The outbreak of the Russia-Ukraine conflict in 2022 has triggered a powerful “butterfly effect” in the international grain market, with a succession of countries raising barriers to grain exports and international grain prices surging, which has also exacerbated the structural shortage of China’s domestic grain supply. Although China’s total domestic grain production is steadily increasing, the supply of key grain crops such as soybeans and corn is limited domestically and depends increasingly on imports. This is currently the biggest, structural problem facing China’s food security and the fundamental reason that international market fluctuations still pose a risk to China’s food security. Amid the global food security storm caused by this geopolitical conflict, China—as an important destination of Russian and Ukrainian grain exports and the world’s largest grain importer—faces the risks of a contraction in total grain imports and soaring prices of imported grain.

2022 年俄乌冲突的爆发在国际粮食贸易市场上引发了剧烈的“蝴蝶效应”,各国陆续抬高粮食出口壁垒、国际粮食价格迅速攀高,也加剧了中国国内粮食供给的“结构性短缺”。尽管中国国内粮食总产量与日俱增,但是在大豆、玉米等关键粮食作物中,国内生产有限,供给愈发依赖国际进口。这种结构性问题是当前中国粮食安全所面临的主要矛盾,亦是中国仍然面临着国际市场波动所带来的粮食安全风险的核心原因。在此次地缘冲突所造成的全球性粮食安全风暴中,中国作为俄乌两国重要的粮食出口对象以及全球最大的粮食进口国,面临着粮食进口总量收缩和进口粮价飙升的风险。

To date, there has been relatively limited scholarship that specifically explores the impact of the Russia-Ukraine conflict on China’s food security.1 Existing research either focuses on analyzing how changes in global grain flows have adversely affected food security,2 or considers the Russia-Ukraine conflict as an unexpected event in the process of economic globalization and analyzes the direct economic losses it has caused to China’s grain imports.3 Such studies allow an in-depth understanding of the roles played by Russia and Ukraine in the global grain market, but they are still limited to factual descriptions of a particular case without delving into the mechanism that has continuously amplified the negative impact of the Russia-Ukraine conflict on the global grain market or offering a theoretical explanation of how geopolitics may interfere with the global grain market.

截至目前,专门探讨俄乌冲突对中国粮食安全影响的研究相对有限。既有研究或是着力于分析全球粮食流通变化对粮食安全造成的负面后果,或是将俄乌冲突视为经济全球化进程中的一次突发事件来分析对中国粮食进口造成的直接经济损失。既有研究为深入了解俄乌两国在全球粮食市场中的地位提供了参考,但这些研究仍然框定于“一事一议”为特征的现实描述,未能深入探究此次俄乌冲突的负面影响在全球粮食市场中不断放大的背后机理,未能在理论上解释地缘政治对全球粮食市场的干预作用。

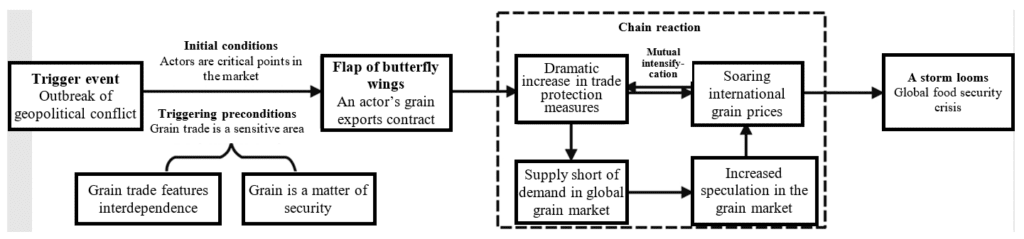

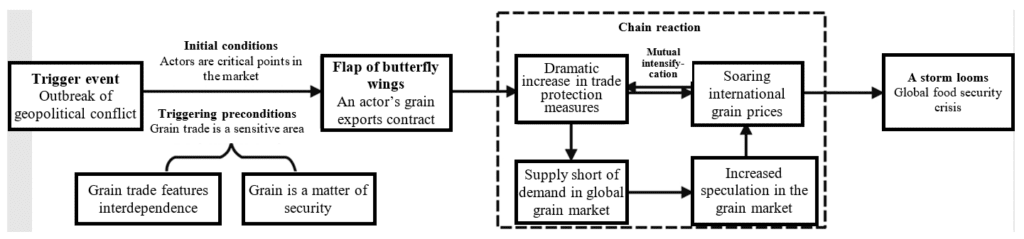

Accordingly, this article introduces the “butterfly effect” as an analytical perspective and applies it to a case study of the consequences of the Russia-Ukraine conflict for China’s food security, so as to explore how repercussions of geopolitical conflicts between countries are increasingly amplified in the global grain market, embroil major market players such as China, and lead eventually to a systemic food security crisis. This article argues that geopolitical disruption to critical points in the grain market has set off a chain reaction that has interrupted the normal operation of the international grain trade and grain pricing, triggering a systemic food security crisis.

基于此,本文引入“蝴蝶效应”的分析视角,以俄乌冲突对中国粮食安全带来消极后果为例,试图探讨国家间地缘冲突的后果如何在全球粮食市场中不断放大,将包括中国在内的全球粮食市场中的大国卷入其中,以至于引发了体系性粮食安全危机。本文提出,由于地缘政治关系扰乱了粮食市场中的“关键点”,其所产生的“连锁反应”先后冲击了国际粮食贸易和粮食定价的正常运行,从而导致了体系性的粮食安全危机的爆发。

1. Butterfly Effect: How Geopolitical Conflicts Affect Global Food Security

一、“蝴蝶效应”:地缘冲突影响全球粮食安全的基本逻辑

The butterfly-effect perspective pays particular attention to how small and specific changes in individual actors in a system come to produce systemic effects and emphasizes the interconnectedness of actors’ actions in the course of development. It complements existing scholarship on food security risks associated with the Russia-Ukraine conflict and provides a new analytical framework for studying the changing situation of global food security.

“蝴蝶效应”视角尤其重视体系中单位行为体具体而微小的变化所造成的体系性影响,强调演化过程中行为体间行动的相互联系,这有助于补充既有研究中对俄乌冲突下粮食安全风险的未尽之处,为分析全球粮食安全变局提供全新的分析框架。

1.1 The meaning and triggering conditions of the butterfly effect

1.1 “蝴蝶效应”的内涵与触发条件

The idea of the “butterfly effect” originated from research in physics and meteorology, which would lay the foundation for the study of complexity in the interaction between actors. In 1963, mathematician and meteorologist Edward Lorenz proposed that even tiny initial changes in a system could result in disproportionate, system-wide impacts.4 To make his heavily formula-based theory more comprehensible, Lorenz encapsulated it in a metaphor: the flap of a butterfly’s wings in Brazil could set off a tornado in Texas—hence the name “butterfly effect.”5 This concept challenged the traditional mechanistic worldview centered on linear thinking in modern science, subverted the prevailing reductionist approach, and laid the foundation for complexity science.6

“蝴蝶效应”发轫于物理学和气象学的研究,其研究成果奠定了行为体互动“复杂性”研究的基础。数学与气象学家爱德华·洛伦兹1963 年提出,在系统中即使微小的初始变化亦足以形成与之体量不相匹配的系统性影响。为使这一高度公式化的研究成果便于理解,洛伦兹将其研究成果概述为“在巴西蝴蝶扇动翅膀足以在得克萨斯州引发龙卷风”,因此而得名“蝴蝶效应”。 这一观点挑战了现代科学中以线性思维为核心的传统机械性世界观,冲击了以还原主义为主流的方法论,成为复杂性科学(Complexity Science)的基础。

Since the end of the twentieth century, more and more scholars have applied the concept of complexity to the study of the world economy and international politics, improving the “butterfly effect” as an analytical framework. James N. Rosenau was the first to use the theory of “cascading interdependence” to explain how interconnections cause the spread of tensions in a system.7 Robert Jervis summarized the outcomes of interactions between actors as “system effects”8 and pointed out that local changes could have disproportionate impacts. However, his examination and application of system effects did not go beyond defining concepts and he did not formulate a framework for analyzing system effects.9 Filling in this gap, Thomas Oatley has articulated an analytical framework of “complex interdependence” and focused particularly on dynamic changes within actors and how they affect the system itself, noting that a system’s complexity derives from its ability to “generate unpredictable events,”10 which is highly compatible with the internal logic of the “butterfly effect” and which helps to provide further insight into its workings.

20 世纪末以来,越来越多的学者借鉴“复杂性”研究世界经济与国际政治,为完善“蝴蝶效应”分析框架创造了条件。其中,詹姆斯·罗斯诺最早使用“级联式相互依赖”(cascading interdependence)解释相互联系所导致系统内冲突的扩散。杰维斯(Robert Jervis)进一步将行为体间互动所产生的后果总结为“系统效应”,指出局部性的改变会产生与之不相对称的后果。然而,杰维斯对系统效应的考察和运用只停留在概念界定层面,而未能提供一个系统效应的分析框架。 此后,托马斯·奥特利所提出的“复杂性相互依赖”的分析框架对这一不足之处进行了补充。奥特利尤其关注行为体内部的动态变化及其如何影响到系统本身,并特别指出系统的复杂性来自“系统产生难以预测事件的能力”,这就使得其与“蝴蝶效应”的内在逻辑高度适配,有助于进一步发掘“蝴蝶效应”的作用机理。

These existing works have served to refine the trigger mechanism of the “butterfly effect” and give it strong explanatory power in analyzing various potential and uncontrollable risks faced by countries. According to the initial definition of the “butterfly effect,” contingent events in the international system will bring about systemic consequences through the combined agency of the following two trigger conditions. First, the actors are highly sensitive to change; that is, they pay a high price for fluctuations in the system. Provided that they do not seek to leave the system, in order to avoid paying an unnecessary price, the actors will not only take immediate action in response to change, but will do so regardless of the degree of change, responding to even minute changes.11Matthew J. Hoffmann and John Riley, “The Science of Political Science: Linearity or Complexity in Designing Social Inquiry,” New Political Science 24, no. 2 (2002): 312. Notably, initial conditions, which potentially have system-wide effects, are not random, and thus in conducting research it is necessary to identify them and determine whether they are at “critical points” in the system.12 Second, the actors’ actions in response to change are interconnected; in other words, “a factor’s effect on a social system depends upon the state of other factors.”13 Positive feedback magnifies the effect:14 a change in an actor within the system sets off other changes in the same direction, leading to drastic alterations in the system and its elements.15

这些既有工作有助于完善“蝴蝶效应”的触发机制,使其在探析国家所面临的各种潜在且不可控的风险方面拥有强解释力。根据“蝴蝶效应”的初始定义,在下述两种触发条件的共同作用下,国际体系中的偶发性事件将带来体系性的后果。其一,行为体对变化具有高度敏感性,即行为体需要为体系中出现的波动付出高昂的代价。在不谋求脱离体系的前提下,为避免付出不必要的代价,行为体在面对变化时不仅会立刻采取行动予以应对,且会无视变化程度的差异,即使微小的变化也会使得行为体采取应对措施。 需要特别指出的是,初始条件不是随机的,这就需要在具体研究中对这些引发体系性影响的初始条件进行识别,判断其是否处于体系中的“关键点” (critical points)。 其二,行为体应对变化的行动相互联系,即“一个行为体产生的体系性影响同样也取决于其他行为体的情况”。 其中正向反馈放大了其在体系内带来的改变,体系内行为体所出现的变化,都会引发同一方面的其他变化,从而导致系统及要素的剧烈改变。

Due to the actors’ sensitivity to change and their interconnectedness, changes in initial conditions will set in motion a chain reaction in the system. Sensitivity prompts the various actors to respond to the initial changes, and interconnections between them mean that adjustments in parts of the system will be continuously magnified through positive feedback, which produces an end result where “the whole is greater than the sum of its parts.” What underlies this process is nonlinearity, a key concept in the study of “complexity”.

