斯坦主要出口矿产品,其煤、铁、铜、铅、锌等矿产资源和油气资源丰富;俄罗斯主要出口石油和天然气;乌克兰主要出口黑色金属和无机化学材料等;白俄罗斯的机械制造业、冶金加工业、农业和畜牧业较为发达。

In going from the layout initiation stage to the high-quality development stage, BRI construction needs to further refine the development goals, clarify the development path, and highlight the development priorities. In 2018, General Secretary Xi Jinping pointed out at a symposium marking the fifth anniversary of the BRI that “in the past few years, the overall layout of Belt and Road construction has been completed, and the ‘big picture’ has been drawn. In the future, we need to focus on the key points, fill in the details, and work together to do the delicate ‘fine brushwork.’”4 At the layout initiation stage, BRI construction mainly focused on top-level design and mechanism-building, highlighting infrastructure construction, and promoting national connectivity, specifically including industrial investment, construction of industrial parks abroad, and the construction of facilities such as railroads, highways, ports, energy pipelines, and so on. At the high-quality development stage, it is necessary to strengthen refined construction management and solve key issues such as project selection, financial support, investment assessment, risk control, and security assurance.

从启动布局阶段走向高质量发展阶段,“一带一路”建设需要进一步细化发展目标、明确发展路径、突出发展重点。2018 年,习近平总书记在推进“一带一路”建设工作 5 周年座谈会上指出:“过去几年共建‘一带一路’完成了总体布局,绘就了一幅‘大写意’,今后要聚焦重点、精雕细琢,共同绘制好精谨细腻的‘工笔画’”。 在启动布局阶段,“一带一路”建设主要着眼于顶层设计和机制构建,突出基础设施建设,促进国家互联互通,具体包括产业投 资、境外产业园区建设以及铁路、公路、港口、能源管道等设施建设。在高质量发展阶段,需要加强精细化建设管理,解决好项目选择、金融支撑、投资评估、风险管控、安全保障等关 键问题。

Infrastructure is the cornerstone of promoting the high-quality development of the Belt and Road. Infrastructure construction is the priority development area in BRI construction, and its basic framework is “six corridors, six roads, and multiple countries and ports.” Economic corridors such as the New Eurasian Land Bridge can lead many countries to participate in joint economic development. With land transportation trunk routes such as the China-Europe Railway Express, sea routes such as the Indian Ocean route, and information network routes, three-dimensional channels of interconnection have been constructed, and a connectivity network has been built relying on railroads, ports, pipeline networks, etc., forming a “four-in-one” infrastructure layout of land, sea, air, and internet. To strengthen infrastructure construction and promote connectivity, BRI construction must take multinational enterprises as the main actors, industry investment as the main method, and multilateral cooperation as the principal assurance in carrying out the orderly construction of infrastructure such as road transportation, shipping routes, and information networks, and thereby achieve the interconnection of the Asian and European continents.

基础设施是促进“一带一路”高质量发展的基石。基础设施建设是“一带一路”建设的优先发展领域,“六廊六路多国多港”是共建“一带一路”的基本框架,新亚欧大陆桥等经济走廊能够引领多国共同参与经济开发。中欧班列等陆路交通主干道、印度洋航线等海上通道以及信息网络通道,构建了立体化的互联互通渠道,搭建了依托铁路、港口、管网等的联通网络, 形成了陆、海、天、网“四位一体”的基础设施布局。加强基础设施建设,推动互联互通,需要“一带一路”建设以跨国企业为推进主体,以产业投资为主要方式,以多边合作为主要保障, 有序开展道路交通、海运航线、信息网络等基础设施的建设,进而实现亚欧大陆的互联互通。

International cooperation is key to promoting the high-quality development of the BRI. China and the countries and regions along the BRI routes have a huge consumer market and momentum for sustained economic development, and they are at different stages of economic development. It is the differences in the distribution of industries and stages of development which create the expectation that China and the countries concerned will realize economic complementarity and industrial linkages. Under the BRI initiative, China adheres to the core values of mutual benefit and win-win cooperation, and actively cooperates with the BRICS countries, the ten ASEAN countries, and other Asian and European countries, either by signing memorandums of cooperation or establishing strategic cooperative partnerships, to strengthen international cooperation, enhance political mutual trust, promote diplomatic coordination, and drive the recovery of the global economy. This has created a new model of win-win cooperation and provided a new type of public good for global cooperation.

国际合作是促进“一带一路”高质量发展的关键。我国与“一带一路”沿线国家和地区 都具有庞大的消费市场和持续发展经济的动力,并且处于不同的经济发展阶段,产业分布与 发展阶段存在差异,这就决定了我国与相关国家有望实现经济互补与产业对接。在共建“一带一路”倡议下,我国秉持互利共赢这一核心价值,积极与金砖国家、东盟十国以及其他亚欧国家,或签署合作备忘录,或建立战略合作伙伴关系,加强国际合作,加强政治互信,推进外 交协同,带动全球经济复苏,开创了合作共赢的新模式,为全球合作提供了新型公共产品。

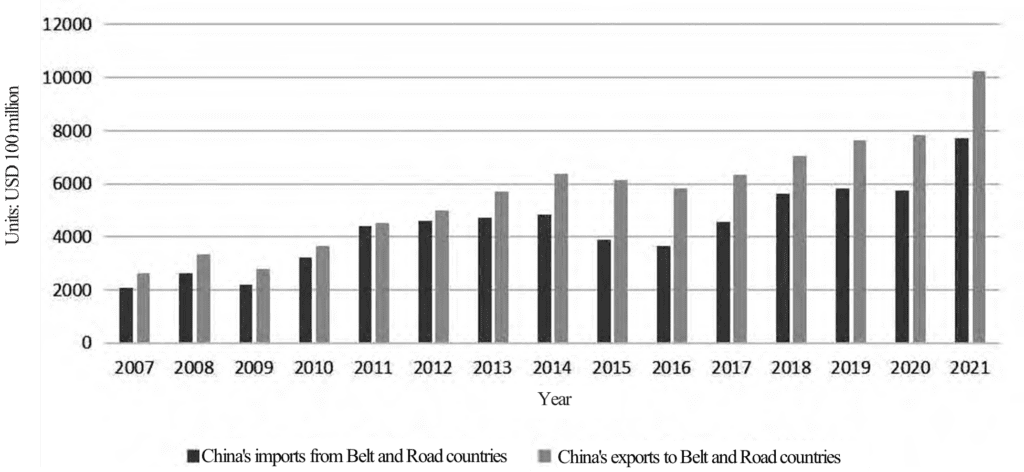

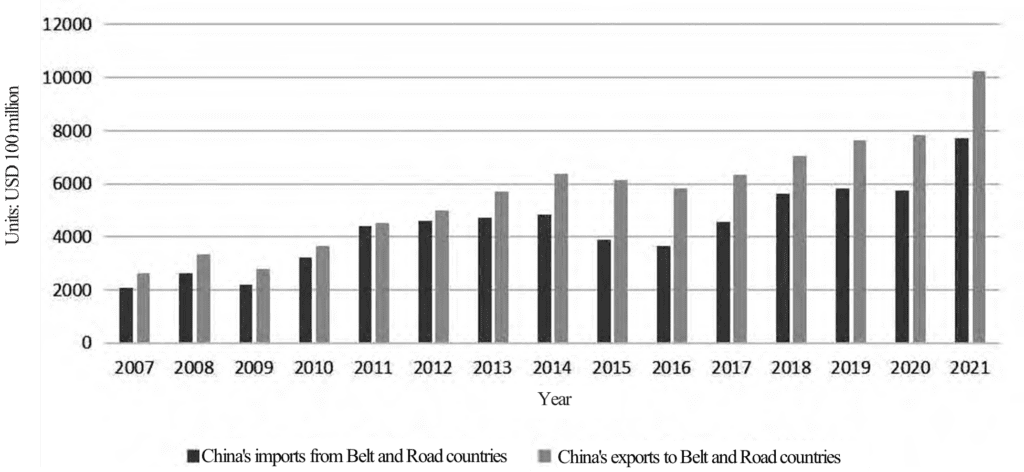

Figure 2 shows China’s trade with countries along the BRI from 2007 to 2021. China’s import and export trade with countries along the BRI has developed rapidly since 2007. In particular, China’s exports to 64 countries along the BRI have increased from US$261.9 billion in 2007 to US$1.0243 trillion in 2021, with an average annual growth rate of 20.79%. During the same period, the exports to China of the 64 countries along the BRI increased from US$207.8 billion to US$771.9 billion, with an average annual growth rate of 19.39%. In terms of trade balance, before 2005 China usually ran a deficit in trade with countries along the BRI. Since 2007, however, China has run a trade surplus with the countries along the BRI due to exports growing faster than imports. That surplus reached a new high of about US$252.4 billion in 2021. Countries along the BRI have different resource endowments: Some are rich in energy, some have broad market prospects, and some are in urgent need of infrastructure construction. Generally speaking, China and the countries along the BRI have complementary resource advantages and strong economic complementarity, and there is great potential and space for cooperation. Over the past decade, bilateral trade relationships between China and the countries along the BRI have developed rapidly, laying a solid foundation for further cooperation between those countries and China.

图 2 展示了 2007 年至 2021 年我国与“一带一路”沿线国家的贸易往来情况。自 2007 年 以来,我国与“一带一路”沿线国家的进出口贸易发展迅速。其中,我国对“一带一路”沿线64 个国家的出口从 2007 年的 2619 亿美元增长到 2021 年的 10243 亿美元,年均增长 20.79%。与此同时,“一带一路”沿线 64 个国家对华出口由 2078 亿美元增至 7719 亿美元,年均增长 19.39%。在贸易收支方面,2005 年之前我国与“一带一路”沿线国家的贸易通常出现逆差。但由于 2007 年来出口增长高于进口增长,我国与“一带一路”沿线国家实现了贸易顺差。这一顺差在 2021 年达到新高,约为 2524 亿美元。“一带一路”沿线国家的资源禀赋不同:有的国家能源丰富,有的国家市场前景广阔,有的国家急需基础设施建设。总体而言,我国与 “一带一路”沿线国家资源优势互补,经济互补性强,有很大的合作潜力和空间。过去 10 年, 我国与“一带一路”沿线国家双边贸易关系发展迅速,为我国与“一带一路”沿线国家的进一步合作奠定了坚实基础。

Figure 2. China’s trade with countries along the BRI

图 2 中国与“一带一路”沿线国家的贸易往来

The large number of countries and the complexity of geopolitical relationships make BRI construction vulnerable to geopolitical risk, that is, the direct or indirect impacts of international political actors and events on transnational corporations or key value chain partners. Such impacts can expose enterprises engaged in BRI joint construction to the risk of loss of benefits and opportunities. Wars between states, power shifts, multilateral economic sanctions and interventions, terrorist attacks, and regional tensions or rivalries between major powers can all adversely affect the normal operation of business infrastructure and enterprise supply chains. For example, in order to maintain its global hegemony, the United States has, since the Obama administration, insisted on pursuing the Asia-Pacific rebalancing strategy, and with the help of mechanisms such as the “trilateral security partnership” between Australia, the UK, and the United States (AUKUS), and the Group of Seven (G7), it has expanded the rebalancing region, from the national security alliance point of view, into “an arc extending from the Western Pacific and East Asia to the Indian Ocean region and South Asia.” Although the Trans-Pacific Partnership (TPP), which the United States led in organizing in the international economic arena, has failed to advance effectively, the United States has adopted workarounds, using high-threshold, high-standard trade rules to intervene in Asian-European economic interconnection and hinder China’s participation in global economic development. For example, using carbon tariffs, environmental subsidy taxes, green technology standards, green environmental labels, green packaging, green quarantine, green subsidies, and other means, it has practiced trade protection in the name of low-carbon development; through technical barriers, artificially raising market access thresholds, and restricting imports of products from developing countries by the United States and its Asian and European allies, it has weakened the competitiveness of products from developing countries; it has established the US-EU Trade and Technology Council (TTC), joining with its allies to curtail the technological conditions necessary for China’s development of a digital economy, and to seek monopolies on a number of technologies in the field of digital trade; and so on.

国家数量多,地缘关系复杂,使得“一带一路”建设易受地缘政治风险的影响,亦即国际上的政治行为体及各类事件对跨国公司或关键价值链合作伙伴的直接或间接影响。这种影响会使“一带一路”共建企业面临遭受利益与机会损失的风险。国家间战争、大国权势转移、多边经济制裁与干预、恐怖袭击以及地区局势紧张或大国竞争等,都会对商业基础设施、企业供 应链的正常运营带来冲击。例如,美国为维护全球霸主地位,自奥巴马政府起坚持推行亚太再平衡战略,借助美国、英国、澳大利亚“三边安全伙伴关系”(AUKUS)和七国集团(G7)等机制,从国家安全联盟的角度,将再平衡地区扩大至“从西太平洋和东亚延伸到印度洋地区和南亚的弧形地带”。虽然美国在国际经济领域牵头组织的跨太平洋伙伴协定(TPP)未能有效 推进,但采取变通手法,以高门槛、高标准的贸易规则干预亚欧经济互联互通,阻碍我国参 与全球经济发展。例如,利用碳关税、环境补贴税、绿色技术标准、绿色环境标志、绿色包 装、绿色检疫、绿色补贴等手段,以低碳发展之名,行贸易保护之实;通过技术壁垒,人为抬高市场准入门槛,限制本国和亚欧地区盟国进口发展中国家产品,削弱发展中国家产品竞争 力;成立美欧贸易和技术委员会(TTC),联合盟友遏制中国发展数字经济所必需的技术条件,寻求在数字贸易领域的多项技术垄断权;等等。

II. Assessment of BRI Construction Economic Security Risks

二、“一带一路”建设的经济安全风险研判

From layout initiation to high-quality development, the development stage of BRI construction has changed, and the spillover effects of economic security risks are increasingly pronounced, requiring China to clarify the economic security risks in construction and improve the level of refined management. The BRI crosses the Eurasian continent, connecting many Asia-Pacific and European countries. It covers a large area, involves many countries, and faces a complex social environment, which means that it will inevitably face numerous economic security risks in the construction process.

从启动布局到高质量发展,“一带一路”建设的发展阶段发生了变化,经济安全风险溢出效应日益凸显,要求我国厘清建设中的经济安全风险,提高精细化管理水平。“一带一路”横贯欧亚大陆,连接亚太与欧洲多国,覆盖面积之大、涉及国家之多、面对社会环境之复杂, 决定其建设过程中必然面临多重经济安全风险。

(i) The manifestation of economic security problems

(一)经济安全问题的表现

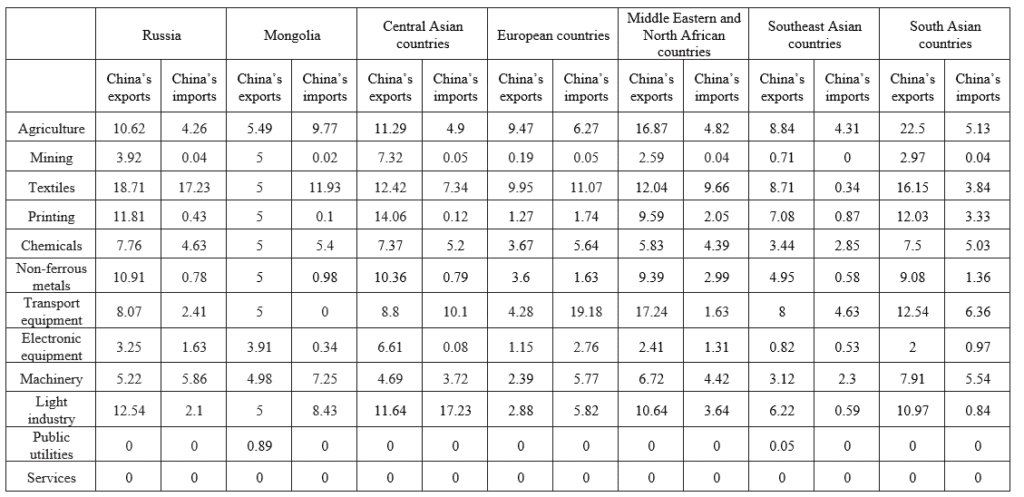

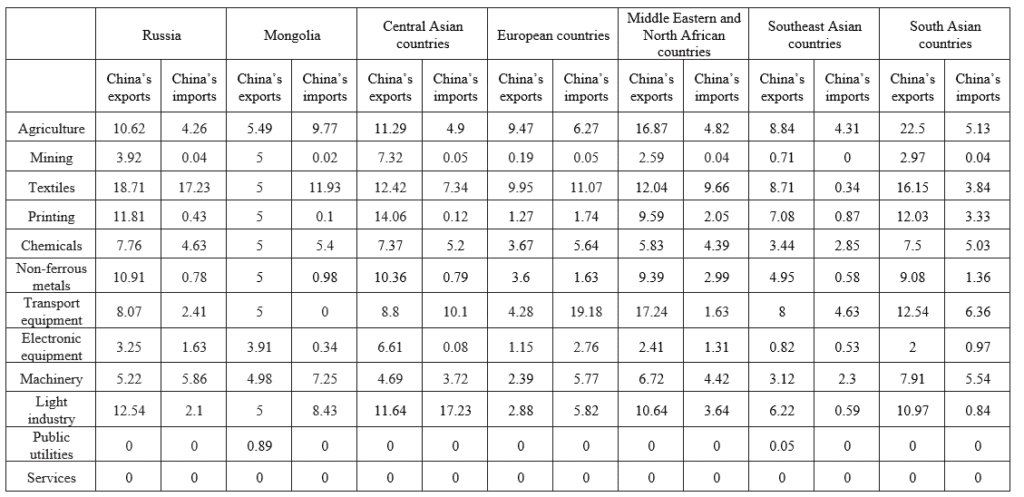

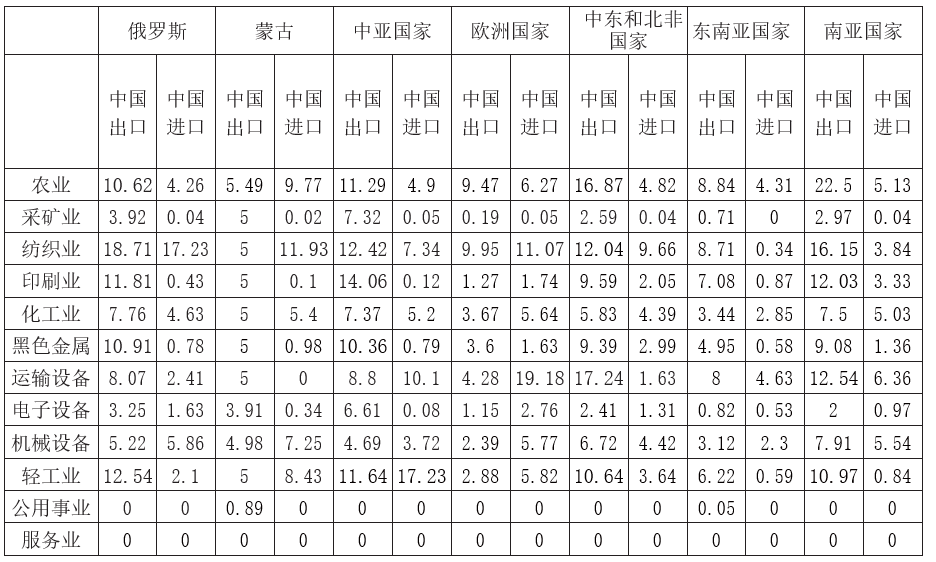

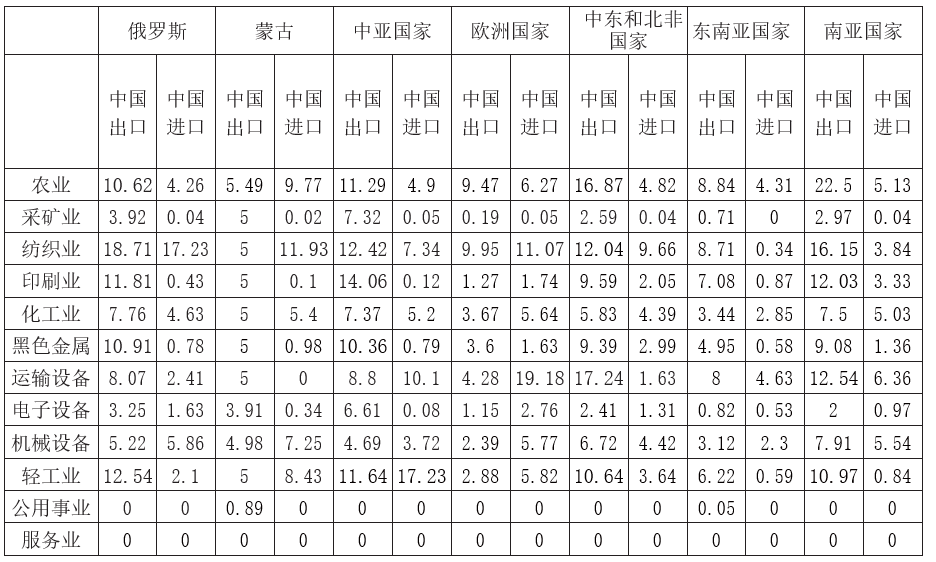

1. The risk of global economic barriers. Most of the countries along the BRI are developing countries, and in the trade and investment system dominated by western countries, their participation in global free trade and investment is often restricted by trade barriers, industrial transfer, and even economic sanctions. Under their Indo-Pacific strategies, the United States and Japan are trying to use the Asia-Africa Growth Corridor as a platform for building so-called “institutional connectivity” as a counterbalance to China’s “material connectivity.” The concept of “extensive consultation, joint contribution, and shared benefits” advocated by the BRI may conflict with the industrial barriers imposed by some countries, leading to trade and investment restrictions on the grounds of national security. After they go global, China’s private enterprises may be more vulnerable than state-owned enterprises (SOEs) to the adverse effects of political and social actions of host countries, thus bearing more risks of national economic barriers.5 The tariff barriers between China and the countries along the BRI have different industry distributions, which implies that different strategic initiatives may have different regional and sectoral effects, and also implies that different strategies may lead to different supply chain adjustments and logistics developments. Table 1 presents import and export tariffs calculated using the Global Trade Analysis Project (GTAP) model. The model is a global multi-region, multi-sector computable general equilibrium (CGE) model, with U.S. dollar amounts in 2011 as the base period. It includes basic data on 140 economies and 57 industries worldwide, and can reflect the extent of bilateral economic barriers.6 In the GTAP model framework, changes in a country’s economic policy not only generate domestic effects, but also have impacts on other countries through international trade and foreign investment. As shown in Table 1, textiles exported from Russia to China were subject to a tariff of 17.23%; Chinese agricultural and textile exports to Europe were also subject to tariffs of 9.47% and 9.95%, respectively; transportation equipment exported from Europe to China was subject to tariffs as high as 19.18%; and China’s agricultural, transportation equipment, and textile industry exports to the Middle East and North Africa (MENA) faced tariffs of 16.87%, 17.24%, and 12.04%, respectively; MENA’s textile industry exports to China are also subject to 9.66% tariffs; China’s agricultural and textile exports to South Asia are subject to tariffs of 22.5% and 16.15%, respectively; and South Asia’s exports of transportation equipment to China face a 6.36% tariff. Overall, there are different degrees of trade barriers between China and the countries along the BRI, mainly in the agriculture, textiles, paper products, publishing, chemical, rubber and plastic, and transportation equipment industries. If trade liberalization can be achieved between China and the countries along the BRI, it is foreseeable that the above industries will see further development.