由于行为体应对变化的敏感性和相互联系的特征,初始条件的变化在系统中呈现出以“连锁反应”为特征的演化过程。敏感性诱发各行为体纷纷应对初始条件的变化,而行为体间的相互联系致使系统中部分的增减会通过正向反馈不断放大,最终导致出“整体大于部分之和”的结果,其产生的原因便是“复杂性”研究所强调的“非线性关系”。

Overall, the global grain market highly satisfies the trigger conditions for the “butterfly effect” as it is characterized by interdependence and as grain itself is a product essential to security. Therefore, fluctuations in certain countries’ shares of grain exports are likely to bring about drastic consequences in the global grain market. First, the growing international grain trade has bound the grain supply of various countries into a framework of mutual dependence, with more countries supplementing or even replacing domestic grain production through the international market, and the grain trade has become a main source of grain supply. As the export of grain is relatively concentrated in a few countries,16 and as financial speculation has increasingly interfered with the international grain trade, fluctuations in the global grain trade have increasingly deviated from the law of supply and demand, and grain supply on the global market has thus become highly uncontrollable. Grain, moreover, is essential to national security, and so governments are highly sensitive to fluctuations in grain supply. Domestically, food is the cornerstone of political stability. Formulating social and economic policies to ensure access to sufficient food resources for all citizens is one of the government’s core obligations.17 Internationally, food is a strategic asset and a tool for improving foreign relations or for undermining political rivals. It has “quickly become the hidden driver of world politics.”18 It is precisely because food is a matter of security that grain shortage and the ensuing surge in grain prices often reverberate beyond the grain trade sector19 and lead to more serious consequences such as mass riots, social unrest, and even regime change.20 Therefore, when facing changes—especially negative ones—in the international grain market, governments will take active measures to protect their domestic food security from external threats.

综合来看,由于全球粮食市场具有相互依赖的特征以及粮食本身是一种具有安全属性的产品,粮食国际贸易市场高度匹配“蝴蝶效应”的触发条件,因此,个别国家粮食出口份额的波动极有可能会在全球粮食市场中造成剧烈后果。一方面,在全球粮食市场中,不断增长的跨国粮食贸易已经将各国的粮食供给绑定于一个相互依赖的框架之中。越来越多的国家通过国际市场补充、甚至替代国内粮食生产,粮食贸易成为粮食供给的主要途径之一。而由于粮食出口国相对集中、金融投机行为对国际粮食贸易的干预加剧,全球粮食贸易的波动愈发偏离正常的供需关系,故而国际市场的粮食供给具有高度不可控性。另一方面,粮食作物具有强烈的安全属性,因此国家对粮食供给关系的波动具有高度敏感性。对内,粮食是保障国家政权稳定的基石,通过制定经济和社会政策确保所有国民能够获得充足的粮食资源是政府的核心义务之一;对外,粮食是战略物资,是改善国家间关系或打击政治对手的“工具”,粮食“正在成为改变世界政治的潜在发动机”。 正是由于粮食的安全属性异常突出,粮食供给不足及与之相关的粮价飙升所产生的影响往往超越粮食贸易领域,导致群体性骚乱,并诱发社会动荡甚至政权颠覆等更为严重的后果。 故而,在面对国际粮食市场的变动,尤其是消极变化时,各国政府会积极采取措施,避免外部威胁波及国内粮食安全。

图1 地缘冲突的“蝴蝶效应”触发机制

图1 地缘冲突的“蝴蝶效应”触发机制1.2 How the “butterfly effect” of the Russia-Ukraine conflict on the global grain market has developed

1.2 俄乌冲突对全球粮食市场的“ 蝴蝶效应”演化机理

The “butterfly effect” triggered by the Russia-Ukraine conflict has not only directly endangered food security in the destinations of Russian and Ukrainian exports, but also created varying degrees of food security risks for countries around the world. The condition that has enabled this “butterfly effect” to develop is that Russia and Ukraine are critical points in the global grain market, and the development has unfolded as a worldwide chain reaction set off by changes in the scale of their exports. The geopolitical conflict, that is, has disrupted the flows of the global grain trade and precipitated significant fluctuations in international grain prices, thereby triggering a storm in the global grain trade.

俄乌冲突所引发的“蝴蝶效应”不仅直接危及俄乌两国出口对象的粮食安全,而且还造成全球各国面临不同程度的粮食安全风险。这一“蝴蝶效应”得以不断演化的条件在于俄罗斯和乌克兰是全球粮食市场中的“关键点”,演化过程表现为其出口规模的改变在全球范围内导致了一系列的“连锁反应”。故此,地缘冲突先后影响了全球粮食贸易的正常流通并催化了国际粮价的大幅波动,因而引发了全球粮食贸易的“一场风暴”。

(1) Critical points in the market: Russia and Ukraine as initial conditions for the butterfly effect

(1)市场关键点:作为“蝴蝶效应”初始条件的俄罗斯和乌克兰

Russia and Ukraine have become critical points in the global grain market not only on the strength of their considerable grain exports and their export destinations’ high sensitivity to the stability of grain supply, but also on account of their indirect control over global grain production and grain trade flows—two areas crucial to food security.

俄罗斯和乌克兰成为全球粮食市场中的“关键点”,这不仅有赖于其颇具规模的粮食出口总量以及对粮食供给稳定高度敏感的出口对象,而且还在于两国对全球粮食生产和粮食贸易流通两个关乎粮食安全的关键环节具有间接控制力。

First, Russia and Ukraine account for a huge share of global grain exports. In 2021, the two countries produced 19 percent, 14.3 percent, and 4.6 percent of the world’s barley, wheat, and corn, respectively, and accounted for more than 20 percent of the global exports of these cereals, with 32.5 percent of the world’s barley exports, 30.6 percent of wheat exports, and 19.7 percent of corn exports coming from Russia and Ukraine.21 Since the two countries occupy important positions in the relatively concentrated global grain export market, the geopolitical conflict between them has directly and severely disrupted the operation of the global grain market.

其一,就贸易规模而言,俄罗斯和乌克兰在全球粮食贸易市场中具有庞大的出口份额。2021 年,两国的大麦、小麦和玉米产量合计占全球总量的19%、14.3%和4.6%,与之相应,两国在相关作物的出口中均占据超过20%的全球市场份额,全球32.5%的大麦、30.6%的小麦以及19.7%的玉米出口均来自俄乌两国。 俄罗斯和乌克兰在相对集中的全球粮食出口市场占据一席之地,正因如此,两国的地缘冲突直接冲击了全球粮食市场的正常运行。

Second, the grain exports of Russia and Ukraine are irreplaceable for their destination countries. A large amount of Russian and Ukrainian grain is exported to the Middle East—the “powder keg” of global geopolitics. Many countries there, including Egypt, Lebanon, and Yemen, import over 90 percent of their wheat from Russia and Ukraine,22 and the political stability of those countries hinges on the stability of food imports. Russia and Ukraine, furthermore, maintain close food trade ties with major countries that dominate global geopolitics. Ukraine—the “granary of Europe”—is European countries’ main source of food imports and has pursued food cooperation with China through the Belt and Road Initiative. Russia regards food trade as a strategic asset in its diplomacy and actively cultivates agricultural economic cooperation in the Far East region.

其二,就贸易对象而言,两国的粮食出口对其出口对象具有不可替代性。一方面,俄乌粮食出口大量流向了被称为全球地缘政治“火药桶”的中东地区,包括埃及、黎巴嫩、也门在内的多国对俄乌的小麦进口依存度超过90%,而粮食进口来源的稳定与这些国家的政局稳定具有强相关性;另一方面,俄乌两国与主宰全球地缘政治的大国保持着密切的粮食贸易往来,乌克兰是欧洲国家的粮食进口主要来源,素有“欧洲粮仓”之称,且通过“一带一路”倡议不断推进与中国的粮食合作。俄罗斯将粮食贸易作为配合其外交手段的战略物资,积极在远东地区开发农业经济合作。

In addition, it is important to note that Russia and Ukraine are “node countries” in grain production and grain flows respectively, with the former controlling the trade in intermediate goods in the production of grain and the latter a key route of global grain flows. Russia is the world’s largest exporter of fertilizers, and countries in Latin America, Eastern Europe, and Central Asia import more than 30 percent of their fertilizers from Russia, which has further enhanced its position in the global grain market. The Black Sea ports controlled by Ukraine are one of the arteries for global grain transportation.23 Over one-fifth of the world’s wheat trade and one-sixth of the corn trade pass through the Black Sea, which illustrates the indispensable role of Ukrainian ports in the global grain market. 24

此外,不可忽视的是,俄罗斯和乌克兰分别是粮食生产和流通过程中的“节点国”,控制着粮食中间品贸易和全球粮食流通的要道。俄罗斯是全球最大的化肥出口国,包括拉丁美洲、东欧以及中亚等国对俄罗斯的化肥进口依赖超过30%,这亦提高了俄罗斯在全球粮食市场中的地位。乌克兰所控制的黑海港口是全球粮食运输的“咽喉要道”之一,全球超过五分之一的小麦和六分之一的玉米贸易经黑海运出,乌克兰控制下的港口在全球粮食市场中不可或缺的关键地位得以展现。

In short, the scale and the destinations of grain exports from Russia and Ukraine have made the two countries critical points in the global grain market, and their roles as nodes in the global grain industry have consolidated their prominent market positions. As a result, repercussions of the Russia-Ukraine geopolitical conflict have been spreading across the globe, and countries all over the world have had to weather the food security storm caused by this butterfly effect.