第一,全球经济壁垒风险。“一带一路”沿线多为发展中国家,在西方国家主导的贸易和 投资体系中,发展中国家往往被施以贸易壁垒、产业转移甚至经济制裁等手段,限制其参与 全球自由贸易和投资。在印太战略下,美国和日本正在试图以亚非增长走廊为平台建设所谓 的“制度型互联互通”,对冲中国的“物质型互联互通”。“一带一路”建设倡导的共商共建共享理念,可能会与部分国家施行的产业壁垒相冲突,从而导致以国家安全为由的贸易投资限 制。不同于国有企业,我国的民营企业在走出去后,可能更容易受到东道国政治和社会行动的不利影响,从而承担较多的国家经济壁垒风险。 我国与“一带一路”沿线国家之间的关税壁垒具有不同的产业分布,意味着不同的战略举措可能会产生不同的区域和部门效应,也意味 着不同战略的供应链调整和物流发展也可能不同。表 1 呈现了采用全球贸易分析模型(GTAP Model)计算的进出口关税。该模型是一个全球多区域、多部门的可计算的一般均衡模型(CGE),以2011 年的美元金额为基期,包括全球 140 个经济体、57 个行业的基础数据,可以反映双边经济壁垒的程度。在全球贸易分析模型框架下,一国的经济政策变化不仅会产生国内效应, 还会通过国际贸易和外国投资对其他国家产生影响。如表 1 所示,从俄罗斯出口到中国的纺织品被征收了 17.23% 的关税;中国对欧洲出口的农产品和纺织品也分别被征收 9.47% 和 9.95%的关税;从欧洲出口至中国的运输设备被征收了高达 19.18% 的关税;中国对中东和北非的农业、运输设备、纺织工业出口分别面临 16.87%、17.24% 和 12.04% 的关税;中东和北非对中国的纺织工业出口也被征收 9.66% 的关税;中国对南亚农业和纺织业出口的关税分别为 22.5% 和16.15% ;南亚对华运输设备出口则面临 6.36% 的关税。总体来看,我国与“一带一路”沿线国家之间存在不同程度的贸易壁垒,主要集中在农业、纺织业、纸制品、出版业、化工橡塑、运输设备等领域。如果我国与“一带一路”沿线国家能够实现贸易自由化,可以预见,上述产业将实现进一步发展。

Table 1. Tariff barriers (%) between China and countries along the BRI

表 1 中国与“一带一路”沿线国家之间的关税壁垒(%)

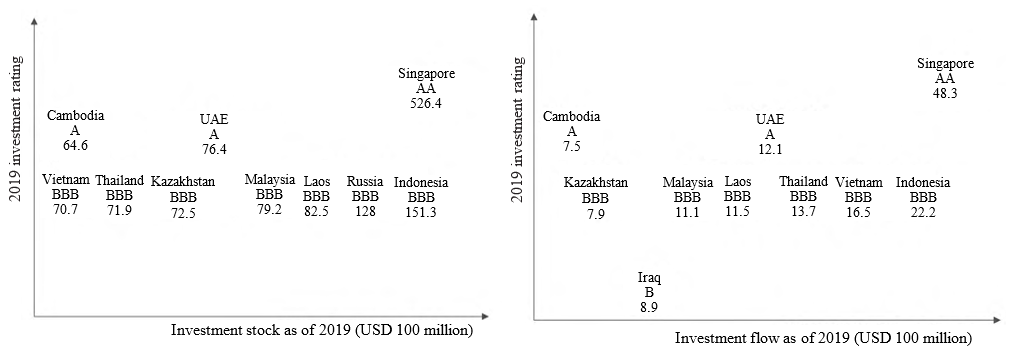

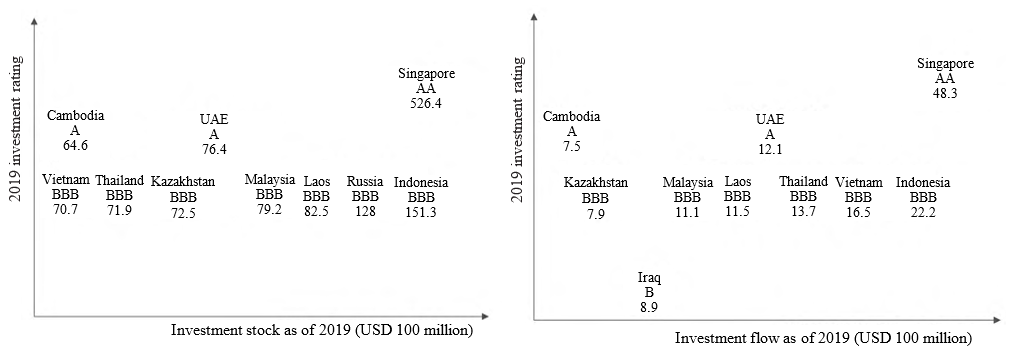

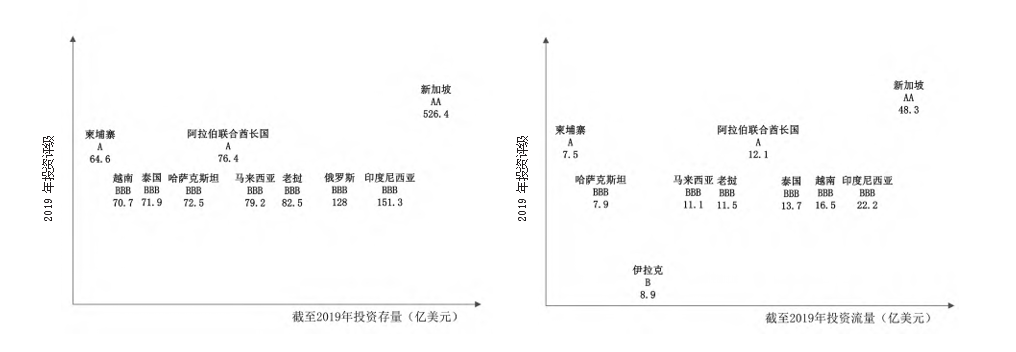

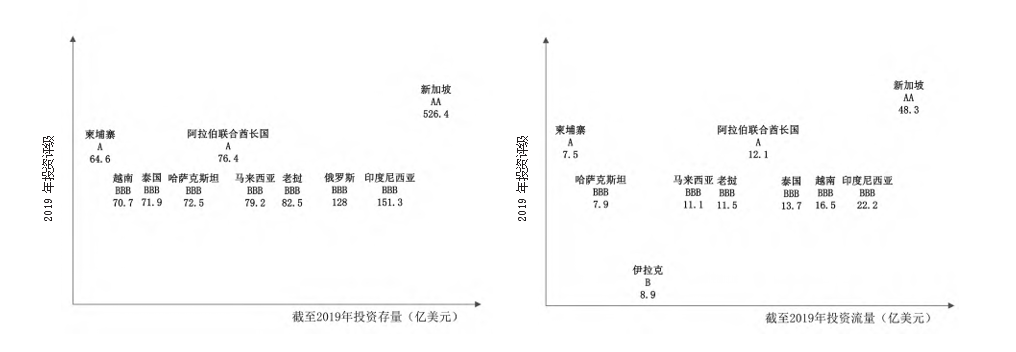

2. Investment risk of countries along the Belt and Road. From a ranking of the investment risk levels of the top ten countries in terms of investment stocks and flows in 2019 (see Figure 3), it can be seen that Singapore is the host country with the largest investment stock and flow, and is also the only country among the top ten BRI countries in terms of scale of investment with a low risk rating (AAA-AA). Countries with medium investment risk (A-BBB) include the United Arab Emirates, Cambodia, Indonesia, Laos, Thailand, Malaysia, Kazakhstan, Russia, and Vietnam. With regard to investment flows, Iraq, as a major new investment target country for China, has a high investment risk level (BB-B) due to the influence of rampant extremist forces and frequent terrorist attacks and kidnappings, among other factors. In terms of the risk ratings for BRI investment, there are more medium-risk countries and fewer high-risk and low-risk countries. The risk ratings of RCEP member countries are better than the overall level. The overall investment risk of countries along the BRI is controllable, but there is still a need to fully take into account the trade-off between investment necessity and risk.

第二,“一带一路”沿线国家投资风险。从对 2019 年投资存量和流量前十名国家的投资风险级别排序(见图 3)可见,新加坡是投资存量和流量最大的东道国,也是“一带一路”投资规模前十名国家中唯一风险评级为低风险级别(AAA-AA)的国家。中等投资风险(A-BBB) 国家包括阿拉伯联合酋长国、柬埔寨、印度尼西亚、老挝、泰国、马来西亚、哈萨克斯坦、俄罗斯和越南。从投资流量来看,伊拉克作为中国新增的主要投资对象国,由于极端势力猖 獗,恐怖袭击和绑架案件频发等因素影响,其投资风险水平处于高风险级别(BB-B),存在较大的投资风险。根据“一带一路”投资风险评级情况看,中等风险国家较多,高风险和低风险国家占比都较少。《区域全面经济伙伴关系协定》成员国风险评级得分好于整体水平。“一带一路”沿线国家总体投资风险可控,但仍需在投资必要性与风险性之间做出充分权衡。

On one hand, China’s rapid rise has made developed countries such as the United States and some developing countries such as India vigilant, and trade and investment reviews on national security grounds have proliferated, making the complexity and volatility of the international investment environment increasingly severe. On the other hand, Chinese enterprises have insufficient experience in outbound investment, and the risk assessment system for outbound investment is weak, resulting in some cases of blind investment, duplication of investment, and even investment failure in the layout initiation stage. Once the scale of Chinese investment exceeds the economic scale of the host country, it may reduce the return on investment.7 At the same time, the diversity and instability of local standards, laws, and regulations also inhibit transnational investment and increase the uncertainty of overseas investment by Chinese enterprises. In addition, it is also necessary to be alert to the investment risk brought about by waving necessary conditions. For example, when competing with Japanese companies for high-speed rail projects in Malaysia, Thailand, and Indonesia, Chinese enterprises waived host government guarantees. Some scholars believe that this will bring about uncontrollable investment management risks for China, resulting in bad infrastructure investments and causing huge economic losses.8 Against the background of slowing growth in overseas investment by Chinese enterprises and the overall shrinkage of the scale of investment, it is more important to pay attention to investment risks in countries along the Belt and Road.