总之,俄乌两国的粮食出口规模和出口对象奠定了其在全球粮食市场中的“市场关键点”地位,而两国在全球粮食产业中发挥的“节点”作用巩固了两国不容忽视的市场地位。正因如此,俄乌地缘冲突的爆发所带来的后果不断向全球扩散,使得世界各国共同承担这一“蝴蝶效应”所带来的粮食安全风暴。

(2) Chain reaction: The impact of the Russia-Ukraine conflict on the global grain market

(2)连锁反应:俄乌冲突对全球粮食市场的冲击

The geopolitical conflict has disrupted the export of grain from Russia and Ukraine—a flap of the wings in the global grain market that has set off a food security storm. In Ukraine’s case, shelling on its major grain-producing areas and transshipment ports has largely brought grain production and export to a halt, with its main grain-producing areas having become a war zone and its export capacity in the Black Sea crippled by the conflict, both of which pose direct and unpredictable risks for Western grain imports and even for the global grain market. In Russia’s case, in the face of unprecedented economic sanctions by the West, it took the initiative to launch a counterattack in the food trade sector, not only announcing that it would no longer export grain to “unfriendly countries” and the Eurasian Economic Union,25 but also limiting the currencies of payment to rubles and trade partners’ national currencies only, so as to accelerate Russia’s dedollarization.26 Fertilizer exports, too, have been suspended as Russia expanded its toolbox of countersanction measures by weaponizing food.27 Russia’s weaponization of food—with its grain exports to Western countries cut off—has further intensified the antagonism between Russia and the West.

地缘冲突导致俄罗斯和乌克兰两国的粮食正常出口受到影响,俄乌两国在全球粮食市场“扇动翅膀”,掀起了粮食安全波澜。一方面,炮火袭击了乌克兰的重要粮食产区及转运港口,乌克兰的粮食生产和出口基本中断。在生产端,乌克兰粮食主产地均已沦陷在战火之中;在流通端,战争冲突重挫了乌克兰在黑海的出口能力。这都直接对西方粮食进口乃至对全球粮食市场带来难以预估的风险。另一方面,面对西方世界规模空前的经济制裁,俄罗斯率先在粮食领域发起了反击。俄罗斯不仅宣布不再向“不友好国家”以及欧亚经济联盟出口谷物,而且仅允许以卢布和国家本币的方式进行结算,加速俄罗斯“去美元化”进程。 此外,化肥出口也被纳入俄罗斯利用粮食武器进行反制裁的工具箱之中,暂停对外出口。 俄罗斯“粮食武器”的使用直接切断了其对西方国家的粮食出口,进一步加剧了俄罗斯与西方国家之间的对立。

Moreover, the contraction of Russian and Ukrainian grain exports prompted other countries to erect barriers to the food trade, which has exacerbated the surge in international food prices and amplified the impact of insufficient Russian and Ukrainian grain exports, so much so that a global food security crisis looms large. First of all, as supplies from Russia and Ukraine decreased, more and more countries erected barriers to the export of foodstuffs on the grounds of protecting the stability of domestic supply, which in turn made the global food supply shortage a self-fulfilling prophecy. Since the start of the Russia-Ukraine conflict, nearly 20 countries have imposed various food export restrictions, and the exports affected by the restrictions account for over 17 percent of the global food trade.28 More than two-thirds of such restrictions target cereals such as wheat, rye, and barley.29 Subsequently, the global food market descended into chaos, catalyzing the surge in global food prices. As a bellwether for global food prices, the Chicago Mercantile Exchange repeatedly warned of abnormal fluctuations in global grain prices. Trading prices of futures contracts for wheat, soybeans, and corn soared to new highs after the outbreak of the Russia-Ukraine conflict, breaking the records set during the “super cycle” in the spring of 2008.30 Despite a fall after a bumper grain harvest in the southern hemisphere and the Black Sea Grain Initiative signed by Russia and Ukraine in July 2022, global grain prices remain at a high level in general.

此外,俄乌粮食出口收缩导致其他国家高筑粮食贸易壁垒并激化了国际粮价不断飙升,这都在不断放大俄乌粮食出口供不应求的影响,以致于全球性粮食安全危机的“风暴逼近”。首先,随着俄乌两国供给收缩,越来越多的国家以“保护国内供给稳定”为由高筑粮食贸易壁垒,这反而使得全球性的粮食供给不足成了“自我实现的预言”。自俄乌冲突以来,已有近20个国家先后实施各种粮食出口限制,受限商品贸易量在全球粮食贸易比重超过17%,超过三分之二的限制措施针对小麦、黑麦和大麦等谷物。 随后,全球粮食市场陷入混乱,催化了全球粮价的飙升。芝加哥期货交易市场作为全球粮食价格的风向标,多次预警全球谷物价格的异常波动。小麦、大豆和玉米的期货合约交易价在俄乌冲突爆发后一度达到巅峰,打破了2008 年春季所谓“超级周期” 期间创下的纪录。 尽管由于南半球粮食丰收以及俄乌两国在2022 年7 月达成《黑海海域谷物出口协议》,全球粮食价格已经有所下跌,但总体而言交易价格仍然处于高位。

In summary, the reduction in grain exports from Russia and Ukraine following the outbreak of the conflict has set in motion a “butterfly effect.” The “beggar-thy-neighbor” trade protection measures taken by various countries and the consequent futures speculation have amplified each other, spreading the negative consequences of the geopolitical conflict and causing varying degrees of harm to grain supply and price stability in countries around the world. Major grain-importing countries, including China, are vulnerable to this food security storm. China’s food security has deteriorated as risks arising from changes in Russian and Ukrainian supplies are compounded by the repercussions of fluctuations in the global grain market.

总之,俄乌冲突所导致的两国粮食出口缩减成为“蝴蝶效应”的起点,各国“以邻为壑”的贸易保护措施以及由此激发的期货投机行为相互激化,致使地缘冲突所导致的消极后果持续扩散,导致各国粮食供给以及价格稳定均受到不同程度的伤害。包括中国在内的粮食进口大国亦未能幸免,因此陷入了粮食安全“风暴”之中。对于中国而言,俄乌供给变化所产生的粮食安全风险叠加全球粮食市场波动所带来的后果,恶化了中国的粮食安全现状。

2. Critical Points in the Market: Why the Russia-Ukraine Conflict’s “Butterfly Effect” Has Threatened China’s Food Security

二、市场关键点:俄乌冲突的“蝴蝶效应”缘何冲击中国粮食安全

Russia and Ukraine are critical points in the global grain market not only by virtue of their substantial volume of trade, but also because they play an indispensable role in the market for the destination countries of their exports. China, for example, has seen Russia and Ukraine as important options for diversifying its sources of grain imports. Both countries have established close grain trade ties with China, with their exports to China having increased significantly. They are becoming China’s main sources of grain imports and their importance to its food security is growing ever more prominent.

俄罗斯和乌克兰是全球粮食市场中的“关键点国家”,这不仅在于两国相对庞大的贸易规模,还在于两国在全球市场中对其出口对象而言具有不可或缺的地位。对于中国而言,俄罗斯和乌克兰是中国缓解粮食进口来源集中的重要选择。两国已经与中国建立密切的粮食贸易关系且对华出口大幅提升,正在成为中国粮食进口的主要来源,对保障中国粮食安全的重要性日益突出。

2.1 Ukraine: A hub country that supplements China’s grain supply

2.1 乌克兰:补充中国粮食供给的枢纽国家

Well endowed with natural resources, Ukraine has long been a major agricultural producing and exporting country. Geographically, it has convenient access to the Black Sea and connects Europe and Asia, which make it a node of global grain flows. It has become China’s key source of grain imports and a hub country that allows China to supplement its domestic supply through the global market.

乌克兰是传统农业大国,兼具资源禀赋优势和农业出口实力,且在地理位置上扼守黑海、联通欧亚,因此是全球粮食流通的节点。对于中国而言,乌克兰已经成为中国粮食进口的核心来源,是中国利用全球市场补充国内供给的枢纽国家。

Boasting a mild climate and over 40 percent of the world’s fertile black soil, Ukraine has done well in agricultural production and trade.31 After the Crimean crisis in 2014, it was an important goal of Ukraine’s foreign economic policy to compensate for the economic losses resulting from its deteriorating relations with Russia and find new geoeconomic partners. To this end, Ukraine needed to open up new international markets and diversify its trade partners. As long-term political instability, social unrest, and regional conflicts plagued Ukraine’s economic development,32 its economic growth mainly relied on the export of grain and other commodities in the production of which it could take advantage of its resource endowments.33 In this context, Ukraine became China’s best option for expanding its sources of grain imports and developing foreign sources of grain.

乌克兰是拥有全球40%以上的肥沃黑土,气候温和,农业生产和贸易都比较发达。自2014 年克里米亚危机后,弥补对俄关系恶化所造成的经济利益损失并扩展地缘经济伙伴成为乌克兰对外经济政策的重要目标。这一目标的实现需要其开辟更加广阔的国际市场、发展多元化的贸易对象。由于长期的政治不稳定、社会动乱以及地区冲突给乌克兰经济发展造成的负面影响,其经济增长更加集中于出口粮食等具有资源禀赋优势的商品。 在此背景下,乌克兰成为中国拓展粮食进口来源、构建海外粮源的最佳选择。

Ukraine has since developed into a source of grain supply that plays a crucial role in China’s food security, becoming China’s preferred choice for corn imports and a main source of wheat, barley, and other cereals as well. After China significantly opened up to Ukrainian corn in 2012,34 Ukraine’s corn exports to China grew several times over, and for a time it supplanted the United States as China’s largest source of corn imports. Ukraine’s exports of other cereals to China were on the rise, too. It accounted for over a quarter of China’s barley imports, of which it was the largest source,35 and it was also an important source of beer and starch imports, with the volume of trade having doubled annually over the past eight years.

一方面,乌克兰已经发展成为保障中国粮食安全的海外粮源之一,其不仅是中国玉米进口的首选国家,同样也是小麦、大麦等其他作物的主要进口来源。在2012 年中国大幅开放乌克兰玉米进口后,乌克兰对华玉米出口成倍增长,一度取代美国成为中国最大的玉米进口来源。在其他粮食作物中,乌克兰对华粮食出口规模亦不断扩张,不仅是中国第一大大麦进口来源国,在中国大麦进口中占比超过25%,而且还是啤酒、淀粉等的重要进口来源,在过去8年中以年增一倍的速率扩大贸易规模。

Ukraine, furthermore, has featured in China’s plan for the overseas expansion of its grain industry. Ukraine’s superior resource endowments and geographical advantage made it a top country for China’s “Agriculture Going Global” policy, which further deepened China’s dependence on Ukraine in the grain trade. With the support of the Belt and Road Initiative, Chinese food and agricultural companies, especially COFCO, took the lead on three fronts—grain trading, logistics and transportation, and storage construction. First, COFCO became one of the biggest agricultural exporters in Ukraine by acquiring all Ukrainian assets of the European agricultural trader Noble Group. Second, COFCO invested in the construction of a grain shipping terminal in Ukraine that has become one of the key points of transshipment of agricultural goods in Eastern Europe. Third, COFCO owns four large grain silos along the Dnieper River.36 China’s agricultural investments in Ukraine have covered the full production chain, from production, processing, and warehousing to packaging, logistics, and trading.37

另一方面,乌克兰已经参与到中国全球粮食产业的海外布局之中,乌克兰的资源禀赋优势以及地理位置优势使其成为中国“农业走出去”政策的首选国家,这也进一步加深了中国在粮食贸易上对乌的依赖。以中粮集团为代表的中国粮农企业在“一带一路”倡议的支持下,率先在粮食交易、物流运输以及仓储建设中发力。在粮食交易方面,通过收购欧洲粮商来宝集团(Noble Group)在乌克兰的全部股份,中粮集团成为乌克兰境内最大的粮农出口商之一;在物流运输方面,中粮集团在乌克兰投资建设的粮食码头已经成为东欧农产品转运的关键节点之一;在仓储建设方面,中粮集团在乌克兰拥有4 个沿第聂伯河东西方向分布的大型粮仓。 中国在乌克兰的农业投资已经形成全产业链,覆盖了种养殖、加工制造、仓储、包装、物流和贸易多个环节。

Ukraine, therefore, is key to China’s food security, to which its strategic significance is illustrated by the import volume of Ukrainian corn—a critical cereal for China—and by its broad integration into China’s grain production chain. Its importance to China’s food security increased as closer links were forged between the development of its grain industry and China’s Belt and Road Initiative.

简言之,乌克兰作为维护中国粮食安全的枢纽,对中国粮食安全的战略意义分别体现在乌克兰对中国关键粮食作物玉米的进口规模以及对中国粮食产业链条融入广度方面。随着乌克兰粮食产业发展与中国“一带一路”倡议的联系日益密切,乌克兰对中国粮食安全愈发重要。

2.2 Russia: A foreign source of grain that safeguards food security

2.2 俄罗斯:保障粮食安全的海外粮源

Russia is an emerging food-exporting powerhouse with both agricultural development potential and strong policy support. Its political and economic aspirations, moreover, align with those of China, and it actively participates in China’s plan for the overseas expansion of grain industry. Therefore, although the scale of Russia’s grain trade with China is unremarkable today, it is strategically valuable for safeguarding China’s food security as a foreign source of grain where China can promote the production of key grains.

俄罗斯是粮食出口的新兴大国,兼具农业发展潜力和政策扶持优势,且与中国有共同的政治和经济诉求,积极参与中国粮食产业的海外布局。基于此,尽管俄罗斯对华粮食贸易规模在当前并不突出,然而其对于保障中国粮食安全具有战略价值,是中国推动关键作物海外生产以维护国内粮食安全的海外粮源。

Russia’s arable land is vast, flat, and fertile,38 ideal for agricultural development. In a period when oil prices were high, foreign exchange reserves were abundant, and the national coffers were full, however, the comparative advantages of Russia’s agricultural resources lay underappreciated, and therefore agriculture had long been a weak point in Russia’s industrial planning. After the Crimean crisis, Russia was hit with economic sanctions by Western countries. In response, Russia has gradually adjusted the direction of its economy, and agriculture has become a new focal point in its economic development.39 Against this backdrop, the strategic value of grain cooperation between Russia and China has steadily grown, with Russia becoming China’s preferred partner for developing foreign grain supplies.

俄罗斯耕地广阔平坦且肥沃,具有发展农业的先天优势,但是在高油价、外汇充足、财政充裕时期,农业资源的比较优势并不亮眼,故而在俄罗斯产业布局中,农业长期以来是发展短板。克里米亚危机后,俄罗斯遭遇了西方国家的经济制裁,为应对封锁,俄罗斯陆续调整了经济发展方向,农业成为俄罗斯经济发展中的“新亮点”。 以此为背景,俄罗斯与中国粮食合作的战略价值不断加强,成为中国开发海外粮食供应的优先选择。

Specifically, Russia is China’s preferred overseas location for expanding the production of key grains. A prime example is the promotion of soybean production in Russia’s Far East region, which illustrates how the two countries have increased the alignment of their interests in common areas related to economic security, and that Russia has become a foreign source of grain that allows China to shield its food supply from fluctuations on the international market. The Far East region is the frontier of Russia’s eastward expansion of its strategic space, and its level of development to a large extent directly determines the depth and breadth of Russia’s integration into the Asia-Pacific region.40 Soybeans, meanwhile, are central to China’s food security, over which they hang like the “sword of Damocles” due to China’s low self-sufficiency rate and the predominance of U.S. and Brazilian soybeans in its imports.41 The Far East region has thus become a focus of Sino-Russian agricultural cooperation: China actively promotes the development of the soybean industry there, which it tries to use as a stepping stone to further agricultural cooperation deeper into the Russian hinterland.42 Back in 2011, China identified the Far East region as a priority area for Chinese agricultural investment and explicitly proposed that China and Russia jointly build a series of grain complexes and strive to produce high value-added products, develop logistics facilities for produce, and apply innovative agricultural technologies.43

具体而言,俄罗斯是中国关键粮食作物生产外移的优先选择,以推动在远东地区的大豆生产为代表,两国在关乎经济安全的共同领域加强利益捆绑,俄罗斯成为中国规避国际市场冲击国内供给的海外粮源。远东地区是俄罗斯向东扩展战略空间的前沿,其发展水平在很大程度上直接决定着俄罗斯融入亚太地区的深度和广度。 而大豆是中国保障粮食安全的核心,由于其自给率低、进口来源由美国和巴西两国主导,大豆已经成为中国粮食安全的“悬梁之剑”。 因此,远东地区成为中俄农业合作的集聚区,中国积极推动远东地区的大豆产业发展,以此为开端,尝试逐渐将中俄农业合作深入到俄罗斯腹地。 在2011 年,中国便确立远东地区是中国农业投资的优先地区,明确提出中俄双方共同建设一系列粮食综合体,致力生产高附加值产品、发展农产品物流设施、应用农业创新技术。

Accordingly, China and Russia have gradually liberalized agricultural trade and investment between them and built common interests in the grain sector. After 2015, restrictions on grain trade between the two countries were gradually lifted,44 which opened up the Chinese market to Russian grain exports, and Russian wheat exports to China increased year after year. As for investment, China has provided opportunities for agricultural companies to invest in Russia to boost the development and upgrading of the Russian grain industry. In 2016, the Russian-Chinese Fund for Agro-Industrial Development was established with the support of both countries’ governments to invest in Russian grain production and processing companies, with an initial capital totaling 13 billion rubles, of which 90 percent was provided by Chinese investors and 10 percent by Russian investors.45 The establishment of this cooperation mechanism has aroused the enthusiasm of Chinese agricultural companies to invest in Russia. Today, China’s stock of investment in Russia’s agriculture is second only to that in its mining industry, accounting for 23 percent of China’s total direct investment in Russia.46 The above measures have consolidated Russia’s central position in China’s overseas expansion in the grain industry and laid the groundwork for it to become a foreign source of grain that safeguards China’s food security.

在此基础上,中国与俄罗斯陆续开放了两国的农业贸易和投资限制,加速两国在粮食领域的利益联结。在贸易领域,2015 年后,中俄粮食贸易的限制被逐步取消,这就为俄罗斯粮食出口开辟中国市场打开了通道,俄罗斯对华小麦出口逐年递增。在投资方面,中国为农企赴俄投资提供了机遇,以助力俄罗斯粮食产业的发展升级。2016 年,俄中农业产业发展基金(the Russian-Chinese Fund for Agro-IndustrialDevelopment)在两国政府支持下成立,为俄罗斯粮食生产及加工企业进行投资。现阶段基金的初始资金共130 亿卢布,其中90%由中国投资者提供,10%由俄罗斯投资者提供。 这一合作机制的建立激发了中国粮企赴俄投资的热情。如今中国对俄罗斯的农业投资存量仅次于采矿业,占中国对俄罗斯直接投资总量的23%。 上述措施均加强了俄罗斯在中国粮食产业外移中的核心地位,为其成为保障中国粮食安全的海外粮源奠定基础。

Since China reduced its soybean imports from the United States after the latter initiated a tariff war, Sino-Russian agricultural cooperation in the Far East region has focused increasingly on the soybean industry, which has further highlighted Russia’s importance to China’s food security. In June 2019, China and Russia signed a bilateral agreement on expanding the soybean trade and deepening cooperation throughout the entire production chain—the door opening wider for the import of soybeans from Russia. Since then, almost all Russian soybean exports have headed for the Chinese market. Russia is becoming a more integral part of China’s planning for the soybean industry and a potential key country in ensuring the stability of China’s soybean supply. Overall, although Russia’s grain trade with China is still relatively small, Russia is a key part of China’s strategy for diversifying its grain supply, and grain cooperation between the two countries is likely to deepen further in the future.

在中国因遭遇美国“关税战”而减少自美大豆进口规模后,中俄在远东地区的农业合作加速向大豆产业集中,俄罗斯在中国粮食安全中的重要性进一步凸显。2019 年6 月,中俄两国共同签署双边协议,就扩大大豆贸易、深化全产业链合作达成重要共识,中国进一步开放了自俄罗斯进口大豆的窗口。此后,俄罗斯几乎所有大豆出口均销往中国市场。俄罗斯正在进一步深入到中国大豆产业布局当中,成为保障中国大豆供给稳定的潜在关键国。整体而言,虽然俄罗斯目前与中国粮食贸易总量仍然较为有限,但是俄罗斯是中国粮食供给多元化战略布局中的关键一环,在未来有可能进一步深化双方的粮食合作。

To sum up, as critical points in global grain exports, Ukraine and Russia have played an important role in China’s efforts to ensure its food security. Consequently, the “butterfly effect” of the geopolitical conflict between Russia and Ukraine has inevitably spread to China, and the chain reaction it set off has had systemic implications for China’s food security, upsetting the already tight equilibrium47 of food supply and demand in China and undermining China’s global strategy for safeguarding its food security.