一方面,中国的快速崛起使得美国等发达国家和印度等部分发展中国家保持警惕,以国 家安全为理由的贸易和投资审查层出不穷,国际投资环境的复杂性和多变性日趋严峻。另一方面,中国企业对外投资经验不足,对外投资的风险评估体系薄弱,在启动布局阶段产生了一 些盲目投资、重复投资甚至投资失败的案例。一旦中国的投资规模超过东道国的经济规模,可能会降低投资回报效果。 同时,当地标准、法律和法规的多样性与不稳定性也会抑制跨国投资,增加中国企业海外投资的不确定性。此外,还要警惕放弃必要条件带来的投资风险。如在与日本公司竞争马来西亚、泰国和印度尼西亚的高铁项目时,中国企业放弃了东道国政府的 担保。有学者认为这会给中国带来不可控的投资管理风险,形成基础设施领域的不良投资,造成巨大经济损失。在中国企业海外投资增速放缓、投资规模整体萎缩的背景下,更要重视“一带一路”沿线国家的投资风险。

Figure 3. Country risk ratings of Chinese investment in countries along the BRI

图 3 中国“一带一路”沿线投资国家风险评级

3. Risk of hollowing out domestic industries. Although China has become a net exporter of capital, it is still in a critical period of industrial upgrading and transformation, the quality of China’s manufacturing industry is not yet high, and the demographic dividend is gradually disappearing. Under these circumstances, overly rapid growth of overseas investment could lead to imbalances in China’s industrial structure. For example, with China’s central and western regions needing to develop and improve their industrial systems, overemphasis on international production capacity cooperation while neglecting the industrial cascading between the eastern and western regions of the country will increase the risk of hollowing out domestic industries. Lessons can be learned from the experience of predecessors. For example, industrial hollowing out in the United States led to its financial recession and fiscal deficits, and in Japan, the transfer of a large number of manufacturing industries following the Plaza Accord also harmed its employment, technological development, and industrial restructuring. In the actual process of expanding industries into overseas markets, China should distinguish between different types of industrial investment and transfer, and adopt corresponding strategies for them. First, for the production substitution type of transfers carried out purely for reasons of cost reduction, environmental protection, and trade friction alleviation, if the industries and regions in which they are located fail to fill the gaps left after the transfers with new industries and their required production factors, it will inevitably lead to industrial hollowing out. In addition, even if production substitution-type transfers are done out of necessity, production lines of medium- and high-end products should be appropriately retained or regional headquarters should be established in order to maintain close links between overseas production bases and the sectors in China. Second, for small and medium-sized enterprises (SMEs) with low productivity, actively promoting their outward industrial relocation can alleviate their business difficulties. When an economy’s high-speed growth ends, and as markets becomes saturated and factor costs rise, factors of production and resource allocation will rapidly gravitate to the leading enterprises with large scale effects, while SMEs with smaller scale effects will face enormous competitive pressure in the industry or even suffer bankruptcy and closure. This will in turn have negative impacts on the economy, consumption, employment, and social stability. The transfer overseas of SMEs whose productivity is lower but still high relative to the target countries can not only help the SMEs allay their difficulties, it also provides more development space and resources for the development of new industries, thereby improving overall industrial productivity. Third, for those industries that can develop emerging markets by increasing outward investment, their strategic transfer should be given support. In the final analysis, the key to avoiding the danger of hollowing out local industries due to international industrial transfer lies in continuous industrial upgrading. Under the of BRI initiative’s concept of extensive consultation, joint contribution, and shared benefits, partner countries usually hope that China will help them develop high-quality production capacity, rather than simply hoping to take up China’s excess capacity. While giving full play to its traditional advantages in joint construction of the Belt and Road, China needs to strengthen multi-party cooperation, jointly create and cultivate new advantages, vigorously promote the development of high-end industries, make up respective shortcomings, actively promote the division of labor in production chains, and develop new growth areas in trade cooperation, so as to improve the level and quality of trade.

第三,国内产业空心化风险。当前,中国已经成为资本净输出国,然而中国尚处于产业 升级转型的关键期,中国制造业质量还不高,人口红利也逐渐消失。在此情况下,过快的海 外投资增长有可能导致中国产业结构失衡。如中国中西部地区需要发展和完善工业体系建设, 过度强调国际产能合作而忽视本国东西部地区之间的产业梯次承接,会增大国内产业空心化 风险。前车之鉴业已有之,例如,美国的产业空心化导致其金融衰退和财政赤字,日本广场 协议后的大量制造业转移也损害了其就业、技术发展和产业结构调整。在实际的产业出海过程中,中国要区分不同类型的产业投资与转移模式,采取相应的对策。其一,对于单纯以降低成本、保护环境、缓解贸易摩擦等原因进行的生产替代型转移,若其所在产业和区域不能以新 兴产业及其所需的生产要素填补转移后的空白和缺失,将不可避免地导致产业空心化。此外, 即使出于必要原因而进行生产替代型转移,也应适当保留中高端产品生产线或建立区域总部, 以保持海外生产基地与中国部门之间的紧密联系。其二,对于生产效率偏低的中小企业,积极推动其对外产业转移,能够缓解其经营困境。当经济结束高速增长后,随着市场饱和,要素成本上升,生产要素与资源配置会迅速向规模效应大的头部企业聚集,而规模效应较小的中小 企业则面临巨大的行业竞争压力甚至遭遇破产倒闭,进而对经济、消费、就业、社会稳定造 成负面冲击。将生产率较低但相对目标国家仍然属于生产率较高的中小企业转移到海外,不仅能够帮助中小企业纾困,也能够为新兴产业的发展提供更多发展空间和资源,进而提高产业 整体的生产效率。其三,对于那些加大对外投资力度就能够开拓新兴市场的产业,则应对其战略性转移予以支持。归根结底,要避免国际产业转移带来本土产业空心化的危险,关键在于持续不断的产业升级。在“一带一路”的共商共建共享理念下,合作国家通常希望中国帮助其培育优质产能,而不是简单承接中国的过剩产能。中国在“一带一路”共建中发挥传统优势的同时,需要加强多方合作,共同创造和培育新的优势,大力推进高端产业的发展,补齐各自短 板,积极推进产业链分工,开拓新的贸易合作增长点,提升贸易水平和质量。