简言之,作为全球粮食出口中的“市场关键点”,乌克兰和俄罗斯已经成为中国保障国内粮食安全的重要组成部分。正因如此,俄罗斯和乌克兰地缘冲突的“蝴蝶效应”必然会危及中国,其“连锁反应”将对中国的粮食安全产生牵一发而动全身的影响,动摇中国本已经处于“紧平衡”状态下的粮食供需状况,亦会破坏中国保障粮食安全的全球布局。

3. Chain Reaction: How the Russia-Ukraine Conflict Has Impacted China’s Food Security

三、连锁反应: 俄乌冲突如何冲击中国粮食安全

As the world’s largest grain importer, China has already been drawn into the global food security storm triggered by the Russia-Ukraine conflict, which has directly disrupted its import of grain. The “butterfly effect” arising from this geopolitical conflict has caused huge economic losses to China as it copes with supply shortages in the global grain market and soaring grain prices. Laying bare the food security risk that China’s grain imports are concentrated in only a few commodities and come from too few sources, the conflict has further exacerbated China’s vulnerability to changes in the global grain market. Long-term efforts are needed to offset the conflict’s negative impacts.

作为全球最大的粮食进口国,中国已经被卷入此次俄乌冲突所触发的全球粮食安全风暴之中。这次地缘冲突率先冲击了中国粮食进口的正常运行,由地缘冲突所诱发的“蝴蝶效应”需要中国付出巨大的经济成本,以应对全球粮食市场供不应求以及粮价飙升。俄乌地缘政治冲突凸显出当前中国粮食进口对象及商品集中的粮食安全短板,进一步加剧中国在全球粮食市场变化中的脆弱性,其消极影响需要长期弥补。

3.1 A flap of the wings: Direct impacts of the Russia-Ukraine conflict on China’s food security

3.1 扇动翅膀:俄乌冲突对中国粮食安全的直接冲击

As China imports grain from both Russia and Ukraine, the conflict’s “butterfly effect” has had multiple impacts on China’s food imports. Apart from supply issues such as routes for Ukrainian corn imports having been cut off, China faces the parallel crises of shrinking total grain imports and surging import prices. Such circumstances have allowed fluctuations in international grain prices to destabilize domestic grain prices.

正因中国是俄乌两国的粮食出口对象,地缘冲突的“蝴蝶效应”使得中国的粮食进口面临多重冲击。其所产生的负面后果不限于自乌进口玉米的渠道被切断的供给难题,同时还包括粮食进口整体总量收缩和进口总额飙升的并行危机,这均导致国内粮价受国际粮价波动而失稳的消极后果。

First, the conflict has interrupted China’s import of Ukrainian corn, and the United States has replaced Ukraine as China’s largest source of corn imports. Corn makes up most of the grains that China imports from Ukraine. As the conflict has obstructed corn exports, China has imported less corn from Ukraine and more from the United States, and its dependence on U.S. corn imports has thus further increased. Ukraine remained China’s largest source of corn imports in the first quarter, since Ukrainian exports had already been shipped to China before the war broke out and arrived in March. After the conflict started, however, China’s corn imports from Ukraine were blocked, and it became more dependent on U.S. corn, with total imports from the United States quickly surpassing those from Ukraine and, in 2022, reaching the highest level since 2013.48 The geopolitical conflict has crippled the channels for importing Ukrainian corn that China developed and dealt a blow to its efforts to diversify its sources of grain imports, as evidenced by its increased dependence on U.S. corn imports, which has further deepened its vulnerability in a cereal key to national food security.

首先,玉米进口受到此次地缘冲突的影响,中国自乌进口玉米暂停,美国取代乌克兰成为中国最大的玉米进口来源。玉米是中国自乌克兰进口规模最大的粮食作物,由于地缘冲突限制玉米出口,中国自乌克兰玉米进口规模减小,自美国玉米进口规模增加,因此对美国玉米进口依赖程度进一步提高。战争爆发前,乌克兰出口货物已经运往中国,并在3 月到达。在第一季度,乌克兰仍然是中国玉米进口的第一大来源国。然而在冲突爆发后,中国自乌进口玉米受阻,对美国的玉米依赖进一步提高,自美国进口总量迅速超越乌克兰。2022 年,中国自美国进口玉米总量已经创下自2013 年以来的新高。 由于地缘冲突的爆发,中国开辟的乌克兰玉米进口渠道受到重创,中国对美国玉米进口依赖的提升表明中国尝试分散粮食进口来源的努力受到打击,在关乎国家粮食安全的玉米作物中,对美国进口依赖的脆弱性进一步加深。

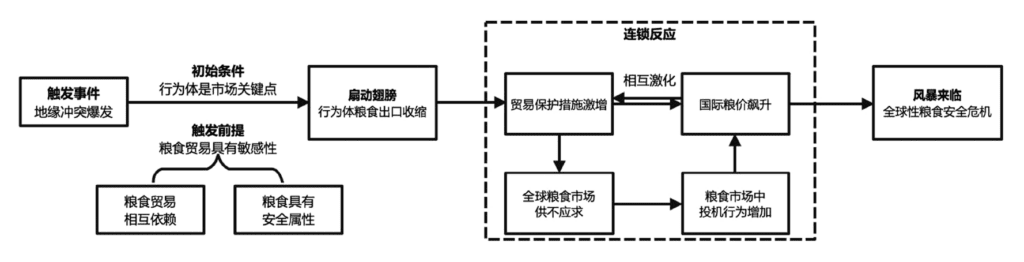

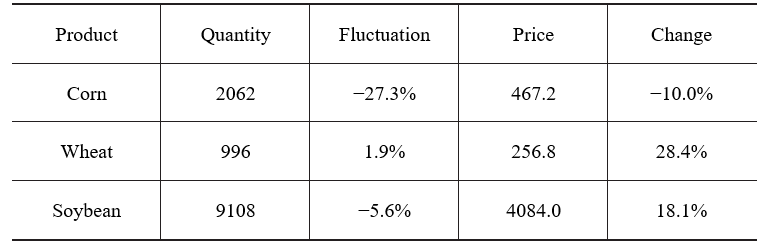

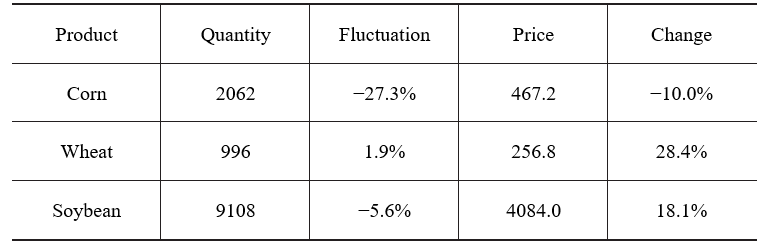

Moreover, as various countries have imposed increasingly strict export restrictions, which have hindered the normal global flows of grain, China is faced with the twofold problems of declining grain imports and soaring import prices. As the world’s largest agricultural importer, China does not have a “large-country effect” in the global grain market.49 It does not have much say in setting international grain prices, which has increased the economic cost of maintaining food security through grain imports with sellers holding sway over import prices. In 2022, China imported more than 130 million tons of grain—a decrease of 10.7 percent year-on-year, in spite of which China remained the world’s largest grain importer, with the value of imports totaling 549.99 billion RMB—a year-on-year increase of 13.7 percent. Changes in the import values of grains crucial to China’s food security—soybeans, corn, and wheat—did not correspond to changes in their quantities (see Table 1).

此外,由于各国不断加强的出口保护政策导致全球粮食正常流通受阻,中国因此面临粮食进口规模收缩且进口价格飙升的双重困局。作为全球最大的农业进口国,中国在全球粮食市场中不具有“大国效应”,是国际粮食价格的接受者,进口价格追随卖方市场,这就提高了通过粮食进口维护国内粮食安全的经济成本。2022 年以来,中国进口粮食超过1.3 亿吨,虽然同比减少10.7%,但仍然是全球最大的粮食进口国;进口总额达5 499.9 亿人民币,同比增长了13.7%。其中,对国内粮食安全至关重要的大豆、玉米、小麦等作物进口价格均面临与数量不相匹配的增幅(见表1)。

Table 1 China’s import volume of major grains in 2022 and year-on-year fluctuations (units: 10,000 tons/RMB 100 million)

表1 2022 年中国主要粮食作物进口量值与同期波动(单位:万吨/ 亿人民币)

More importantly, external risks have affected the normal operation of the domestic grain market, with domestic grain purchase prices having been pushed up overall, which has threatened the stability of domestic prices. This highlights the increasingly strong knock-on effect of changes in the international grain market on domestic grain prices. Grain prices are the most fundamental prices: fluctuations in grain prices not only have a direct impact on food security, but also affect the development of related industries, citizens’ quality of life, and social stability.50 After the conflict broke out, shocks in the international grain market spread to the Chinese market and pushed domestic grain purchase prices to a high level. Corn was especially affected by geopolitics and its purchase price rose the most, approaching that of wheat—a substitute grain. Domestic price levels rose in the wake of rising grain prices. In 2022, China’s food consumer price index increased by 2.4 percent.

更重要的是,外部风险已经波及国内粮食市场的正常运行,国内粮食收购价格整体抬升,并波及国内物价稳定,这凸显了国际粮食市场变化对国内粮食价格不断增强的联动效应。粮价是百价之基,粮价的波动不仅直接关乎粮食安全,同时也与相关产业发展、居民生活水平及社会稳定等方面有密切联系。 此次地缘冲突爆发后,国际粮食市场震动波及国内,不断抬升国内的粮食收购价格。粮食价格高涨,其中玉米受到地缘政治冲击最为激烈,收购价格涨幅也最大,直逼其替代作物小麦的收购价。受此影响,国内物价水平亦水涨船高,2022 年,全国食品消费价格指数上涨2.4%。

3.2 A brewing storm: Lasting consequences of the Russia-Ukraine conflict for China’s food security

3.2 风暴来临:俄乌冲突对中国粮食安全的持续后果

The lasting consequences of the Russia-Ukraine conflict for China’s food security warrant greater attention than its limited direct impacts. Political relations are highly unstable between China and the countries from which it imports grains crucial to its food security such as corn and soybeans, which exposes food security to the tempest of geopolitical rivalry. As the Russia-Ukraine conflict has made clear, amid increasingly fierce great-power strategic competition, security considerations are becoming more and more prominent in international trade, and China’s food imports are further under the sway of a few countries with which it has unstable geopolitical relations, which makes it vulnerable to the global food security storm.

相较于此次俄乌冲突对中国粮食安全所带来的有限直接冲击,这一趋势不断发酵对中国粮食安全造成的持续后果更加值得关注。由于在玉米、大豆等攸关国家粮食安全的商品种类中,中国的粮食进口来源国与中国的政治关系高度不稳定,这就将粮食安全置于地缘政治竞争的旋涡之中。俄乌冲突暴露了在大国战略竞争愈发激烈的背景下,国际贸易中的安全逻辑逐渐上升,中国的粮食进口更加受制于少数同中国地缘关系不稳定的国家,这将使得中国卷入全球粮食安全“风暴”中。

First, due to the Russia-Ukraine conflict, the degree to which the grain trade is entangled in geopolitics—along with the risk of the weaponization of the grain trade—has increased significantly, which poses serious food security risks to China. The conflict has deepened the economic and security misalignments between the United States and China, and China’s dependence on U.S. grain imports will put a great strain on its food security. After the conflict broke out, China imported more grain from the United States, which has become China’s most important import source for key grains such as corn and soybeans. For this reason, changes in political relations between the two countries and the resulting adjustments in economic and trade policies will inevitably undermine China’s food security.51 Meanwhile, although Russia’s grain exports to China will continue to grow after the conflict, its relatively limited capacity to export grain to China will complicate China’s efforts to safeguard food security. After the conflict started, China quickly opened its grain market to Russia, signaling close geopolitical relations between them. Due to differences in their industrial structures and economic models,52 however, China needs to make long-term investment in Russia’s agriculture to effectively enhance their agricultural cooperation.53 In the short term, Russian grain exports are unlikely to replace supplies from China’s existing import sources, but closer grain trade ties between the two countries will make Western economic sanctions on China more likely—a situation that complicates China’s food security environment.

其一,由于冲突爆发,粮食贸易被地缘政治裹挟的程度大幅提高,粮食贸易“武器化”的风险进一步增加,这将使中国面临巨大的粮食安全风险。一方面,俄乌冲突深化了美国与中国在经济与安全上的错位联动,中国对美国的粮食进口依赖会对中国的粮食安全带来巨大压力。冲突爆发后,中国扩大了自美进口粮食的规模,尤其是在玉米、大豆等关键作物领域,美国都成为中国最重要的进口来源。正因如此,中美两国政治关系的变动以及由此引发的经贸政策调整必将削弱中国的粮食安全。 另一方面,俄罗斯对华出口的粮食规模在冲突后仍将继续上升,但俄罗斯对华粮食出口相对有限的实力将使得中国保障粮食安全的局势更加复杂。在冲突爆发后,中国迅速向俄罗斯开放粮食市场,释放出中俄地缘关系密切的信号。然而,由于中俄两国在产业结构及经济模式上存在差异,中国需要对俄罗斯进行长期农业投资,方能有效提高中俄两国农业合作水平。 俄罗斯出口供给在短期内难以替代中国既有粮食进口来源,但中俄粮食贸易关系的密切将增加中国遭受西方国家经济制裁的可能性,这就使得中国面临的粮食安全环境更加复杂。

Second, the relatively open global grain trade is sliding towards restrictedness and the global grain market is becoming more closed, which has made it more difficult to mitigate risks and improve domestic food security through imports as the channels for doing so are disrupted. For a long time, the international community has repeatedly emphasized the positive relationship between the international grain trade and national food security, but this positive correlation hinges on the freedom of global grain flows.54 If grain cannot flow freely throughout the world, the existing tension between large fluctuations in sources of grain imports and the low elasticity of demand in the grain market will become sharper. The Russia-Ukraine conflict has magnified the risks posed by the current global grain market to national food security and prompted a reexamination of the global grain trade pattern based on free trade. For China, food security is now closely linked to the global grain market, and in order to balance grain supply and demand, relying on imports and the international circulation to match supply to demand is unavoidable, which naturally results in the intertwinement of domestic and international grain circulation.55 The gradual decline in the global grain trade will thus have an immeasurable negative impact on China’s food security.

其二,相对开放的全球粮食贸易格局正在逆转,通过进口缓解国家粮食安全的渠道受到冲击,这导致全球粮食市场更加封闭,通过进口改善国内粮食安全水平的难度再度升级。长期以来,粮食国际贸易与国家粮食安全之间的正向关系被国际社会反复强调,但粮食贸易与粮食安全间的正相关关系是建立在全球粮食自由运行基础之上的。 如果全球粮食难以自由流通,粮食进口来源的大幅波动与粮食市场的弱需求弹性间的既有矛盾将更加突出。俄乌冲突放大了当前全球粮食市场为国家粮食安全所带来的风险,使得以自由贸易为主的全球粮食贸易模式正在被重新审视。对于中国而言,粮食安全如今已经与全球粮食市场密切联系在一起,为了实现粮食供需平衡的目标,难以避免依靠海外进口,通过外循环来解决粮食供给对需求的适配性问题,粮食内外循环的交错成为实现供需平衡的必然结果。 因此,逐渐收缩的全球粮食贸易将为中国粮食安全带来难以估量的负面影响。

Third, the conflict has revealed the insidious influence of international speculative capital on international grain prices, and China, which plays a passive role in international grain pricing, therefore faces unavoidable food security risks. As the abnormal changes in global grain prices following the conflict have shown, the futures market is gradually replacing the spot market in performing the price discovery function, and the profit-seeking nature of futures speculation has amplified the fluctuations in grain supply and demand during the crisis and inflated global grain prices in the wake of the Russia-Ukraine conflict. As China plays no part in speculative capital’s interference in international grain prices, it suffers severe economic consequences from their fluctuations, which have become a potential trigger for risks to China’s food security, especially since geopolitical interference has complicated the global grain market.

其三,此次地缘冲突揭示出国际投机资本对国际粮价的渗透,在国际粮食定价中处于被动地位的中国将因此面临难以规避的粮食安全风险。这次地缘冲突后的全球粮食价格异动表明,现货市场的价格发现功能逐渐被期货市场取代,而期货投机的逐利性放大了危机中粮食供需关系的波动,故此诱发了俄乌冲突后全球粮食价格的“虚高”。由于在投机资本干预国际粮价的全球博弈中缺席,中国为国际粮价波动承担高昂的经济后果。尤其是在全球粮食市场因地缘政治干预而更加复杂的背景下,国际粮价波动成为引发中国粮食安全风险的潜在诱因。

As a major grain importer, then, China is bearing the brunt of the intensifying “butterfly effect” in the global food market, which has brought sustained food security risks to China. This geopolitical conflict has further deepened the connection between geopolitical relations and food trade, strengthening the negotiating power held by grain-exporting countries in the increasingly concentrated grain trade and worsening the international environment for China’s import of grain. What is even more serious is that the conflict’s “butterfly effect” has not stopped yet, and food security risks continue to brew globally. As the world’s largest grain importer and a key player in global geopolitics, China has already been caught in the eye of the food security storm, and its grain imports will continue to be affected by the increasingly volatile international market.

综上所述,中国作为全球粮食进口大国,首当其冲承受着全球粮食市场中“蝴蝶效应”不断激化的后果,这为中国带来了持续的粮食安全风险。这次地缘冲突进一步深化了地缘政治关系与粮食贸易之间的联结,加剧了粮食出口国在愈发集中的粮食贸易中所拥有的卖方权力,这均在不断恶化中国粮食进口的国际环境。更为严峻的是,地缘冲突所触发的“蝴蝶效应”并未中止,全球范围内的粮食安全风险仍在不断发酵。中国作为全球最大的粮食进口国,同时也是全球地缘政治中的关键国家,已经进入了粮食安全“风暴”的中心,粮食进口仍将持续遭受愈发动荡的国际市场影响。

4. Improving Resilience: How Can China Protect Its Food Security from the “Butterfly Effect”?

四、提高韧性:中国粮食安全如何规避“蝴蝶效应”?

Faced with fluctuations in the global grain market, China—the most important grain-importing country—must “prepare for a rainy day” and improve its resilience in the market; that is, China must strengthen the capacity of its grain imports to quickly respond to and recover from contingencies, so as to prevent the repercussions of the “butterfly effect” from affecting its food security. Under the current circumstances, China’s growing grain imports have further aggravated food security risks arising from exposure to the open market, and the high concentration of import sources has, furthermore, tied China’s food security to countries with low geopolitical stability, such as Russia and Ukraine. When geopolitical turbulence occurs, therefore, pressure on China’s food security increases exponentially, and the food security risks transmitted by the international market are ultimately reflected in the high prices of imported grain. Generally speaking, improving grain supply and grain access is key to achieving food security.56 Accordingly, to expand its policy options in response to changes in the international market, China should focus both on diversifying its sources of grain import and on developing innovative financial instruments.

面对全球粮食市场的波动,中国作为其中最重要的粮食进口国,需要“未雨绸缪”,提高中国在全球粮食市场中的“韧性”,即增强中国的粮食进口在应对意外情况时得以迅速反应并恢复正常的能力,从而避免“蝴蝶效应”的后果波及中国粮食安全。在当前情况下,中国日益增加的粮食进口规模进一步加剧了因暴露在开放市场而导致的粮食安全风险,而进口对象的高度集中更是将中国的粮食安全与俄罗斯、乌克兰等地缘政治稳定性低的国家绑定在一起。因此在面临地缘政治波动时,中国所承受的粮食安全压力便呈指数性上升,最终国际市场所传导的粮食安全风险通过进口粮价的高企得以体现。整体而言,提高粮食供给和粮食获取的能力是实现粮食安全的核心要素。基于此,中国应当同时着力于分散粮食进口来源并创新金融工具两个维度,以丰富中国在应对国际市场变化的政策选择。

4.1 Diversify import sources to weaken the irreplaceability of critical points in the market

4.1 分散进口来源:削弱“市场关键点” 的不可替代性

Building on the gradual liberalization of the grain trade during the height of economic globalization, the global grain market has entered a period of relative prosperity and the trade of grain has multiplied, which has created favorable conditions for China to diversify its sources of grain imports. At the same time, many countries rich in agricultural resources still look to develop their capacity for agricultural production and export, with weaknesses in agricultural infrastructure and loopholes in industrial policies still restricting the upgrading of their agricultural sector. This provides potential opportunities for China to open up sources of grain imports. In diversifying its import sources, therefore, China needs not only to expand trade with existing major grain exporters, but also to actively tap into countries with the potential to supply grain to China.