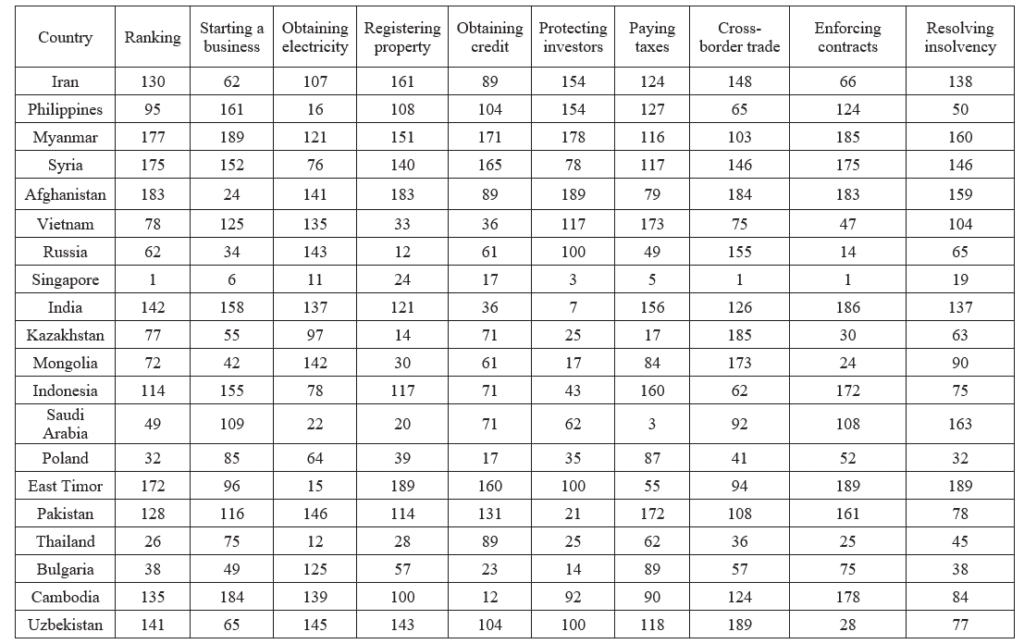

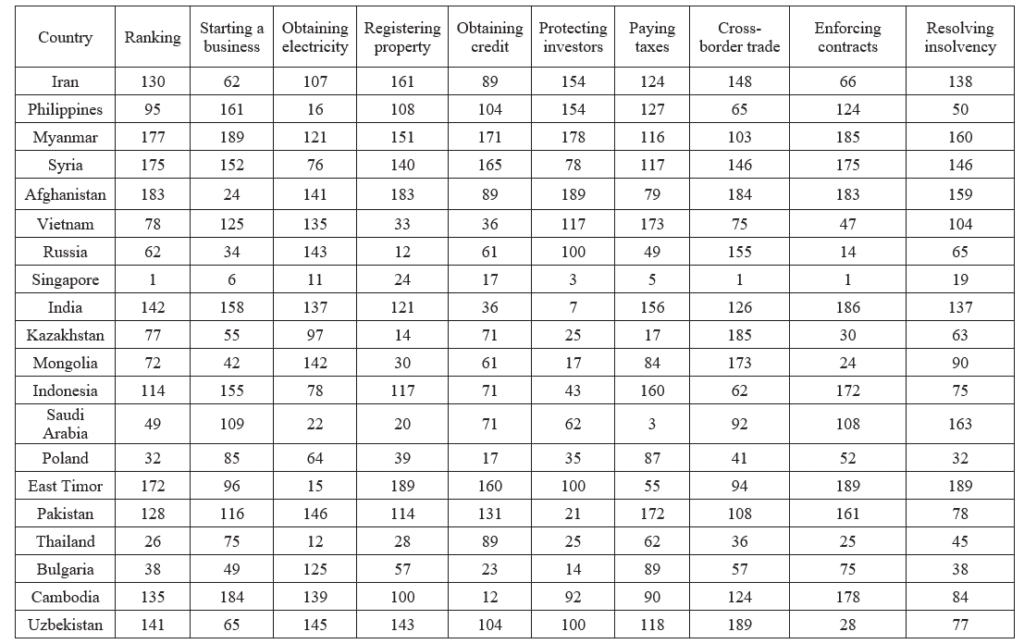

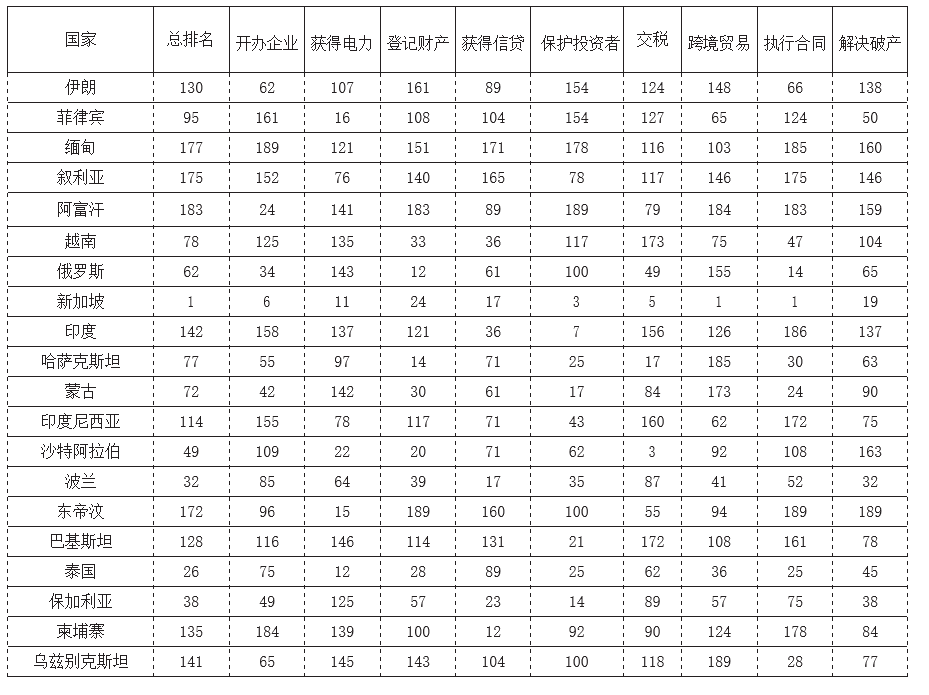

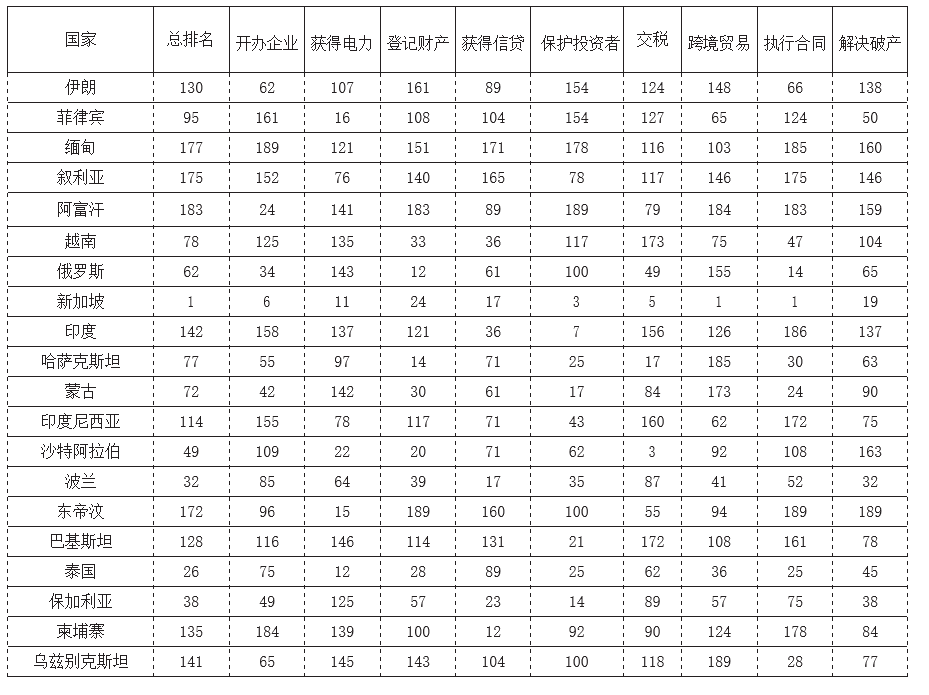

4. Host country business environment risk. The global economic recession and the persistence of the COVID-19 pandemic have led to serious impacts on the recovery process of the world’s economies. The economic risk index of countries is rising globally, and uncertainty due to economic activities deviating from expectations is increasing, which increases the risk that outward investment income will suffer losses. When investing in countries along the Belt and Road, policies that lengthen or even restrict the cross-border investment process will increase the cost of outward investment and reduce the efficiency of BRI project construction.9 Poor investment environments, weak ability to repay funds, and incomplete credit systems of countries along the BRI have increased the economic security risks for Chinese enterprises participating in BRI construction.10 Under the pretext of excessive debt burdens, governments in some countries along the BRI have refused to guarantee Chinese loans, asked China to provide loans with ultra-low interest rates, or used previous investment projects as threats to require China to provide additional financial assistance. For enterprises, different investment motivations will determine the degree of business environment risk they face. First, Chinese enterprises are more competitive than their counterparts in developed countries in business environments where economic systems, credit systems, and markets are not that well developed. In the case of Chinese enterprises whose motivation for foreign direct investment (FDI) is to seek to expand their markets, they tend to choose as their investment targets developing countries with higher risks but greater market potential. Second, developing countries with a small bilateral trade base and a strategically important position are often prioritized for FDI, but many developing countries tend to have low levels of economic development,11 and most of the entities preferring this type of investment are SOEs. Since SOEs generally have an ownership advantage and the ability to withstand risk when making FDI, they are more tolerant of market risk. Table 2 presents a ranking of some countries along the BRI by business environment. According to statistics in the World Bank’s Doing Business 2015 report, countries along the BRI pose security risks when it comes to starting a business and protecting investors. Among them, Myanmar ranks last in the world in terms of the environment for starting a business, which is time-consuming, laborious, and extremely costly. East Timor ranks last in the world in three aspects: registering property rights, enforcing contracts, and resolving insolvency. When settling business disputes, it takes 1,285 days from the time a plaintiff files a lawsuit to the actual payment. Afghanistan ranks last globally in terms of investor protection. Under the country’s legal framework, transparency and credit disclosure levels are low, and the governance system is very poor. Uzbekistan ranks last globally in terms of cross-border trade, with import and export costs as high as US$6,452 per container and US$5,090 per container, respectively.12 The many security risks in the business environment of countries along the BRI undoubtedly increase the cost and risk of overseas investment for Chinese enterprises, and should be given extra attention.

第四,东道国营商环境风险。全球经济衰退和新冠疫情持续,导致世界各国经济的恢复进程受到严重冲击。全球范围内国家经济风险指数日益上升,经济活动偏离预期的不确定性增强,使得对外投资收益受到损失的风险加大。在对外投资“一带一路”沿线国家时,跨境投资冗长乃至限制性的政策,会提高对外投资成本,降低“一带一路”项目建设效率。 沿线国家投资环境不佳、偿还资金能力薄弱、信用体系不完备等,都增加了中国企业参与“一带一路” 建设的经济安全风险。 在一些沿线国家,政府或打着债务负担过重的旗号拒绝为中方的贷款进行担保,或要求中方提供超低利率的贷款,或以前期的投资项目为要挟要求中方提供额外 的财政救助。对于企业而言,不同的投资动因,将决定其所面临营商环境的风险程度。其一, 相较于发达国家的企业,中国企业在经济制度、信贷体系和市场完善程度欠佳的商业环境中 更具有竞争力。对于以寻求拓展市场作为对外投资动机的中国投资企业而言,在进行对外直接投资时,往往会选择一些风险较高但市场潜力较大的发展中国家作为投资对象。其二,双边贸易基数小、战略地位重要的发展中国家往往成为对外直接投资的优先对象,然而许多发展中 国家的经济发展水平往往较低, 偏好此类投资的多数主体是国有企业。由于国有企业在进行对外直接投资时普遍具有所有权优势和抗风险的能力,因此能够较大程度地提高企业对于市 场风险的容忍度。表 2 呈现的是“一带一路”沿线部分国家的营商环境排名情况。根据世界银 行《2015 年全球营商环境报告》的统计数据,“一带一路”沿线国家在开办企业、保护投资者等方面都存在安全隐患。其中,缅甸在开办企业环境方面全球排名倒数第一,耗时费力而且成本极高;东帝汶在登记产权、执行合同和解决破产三个方面的全球排名均为倒数第一,在解决商务纠纷时,从原告提起诉讼到实际付款需耗费 1285 天;阿富汗在保护投资者方面全球排名倒数第一,在该国法律框架下,公司透明程度和信息披露程度都很低,治理制度十分落后;乌兹别克斯坦的跨境贸易全球排名倒数第一,进出口成本分别高达 6452 美元 / 集装箱和 5090 美元 / 集装箱。“一带一路”沿线国家在营商环境方面所存在的诸多安全隐患,无疑加大了中国企业海外投资的成本和风险,应当引起格外重视。