依托于经济全球化高峰时期粮食贸易的逐渐开放,全球粮食市场迎来了相对繁荣阶段,粮食贸易规模成倍扩大,这为中国分散粮食进口的来源创造了有利条件。与此同时,大量农业资源强国的农业生产及出口能力仍有待开发,农业基础设施短板及农业产业政策漏洞仍制约着农业产业的升级,这为中国开辟粮食进口来源提供了潜在机会。因此,中国在丰富粮食进口来源的过程中,不仅需要拓展与既有粮食出口大国的贸易往来,同时还要积极开发粮食进口的潜在国家。

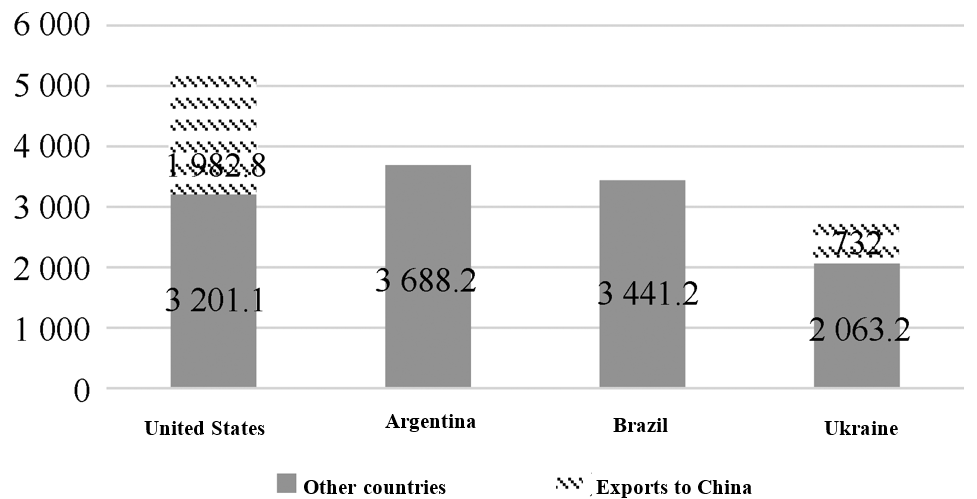

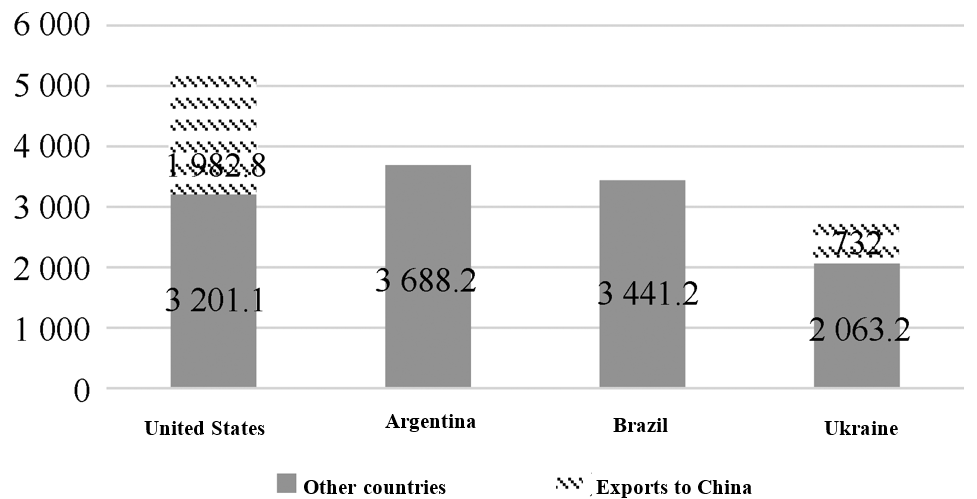

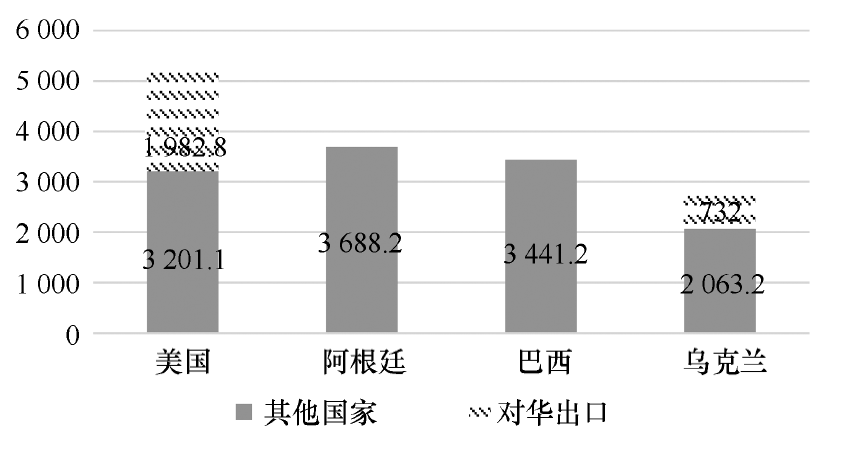

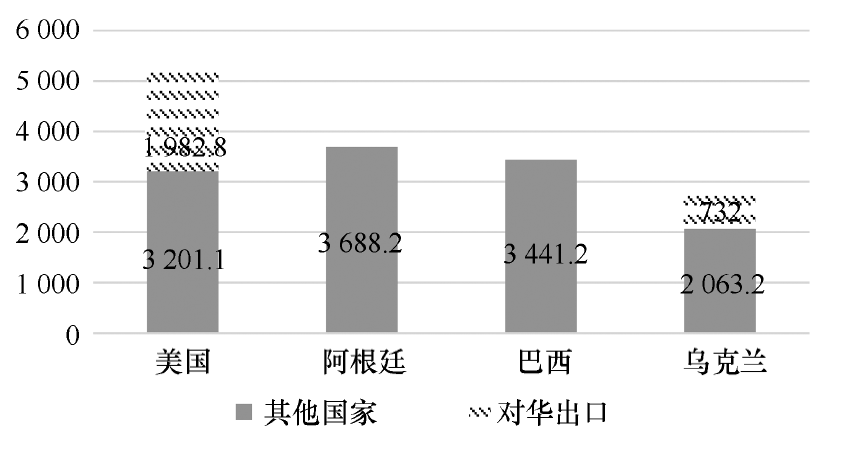

First, it is necessary for China to proactively expand its trade with the world’s major grain-exporting countries and widen its choice of import sources. Among the countries that already have an advantage of scale in grain exports, only a few countries such as the United States and Brazil have developed close grain trade relationships with China, whereas the other countries’ grain exports to China are still very limited, and they are all promising alternative sources of China’s grain imports. In the corn trade, which has been directly affected by the Russia-Ukraine conflict, the United States, Argentina, Brazil, and Ukraine are the world’s top four exporters, and yet the exports of Argentina and Brazil to China in 2020 were almost negligible. Excluding the Chinese market, the global corn exports of Argentina and Brazil far exceed those of the United States and Ukraine (Figure 2). This shows that countries such as Argentina, Brazil, and Romania—already strong in the export of grain—have the capacity not only to fill in the gap in China’s grain imports, but potentially also to further enhance their dominant positions in the global grain market through closer grain ties with China.

一方面,主动拓展同全球粮食出口大国的贸易规模,扩充中国粮食进口的选择范围。在已经具有粮食出口规模优势的国家中,除美国、巴西等少数国家已经与中国展开了密切的粮食贸易往来外,其他各国对华粮食出口规模仍十分有限,均有望成为中国粮食进口的替代国家。以受到此次地缘政治冲突直接影响的玉米贸易为例,美国、阿根廷、巴西、乌克兰是全球前四大玉米出口国,但阿根廷与巴西在2020 年对华出口量几乎可以忽略不计,而刨除中国市场后,阿根廷与巴西在全球的玉米出口规模已经远超美国和乌拉圭两国(如图2)。由此可见,阿根廷、巴西及罗马尼亚等国本身已经具有强大的粮食出口实力,不仅有能力满足中国粮食进口缺口,还有望通过与中国开展更加密切的粮食联系进一步扩大其在全球粮食市场中的优势地位。

Figure 2 Export destinations of major corn-exporting countries (unit: 10,000 tons)

图2 全球主要玉米出口国出口对象(单位:万吨)

China should, moreover, actively develop the grain industry in countries with resource endowments, so as to further safeguard China’s grain imports. In the international grain market, a large number of countries see their agricultural development hampered by insufficient national policy support and obvious weaknesses in agricultural infrastructure, which have prevented them from making the most of their advantages in factors of production. Developing countries in Central Asia, Africa, and Southeast Asia are all “overseas farmland” that awaits China’s cultivation, and through increased investment in their agriculture, they are likely to become potential sources of China’s grain imports. Many countries in sub-Saharan Africa, Eastern Europe, Southeast Asia, and Latin America have abundant arable land, possessing twice as much per capita arable land as China. Building on this, China can continue to develop countries along the “Belt and Road” in Southeast Asia and Central Asia, such as Thailand, Cambodia, and Kazakhstan, and further expand the grain industry in sub-Saharan Africa and Latin America as part of a long-term effort to diversify China’s sources of grain imports.

另一方面,积极开发具有资源禀赋国家的粮食产业,增加中国粮食进口的海外保障。在国际粮食市场中,大量国家农业发展受制于国家政策支持力度不足、农业基础设施短板明显,因此导致其生产要素优势未能充分发挥,包括中亚、非洲以及东南亚各国在内的各发展中国家均是中国有待开辟的“海外耕地”,有望通过增加对其农业投资使其成为中国粮食进口的潜在来源。在撒哈拉以南非洲地区、东欧、东南亚以及拉丁美洲等全球范围内,诸多国家耕地资源充沛,人均耕地面积是中国的两倍以上。以此为基础,中国可以继续开发泰国、柬埔寨以及哈萨克斯坦等位居东南亚和中亚的“一带一路”沿线国家,并进一步拓展撒哈拉以南非洲地区、拉丁美洲在内的粮食产业,为扩展中国粮食进口来源谋求长远之计。

Policy support plays an indispensable role in measures to diversify sources of grain import and improve resilience. The government should therefore actively pursue food diplomacy and promote agricultural cooperation between China and relevant countries to ensure the efficient operation of the grain trade and neutralize geopolitical risks in agricultural investment. In bilateral consultations, China can prioritize the agricultural sector, including grain, in economic cooperation and further formalize economic and trade relations by improving free trade agreements and bilateral investment agreements. In multilateral dialogues, China can continue to use platforms such as the Forum on China-Africa Cooperation, the Shanghai Cooperation Organization’s dialogue mechanism, and the China-ASEAN cooperation mechanism to include expanding food cooperation and promoting agricultural development into the agenda, so as to create an inclusive cooperation platform for food security. In global governance, China should actively participate in making changes to mechanisms for global agricultural cooperation, such as WTO agricultural negotiations and the reform of the Committee on World Food Security, to ensure that China’s food security interests are reflected in the improvement of the global food trade rules and in global food security governance.

具体而言,丰富粮食进口来源以提高“韧性”的措施离不开国家的政策支持,因此,政府应当积极推动“粮食外交”,促进中国同相关国家建设农业合作关系,以保障粮食贸易的高效运行并化解农业投资的地缘风险。在双边协商方面,中国可以将包含粮食在内的农业领域作为经济合作的优先领域,通过与相关国家完善自由贸易协定、双边投资协定等方式提升双方经贸往来的制度化水平;在多边对话方面,中国可以继续利用中非合作论坛、上合组织对话机制及中国与东盟合作机制等多边平台,将扩展粮食合作、推动农业发展纳入协商议程之中,以打造包容性的粮食安全合作平台;在全球治理方面,中国应当积极参与WTO 农业谈判、世界粮食安全委员会改革等全球农业合作的机制变革,从而保障中国的粮食安全利益得以在全球粮食贸易规则完善、全球粮食安全治理中得以体现。

4.2 Develop innovative financial instruments to prevent chain reactions from affecting the stability of domestic grain prices

4.2 创新金融工具:避免“连锁反应” 波及国内粮价稳定

As has been the case with the potential global food crisis triggered by the Russia-Ukraine conflict, a key link in the “butterfly effect” that threatens a food crisis lies in surges in international grain prices catalyzed by chain reactions from fluctuations in global grain supply and demand. International financial capital’s speculation in the grain market is a main cause of the frequent fluctuations in global grain prices.57 Given China’s underdeveloped financial market in agricultural commodities,58 the small number of participants in domestic agricultural futures trading, the small amount of capital involved, and the even smaller number of people who hedge in the international futures market, the extent of China’s participation in the agricultural financial market hardly matches the volume of its grain imports, which further exacerbates its vulnerability to grain price fluctuations, thereby implying higher costs of import for China in the global grain trading market. As China’s grain imports via the global market continue to grow, it is important to also enhance China’s participation and initiative in the financial market in grain. To address the food security crisis, therefore, now it is necessary to develop innovative financial instruments to improve China’s unfavorable position in the face of fluctuations in global grain prices, mitigate the “butterfly effect” that destabilizes grain prices through the financial market, and enhance China’s initiative in global grain pricing.

包括此次俄乌冲突诱发的潜在性全球粮食危机在内,因全球粮食供需关系波动的连锁反应而催化的国际粮价飙升是粮食危机“蝴蝶效应”中的关键环节。国际金融资本在粮食市场中的投机行为是导致全球粮食价格异动频繁发生的主要原因之一。 由于中国大宗农产品金融市场尚不发达、国内农产品期货交易参与者较少、参与资金规模小、利用国际期货市场套期保值者更少,以致中国在农产品金融市场中的参与度与粮食进口的规模难以匹配,这进一步放大了中国在粮食价格波动中的弱势地位,故而中国不得不在全球粮食交易市场中承担更多的进口成本。而随着中国在全球粮食市场中的进口规模继续扩大,同步提高中国在粮食金融市场中的参与度和主动权亦相当重要。因此,创新金融工具以缓解中国在全球粮价异动中的被动地位,减少“蝴蝶效应”通过金融市场破坏粮价的稳定,提高中国在全球粮食定价中的主动权,是当前应对粮食安全危机的必要之举。

Specifically, measures to develop innovative financial instruments to improve resilience mean that China needs to participate more in the global grain futures market to remedy the misalignment between the volume of its imports and its pricing power in the global grain market. First of all, China should actively participate in international agricultural futures trading and use the futures market to avoid risks. First, we should set up hedge funds and look for suitable buying opportunities in the international market to protect domestic supply from the risk of rising grain prices. Second, we should encourage large grain companies such as COFCO to directly participate in international agricultural commodity trading to enhance their initiative throughout the grain production chain. Third, we should encourage domestic financial institutions to increase financial trading in agricultural commodities and enhance the trading products of important grain derivatives. Moreover, China should develop domestic agricultural futures trading platforms to improve China’s unfavorable position in grain pricing. First, we should improve the trading mechanisms of the two major agricultural futures exchanges in Dalian and Zhengzhou to bring their rulemaking and risk-based regulation into line with international standards. Second, we should gradually loosen the restrictions on the trading products of domestic agricultural futures to let the market play a greater role in screening grain futures products. Finally, China should actively pursue international financial cooperation and work with partners to regulate speculation in the global grain market. First, we should actively participate in consultations on risk management and control in grain commodity futures trading held by international organizations such as the Food and Agriculture Organization of the United Nations, so as to formulate an international regulatory system favorable to China. Second, we should encourage other countries to jointly establish a database of information on the supply, demand, and transaction of international agricultural products to prevent speculation from destabilizing global grain prices and let supply and demand fundamentals drive prices.

具体而言,创新金融工具以提高“韧性”的措施需要提高中国在全球粮食期货市场中的参与度,以改善中国在全球粮食市场中进口规模与定价权之间的错位。首先,主动参与国际农产品期货交易,利用期货市场规避风险。一是建立相应的套期保值基金,在国际市场上寻找合适的买入机会,以保障国内供应,防范粮价上涨风险;二是支持包括中粮集团在内的大型粮商直接参与国际大宗农产品市场交易,以提升其在粮食全产业链中的主动权;三是推动国内本土金融机构增加大宗农产品金融交易,做强重要粮食衍生品交易品种。其次,发展国内农产品期货交易平台,缓解中国在粮食定价中的被动地位。一是完善位于大连和郑州的两大农产品期货交易所的交易机制,使其在规则制定、风险监管等方面同国际规则接轨;二是逐步开放国内农产品期货的交易品种限制,更大程度上发挥市场在粮食期货交易品种的筛选功能。最后,积极开展国际金融合作,共同监管全球粮食市场的投机行为。一是积极参与包括联合国粮农组织在内的国际组织对粮食大宗期货交易风险管控的协商,以制定有利于己的国际监管制度;二是推动各国共同建立国际农产品供需及交易信息的数据库,以避免全球粮价因投机行为而波动,引导全球粮价根据供需基本面调整。

In summary, to make China’s food security more resilient and safeguarded from the negative impacts of the “butterfly effect” stemming from geopolitical turbulence, a feasible strategy is to adjust China’s current pattern of grain imports and improve China’s unfavorable position in the grain futures market. Adjusting the structure of grain imports will help reduce China’s asymmetric reliance on imports from a few countries, thereby lowering the risk of a food security crisis caused by changes in other countries’ grain export policies. Active participation in global grain futures trading, moreover, will help China better respond to the impact of fluctuations in international grain prices on domestic grain prices. Additionally, participating in global food security governance and supporting the development of integrated food and agricultural companies will help further enhance China’s food security and its ability to respond to changes in the global grain market.

综上所述,调整当前中国的粮食进口格局并提高中国在粮食大宗期货交易市场中的被动地位,是提高中国粮食安全的“韧性”以规避地缘政治波动的“蝴蝶效应”对中国粮食安全造成负面影响的可行之策。一方面,调整粮食进口结构有利于改变当前对少数国家的粮食进口的不对称依赖,从而缓解中国因他国粮食出口政策调整而遭遇粮食安全危机;另一方面,积极投入全球粮食大宗期货交易,有助于提高中国应对国际粮价的波动危及国内粮食价格。此外,参与全球粮食安全治理、培育综合性粮农企业亦有助于进一步提高中国的粮食安全水平,提高中国应对全球粮食市场出现变化的能力。

5. Concluding Remarks

五、结语

This article formulates a framework for analyzing geopolitical conflicts and food security crises from the perspective of the “butterfly effect,” which it uses to examine the Russia-Ukraine conflict’s grave consequences for China’s food security. As grain is essential to national security and as countries have become increasingly interdependent in the grain trade, a contraction of exports from critical points in the global grain market will trigger a “butterfly effect” and cause a global grain security crisis that is disproportionate to those critical points’ volumes of exports. The geopolitical conflict between Russia and Ukraine has disrupted the two countries’ export of grain, and the destination countries of their grain exports have significantly increased imports and restricted exports, which has destabilized the supply and demand relationship in the global grain market. This has, in turn, encouraged speculation in grain commodity futures, and international grain prices have seen volatile fluctuations, which poses huge food security risks to countries around the world. The storm generated by this conflict has exposed China to risks from a contraction in total grain imports, concentration of import sources, and soaring prices, all of which have shaken the foundation of the country’s food security. Therefore, China should improve the resilience of its food security, diversify its sources of grain supply, and proactively develop financial instruments for the grain market, making better use of international forces to improve domestic food security, so as to compensate for its weak points in great-power strategic rivalry and strengthen its hand in global economic competition.

本文以“蝴蝶效应”为视角,构建了一个分析地缘政治冲突与粮食安全危机的框架,以此探究此次俄乌冲突对中国粮食安全所造成的严峻后果。由于粮食的安全属性以及各国在粮食贸易中日益相互依赖,全球粮食贸易中的“市场关键点”出口规模的收缩会触发“蝴蝶效应”,造成与其出口规模不成比例的全球性粮食安全危机。在俄乌冲突中,地缘冲突冲击了俄乌两国的粮食正常出口,两国粮食出口对象大幅增加进口且限制出口的行为恶化了全球粮食市场供需关系稳定,这进一步激发了粮食大宗期货的投机行为增加,国际粮价剧烈波动,各国因此面临巨大的粮食安全风险。对于中国而言,此次冲突所产生的“风暴”使中国面临着粮食进口总量缩减、进口来源集中以及交易价格飙升的风险,这些均撼动着粮食安全根基。基于此,中国应当提升粮食安全的韧性,提升粮食供给来源多样性、主动开发粮食市场的金融工具,更加充分地利用国际力量提高国内粮食安全水平,从而弥补中国在全球大国战略竞争中的短板,并增加中国在全球经济竞争中的筹码。

Of course, it is unlikely that the food security storm triggered by the Russia-Ukraine conflict will intensify without end. The chain reaction in the global grain market has somewhat abated since Russia selectively opened a few Black Sea ports for the export of grain amid the conflict and the United States and other Western countries exempted the grain trade from their sanctions against Russia. Nevertheless, it is still difficult to predict when the Russia-Ukraine conflict will end, and the possibility still exists of geopolitical conflicts triggering a “butterfly effect” in the global grain market. For China, a question that deserves special attention is how to neutralize the negative effects of geopolitical relations on the grain trade, since understanding this will help China identify exporting countries’ potential to weaponize the grain trade as it opens up new sources of grain imports, so that it may select import sources on a case-by-case basis taking into account each country’s particular circumstances and thus prevent the grain trade from becoming a tool for strategic competition between great powers.

当然,俄乌冲突所触发的粮食安全风暴不可能无限放大。随着俄罗斯有选择地在冲突中开放部分黑海港口的粮食流通、美西方国家将粮食贸易排除在对俄制裁体系之外,全球粮食市场中的“连锁反应”有所缓解。然而,俄乌冲突何时终结仍难预计,地缘冲突在全球粮食市场上触发“蝴蝶效应”的可能性仍然存在。对于中国而言,如何化解地缘政治关系对粮食贸易的负面影响尤其值得关注,因为这将有助于中国在开辟粮食国际贸易的过程中,识别出口国将粮食贸易“武器化”的潜在可能,因地制宜、因事制宜地选择进口来源,以避免粮食贸易成为大国战略竞争的工具。