Table 2. Business environment ranking of some countries along the BRI

表 2 “一带一路”沿线部分国家营商环境排名

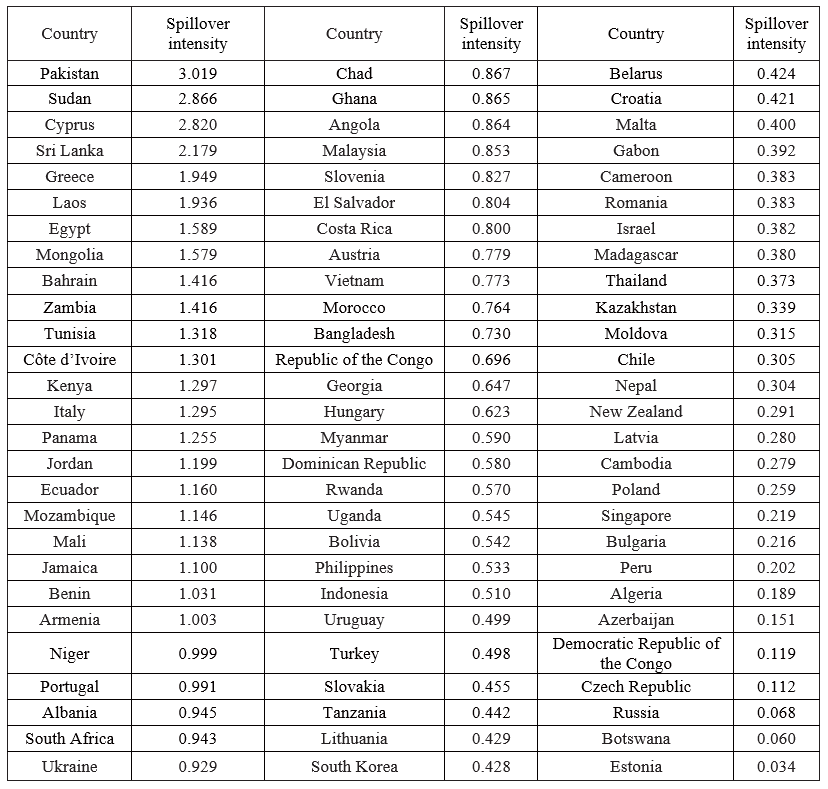

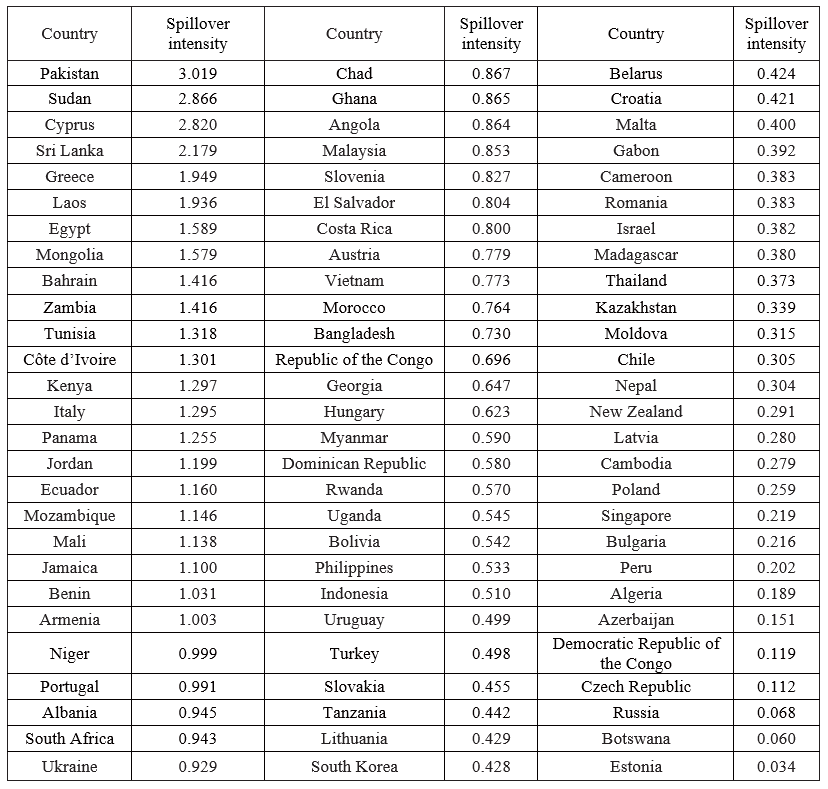

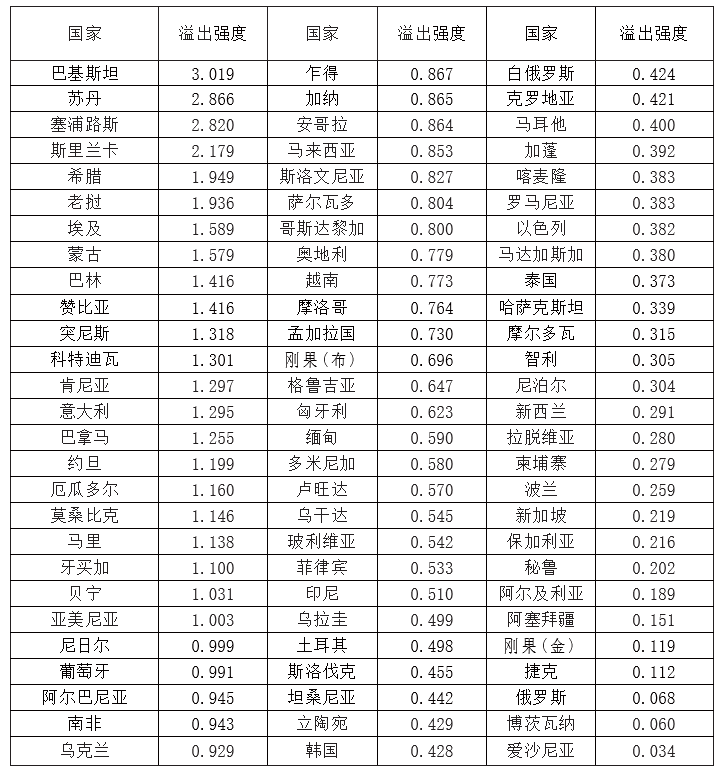

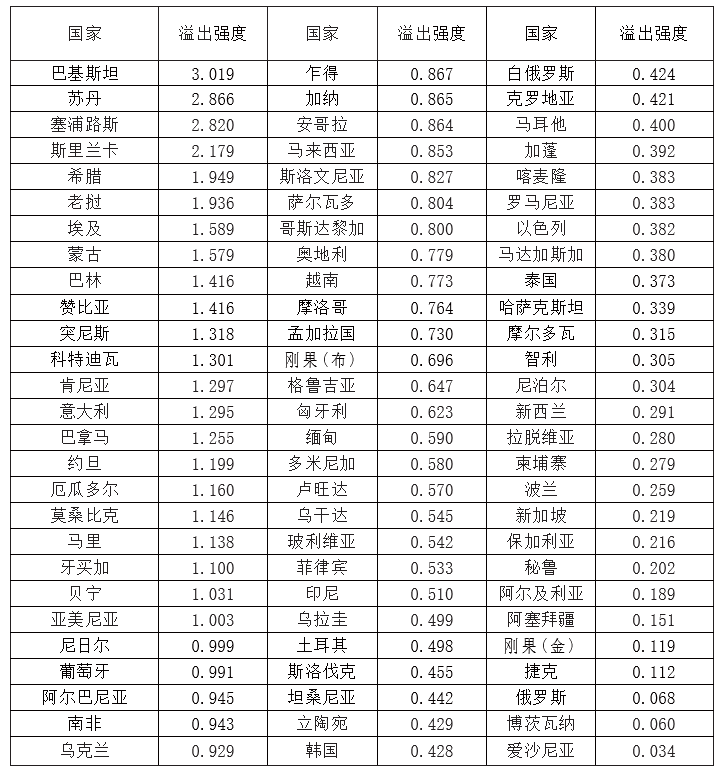

5. Risk of host country fiscal unsustainability. Some of the countries along the BRI routes suffer from financial weakness, poor economic structure, and high degrees of dependence on foreign investment, and the risk of excessive external borrowing by society as a whole has become more prominent, especially as the impact of COVID-19 pandemic was coupled with global trade frictions. The production chains and supply chains of some of the countries along the routes stagnated, consumption shrank, currencies depreciated, and national economies quickly fell into difficulties, adding to their existing debt problems. In order to protect the smooth operation of their economies and the stability of their financial systems, countries have generally implemented large-scale fiscal stimulus policies, resulting in a sharp expansion of the scale of global sovereign bond issuance, which has further amplified global sovereign debt risk. When a country’s sovereign debt level exceeds its economy’s repayment capacity, it is often the case that debt default risk arises, which then spreads to other countries through the credit transmission mechanism, resulting in a concentrated outbreak of sovereign debt crises and even adversely affecting the orderly operation of the international financial system. Among the 64 countries participating in BRI joint construction, eight countries face serious debt risks, and the financial ratings of 27 countries are “junk.”13 Existing research shows that the debt risks of countries along the routes have strong spillover effects on China. This brings unsustainable risks to the foreign investment of China and other countries. As shown in Table 3, China’s neighboring countries, such as Pakistan, Laos, and Mongolia, have very obvious debt risk spillover effects on China, and their debt repayment pressure is higher. In addition, as a major creditor of Sri Lanka, Sudan, Zambia, etc., China also faces debt risk spillover effects from the limited debt service capacity of these countries. The debt risk spillover effects of European countries such as Cyprus, Greece, and Italy on China are also obvious. Considering the economic development environment’s adaptability problems, as well as infrastructure project construction problems, from the perspective of underlying development principles, the large-scale infrastructure construction China has initiated since the commencement of BRI construction will face the challenge of how to continue to promote joint construction cooperation and economic development.14 At the same time, excessive borrowing for certain investment projects and the lack of comprehensive and scientific investment risk assessment and rational resource allocation will easily lead to inefficient spending or investment. This will not only make it difficult to drive employment and economic growth, but will also make it difficult to recover the loans, which may jeopardize China’s good outward investment situation.15

第五,东道国财政不可持续风险。部分“一带一路”沿线国家财政实力薄弱,经济结构 欠佳,对外资依赖程度较高,社会整体对外举债规模过大的风险日渐凸显,尤其在新冠疫情 冲击叠加全球贸易摩擦的情况下,一些沿线国家产业链和供应链停滞,消费萎缩,货币贬值,国家经济迅速陷入困境,使原有的债务问题雪上加霜。为了保护本国经济的平稳运行和金融体系的稳定,各国普遍实施大规模的财政刺激政策,致使全球主权债券发行规模急剧扩大,进 一步放大了全球主权债务风险。当一国的主权债务水平超过其经济偿还能力时,往往会出现 债务违约风险,再通过信贷传导机制扩散至其他国家,从而造成主权债务危机集中爆发,甚 至影响国际金融体系的有序运转。在参与“一带一路”共建合作的 64 个国家中,有 8 个国家面临严重的债务风险,27 个国家的金融评级为“垃圾级”。 现有研究表明,沿线国家的债务风险对我国有着较强的溢出效应,这给我国及其他国家的对外投资带来了不可持续风险。如表 3所示,我国周边邻国,如巴基斯坦、老挝、蒙古等对我国的债务风险溢出效应十分明显,偿债压力较大。此外,作为斯里兰卡、苏丹、赞比亚等国的主要债权国,我国也面临着这些国家的有限偿债能力所带来的债务风险溢出影响。塞浦路斯、希腊、意大利等欧洲国家对我国的债务风险溢出效应也很明显。考虑到经济发展环境的适配性问题以及基础设施工程建设问题,从发展规律看,我国在“一带一路”建设开始后启动的大规模基础设施建设,将面临如何持续促进共建合作和经济发展的难题。 与此同时,某些投资项目过度借贷,缺乏全面、科学的投资风险评估与合理的资源分配,容易导致低效支出或投资,不仅难以有力带动就业和经济增长, 甚至难以收回贷款,有可能损害我国对外投资的良好局面。

Table 3. Spillover intensity for China of the debt risks of countries along the BRI

表 3 “一带一路”沿线国家债务风险对我国的溢出强度

(ii) Analysis of the governance elements of economic security issues

(二)经济安全问题的治理要素分析

The BRI is based on international economic cooperation, but the successful construction of the BRI is closely related to international political, economic, cultural, and other factors. Research on economic security in BRI implementation should not only consider it as a trade cooperation issue, but also analyze the causes of economic security issues from the perspectives of economic investment, geopolitics, international order restructuring, and China’s foreign relations, and explore the underlying political, cultural, and social factors of economic security and their related impacts.

“一带一路”倡议的基础是国际经济合作,但“一带一路”的成功建设与国际政治、经济、文化等多方面因素紧密相关。关于“一带一路”实施中的经济安全研究,不能仅将其看成一种贸易合作问题,而应从经济投资、地缘政治、国际秩序重构及中国对外关系等角度分析经济 安全问题产生的动因,探讨经济安全背后的政治、文化和社会因素及其关联影响。

1. Safeguarding national interests is the political basis for promoting BRI construction. National interests are the foundation of international relations, and the success of BRI construction has a bearing on the interests of China and the countries along its routes, as well as the interests of countries outside the region. The BRI was proposed as a top-level design for China to engage in economic diplomacy, providing an open way for developing countries to participate in international economic cooperation while safeguarding and developing their national interests. Driven by national interests, countries and regions along the Belt and Road, and even in neighboring regions, have chosen extensive consultation, joint contribution, and sharing of benefits with China, and diversified cooperation mechanisms have been created. In the traditional mode of economic globalization led by Western countries, the countries concerned are subject to the long-term constraints imposed by developed countries on supply chains and production chains, and they are often in a passive state. Therefore, whether China does not demand benefits or excessively demands benefits in the construction of the BRI, it will raise doubts among other countries, and even lead them to become passively embroiled in “pan-politicized” sanctions. For example, China’s cooperation with Central Asian countries in the field of energy is likely to arouse the suspicion of other countries, worried that the Eurasian integration process centered on them will be interfered with.16 Some countries even believe that since China’s investment projects have strategic benefits, it should not pursue commercial gains from them, and this conception will lead to a decline in the confidence and determination of the participating countries to cooperate. Some participating countries will even adopt strategies “waiting for, relying on, and requesting from others” or “free-riding,” which will not be conducive to China’s promotion of long-term and healthy BRI development.

第一,维护国家利益是推动“一带一路”共建的政治基础。国家利益是国际关系的基础,“一带一路”建设成功与否,关系到中国与沿线国家的利益,也关系到区域外国家的利益。提出“一带一路”倡议是中国开展经济外交的顶层设计,为发展中国家参与国际经济合作,维护和发展本国利益提供了开放途径。在国家利益的推动下,“一带一路”沿线乃至邻近区域的国家或地区选择与中国共商共建共享,创建多元化合作机制。在传统的由西方国家主导的经济全球化 模式中,相关国家受制于发达国家对供应链和产业链的长期约束,往往处于被动状态。因此, 中国在“一带一路”建设中不索取利益或过度索取利益的行为,都会引起其他国家的质疑,甚至被动卷入泛政治化制裁。如中国与中亚国家在能源领域的合作,容易引发其他国家的疑虑, 这些国家会担心以其为中心的欧亚一体化进程受到干扰。 部分国家甚至认为,中方的投资项目既然有战略收益,就不应该追求商业收益,这种认识会造成参与国的合作信心和决心下降, 甚至有些参与国会采取“等靠要”或“搭便车”策略,这不利于中国推动“一带一路”的长期健康发展。

2. Achieving economic growth is the basic demand for promoting BRI construction. At the national level, promoting development through cooperation and promoting growth through joint construction are the basic demands of countries along the BRI for participating in capacity-building and trade cooperation. Therefore, during the layout initiation phase of BRI construction, China has participated in the construction of railroads, highways, airports, shipping facilities, industrial parks, and other infrastructure in other countries, providing high-quality conditions for the transfer of international production capacity, and thus helping more countries to develop their industrial systems and manufacturing capabilities. The continuous large-scale growth of China’s foreign investment and foreign construction has generated considerable contradictions with China’s still insufficient experience in foreign investment and construction, thus giving rise to many investment security risks, financial and fiscal risks, and project cooperation risks. Some scholars have pointed out that in major infrastructure construction projects involving Russia, China faces the risk of not being able to complete the projects in a timely fashion because China is unable to comprehensively assess the actual implementation risks of Russian projects.17

第二,实现经济增长是促进“一带一路”共建的基本诉求。从国家层面看,以合作促发展, 以共建促增长,是“一带一路”沿线国家参与产能共建和贸易合作的基本诉求。因此,中国在 “一带一路”建设启动布局阶段,参与他国铁路、公路、机场、航运、产业园区等基础设施建 设,为国际产能转移提供优质条件,从而帮助更多国家培育工业体系和制造能力。中国对外投 资、对外建设的持续大规模增长,与尚不充分的对外投资建设经验产生不可忽视的矛盾,从 而衍生出诸多投资安全风险、财政金融风险、项目合作风险等。有学者指出,在俄罗斯参与的 重大基础设施建设项目中,中国会面临项目不能及时完工的风险,这是因为中国无法全面评 估俄罗斯项目的实际执行风险。

At the enterprise level, transnational corporations are the main micro-level actors in BRI construction. Due to the lack of large multinational enterprises in countries along the Belt and Road, as well as high construction costs and long payback periods, most of the enterprises participating in investment, construction, and operation are Chinese SOEs. Although SOEs are quick to act, the backgrounds of SOEs cause the relevant countries to worry about changing the traditional geopolitical order, which exacerbates the pan-politicization of economic issues. This is not conducive to attracting other countries and their enterprises to share the risks and costs of investment and construction, and results in excessive international capital exports by China and a constantly expanding gap between the domestic [supply and] demand for capital, thereby harming the economic foundation of industrial upgrading and transformation.

从企业层面看,跨国公司是推动“一带一路”建设的微观主体。由于“一带一路”沿线 国家缺乏大型跨国企业,且建设成本较高,投资回收期较长,大多是中国国有企业参与投资、建设和运营。虽然国有企业行动迅速,但国有企业的背景,也会引起相关国家对传统地缘政治秩序改变的担忧,加剧经济问题的泛政治化,不利于吸引其他国家及其企业分担投资建设的 风险成本,导致中国过度的国际资本输出和不断扩大的国内资本需求缺口,损害产业升级转 型的经济基础。

3. Respecting cultural customs provides solid assurance for the orderly construction of the Belt and Road. As the BRI enters a period of intensive construction and operation, exchanges between countries and enterprises are becoming more and more frequent, and in order to enhance mutual trust and mutual assistance, it is necessary to respect the customs and cultures, and especially the religious beliefs, of all nationalities. Many countries along the BRI have their own unique cultural backgrounds, and due to a lack of exchanges with foreign cultures, they often have a strong sense of resistance to cultures different from their own. Religion is the cultural form most likely to trigger conflict.18 Geographical and ethnic cultural differences may lead to cultural risks, not only preventing cultural exchanges from playing their role in mutual learning and understanding, but also causing social exclusion and aggravating conflicts between ideologies and national consciousnesses.

第三,尊重文化习俗是“一带一路”有序建设的坚实保障。“一带一路”建设进入密集期和运营期,国家之间、企业之间的交流日益频繁,要增进互信,加强互助,就要尊重每个民 族的风俗与文化,尤其是宗教信仰。“一带一路”沿线的众多国家都有着本民族独特的文化背景,由于缺乏与外来文化的交流,往往对异族文化产生强烈的抵触意识。宗教是最容易引起冲突的文化形态。地域、民族文化的差异可能会导致文化风险,不仅不会发挥文化交流互鉴的功能,反而会引起社会排斥,加剧意识形态和民族意识之间的冲突。

Social identity is the concentrated manifestation of values, beliefs, and action orientations shared by members of a society.19 Failure to gain social and cultural identification, or disrespect for the other party’s cultural background, will give rise to a number of uncertainty risks that deviate from economic interests and national security, and cannot be accurately predicted or effectively addressed. Therefore, some scholars have suggested that if Chinese investors lack outbound investment experience and fail to establish a sense of “ownership” and shared interests within the host community, cultural and country-specific differences may easily lead to questioning and protests from host country nationals.20

社会认同是社会成员共同拥有的价值观念、信仰和行动取向的集中体现。不能获得社会文化的认同或不尊重对方的文化背景,便会产生诸多游离于经济利益和国家安全之外的不确 定性风险,且无法精准预判与有效应对。因此有学者提出,中国投资者如果缺乏对外投资经 验,无法在东道国社区内建立“主人翁”意识和共同利益,文化和国别差异便容易引发东道国国民的质疑与抗议。

4. Multilateral cooperation is an important mechanism for the long-term development of the BRI. The diversity of political, economic, cultural, and social conditions in the countries along the BRI requires China to work with participating countries to build a new development-oriented model of cooperation. BRI construction involves a wide range of inter-governmental, inter-enterprise, and government-enterprise relationships, and is prone to multi-party disputes and controversies.21 It is only by building multilateral mechanisms, advocating the liberalization of global trade and investment, and respecting the political aspirations, economic interests, and cultural diversity of different countries that a community of common destiny for mankind can be built. If Chinese SOEs come to be seen as tools for the Chinese government to expand in international markets and transfer excess capacity, both greenfield investments and cross-border mergers and acquisitions will easily arouse the hostility of host countries. It would thus hinder the establishment of solid multilateral cooperation and lead to increased risk for overseas investment.22

第四,稳固多边合作是“一带一路”长期发展的重要机制。“一带一路”沿线国家政治、 经济、文化和社会状态的多样性,要求中国与参与国共同建设以发展为导向的新型合作模式。 “一带一路”建设涉及广泛的政府之间、企业之间以及政府和企业之间的关系,容易产生多方争议或争端。 构建多边机制,倡导全球贸易与投资自由化,尊重不同国家的政治诉求、经济利益与文化多样性,才能构建人类命运共同体。一旦中国的国有企业被视为是中国政府扩展 国际市场、转移过剩产能的工具,无论是绿地投资还是跨国并购,都容易引起东道国的敌意, 从而不利于建立稳固的多边合作,导致海外投资风险增加。

The key to multilateral mechanisms lies in effective national consultations, political and economic exchanges based on mutual trust, equal cooperation mechanisms, and benefit distribution models. In the course of China’s promotion of BRI construction, the political expression and representation of interests of the participating countries have demonstrated their extreme desire for institutional fairness, and also reflected their demand of safeguarding national security. If it is impossible to promote the establishment of political and economic mutual trust, China should be cautious in dealing with the cooperation demands of different categories of participating countries. Within the framework of mutual benefit and win-win outcomes, it should realize common development that goes beyond traditional economic cooperation, so as to guard against the risk of “active default” (intentional breach) by participating countries.

多边机制的关键在于有效的国家磋商、互信的政治经济交流、平等的合作机制与利益分 配模式。中国在推动“一带一路”建设过程中,参与国的政治表达、利益诉求表现了对制度公平的极度渴望,也反映出其维护国家安全的要求。如果无法推动建立政治互信、经济互信,中国应谨慎对待不同类别参与国的合作诉求,应在互利共赢的框架下,实现超越传统经济合作 的共同发展,防范参与国的主动违约风险。

III. Governance of, and Responses to, BRI Economic Security Issues

三、“一带一路”经济安全问题的治理和应对

At the BRI fine-tuning and high-quality development stage, China should strengthen theoretical and practical research on the security risks, proactively anticipate crises and risks, build an economic assurance system, strengthen the security protection of outbound investment, and form a multi-level economic security governance and response program based on policy instruments, diplomatic strategies, and economic measures.

在“一带一路”精细化推进、高质量发展阶段,中国应当加强安全风险的理论与实践研 究,主动预判危机与风险,构建经济安全保障体系,加强对外投资安全保护,形成以政策手 段、外交策略、经济举措为主的多层次经济安全治理和应对方案。

1. Coordinate construction measures and differentiate responses to the different types and levels of economic security issues from different countries. After a systematic review, the main types of economic security issues are found to vary across countries along the BRI that are closely tied to its construction, as well as the 141 countries and 32 international organizations that have signed cooperation documents with China. For some countries, the main focus is on economic security problems associated with political factors, for some it is on investment security risks and enterprise cooperation risks caused by religious and cultural differences, and for some it is on industrial transformation risks directly arising from economic interests. Economic security problems arise for different reasons and are manifested in different ways. Therefore, in the spirit of cooperation and inclusion, China should proactively study and distinguish between the risk characteristics of different countries, and adopt targeted diplomatic strategies and economic actions. For example, where China’s share of a country’s capital investment is disproportionate, it can take the approach of cooperating with enterprises, third parties, and international financial institutions influential in that country to increase the host country’s cost of default.

第一,统筹建设举措,区别应对来自不同国家的不同类型与不同级别的经济安全问题。经过系统梳理,从与“一带一路”建设具有紧密联系的沿线国家,到与中国签署合作文件的 141个国家和 32 个国际组织,其主要的经济安全类型有所差异。有些国家以政治因素伴生的经济安全问题为主,有些国家以宗教文化差异导致的投资安全风险和企业合作风险等为主,有些 国家以经济利益诉求直接产生的产业转型风险等为主。经济安全问题产生的原因不同,表现方式不同。因此,中国在合作包容的精神下,应当主动研究、区分不同国家的风险特征,采取针对性的外交策略与经济行动。例如,针对中国在某国出资比重失衡的问题,可以采取与该国有影响力的企业、第三方、国际金融机构合作的方式来增加东道国的违约成本。

2. Clarify the construction objectives and seek to maximize the convergence of national interests. In determining the objectives of BRI cooperation, we should avoid two extremes. One extreme is to put too much emphasis on safeguarding China’s interests, proposing goals such as transferring excess production capacity and developing overseas energy resources. This would be regarded as political, economic, and cultural intrusion by countries outside the region and even participating countries, leading to a defensive mentality in economic action, and strengthening the host country’s power to constrain foreign investment in political action, which would not be conducive to achieving the BRI’s “extensive consultation, joint contribution, and shared benefits.” The other extreme is to completely disregard China’s interests. This would lead participating countries to question the institutional fairness of the BRI, and even affect the motivation of the countries concerned to participate in it, thus reducing the efficiency and effectiveness of China’s outward investment and construction. Therefore, when China externally expresses its goals for participating in BRI construction, it should clearly emphasize the expansion of opening up to the outside in the new era, the joint construction of a fair and orderly international trade and investment system in a spirit of cooperation and inclusion, and the building of a system of economic diplomacy that is mainly based on outward investment and international trade, and ultimately promote the building a community of common destiny for mankind, guided by the concepts of “sincerity, real results, amity, and good faith,” and “amity, sincerity, mutual benefit, and inclusiveness.”

第二,明确建设目标,寻求国家利益交集的最大化。在确定“一带一路”建设合作的目 标时,我们应避免两种极端。一种极端是过于强调维护中国利益,提出转移过剩产能和开发海外能源资源等目标。这会被域外国家甚至参与国视为政治、经济和文化上的侵入,从而在经济行动中持防范心理,在政治行动中加强东道国权力对外国投资的制约,不利于“一带一路”共商共建共享的实现。另一种极端是完全不顾及中国利益。这会导致参与国质疑“一带一路”倡议的制度公平性,甚至影响相关国家的参与积极性,降低中国对外投资建设的效率和效益。因此,中国在对外表达参与“一带一路”建设的目标时,应明确强调扩大新时期对外开放,以合作包容的精神共建公平有序的国际贸易投资体系,构建以对外投资、国际贸易为主体的经济 外交体系,最终在真实亲诚、亲诚惠容理念指导下,推动构建人类命运共同体。

3. Adhere to international morality and justice, and jointly build Chinese-foreign BRI cooperation mechanisms. With clear construction goals in mind, and starting from the perspectives of promoting global development, building a community of common destiny for mankind, and respecting the rights of developing and emerging market countries to a say in international affairs, under the BRI China should give full play to its advantages as a major economic and trade power, and work with more countries to achieve national development and regional economic growth through multilateral cooperation mechanisms, emphasizing that, in BRI construction, China will never replicate the “carrot-and-stick” approach to economic diplomacy adopted by the West. While respecting the strategic interests of all participating countries, China should work with them to promote the implementation of specific measures so that each country gradually achieves its national interests, and then promote mechanism-based construction, thereby enhancing the feasibility of measures for China’s BRI and subsequent construction and operation. Specific cooperation mechanisms include financing and taxation mechanisms under the principle of marketization, market-based management mechanisms to promote international cooperation, investment protection mechanisms, dispute resolution mechanisms, international legal assurance mechanisms for national consultations, economic dispute settlement mechanisms, and so on. Joint construction of these cooperation mechanisms can lay a firm foundation for creating new fair and rational international economic mechanisms and reforming existing international rules.

第三,坚持国际道义,共建中外“一带一路”合作机制。在明确的建设目标导向下,中国应当从促进全球发展、构建人类命运共同体、尊重发展中国家和新兴市场国家国际话语权等 角度出发,在“一带一路”倡议下,发挥中国经济贸易大国的优势,与更多国家通过多边合作机制实现国家发展和区域经济增长,强调中国绝不会在“一带一路”建设中复制西方国家“胡萝卜加大棒”的经济外交方式。中国在尊重各个参与国战略利益的国际道义下,与各参与国合作推动具体措施落实,逐步实现各国的国家利益诉求,进而推进机制化建设,提高中国“一带一路”倡议和后续建设运营措施的可行性。具体合作机制包括市场化原则下的融资机制、税收机制,促进国际合作的市场化管理机制、投资保护机制、争端解决机制,国家协商的国际法 律保障机制、经济争端解决机制,等等。共建这些合作机制,可以为创建新的公平合理的国际经济机制和改革现行的国际规则打下坚实基础。

4. Strengthen risk assessment and build an early warning system for BRI economic security. Existing studies have made helpful explorations of economic risk assessment. The Institute of World Economics and Politics of the Chinese Academy of Social Sciences has proposed an evaluation index system that quantitatively evaluates five aspects—economic foundation, solvency, social resilience, political risk, and relationship with China—and pointed out that although the scores of countries along the BRI in terms of relationships with China are significantly higher than those for the overall level, the investment risks of individual countries along the BRI nonetheless merit attention.23 Other studies show that in terms of overall country risk, China’s FDI in most Central and Eastern European countries and a few West Asian countries is characterized by relatively low political and economic-financial risks.24 In the future, China will need to continuously monitor the situations of the countries along the routes and those outside the region, build an economic security [risk] assessment, identification, rating, and response system, refine the security levels, and optimize the early warning mechanism and response measures to prevent being trapped in economic passive risk.

第四,加强风险评估,构建“一带一路”经济安全预警体系。现有研究对经济风险评估 进行了有益探索。中国社会科学院世界经济与政治研究所提出的评价指标体系从经济基础、偿债能力、社会弹性、政治风险和对华关系五个方面进行定量评价,指出“一带一路”沿线国家的对华关系得分虽然显著高于整体水平,但个别沿线国家的投资风险值得注意。 还有研究显示:就整体国家风险而言,中国在大多数中东欧国家和少数西亚国家对外直接投资的政治风险和经济金融风险都比较小。未来中国需要持续关注沿线国家和区域外国家的情况,构建经济安全评估、识别、评级和应对体系,细化安全级别,优化预警机制和应对措施,防止陷于经 济被动风险。

5. Respect the participating countries and strengthen political, economic, and cultural mutual trust in BRI construction. On one hand, it is necessary to avoid misunderstandings or suspicions on the part of countries along the routes, and on the other hand, it is necessary to ensure that the interests of countries are not infringed upon, so that all countries can express their demands on an equal footing, and we advance side-by-side with the countries along the routes, whatever ups and downs we encounter. To this end, the first step is to establish a multilateral security mechanism between China and other countries, and to. In close coordination with national political, diplomatic, economic, cultural, and legal affairs, we should scientifically design and determine the timing, mode, scale, and scope of the “going global” of our military forces, so as to shape favorable strategic postures and deployment patterns.25 Secondly, inclusion and mutual are fundamental demands for a cultural community, and China should strengthen social and cultural exchanges and cooperation with countries along the routes. We should disseminate and introduce Chinese cultural practices and the core values of equality, mutual trust, and mutual respect. We should also take the initiative to learn the cultural practices of other countries, and respect cultural differences in learning and exchanges, paying particular attention to the complex issue of religions and beliefs in Central Asia, so as to prevent religious and cultural risks from causing cultural barriers, economic losses, and even political conflicts. By organizing various cultural exchanges such as youth exchange visits, signing of memorandums of understanding, film and television co-production, cooperation in scientific research, and establishment of sister provinces and cities, we should shape China’s positive image, and with the help of our cultural soft power, let the world understand China and let China integrate into the world.

第五,尊重参与国家,强化“一带一路”建设中的政治、经济和文化互信。一方面要避免沿线国家的误解或猜疑,另一方面要保障各国的利益不受侵害,让各国平等地表达诉求,与 沿线各国共进退。为此,首先要着手建立中国与其他国家的多边安全机制,推动我国军事力 量以和平姿态“走出去”。应紧密配合国家政治、外交、经济、文化和法律事务,科学设计和 确定军事力量“走出去”的时机、方式、规模和范围,塑造有利战略态势和部署格局。 其次, 包容与认同是文化共同体的根本诉求,中国要加强与沿线各国的社会、文化交流与合作。我们既要传播和介绍中国的文化习俗以及平等、互信、互相尊重的核心价值,也要主动学习其他 国家的文化习俗,在学习与交流中尊重文化差异,尤其要重视中亚地区复杂的宗教信仰问题,防止宗教文化风险导致的文化障碍、经济损失甚至政治冲突。通过组织开展青年互访、签署 备忘录以及影视合拍、科研合作和缔结友好省市等各种人文交流活动,塑造中国的良好形象, 借助文化软实力让世界了解中国,让中国融入世界。

6. Strengthen multilateral cooperation and deepen the connectivity of BRI countries. Based on the economic development strategies of the countries in the region, as well as the current state of development in connectivity among countries and their different basic economic demands, a development strategy of overall consideration, differentiated treatment, and gradual advancement can be adopted. With regard to crisis control, further exploration can be made of establishing a crisis control exchange mechanism, specifically including the establishment of a cooperation fund, the organization of theoretical research and joint law enforcement, etc., so as to properly handle the economic risks and crisis control issues among participating countries. In multilateral cooperation, China needs to have a good grasp of the strategic positioning of each country, especially in the context of the strategic game between China and the United States, and it should pay attention to the political stability and international relations of neighboring regions, so as to avoid the risk of “strategic overstretch.”26

第六,加强多边合作,深化“一带一路”国家的互联互通。根据区域内各国的经济发展战略以及国家之间互联互通的发展现状及其不同的基本经济诉求,可以采取统筹兼顾、区别对 待和逐步推进的发展策略。针对危机管控问题,可进一步探索建立危机管控交流机制,具体包括设立合作基金、组织理论研究与联合执法等,妥善处理参与国之间的经济风险与危机管控 问题。在多边合作中,中国需要把握好各国的战略定位,特别是在中美战略博弈的背景下,应重点关注周边地区的政治稳定与国际关系,避免出现“战略透支”风险。

7. Clear multiple channels and build platforms for communication between governments, industries, and enterprises. The Chinese government can use various means to expand political cooperation with countries along the routes, encourage the strengthening of friendly exchanges with cities of various countries, create financial support mechanisms for cooperative joint construction, and eliminate the prejudice and misunderstanding that the BRI is being built by the Chinese government to achieve the goal of controlling the economies of other countries, which arise due to overseas investment ownership. Industry exchanges and enterprise communication should be emphasized, and the protection of private multinational enterprises participating in the BRI investment and trade should be strengthened, for example by establishing a standard cooperation framework, improving the financing mechanisms of the Silk Road Fund and the Asian Infrastructure Investment Bank, etc. In order to attract capital from more countries, the infrastructure construction and connectivity system should respect the underlying principles of economic growth, and synchronization with the economic development needs of the countries where construction is underway should be improved, which will in turn improve the investment expectations of private capital,27 thus increasing private capital investment in BRI construction.

第七,畅通多种渠道,搭建政府、行业与企业沟通平台。中国政府可以借助各种方式扩 大与沿线国家的政治合作,鼓励各国城市之间加强友好交流,创建合作共建的资金支持机制, 消除由于海外投资所有权引起的“一带一路”由中国政府建设以实现控制他国经济的目标的偏见和误解。重视行业交流和企业沟通,加强对民营跨国企业参与“一带一路”投资贸易的保护, 如建立标准合作框架、完善丝路基金和亚洲基础设施投资银行的融资机制等。为吸引更多国家的资本进入,基础设施建设与联通系统应当尊重经济增长规律,提高与在建国经济发展需求 的同步性,进而提高私人资本的投资预期, 从而在“一带一路”建设中增加私人资本的投入。

IV. Conclusion

四、结语

As emphasized by General Secretary Xi Jinping, the BRI is not a conspiracy by China, nor is it a post-World War II Marshall Plan. We should put policy communication, infrastructure connectivity, unimpeded trade, financial integration, and closer people-to-people ties into practice, create new platforms for international cooperation, and add new momentum for shared development, so that the BRI benefits more countries and people.28 Existing practice has shown that, for countries along the routes, BRI cooperation has: Effectively upgraded transportation, energy, and information technology infrastructure levels; effectively reduced their debt risks by reducing the scale of their debt and enhancing their financial sustainability; and effectively improved the allocation efficiency of production factor resources and narrowed regional development gaps by promoting the flow of production factors such as talents, capital, and high technology. By strengthening economic ties among countries and deepening their investment and trade cooperation, it has improved the economic development conditions of the regions along the routes, promoted environmental upgrading and transformation in countries along the routes, and advanced the trade liberalization and facilitation levels of countries and regions along the routes in an orderly manner.

正如习近平总书记所强调的那样,“一带一路”不是中国的阴谋,不是第二次世界大战后的“马歇尔计划”,我们要把政策沟通、设施联通、贸易畅通、资金融通、民心相通落到实处,打造国际合作新平台,增添共同发展新动力,使“一带一路”惠及更多国家和人民。 现有实践表明,“一带一路”合作有力提升了沿线国家的交通、能源和信息技术领域的基础设施水平;通过缩减沿线国家债务规模和增强沿线国家财政可持续性等方式,有效降低了沿线国家债务 风险;通过促进人才、资金和高新技术等生产要素流动,有效提高了生产要素资源的配置效率并缩小了区域发展差距;通过加强各国经济联系,深化投资贸易合作,改善沿线地区经济发 展条件,促进沿线国家环境的升级转型,有序促进了沿线国家和地区的贸易自由化和便利化 水平。

China’s long-term joint construction and cooperation with countries along the BRI requires adherence to bottom-line thinking and focusing on preventing economic security risks. To safeguard national economic security in the construction of the Belt and Road, it is necessary to adhere to the global governance concept of “extensive consultation, joint contribution, and shared benefits,” and strengthen the overall control of national economic security from the three dimensions of governance concept, governance capacity, and governance system, so as to form a more comprehensive and better governance system for economic security and economic development of the Belt and Road, effectively safeguard national economic security during BRI construction, and promote higher levels of opening up to the outside and economic development, thereby advancing the building of a community of common destiny for mankind in an orderly manner, and contributing China’s wisdom to the world’s economic security.

中国与“一带一路”沿线国家的长远共建合作,需要坚守底线思维,注重防范经济安全风险。维护“一带一路”建设中的国家经济安全,需要坚持共商共建共享的全球治理观,从治理理念、治理能力和治理体系三个维度加强对国家经济安全的整体把控,形成一套更为全面、更加完善的“一带一路”经济安全与经济发展治理体系,有效维护“一带一路”建设中的国家经济安全,促进更高水平的对外开放和经济发展,推动人类命运共同体的有序构建,为世界 经济安全贡献中国智慧。